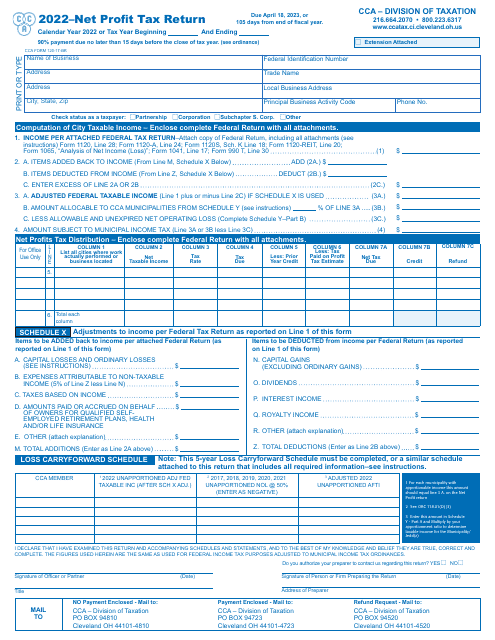

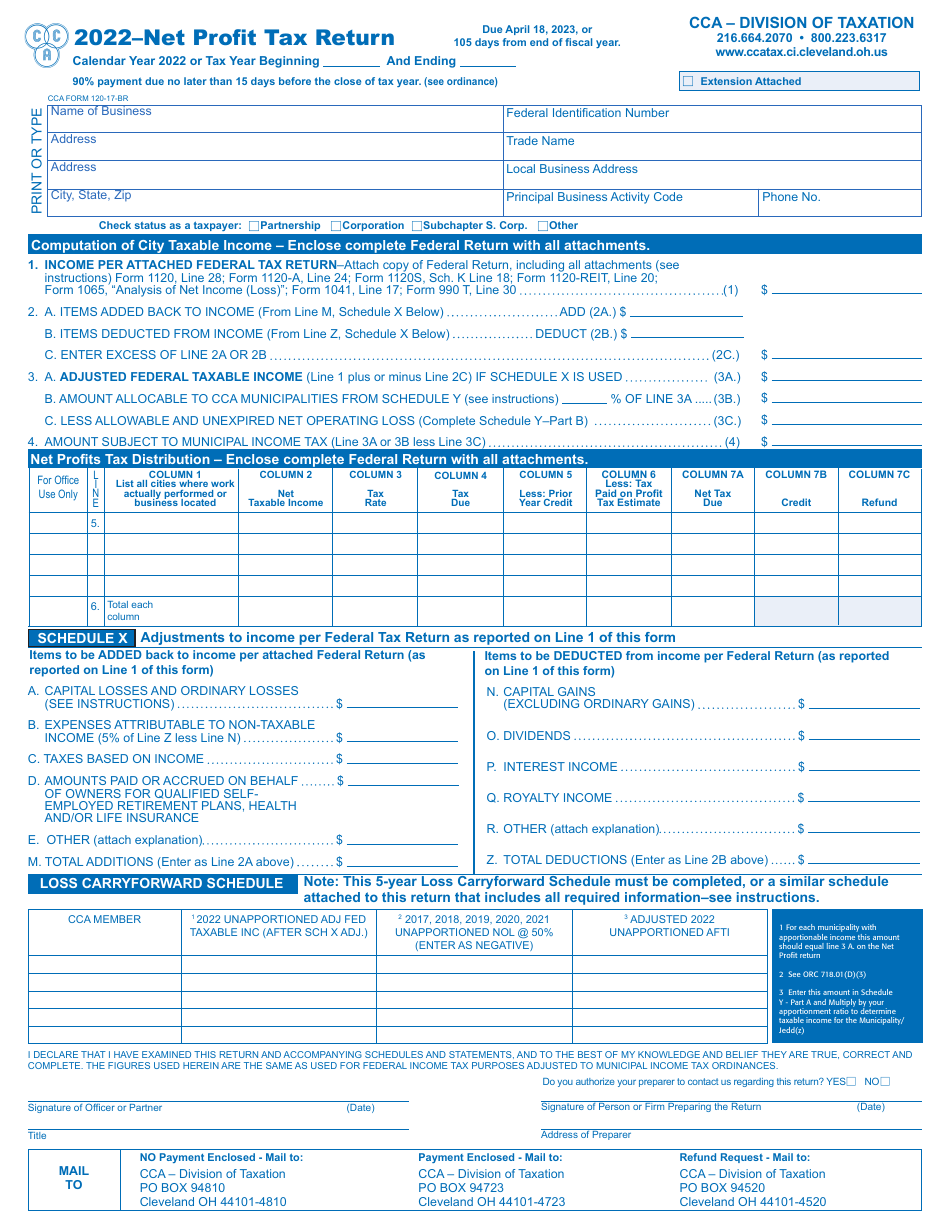

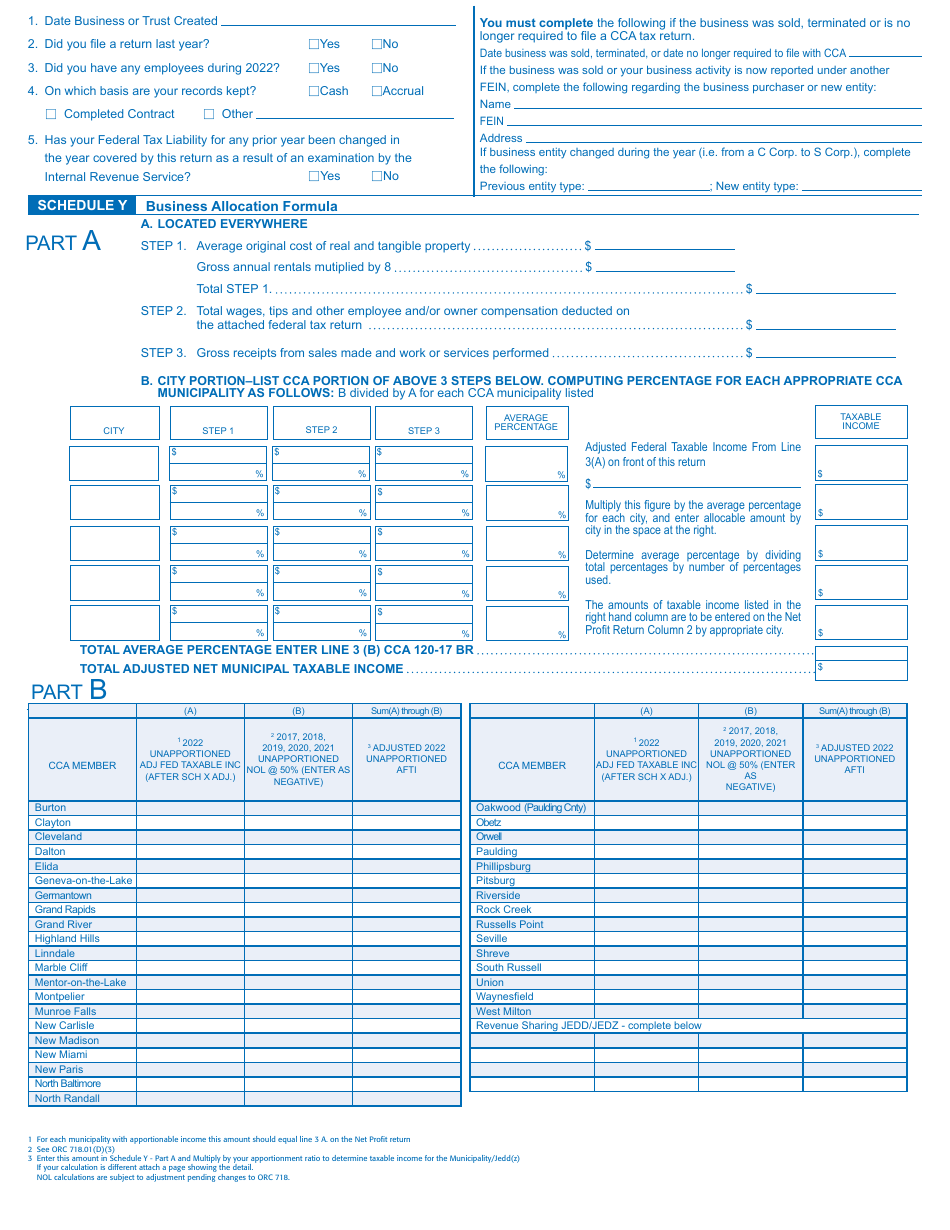

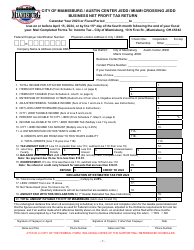

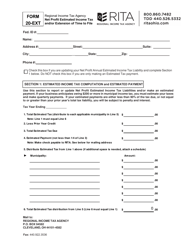

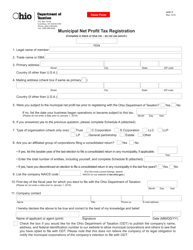

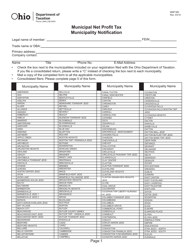

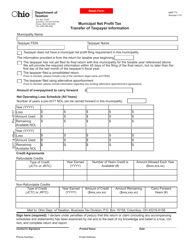

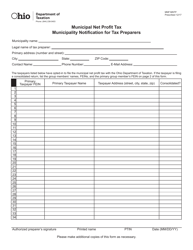

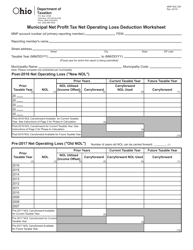

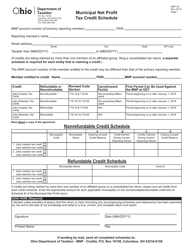

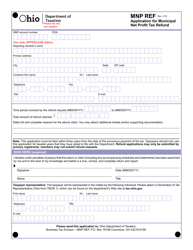

Net Profit Tax Return - City of Cleveland, Ohio

Net Profit Tax Return is a legal document that was released by the Division of Taxation - City of Cleveland, Ohio - a government authority operating within Ohio. The form may be used strictly within City of Cleveland.

FAQ

Q: What is the net profit tax return?

