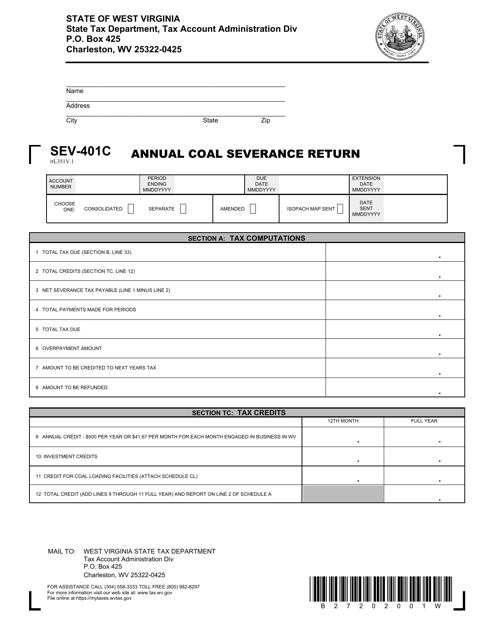

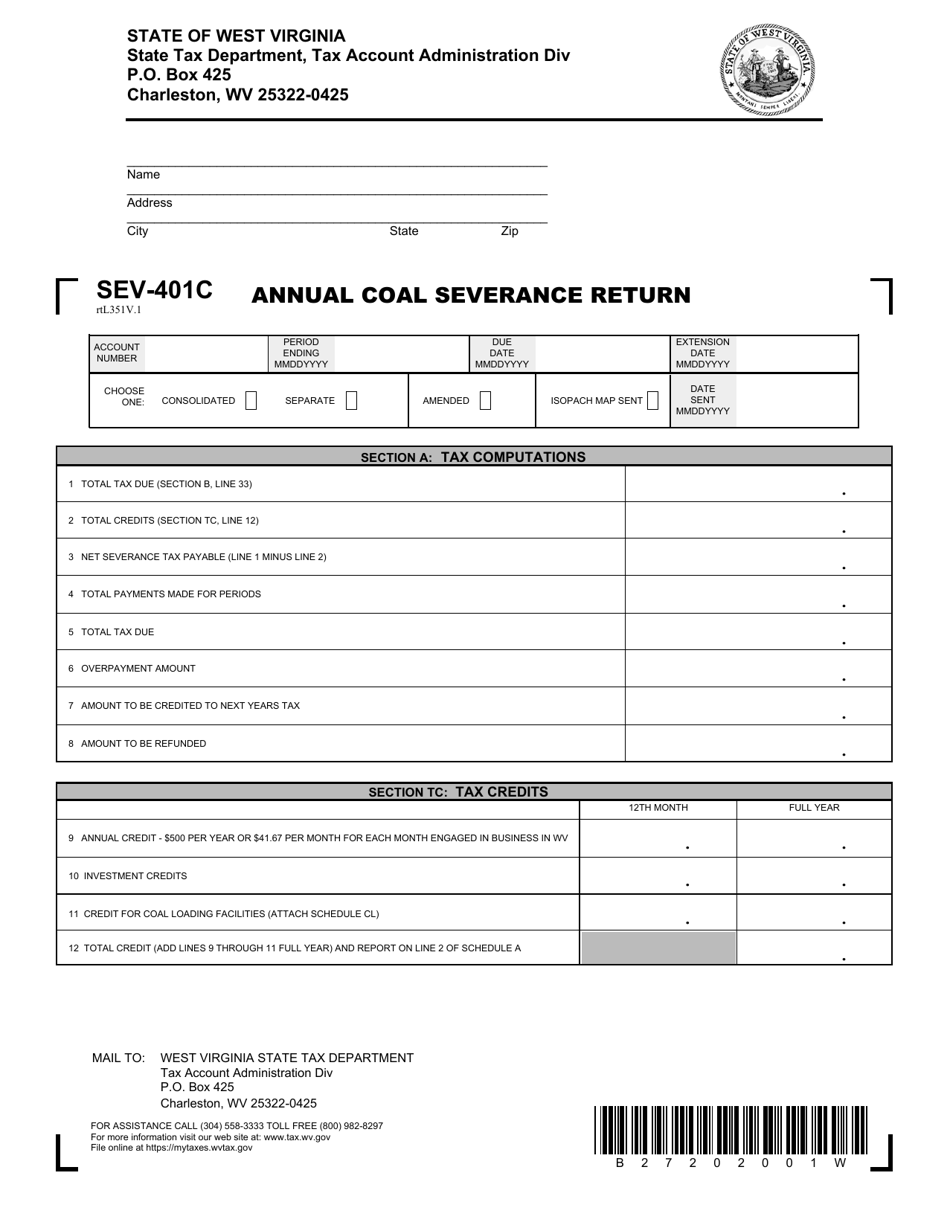

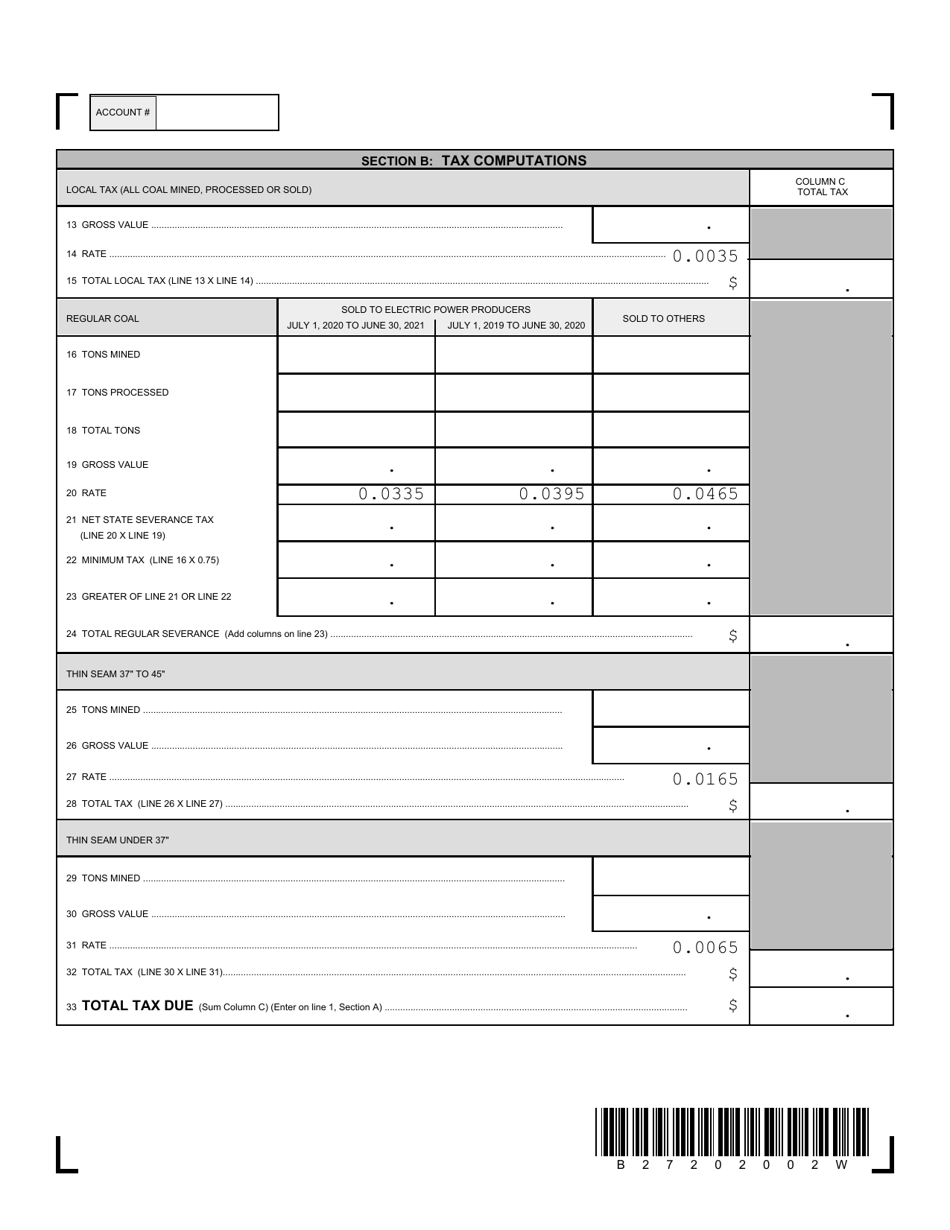

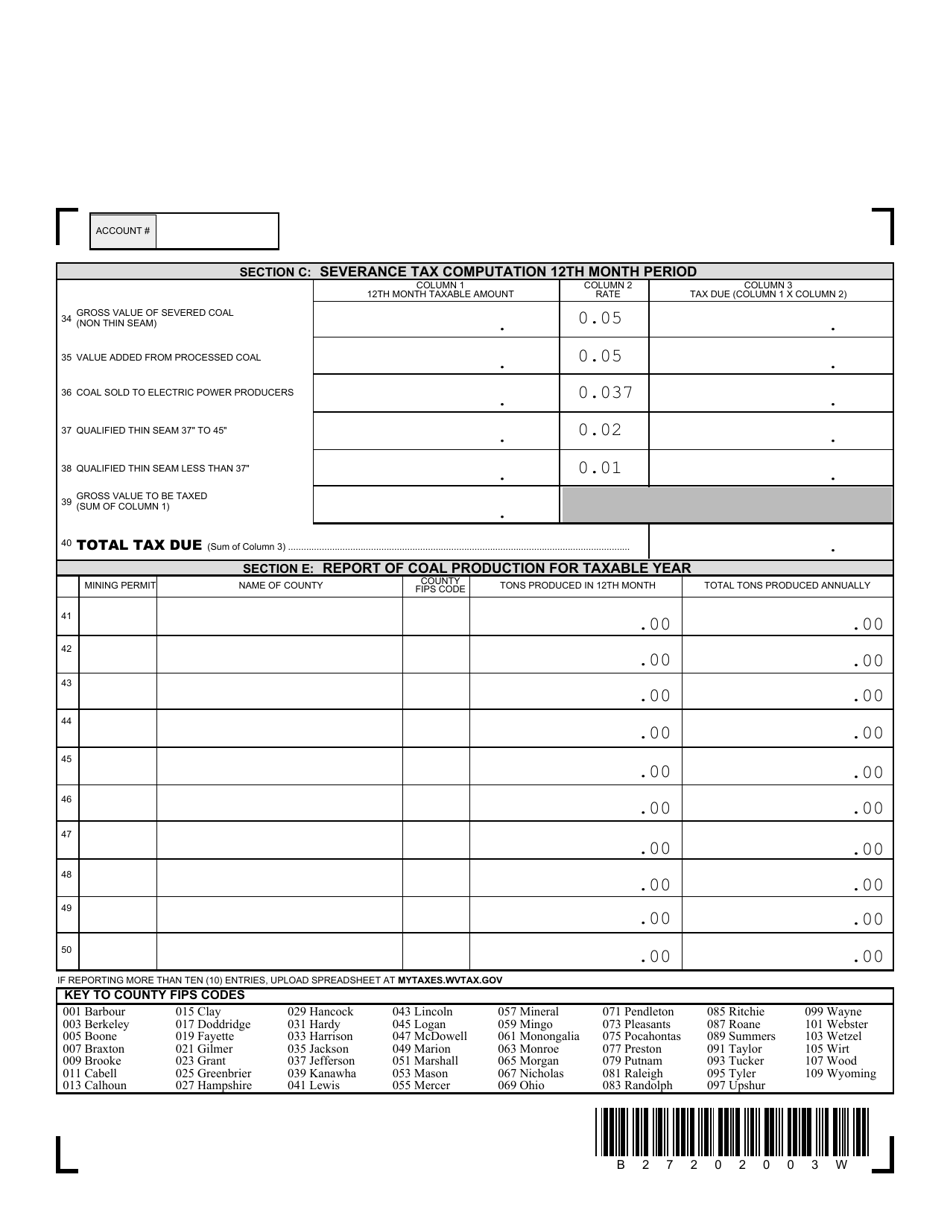

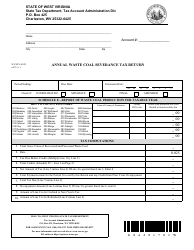

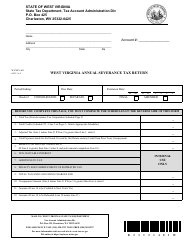

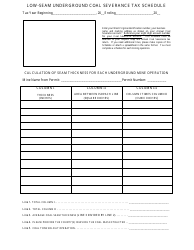

Form SEV-401C Annual Coal Severance Return - West Virginia

What Is Form SEV-401C?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

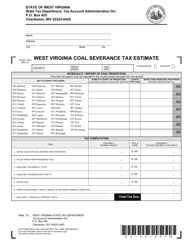

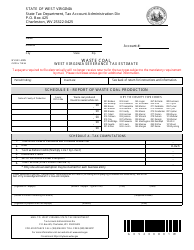

Q: What is Form SEV-401C?

A: Form SEV-401C is the Annual Coal Severance Return for the state of West Virginia.

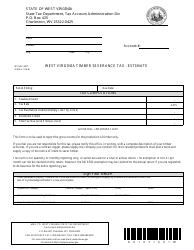

Q: Who is required to file Form SEV-401C?

A: Any person or entity engaged in the severance, production, or extraction of coal in West Virginia is required to file Form SEV-401C.

Q: What is the purpose of Form SEV-401C?

A: Form SEV-401C is used to report and pay the severance tax on coal production in West Virginia.

Q: When is Form SEV-401C due?

A: Form SEV-401C is due on or before the 15th day of the month following the end of the calendar quarter.

Q: Are there any penalties for late filing of Form SEV-401C?

A: Yes, there are penalties for late filing of Form SEV-401C. The penalty is 5% of the tax due for each month or fraction of a month that the return is late, up to a maximum of 25% of the tax due.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SEV-401C by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.