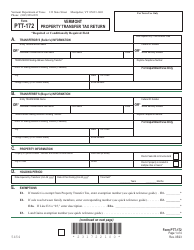

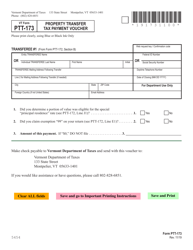

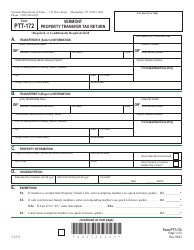

VT Form PTT-172 Quick Reference Guide for Vermont Property Transfer Tax Return - Vermont

This document contains official instructions for VT Form PTT-172 , Vermont Property Transfer Tax Return - a form released and collected by the Vermont Department of Taxes. An up-to-date fillable VT Form PTT-172 is available for download through this link.

FAQ

Q: What is Form PTT-172?

A: Form PTT-172 is the Vermont Property Transfer Tax Return used for reporting property transfers in Vermont.

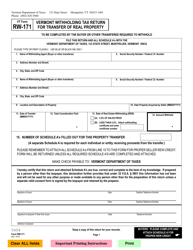

Q: Who needs to file Form PTT-172?

A: Anyone involved in a property transfer in Vermont, including buyers, sellers, and their representatives, may need to file Form PTT-172.

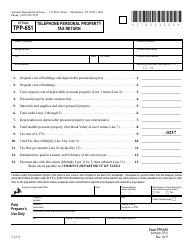

Q: What is the purpose of the Vermont Property Transfer Tax?

A: The Vermont Property Transfer Tax is a tax imposed on the transfer of real property in Vermont. It helps fund the state's Land Conservation and Affordable Housing programs.

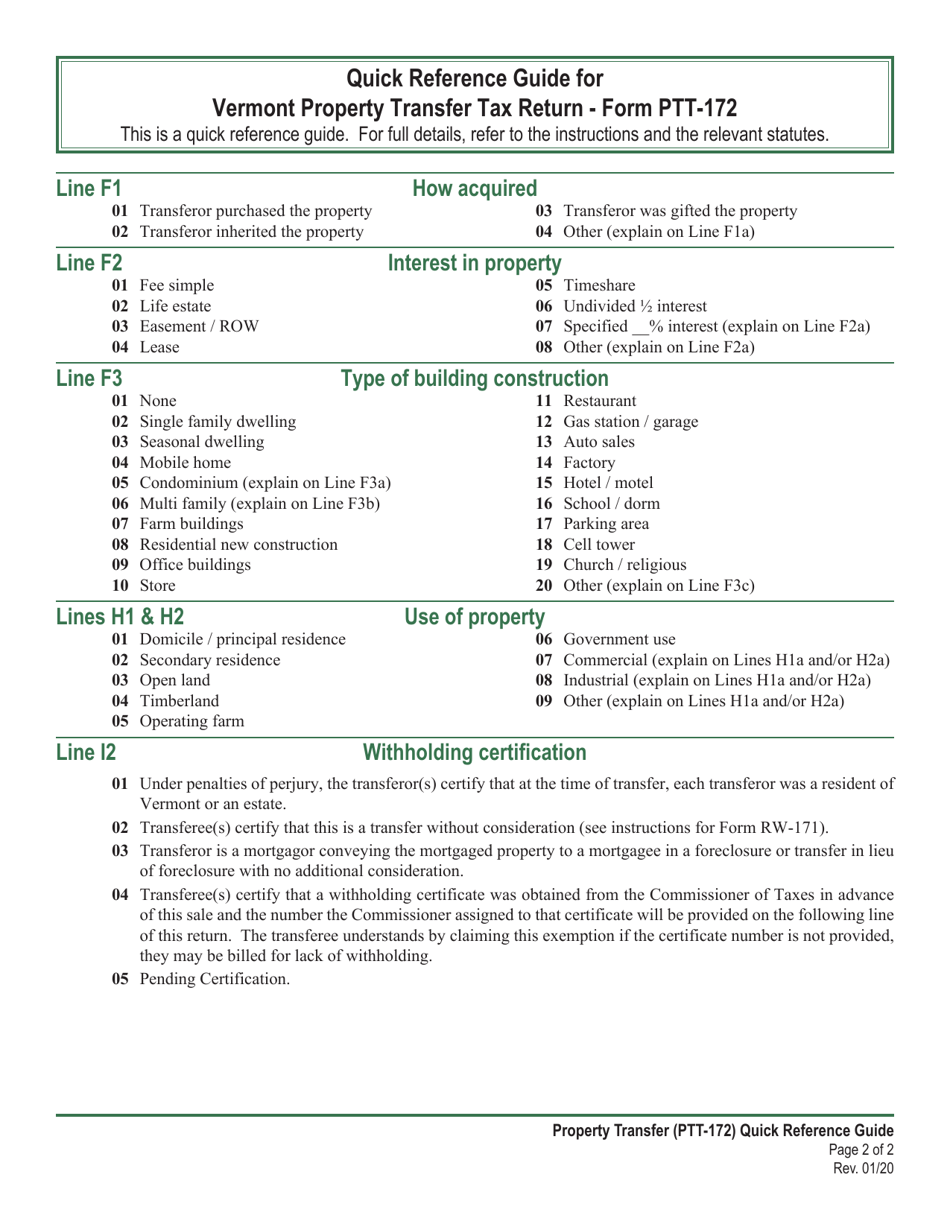

Q: What information is required on Form PTT-172?

