This version of the form is not currently in use and is provided for reference only. Download this version of

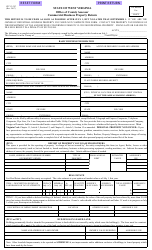

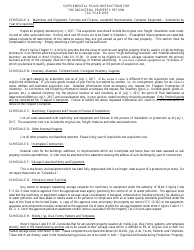

Instructions for Form STC12:32I

for the current year.

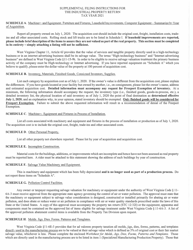

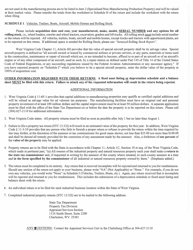

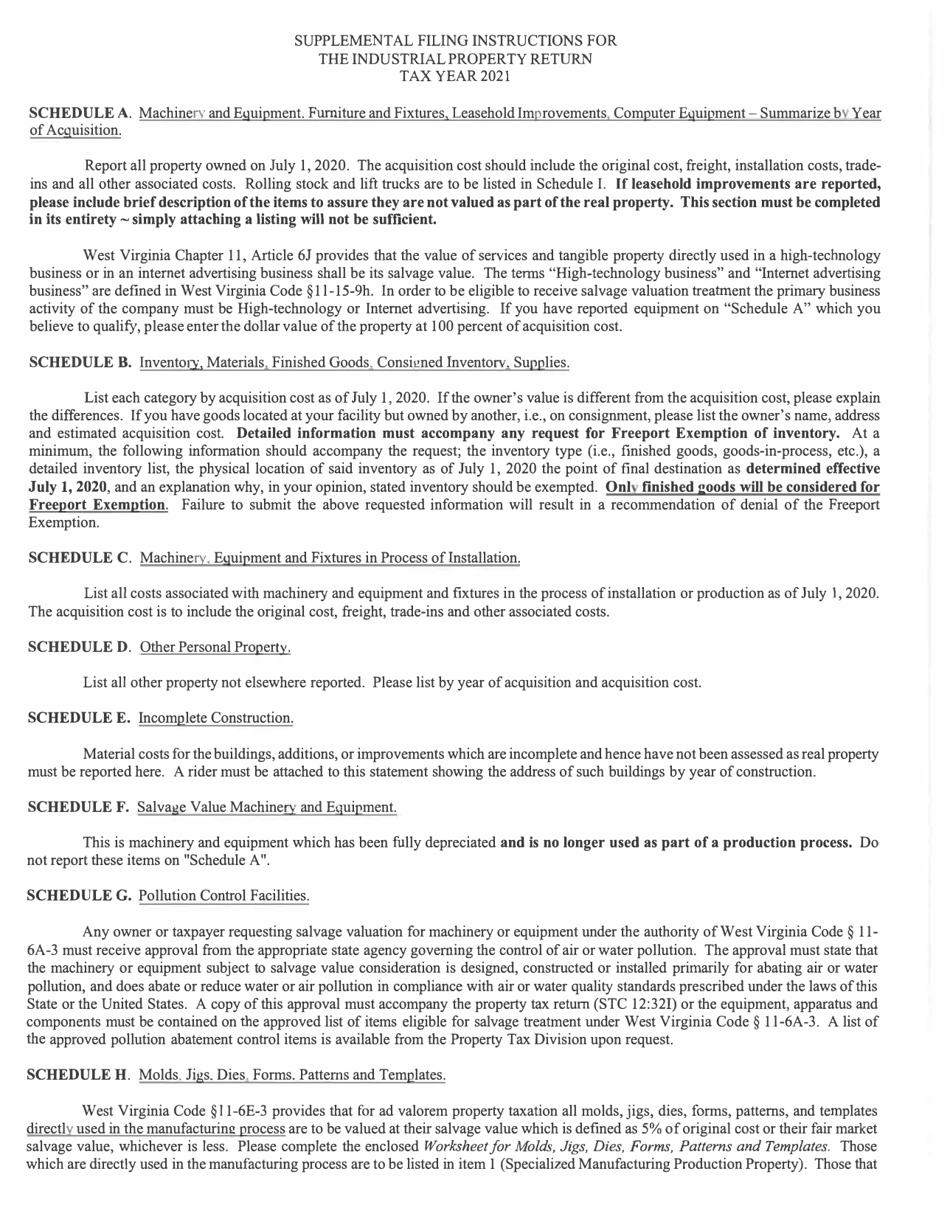

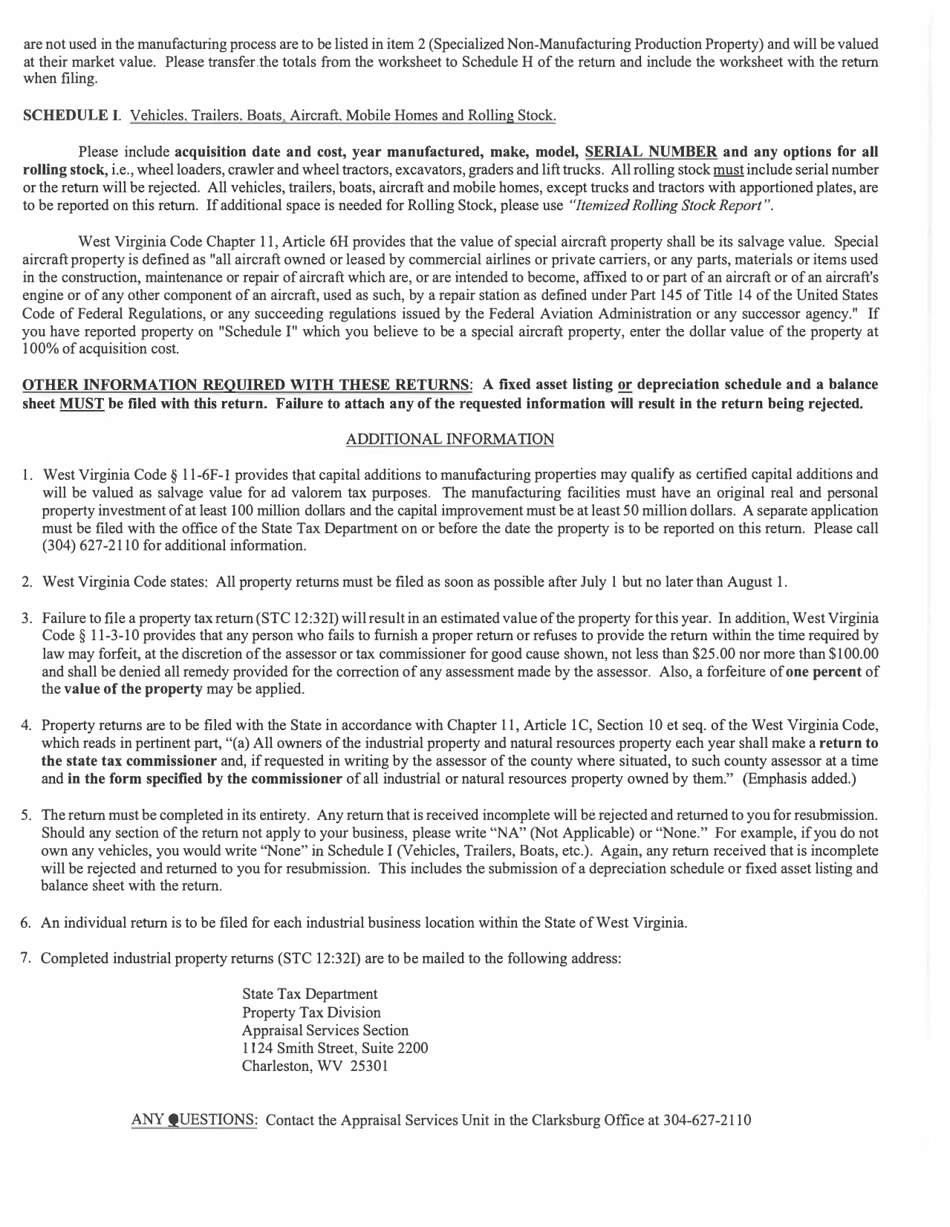

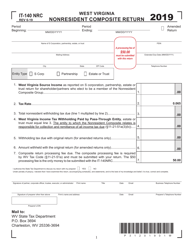

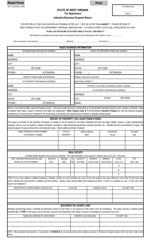

Instructions for Form STC12:32I Industrial Business Property Return - West Virginia

This document contains official instructions for Form STC12:32I , Industrial Business Property Return - a form released and collected by the West Virginia State Tax Department.

FAQ

Q: What is Form STC12:32I?

A: Form STC12:32I is the Industrial Business Property Return form used in West Virginia to report the value of industrial business property.

Q: Who needs to file Form STC12:32I?

A: Businesses in West Virginia that own industrial property are required to file Form STC12:32I.

Q: How often do I need to file Form STC12:32I?

A: Form STC12:32I must be filed annually.

Q: What is the deadline for filing Form STC12:32I?

A: The deadline for filing Form STC12:32I is July 1st.

Q: What information do I need to provide on Form STC12:32I?

A: You will need to provide information about your business and the value of your industrial property.

Q: Do I need to include any supporting documentation with Form STC12:32I?

A: No, you do not need to include supporting documentation with Form STC12:32I, unless specifically requested by the State Tax Department.

Q: What happens if I don't file Form STC12:32I?

A: Failure to file Form STC12:32I may result in penalties and interest charges.

Q: Is there a fee for filing Form STC12:32I?

A: There is no fee for filing Form STC12:32I.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the West Virginia State Tax Department.