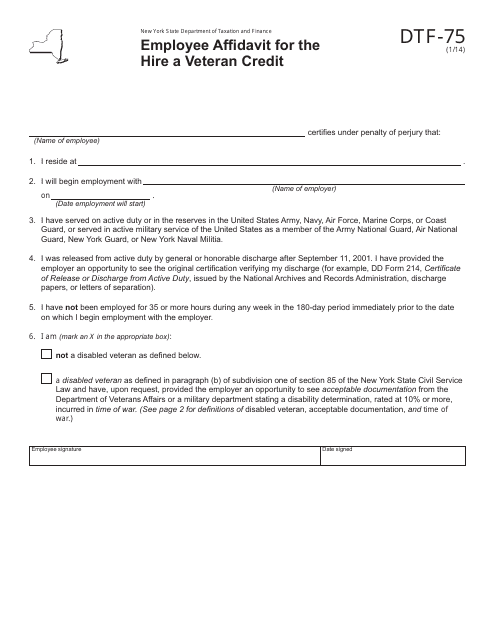

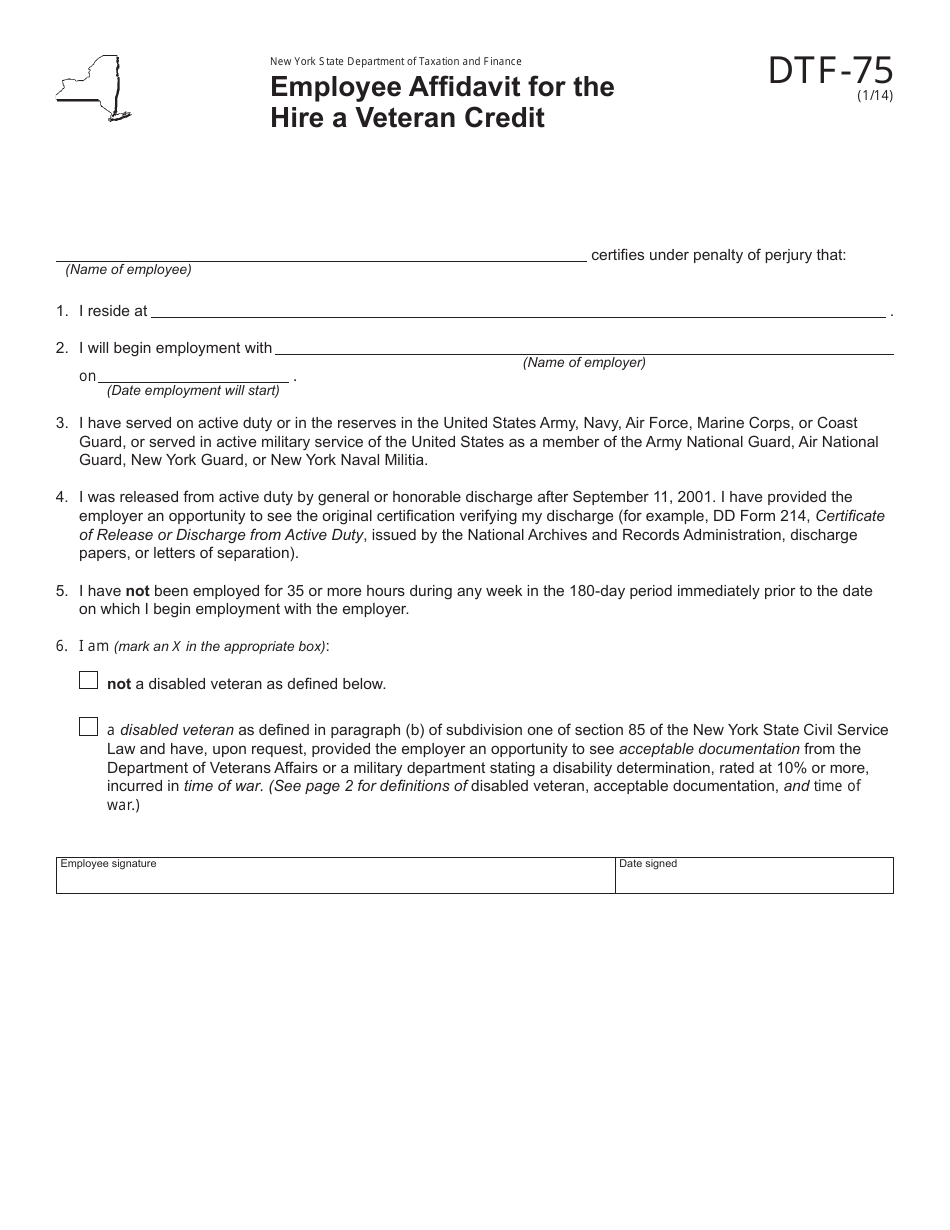

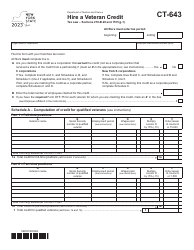

Form DTF-75 Employee Affidavit for the Hire a Veteran Credit - New York

What Is Form DTF-75?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

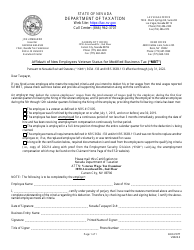

Q: What is Form DTF-75?

