This version of the form is not currently in use and is provided for reference only. Download this version of

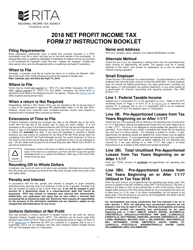

Instructions for Form 27

for the current year.

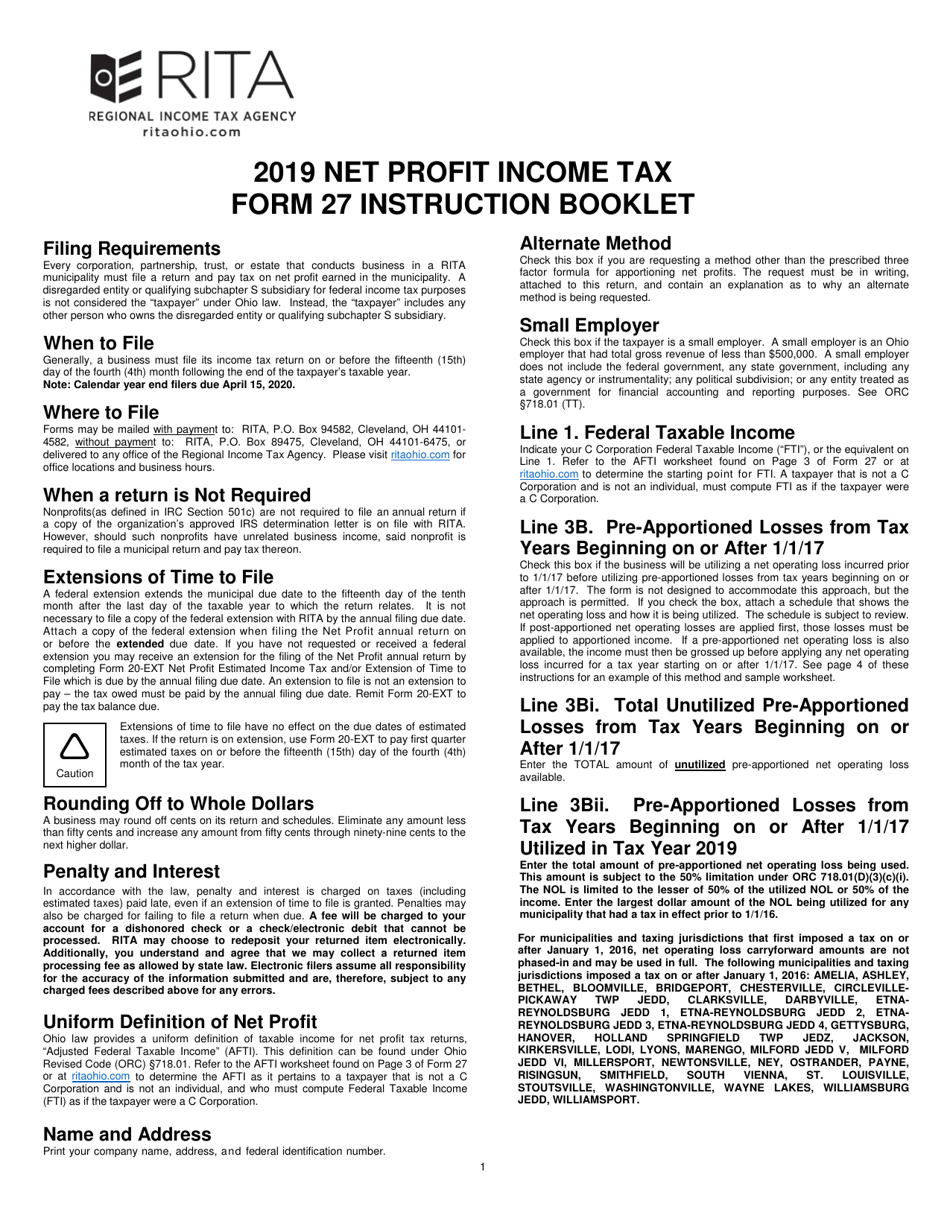

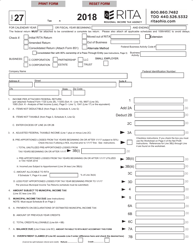

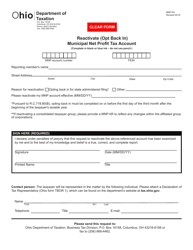

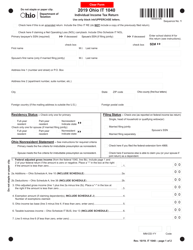

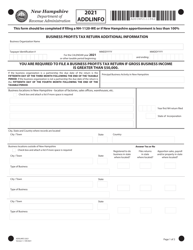

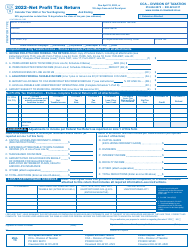

Instructions for Form 27 Net Profit Tax Return - Ohio

This document contains official instructions for Form 27 , Net Profit Tax Return - a form released and collected by the Ohio Regional Income Tax Agency (RITA).

FAQ

Q: What is Form 27?

A: Form 27 is a Net Profit Tax Return for businesses in Ohio.

Q: Who needs to file Form 27?

A: Businesses in Ohio that have a net profit exceeding $100,000 or have a total gross receipts exceeding $500,000 in a calendar year need to file Form 27.

Q: What information is required on Form 27?

A: Form 27 requires information such as the business's name, address, federal employer identification number, net profit calculation, and other financial details.

Q: When is Form 27 due?

A: Form 27 is due on or before April 15th of the following calendar year, or on the extended due date if an extension has been granted.

Q: Are there any penalties for late filing?

A: Yes, there are penalties for late filing of Form 27. The penalty is based on the amount of tax due and can range from 5% to 15% of the unpaid tax.

Q: Can I file Form 27 electronically?

A: Yes, Form 27 can be filed electronically through the Ohio Business Gateway or through an approved tax preparation software.

Q: Do I need to include supporting documents with Form 27?

A: You may need to include supporting documents such as financial statements or schedules that are relevant to your net profit calculation. It is important to keep these documents for reference in case of an audit.

Q: Can I amend my Form 27 after it has been filed?

A: Yes, you can amend your Form 27 by filing an amended return using Form 27-X. However, it is recommended to consult with a tax professional before making any amendments.

Q: Is Form 27 the only tax return I need to file in Ohio?

A: No, depending on your business structure and other factors, you may also need to file other tax returns such as the Ohio Commercial Activity Tax return or individual income tax returns for the owners or partners of the business.

Instruction Details:

- This 4-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Ohio Regional Income Tax Agency (RITA).