A: Form PTT-172 requires information about the property transfer, including the names of the buyer and seller, the property address, and the purchase price.

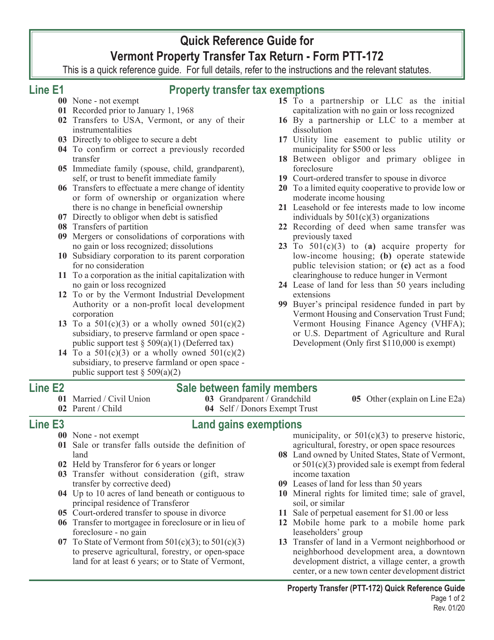

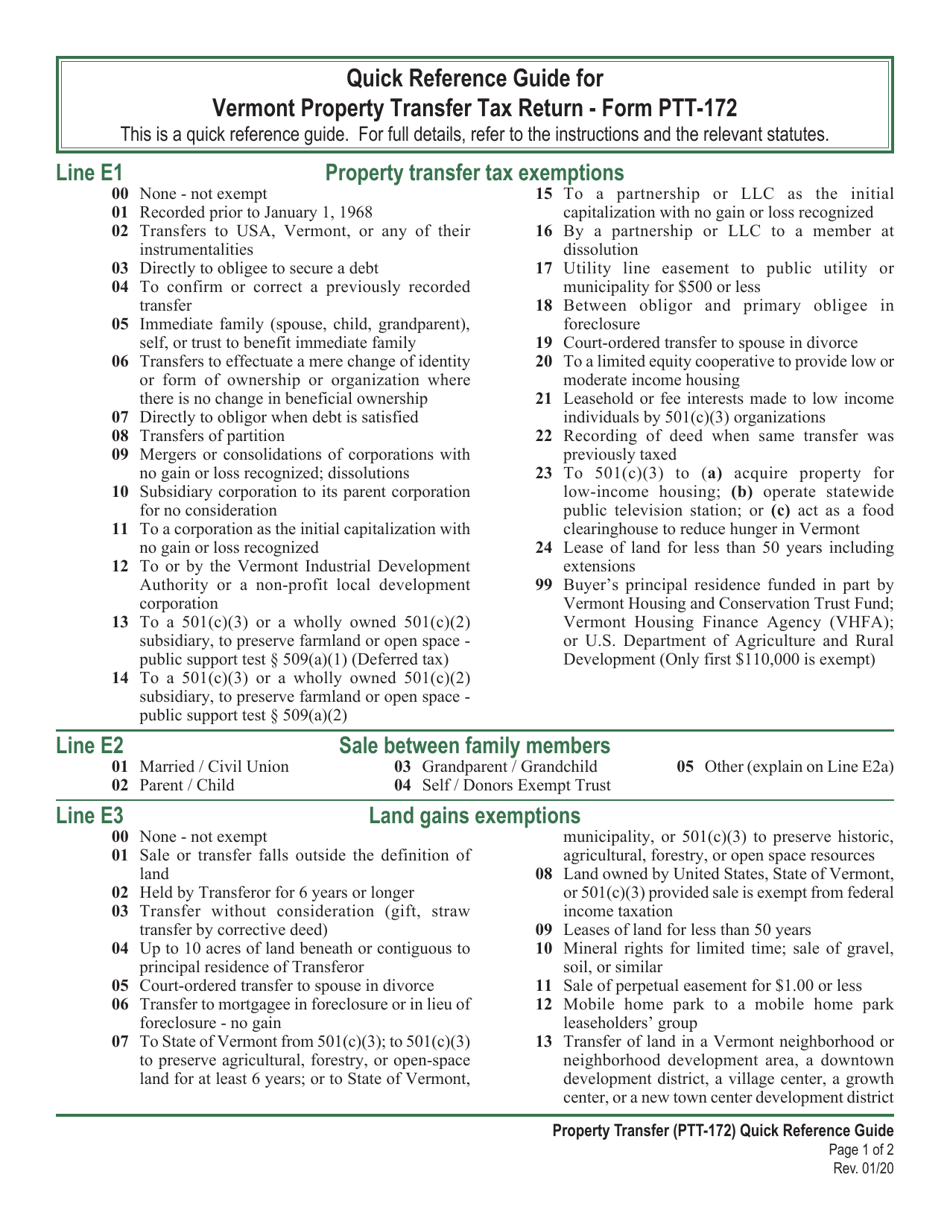

Q: Are there any exemptions or exclusions from the Vermont Property Transfer Tax?

A: Yes, certain transfers may be exempt from the Vermont Property Transfer Tax, such as transfers between spouses, transfers to non-profit organizations, and transfers of agricultural land.

Q: When is Form PTT-172 due?

A: Form PTT-172 must be filed and the tax paid within 15 days of the transfer of the property, unless an extension is granted.

Q: What happens if I don't file Form PTT-172 or pay the Vermont Property Transfer Tax?

A: Failure to file Form PTT-172 or pay the Vermont Property Transfer Tax can result in penalties and interest being assessed by the Vermont Department of Taxes.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Vermont Department of Taxes.