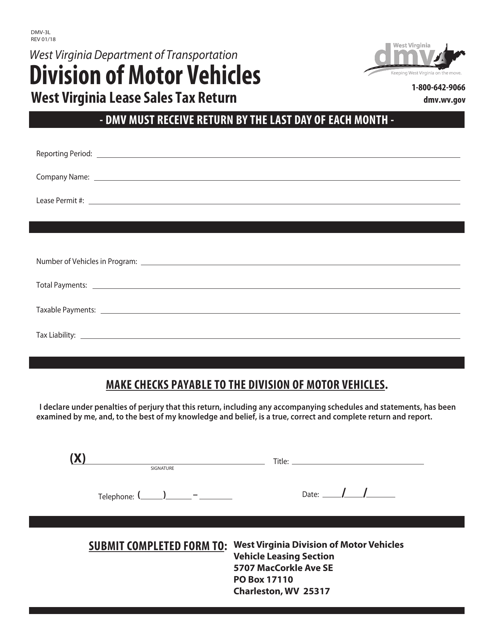

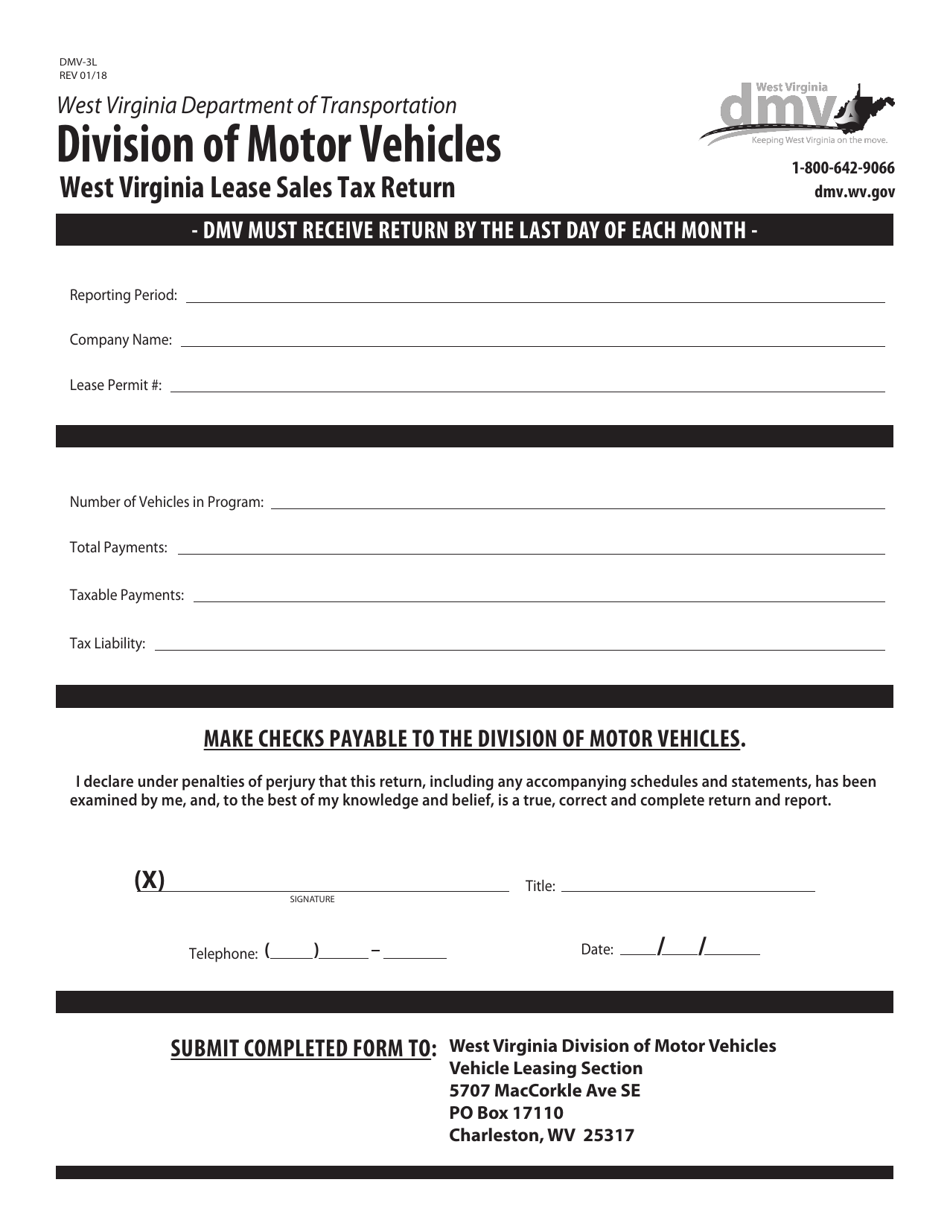

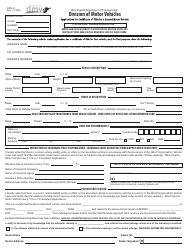

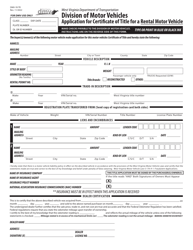

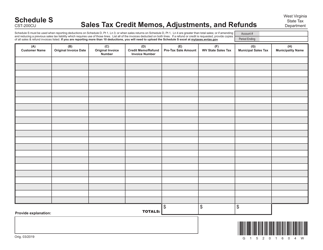

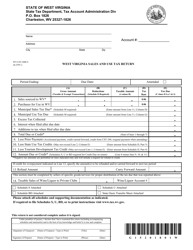

Form DMV-3L West Virginia Lease Sales Tax Return - West Virginia

What Is Form DMV-3L?

This is a legal form that was released by the West Virginia Department of Transportation - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DMV-3L?

A: Form DMV-3L is the West Virginia Lease Sales Tax Return.

Q: What is the purpose of Form DMV-3L?

A: The purpose of Form DMV-3L is to report and pay lease sales tax in West Virginia.

Q: Who needs to file Form DMV-3L?

A: Individuals and businesses engaged in leasing motor vehicles in West Virginia need to file Form DMV-3L.

Q: How often do I need to file Form DMV-3L?

A: Form DMV-3L needs to be filed monthly.

Q: What information is required on Form DMV-3L?

A: Form DMV-3L requires information such as the lessor's name, address, vehicle information, and lease sales tax due.

Q: Are there any penalties for late filing of Form DMV-3L?

A: Yes, there may be penalties for late filing or failure to file Form DMV-3L.

Q: Is there a deadline for filing Form DMV-3L?

A: Yes, Form DMV-3L must be filed and payment must be remitted by the 20th day of the month following the reporting period.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the West Virginia Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DMV-3L by clicking the link below or browse more documents and templates provided by the West Virginia Department of Transportation.