A: Form DTF-75 is the Employee Affidavit for the Hire a Veteran Credit in New York.

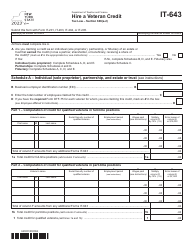

Q: What is the Hire a Veteran Credit?

A: The Hire a Veteran Credit is a tax credit available to employers in New York who hire eligible veterans.

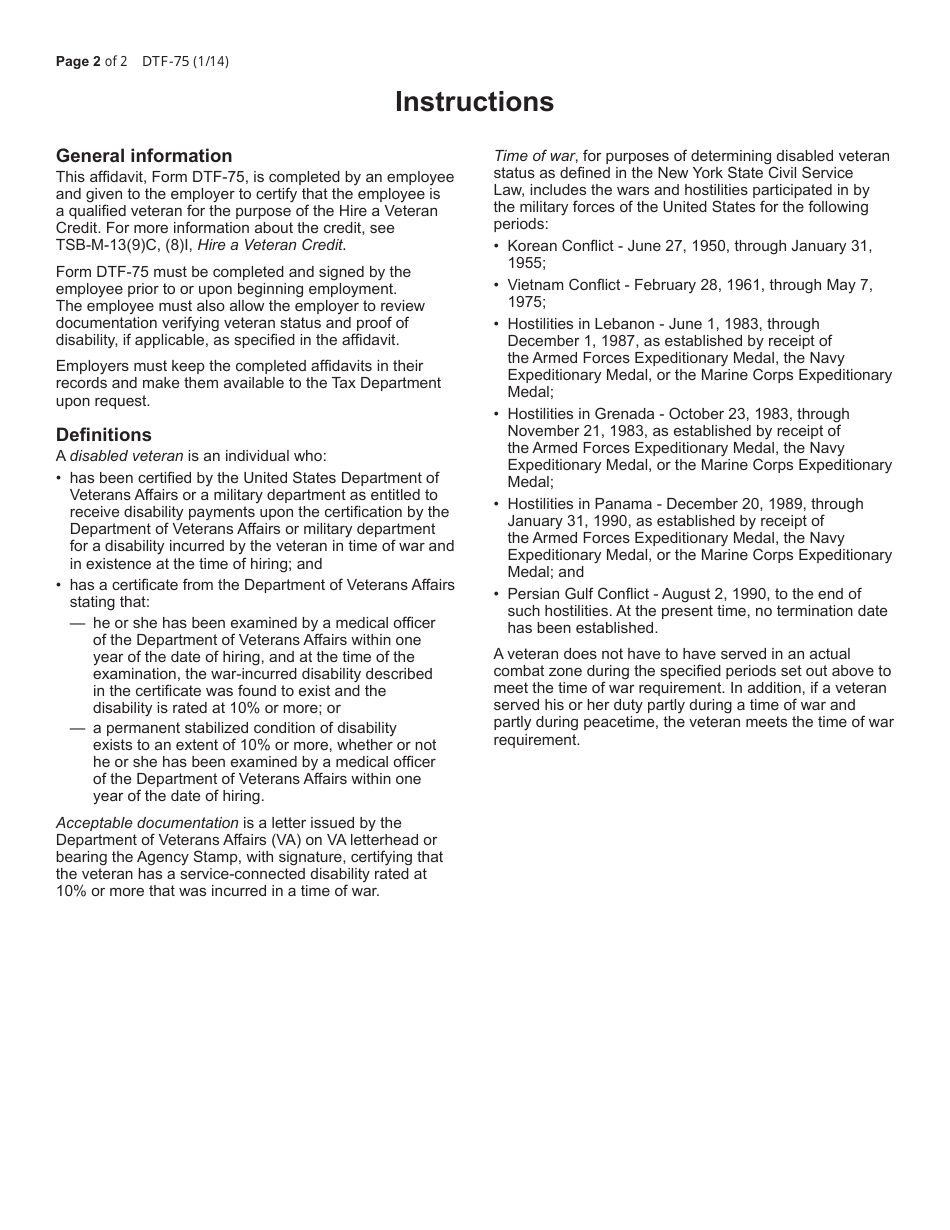

Q: Who is eligible for the Hire a Veteran Credit?

A: Eligible veterans are individuals who served in the active military, naval, or air service and were discharged or released under honorable conditions.

Q: What is the purpose of the Employee Affidavit (Form DTF-75)?

A: The Employee Affidavit (Form DTF-75) is used by employers to certify that the veteran they hired meets the eligibility requirements for the Hire a Veteran Credit.

Q: Is there a deadline for submitting Form DTF-75?

A: Yes, employers must submit Form DTF-75 within 30 days of hiring an eligible veteran.

Q: Are there any other requirements for claiming the Hire a Veteran Credit?

A: Yes, employers must also submit Form DTF-83, the Hire a Veteran Credit Certification, along with Form DTF-75.

Q: How much is the Hire a Veteran Credit?

A: The amount of the credit is $2,000 per eligible veteran hired by the employer.

Q: Can the credit be carried forward or transferred?

A: No, the credit cannot be carried forward to future years or transferred to another taxpayer.

Form Details:

- Released on January 1, 2014;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DTF-75 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.