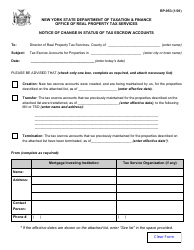

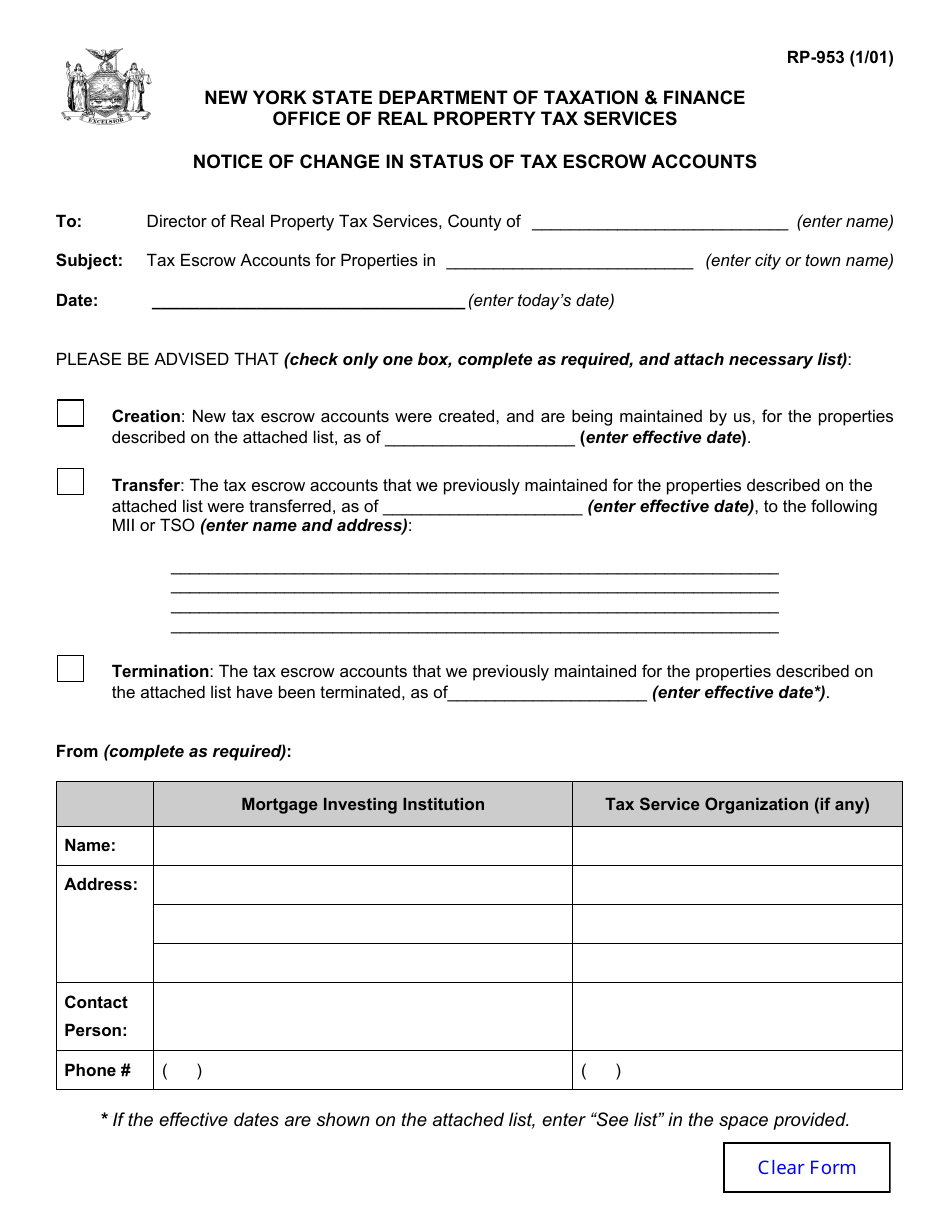

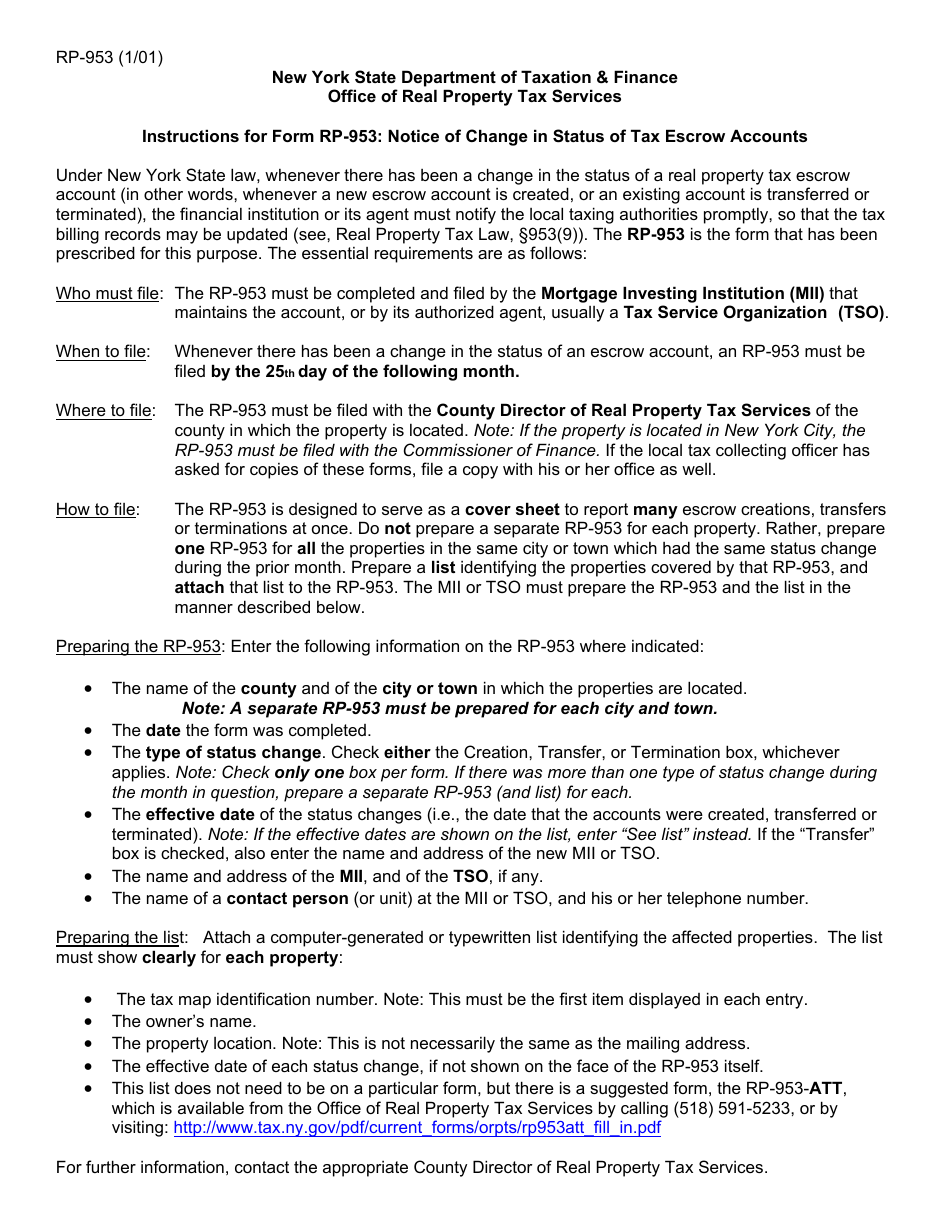

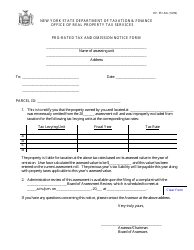

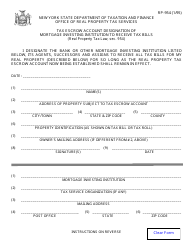

Form RP-953 Notice of Change in Status of Tax Escrow Accounts - New York

What Is Form RP-953?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-953?

A: Form RP-953 is the Notice of Change in Status of Tax Escrow Accounts in New York.

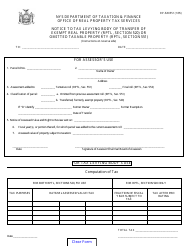

Q: What is the purpose of Form RP-953?

A: The purpose of Form RP-953 is to notify the New York State Department of Taxation and Finance of any changes in the status of tax escrow accounts.

Q: Who needs to file Form RP-953?

A: Any individual or entity that has a tax escrow account in New York and experiences a change in the status of the account needs to file Form RP-953.

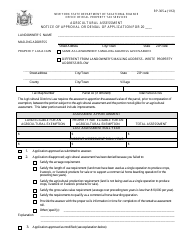

Q: What changes in the status of a tax escrow account require filing Form RP-953?

A: Changes such as closure, transfer, or other significant modifications to the tax escrow account require filing Form RP-953.

Q: Is there a deadline for filing Form RP-953?

A: Yes, Form RP-953 must be filed within 30 days of the change in the status of the tax escrow account.

Q: Are there any penalties for not filing Form RP-953?

A: Failure to file Form RP-953 or filing it late may result in penalties imposed by the New York State Department of Taxation and Finance.

Q: Are there any fees associated with filing Form RP-953?

A: No, there are no fees associated with filing Form RP-953.

Q: Can I make changes to a filed Form RP-953?

A: Yes, if there are any changes or corrections to a previously filed Form RP-953, you can file an amended form to update the information.

Form Details:

- Released on January 1, 2001;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-953 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.