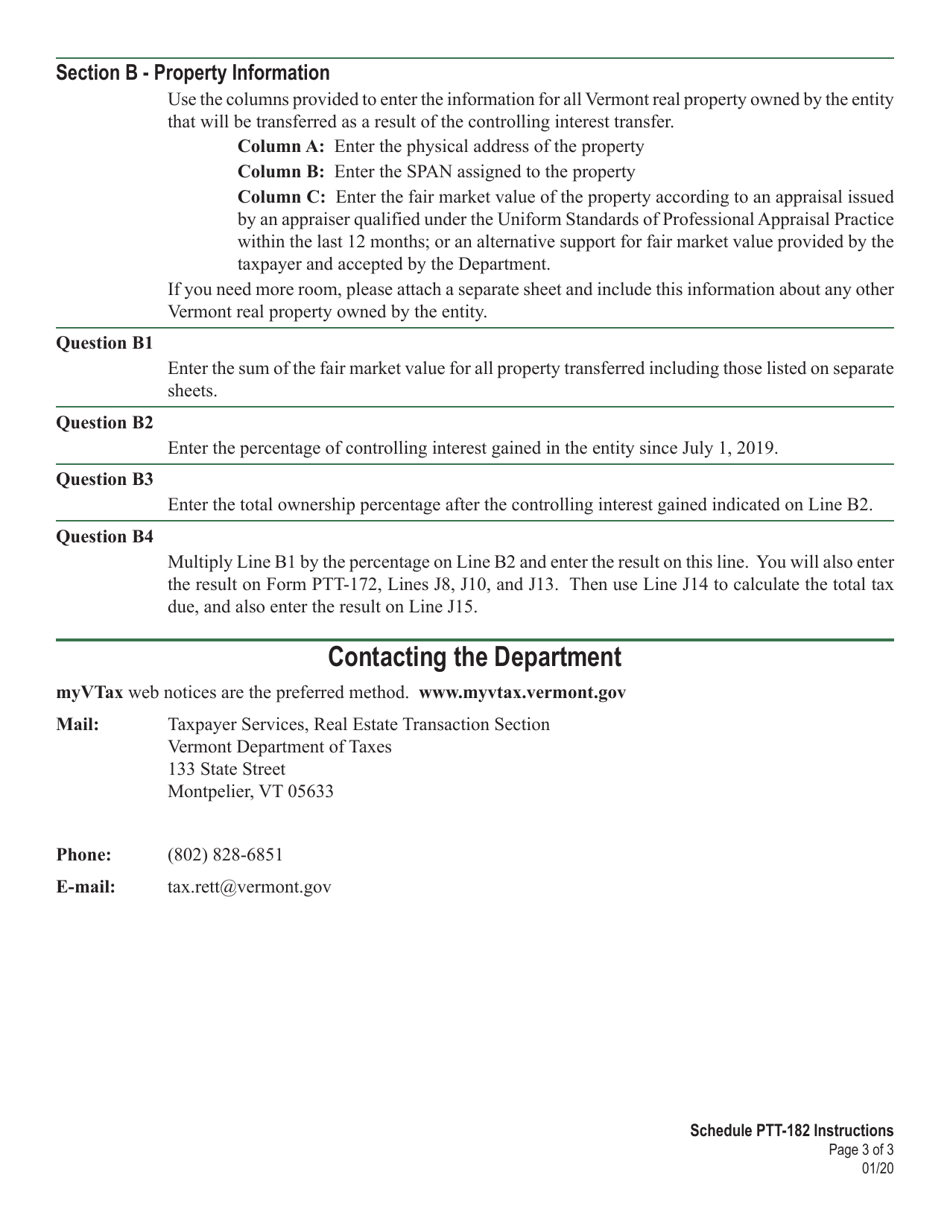

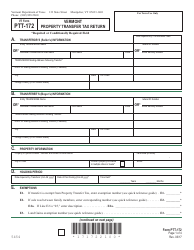

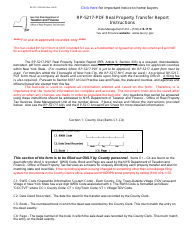

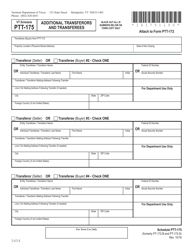

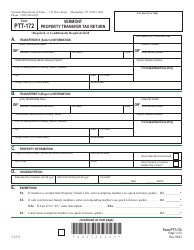

Instructions for Schedule PTT-182 Property Transfer Controlling Interest - Vermont

This document contains official instructions for Schedule PTT-182 , Property Transfer Controlling Interest - a form released and collected by the Vermont Department of Taxes.

