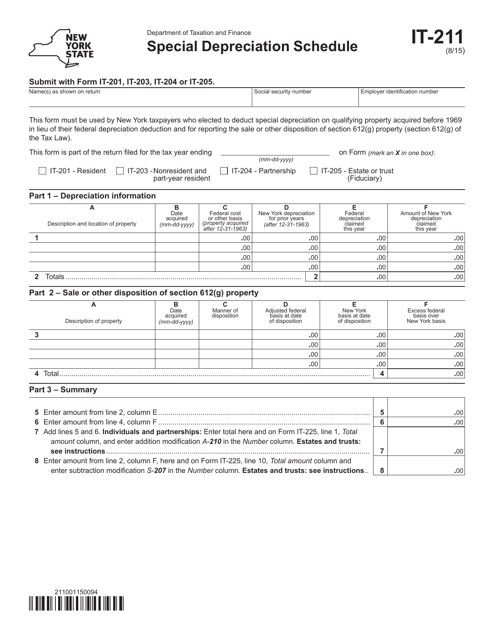

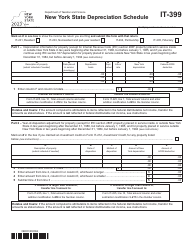

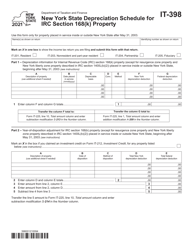

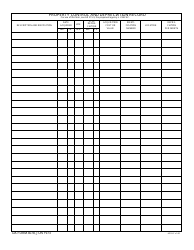

Form IT-211 Special Depreciation Schedule - New York

What Is Form IT-211?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-211?

A: Form IT-211 is the Special Depreciation Schedule for New York State.

Q: Who needs to file Form IT-211?

A: Taxpayers in New York State who are claiming special depreciation deductions for certain property.

Q: What is the purpose of Form IT-211?

A: The purpose of Form IT-211 is to calculate and report special depreciation deductions claimed by taxpayers in New York State.

Q: When is Form IT-211 due?

A: Form IT-211 is due on or before the due date of the taxpayer's personal income tax return for the tax year.

Q: Is Form IT-211 required for federal tax purposes?

A: No, Form IT-211 is specific to New York State and is not required for federal tax purposes.

Q: What should I do with Form IT-211 once it is completed?

A: Once completed, Form IT-211 should be attached to the taxpayer's personal income tax return for the tax year.

Form Details:

- Released on August 1, 2015;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-211 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.