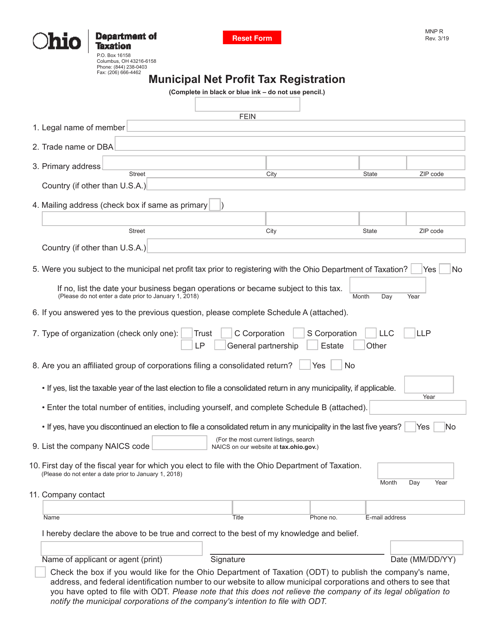

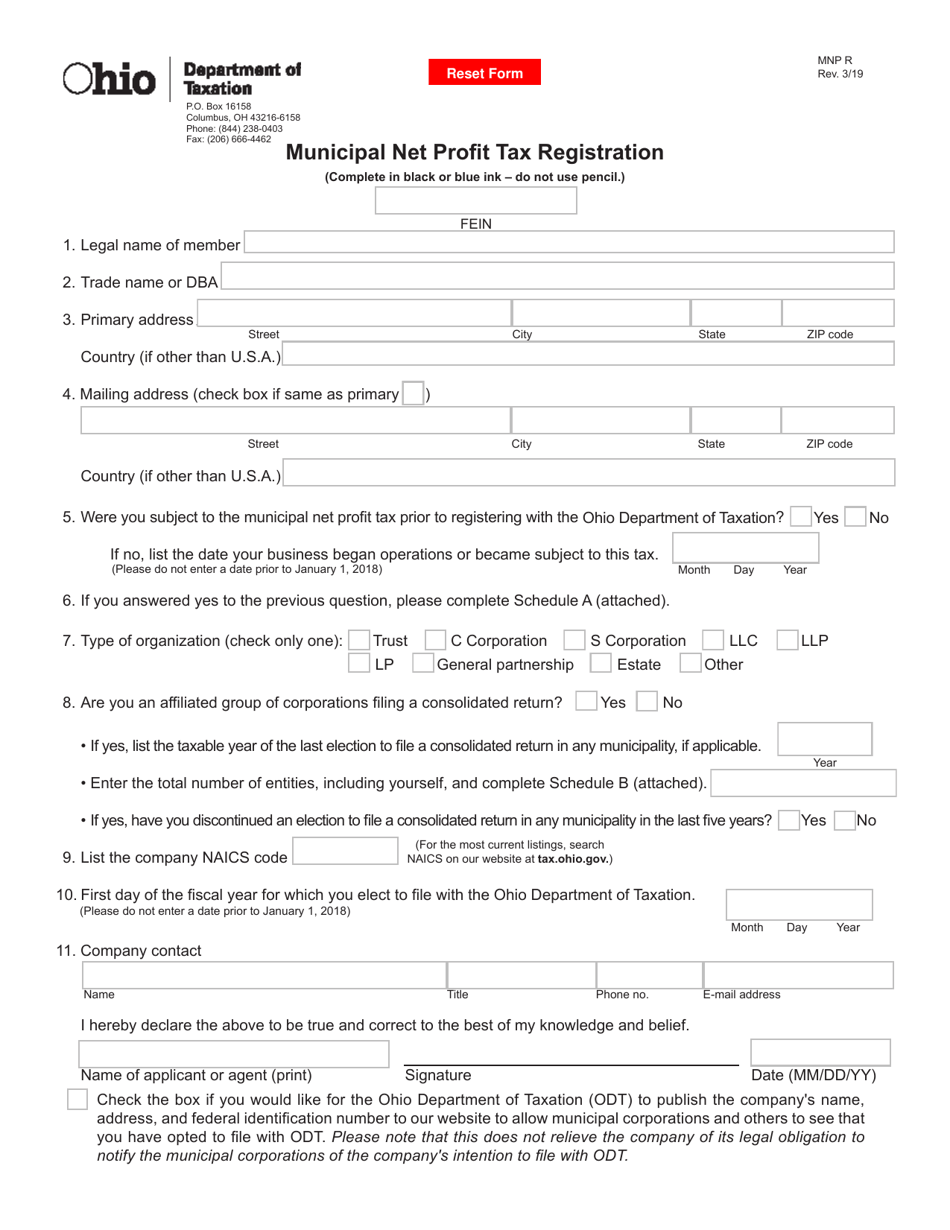

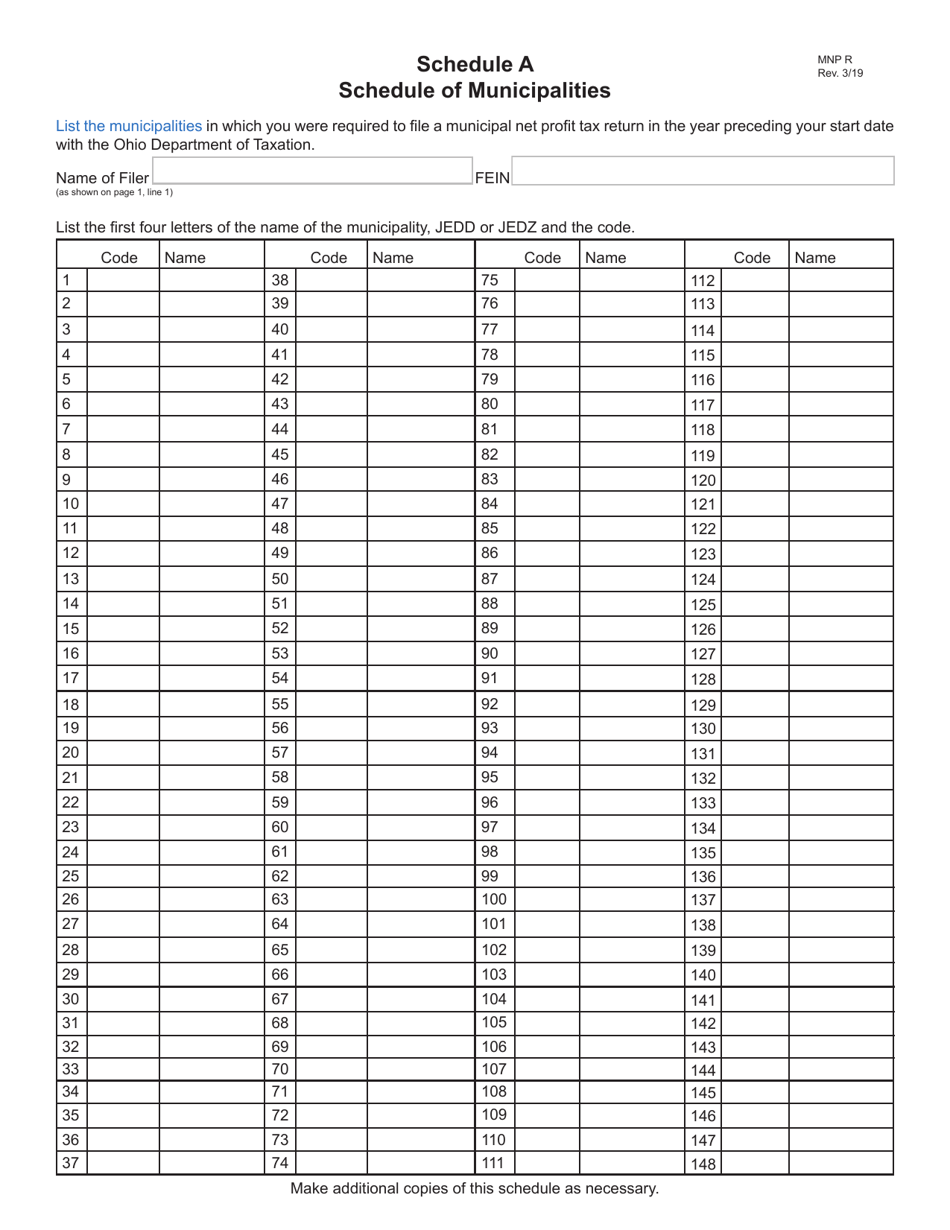

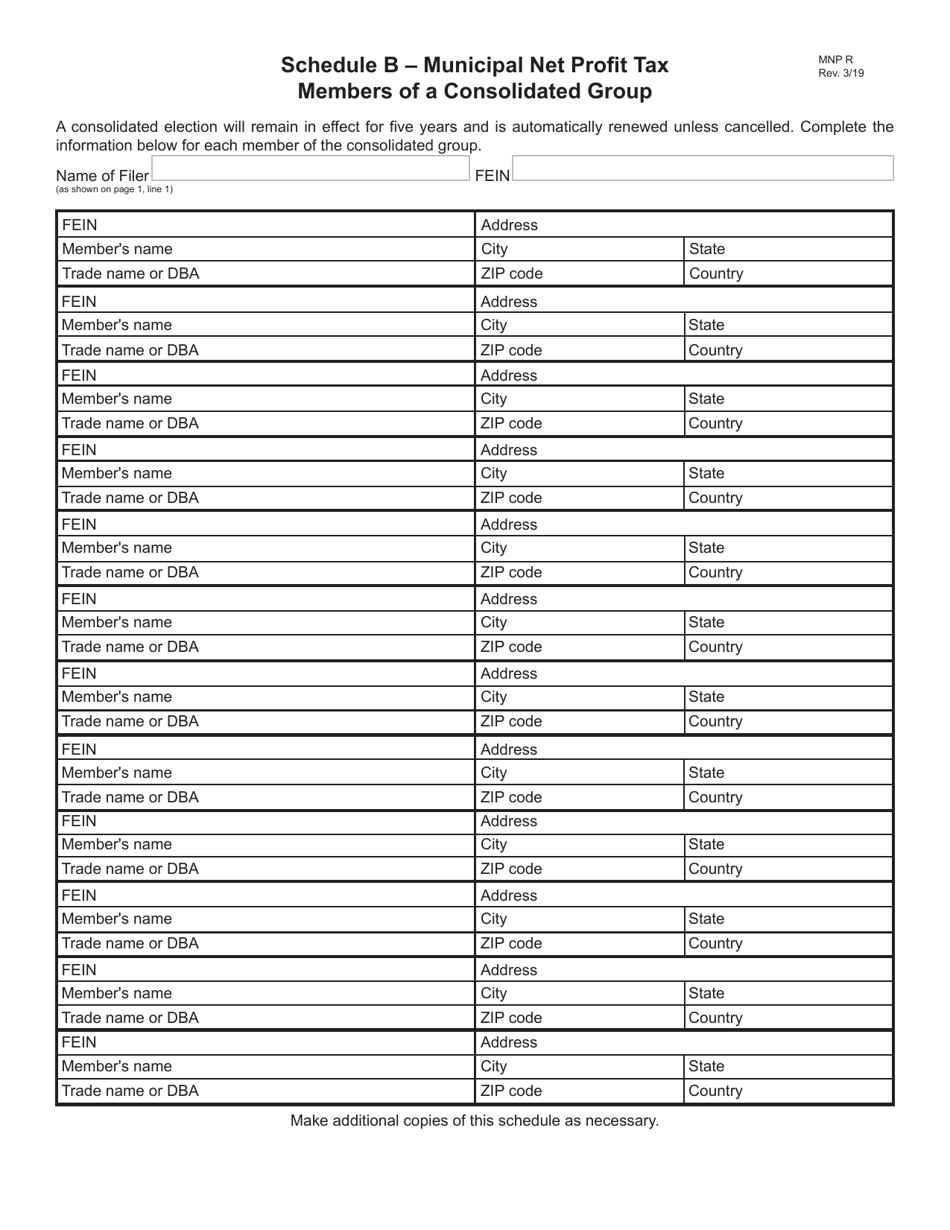

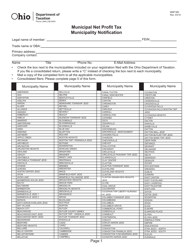

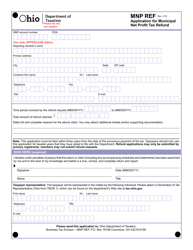

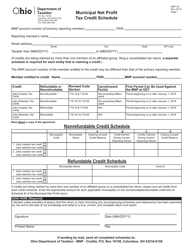

Form MNP R Municipal Net Profit Tax Registration - Ohio

What Is Form MNP R?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form MNP R?

A: Form MNP R is the Municipal Net Profit Tax Registration form in Ohio.

Q: What is the purpose of Form MNP R?

A: The purpose of Form MNP R is to register for the Municipal Net Profit Tax in Ohio.

Q: Who needs to file Form MNP R?

A: Any business entity operating in a municipality that imposes a net profit tax needs to file Form MNP R.

Q: What information is required on Form MNP R?

A: Form MNP R requires basic information about the business, including name, address, and FEIN.

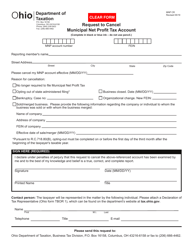

Q: When is the deadline to file Form MNP R?

A: The deadline to file Form MNP R is generally the same as the deadline for filing the Ohio income tax return, which is April 15th.

Q: Are there any penalties for late filing of Form MNP R?

A: Yes, there may be penalties for late filing of Form MNP R, including interest on any unpaid taxes.

Q: Is Form MNP R required every year?

A: Yes, Form MNP R is required to be filed annually as long as the business operates in a municipality that imposes a net profit tax.

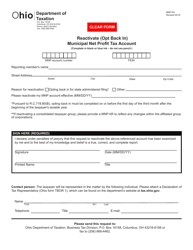

Form Details:

- Released on March 1, 2019;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MNP R by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.