FAQ

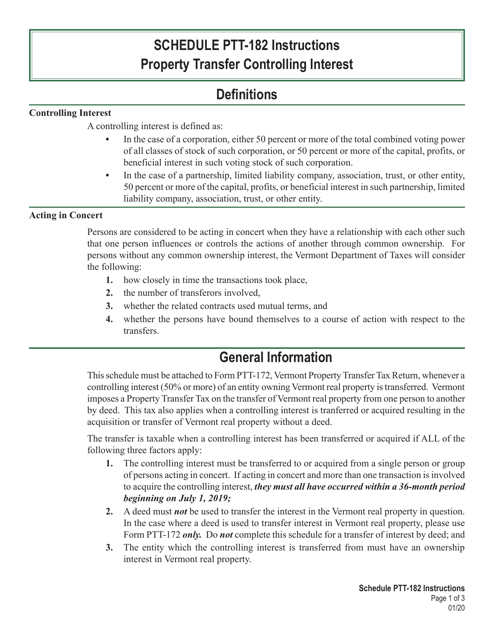

Q: What is Schedule PTT-182?

A: Schedule PTT-182 is a form used in Vermont for reporting the transfer of property with a controlling interest.

Q: Who needs to use Schedule PTT-182?

A: Anyone who is transferring property in Vermont with a controlling interest must use Schedule PTT-182.

Q: What is considered a controlling interest in property transfer?

A: A controlling interest refers to a transfer that results in a change in ownership of 50% or more of the voting shares of a business entity that owns the property.

