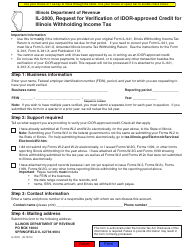

Form IL-1040 Schedule ICR Illinois Credits - Illinois

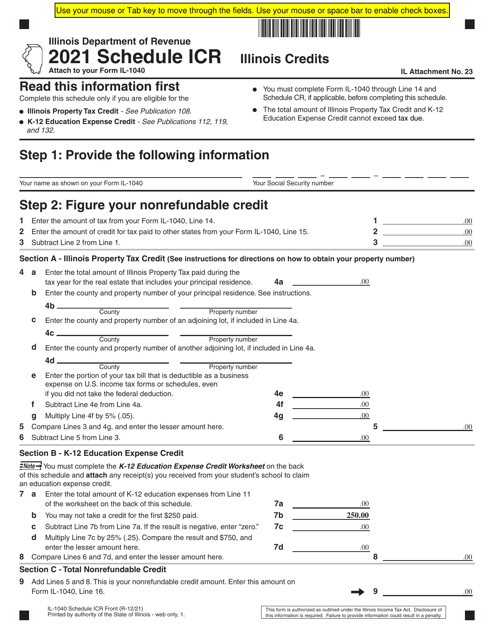

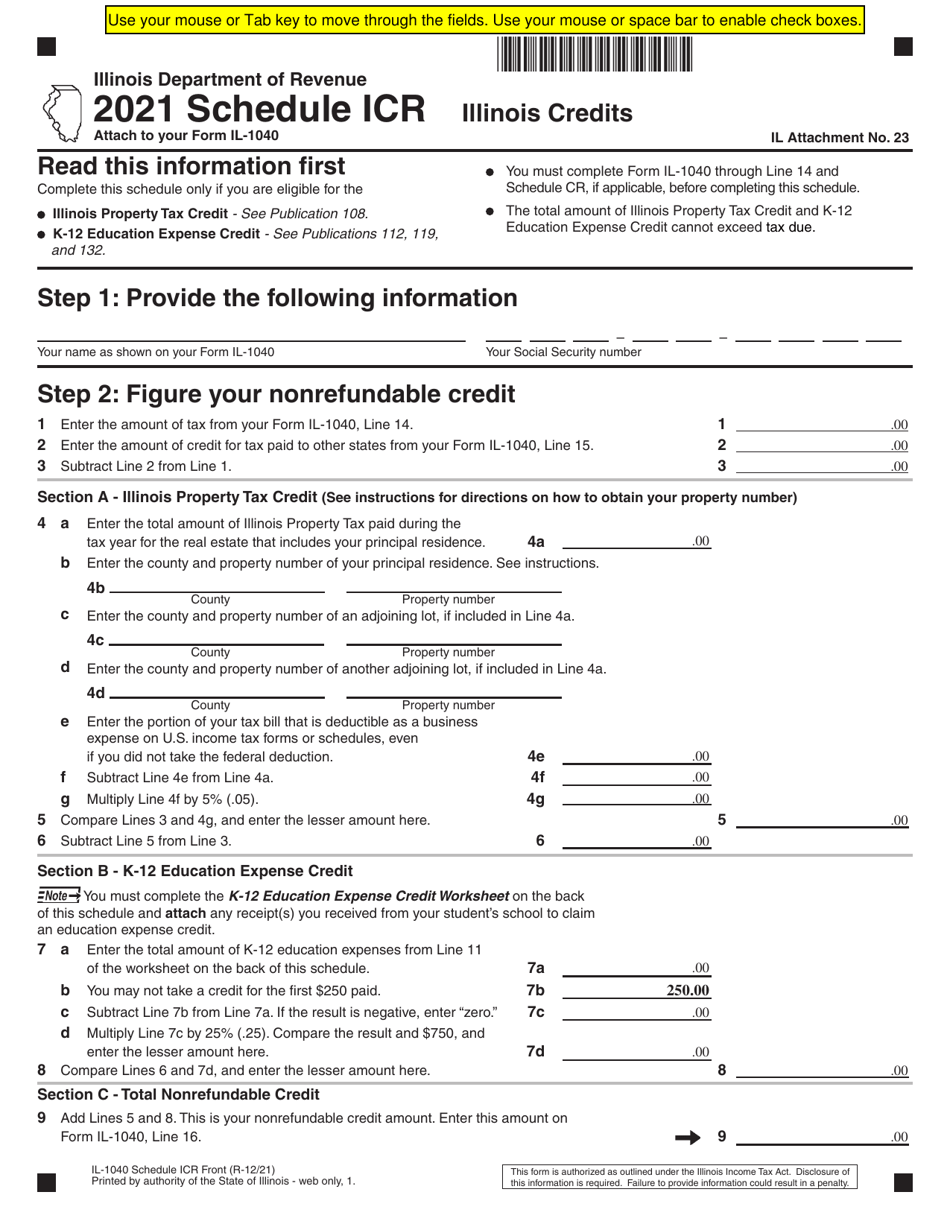

What Is Form IL-1040 Schedule ICR?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois.The document is a supplement to Form IL-1040, Individual Income Tax Return. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IL-1040 Schedule ICR?

A: Form IL-1040 Schedule ICR is a schedule that allows Illinois residents to claim various credits on their state income tax return.

Q: What are Illinois credits?

A: Illinois credits are deductions or reductions in the amount of state income tax owed to the state of Illinois.

Q: Who is eligible to file Form IL-1040 Schedule ICR?

A: Illinois residents who qualify for any of the available credits can file Form IL-1040 Schedule ICR.

Q: What credits can be claimed on Form IL-1040 Schedule ICR?

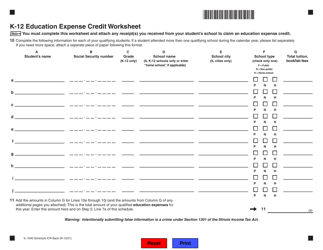

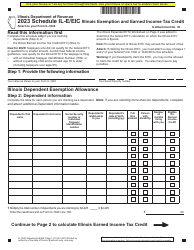

A: Some of the credits that can be claimed on Form IL-1040 Schedule ICR include the Property Tax Credit, the Earned Income Credit, and the Education Expense Credit.

Q: How do I claim credits on Form IL-1040 Schedule ICR?

A: To claim credits on Form IL-1040 Schedule ICR, you need to fill out the schedule and provide the required information and documentation.

Q: Is there a deadline for filing Form IL-1040 Schedule ICR?

A: Yes, Form IL-1040 Schedule ICR must be filed by the same deadline as your Illinois state income tax return, which is usually April 15th.

Q: Can I file Form IL-1040 Schedule ICR electronically?

A: Yes, you can file Form IL-1040 Schedule ICR electronically if you are filing your state income tax return electronically.

Q: Is there a fee for filing Form IL-1040 Schedule ICR?

A: No, there is no fee for filing Form IL-1040 Schedule ICR.

Q: What should I do if I made an error on Form IL-1040 Schedule ICR?

A: If you made an error on Form IL-1040 Schedule ICR, you should file an amended schedule with the correct information as soon as possible.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-1040 Schedule ICR by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.