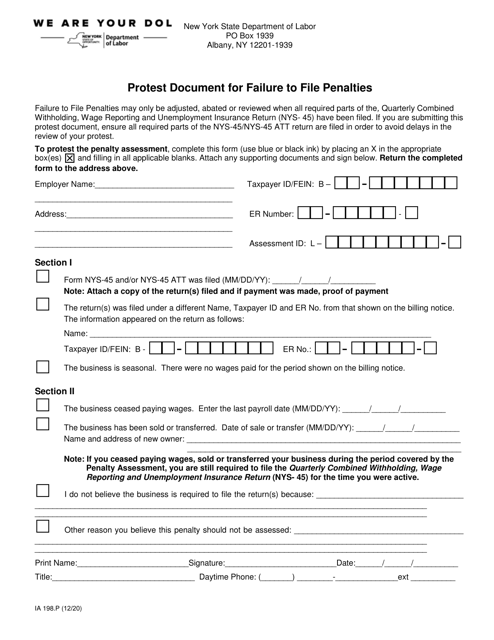

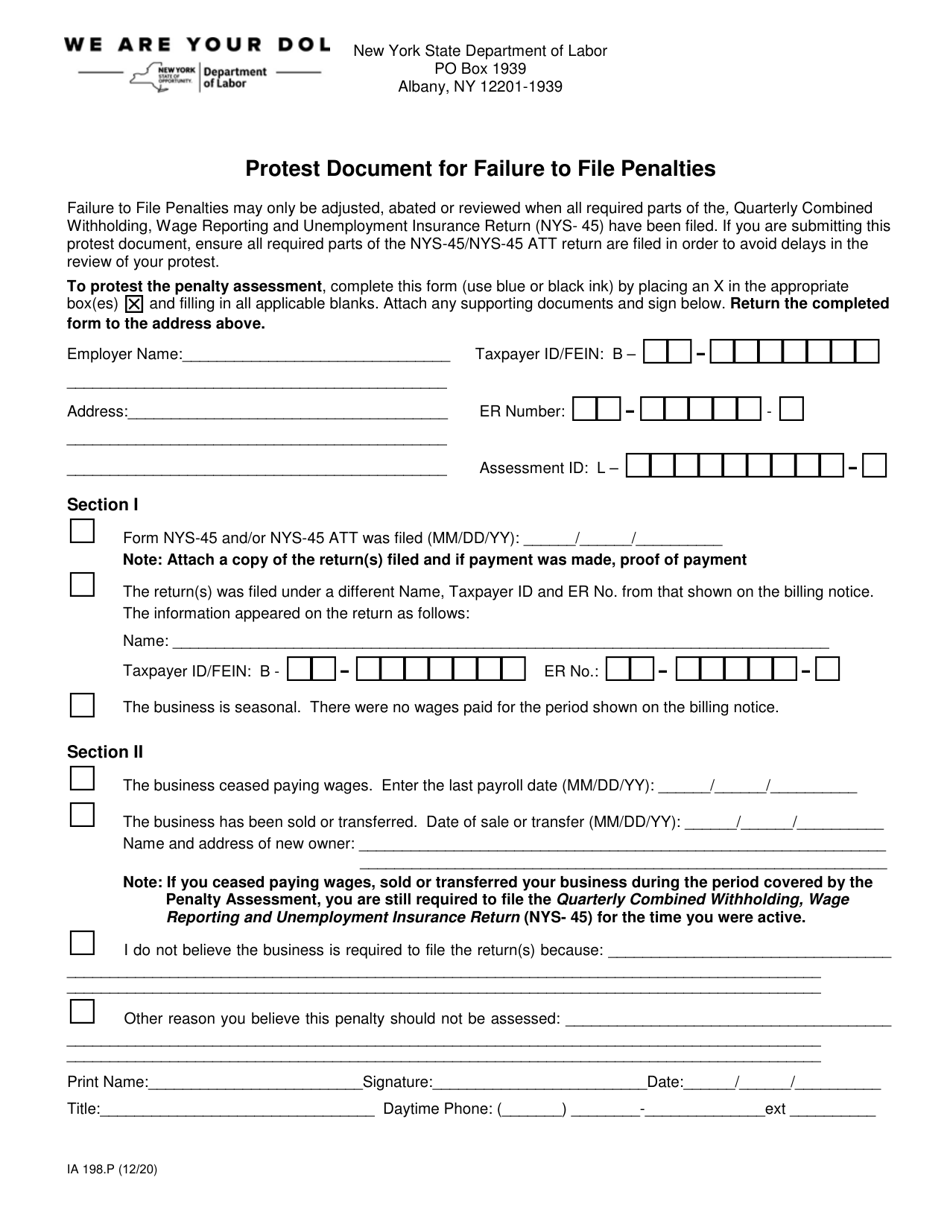

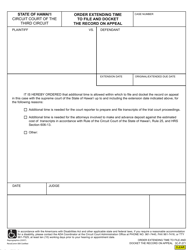

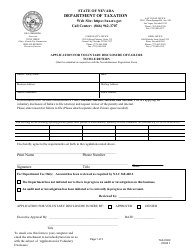

Form IA198.P Protest Document for Failure to File Penalties - New York

What Is Form IA198.P?

This is a legal form that was released by the New York State Department of Labor - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

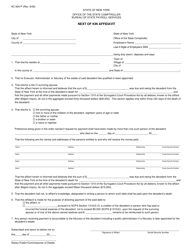

Q: What is Form IA198.P?

A: Form IA198.P is a protest document for failure to file penalties in New York.

Q: What is it used for?

A: It is used to protest penalties imposed for failure to file certain tax forms or returns on time.

Q: Who can use Form IA198.P?

A: Anyone who has been assessed failure to file penalties in New York.

Q: How do I fill out Form IA198.P?

A: You need to provide your personal information, details about the penalty being protested, and the reason for the protest.

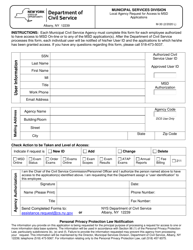

Q: Is there a deadline for filing Form IA198.P?

A: Yes, the form must be filed within 90 days of the date on the notice of penalty.

Q: Do I need to include any supporting documents with Form IA198.P?

A: Yes, you may need to provide supporting documentation depending on the reason for the protest.

Q: What happens after I file Form IA198.P?

A: The Department of Taxation and Finance will review your protest and notify you of their decision.

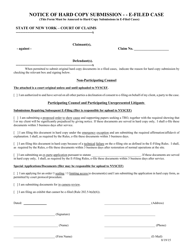

Q: Can I appeal if my protest is denied?

A: Yes, you have the right to request a conciliation conference or file a petition for a hearing if your protest is denied.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the New York State Department of Labor;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IA198.P by clicking the link below or browse more documents and templates provided by the New York State Department of Labor.