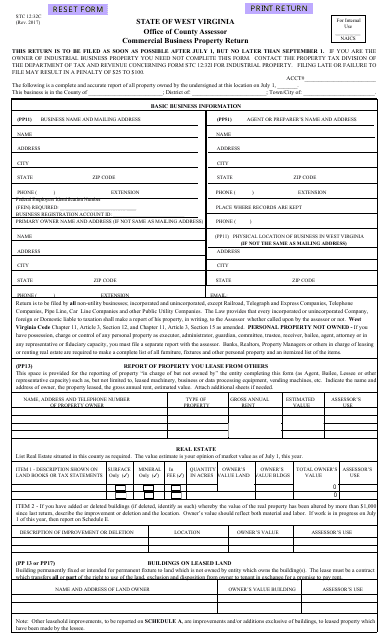

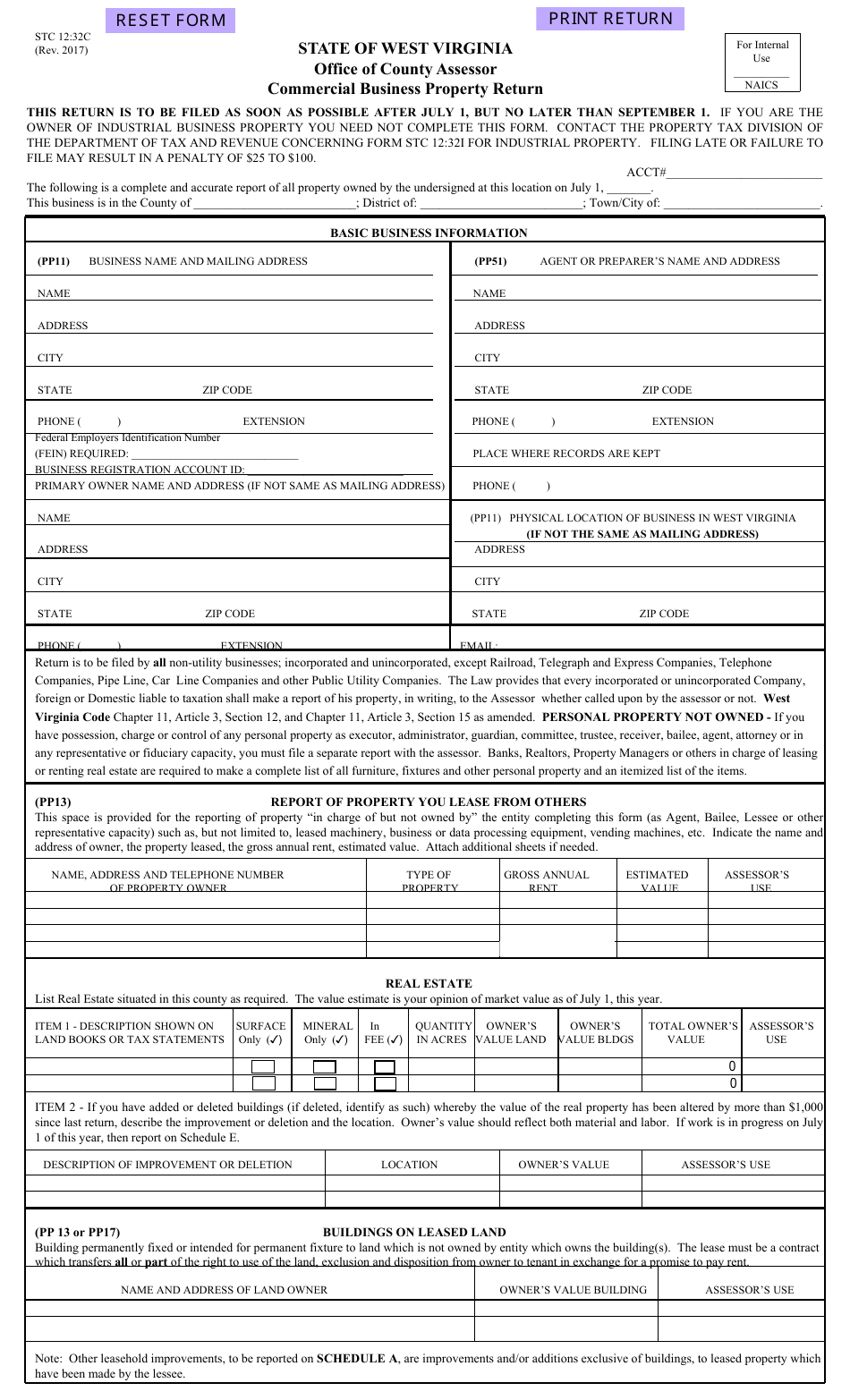

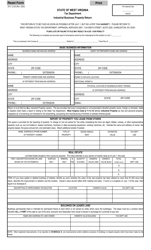

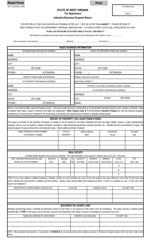

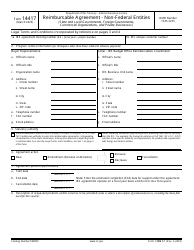

Form STC12:32C Commercial Business Property Return - West Virginia

What Is Form STC12:32C?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form STC12:32C?

