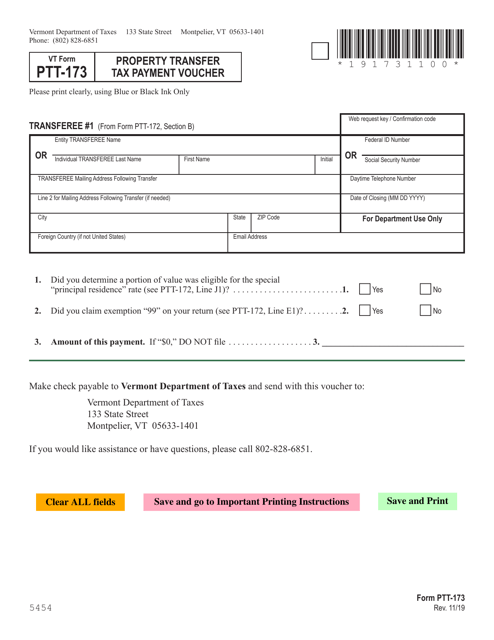

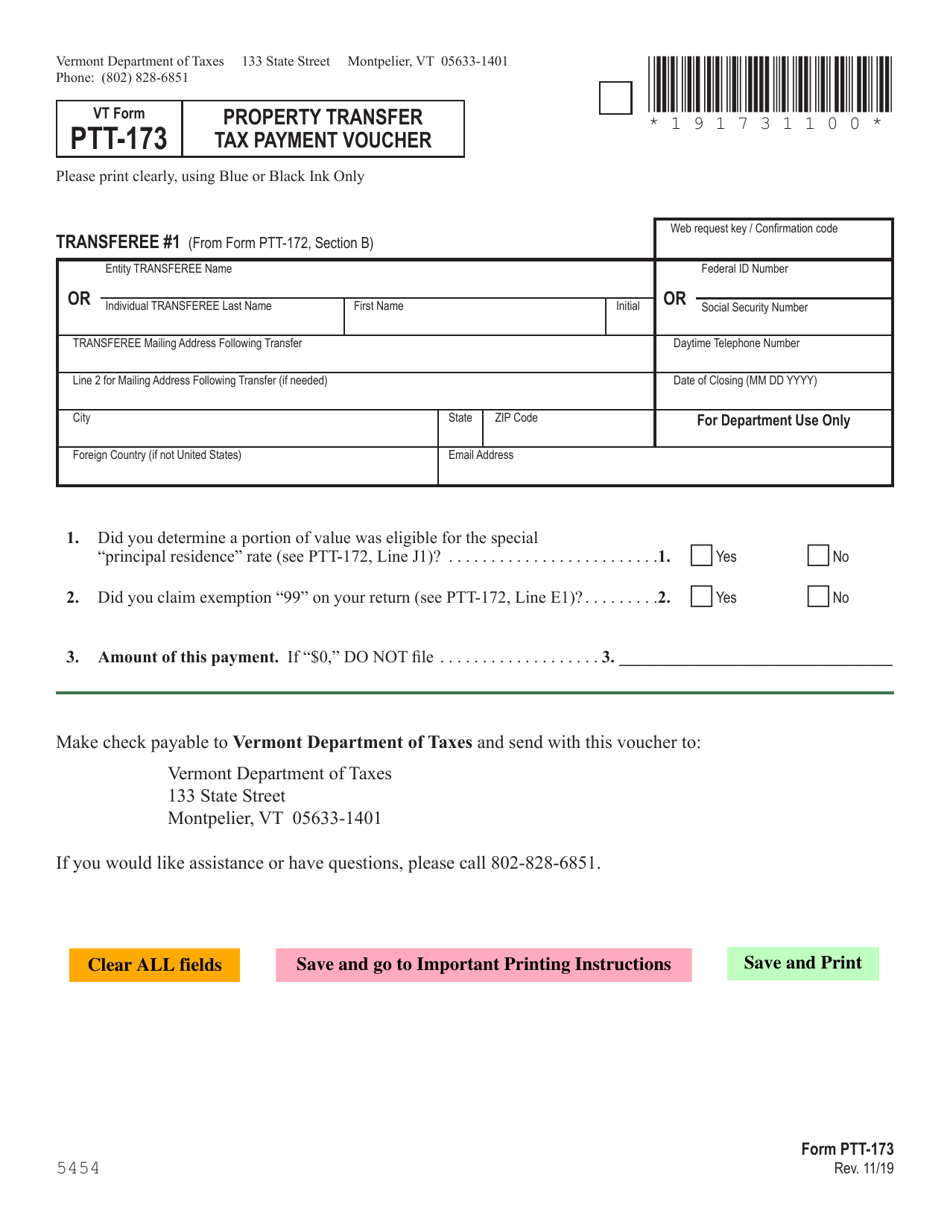

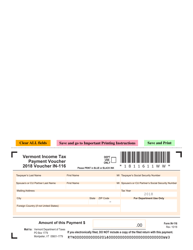

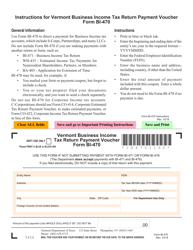

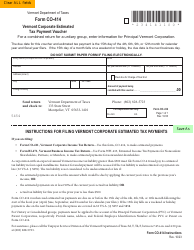

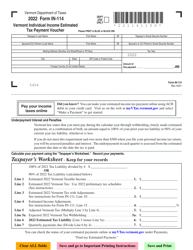

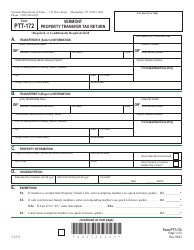

VT Form PTT-173 Property Transfer Tax Payment Voucher - Vermont

What Is VT Form PTT-173?

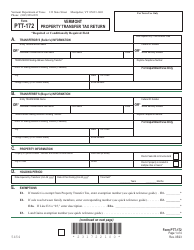

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. Check the official instructions before completing and submitting the form.

FAQ

Q: What is VT Form PTT-173?

A: VT Form PTT-173 is the Property Transfer Tax Payment Voucher used in Vermont.

Q: What is the purpose of VT Form PTT-173?

A: The purpose of VT Form PTT-173 is to facilitate the payment of property transfer tax in Vermont.

Q: Who uses VT Form PTT-173?

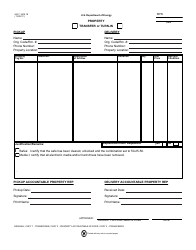

A: VT Form PTT-173 is used by individuals or entities involved in property transfers in Vermont.

Q: What is property transfer tax?

A: Property transfer tax is a tax imposed on the transfer of real property from one owner to another.

Q: How do I use VT Form PTT-173?

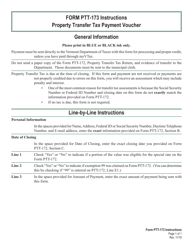

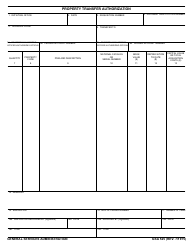

A: To use VT Form PTT-173, fill out the necessary information and submit it along with the payment of property transfer tax.

Q: Are there any deadlines for using VT Form PTT-173?

A: Yes, VT Form PTT-173 must be filed and the payment made within 15 days of the date of the property transfer.

Q: What happens if I don't use VT Form PTT-173?

A: Failure to use VT Form PTT-173 or late payment of property transfer tax may result in penalties or interest charges.

Q: Is there a fee for using VT Form PTT-173?

A: No, there is no fee for using VT Form PTT-173, but the property transfer tax payment must be made.

Form Details:

- Released on November 1, 2019;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VT Form PTT-173 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.