A: The net profit tax return is a form used to report and pay taxes on the net profit earned by businesses in the City of Cleveland, Ohio.

Q: Who is required to file a net profit tax return in Cleveland, Ohio?

A: Any business that earned a net profit in the City of Cleveland, Ohio is required to file a net profit tax return.

Q: How often do businesses need to file a net profit tax return in Cleveland, Ohio?

A: Businesses in Cleveland, Ohio must file a net profit tax return annually.

Q: What is the due date for filing a net profit tax return in Cleveland, Ohio?

A: The due date for filing a net profit tax return in Cleveland, Ohio is April 15th of each year.

Q: Are there any penalties for late filing or non-filing of a net profit tax return in Cleveland, Ohio?

A: Yes, there are penalties for late filing or non-filing of a net profit tax return in Cleveland, Ohio. It is important to file your return on time to avoid these penalties.

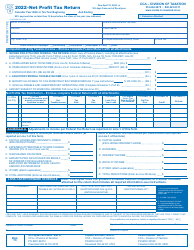

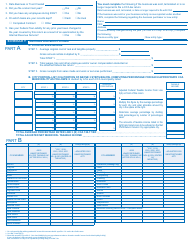

Q: What expenses can be deducted on the net profit tax return in Cleveland, Ohio?

A: There are certain expenses that can be deducted on the net profit tax return in Cleveland, Ohio. It is advisable to consult a tax professional or refer to the instructions provided with the tax return form for more information.

Q: What should I do if I have questions or need assistance with the net profit tax return in Cleveland, Ohio?

A: If you have questions or need assistance with the net profit tax return in Cleveland, Ohio, you can contact the City of Cleveland's tax office for help.

Form Details:

- The latest edition currently provided by the Division of Taxation - City of Cleveland, Ohio;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Division of Taxation - City of Cleveland, Ohio.