A: Form STC12:32C is the Commercial Business Property Return for West Virginia.

Q: What is the purpose of Form STC12:32C?

A: The purpose of Form STC12:32C is to report commercial business property for tax assessment purposes in West Virginia.

Q: Who needs to file Form STC12:32C?

A: Any business owner or property owner in West Virginia who owns commercial property is required to file Form STC12:32C.

Q: When is the deadline for filing Form STC12:32C?

A: The deadline for filing Form STC12:32C is July 1st of each tax year.

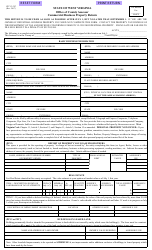

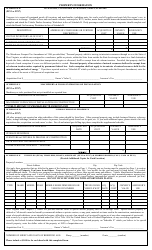

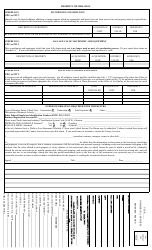

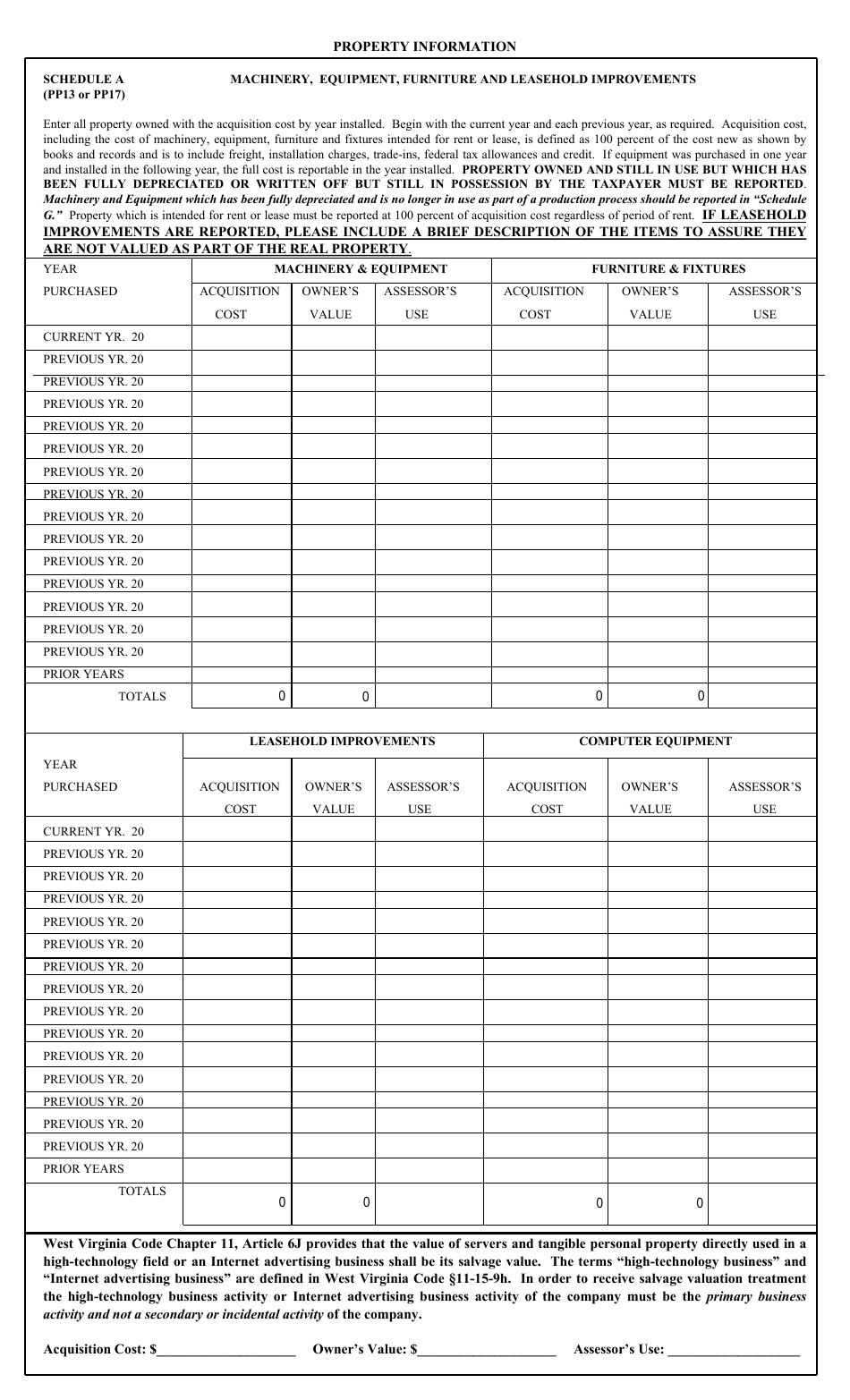

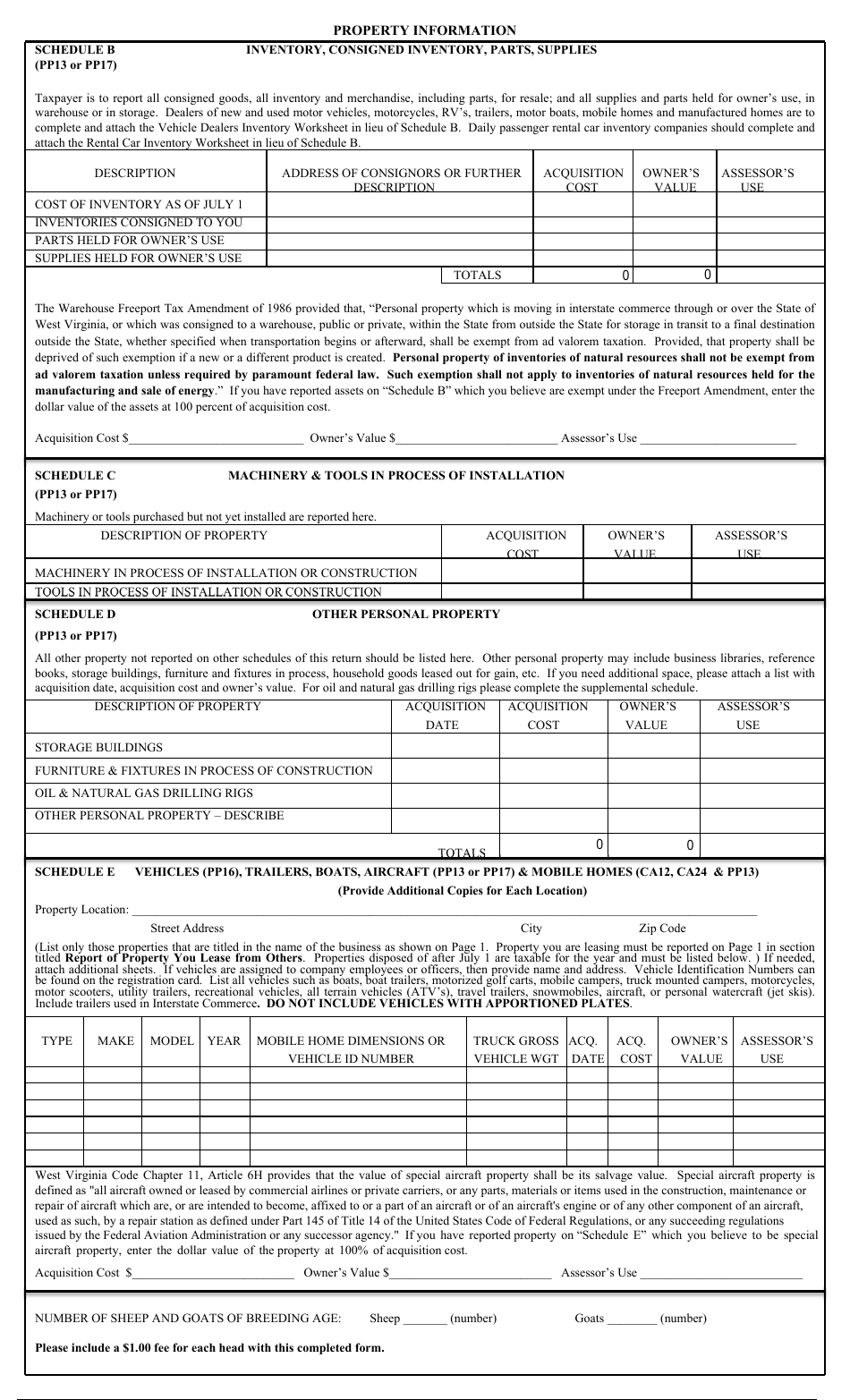

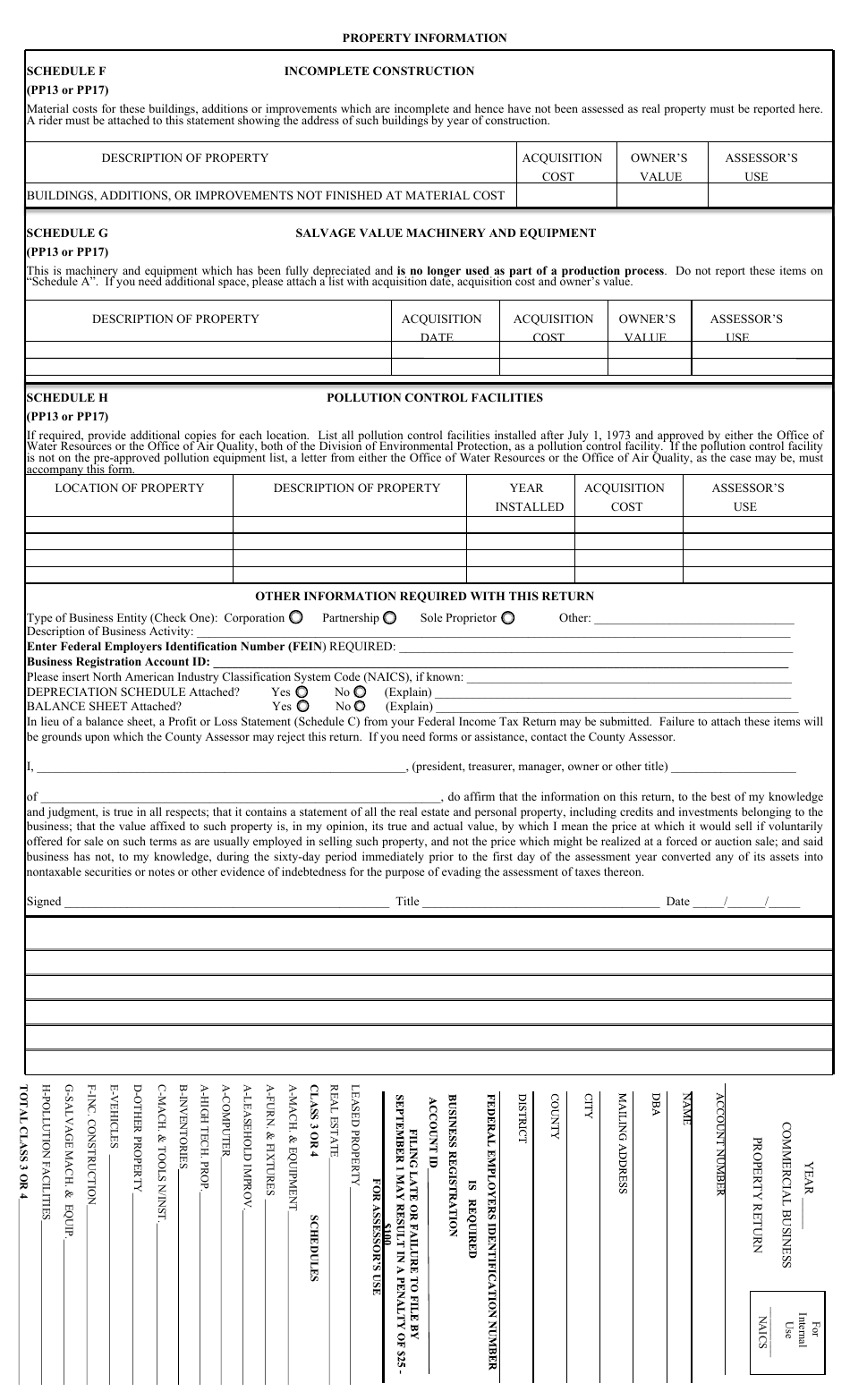

Q: What information is required on Form STC12:32C?

A: Form STC12:32C requires information about the property, including its location, size, and value, as well as information about the business that owns the property.

Q: Are there any penalties for late filing of Form STC12:32C?

A: Yes, there are penalties for late filing of Form STC12:32C, including fines and potential interest charges.

Q: Can I request an extension for filing Form STC12:32C?

A: Yes, you can request an extension for filing Form STC12:32C by contacting the West Virginia State Tax Department.

Q: What should I do if there are changes to my commercial property after I've filed Form STC12:32C?

A: If there are changes to your commercial property after you've filed Form STC12:32C, you should contact the local county assessor's office to update the information.

Q: Is Form STC12:32C used for both real and personal property?

A: No, Form STC12:32C is only used for commercial real property. Personal property is reported on a separate form.

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form STC12:32C by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.