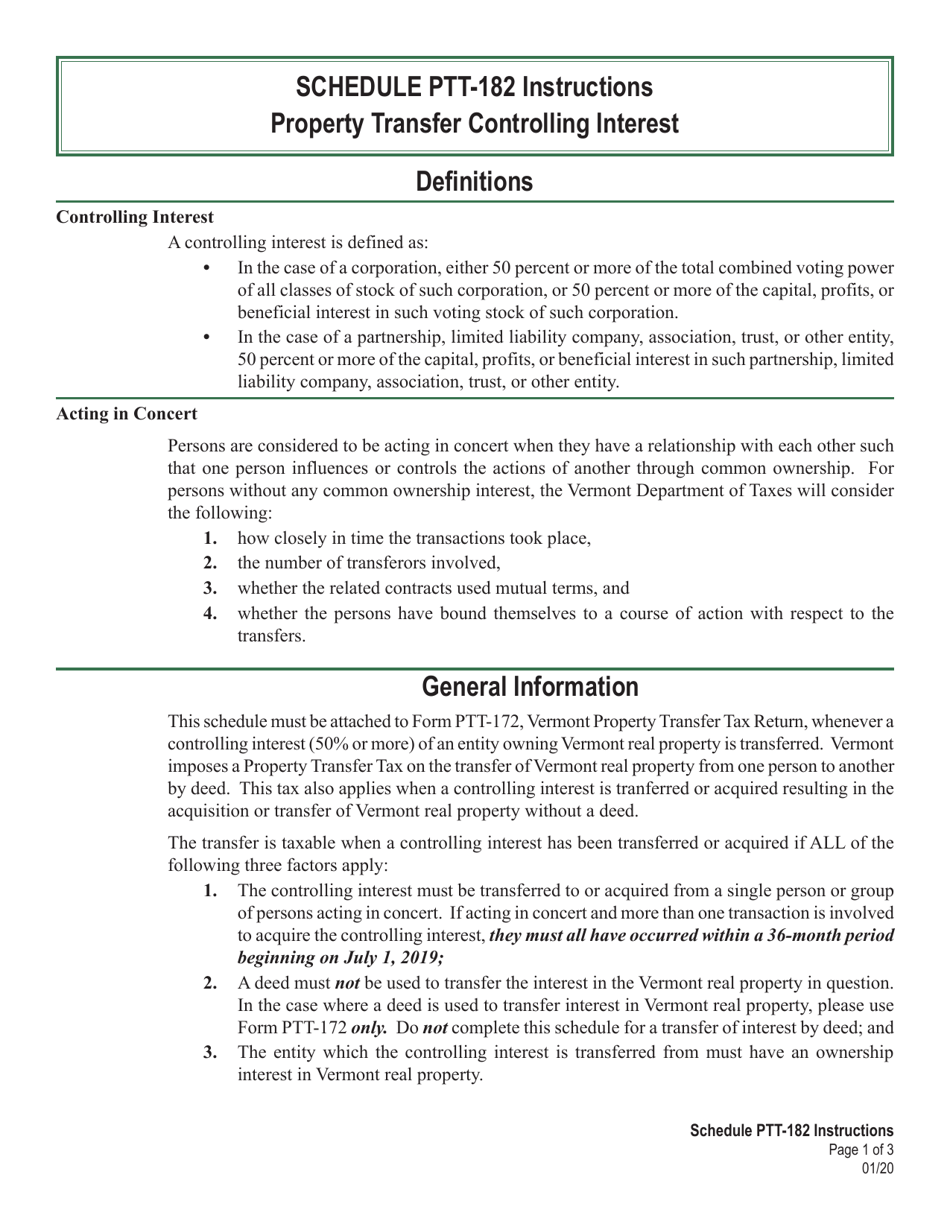

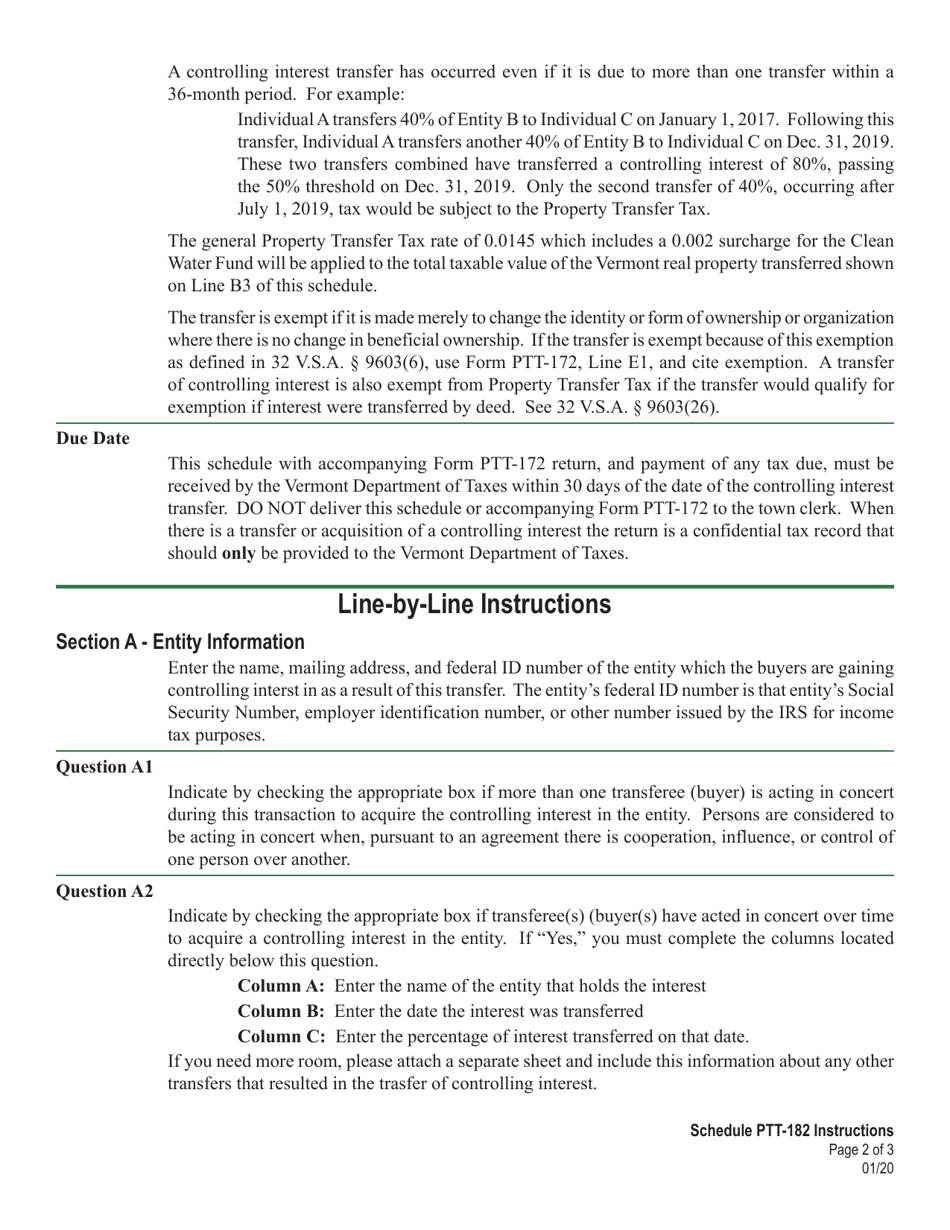

Q: What information do I need to complete Schedule PTT-182?

A: You will need information about the transferee, transferor, property being transferred, and any prior transfers.

Q: Are there any fees associated with filing Schedule PTT-182?

A: Yes, there may be fees associated with filing Schedule PTT-182. You should check with the Vermont Department of Taxes for the current fee schedule.

Q: When should I file Schedule PTT-182?

A: Schedule PTT-182 should be filed within 30 days of the transfer of the controlling interest in the property.

Q: Do I need to submit any supporting documentation with Schedule PTT-182?

A: Yes, you may need to submit supporting documentation such as deeds, contracts, or other legal documents related to the transfer.

Q: What happens after I file Schedule PTT-182?

A: After you file Schedule PTT-182, the Vermont Department of Taxes will review the form and supporting documentation and process your request.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Vermont Department of Taxes.