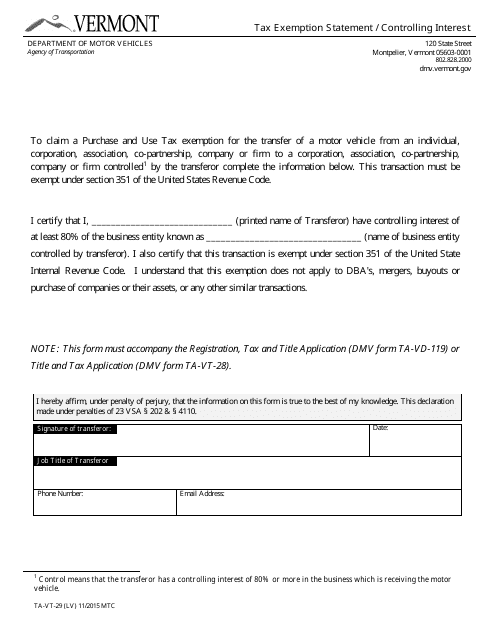

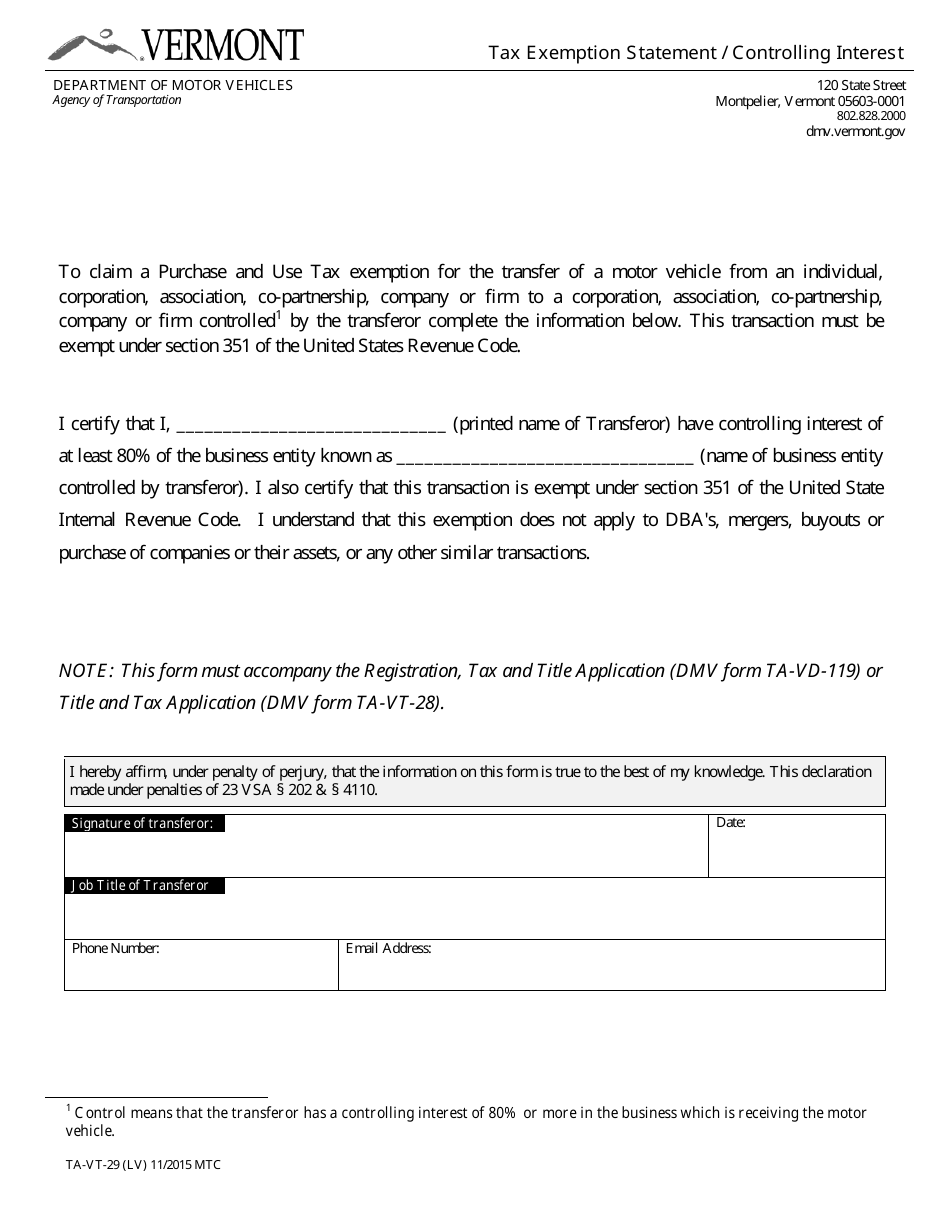

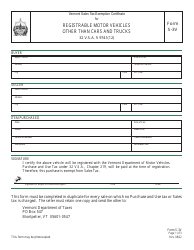

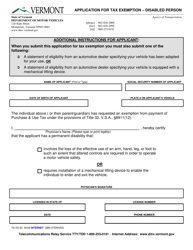

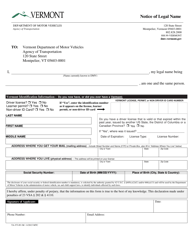

Form TA-VT-29 Tax Exemption Statement / Controlling Interest - Vermont

What Is Form TA-VT-29?

This is a legal form that was released by the Vermont Department of Motor Vehicles - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TA-VT-29?

A: Form TA-VT-29 is a Tax Exemption Statement/Controlling Interest form for Vermont.

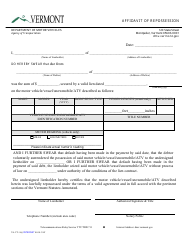

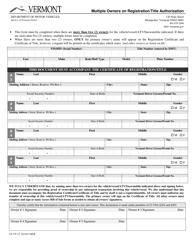

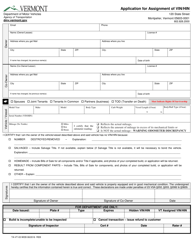

Q: Who needs to fill out Form TA-VT-29?

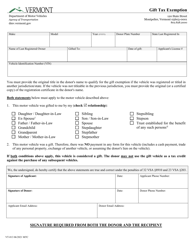

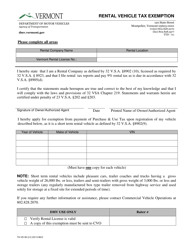

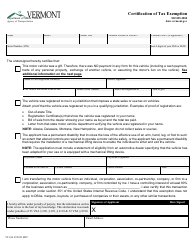

A: Individuals or businesses who want to claim a tax exemption or disclose their controlling interest in Vermont need to fill out this form.

Q: What is the purpose of Form TA-VT-29?

A: The purpose of this form is to provide information to the Vermont tax authorities about tax exemptions and controlling interests.

Q: How do I fill out Form TA-VT-29?

A: You need to fill out your personal or business information, indicate the tax exemption you are claiming or disclose your controlling interest, and sign the form.

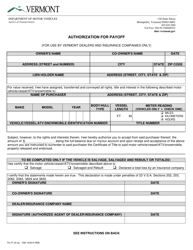

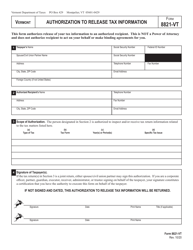

Q: Are there any fees associated with filing Form TA-VT-29?

A: No, there are no fees associated with filing Form TA-VT-29.

Q: When is the deadline to file Form TA-VT-29?

A: The deadline to file Form TA-VT-29 is generally April 15th of each year, unless an extension has been granted.

Q: What should I do if I have questions or need assistance with Form TA-VT-29?

A: If you have questions or need assistance with Form TA-VT-29, you can contact the Vermont Department of Taxes for help.

Form Details:

- Released on November 1, 2015;

- The latest edition provided by the Vermont Department of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TA-VT-29 by clicking the link below or browse more documents and templates provided by the Vermont Department of Motor Vehicles.