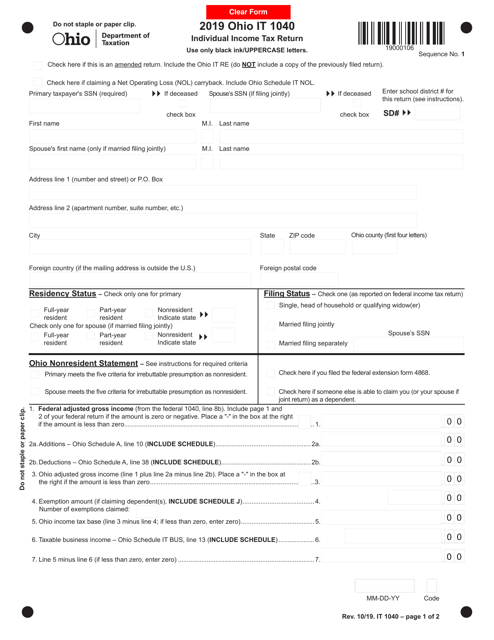

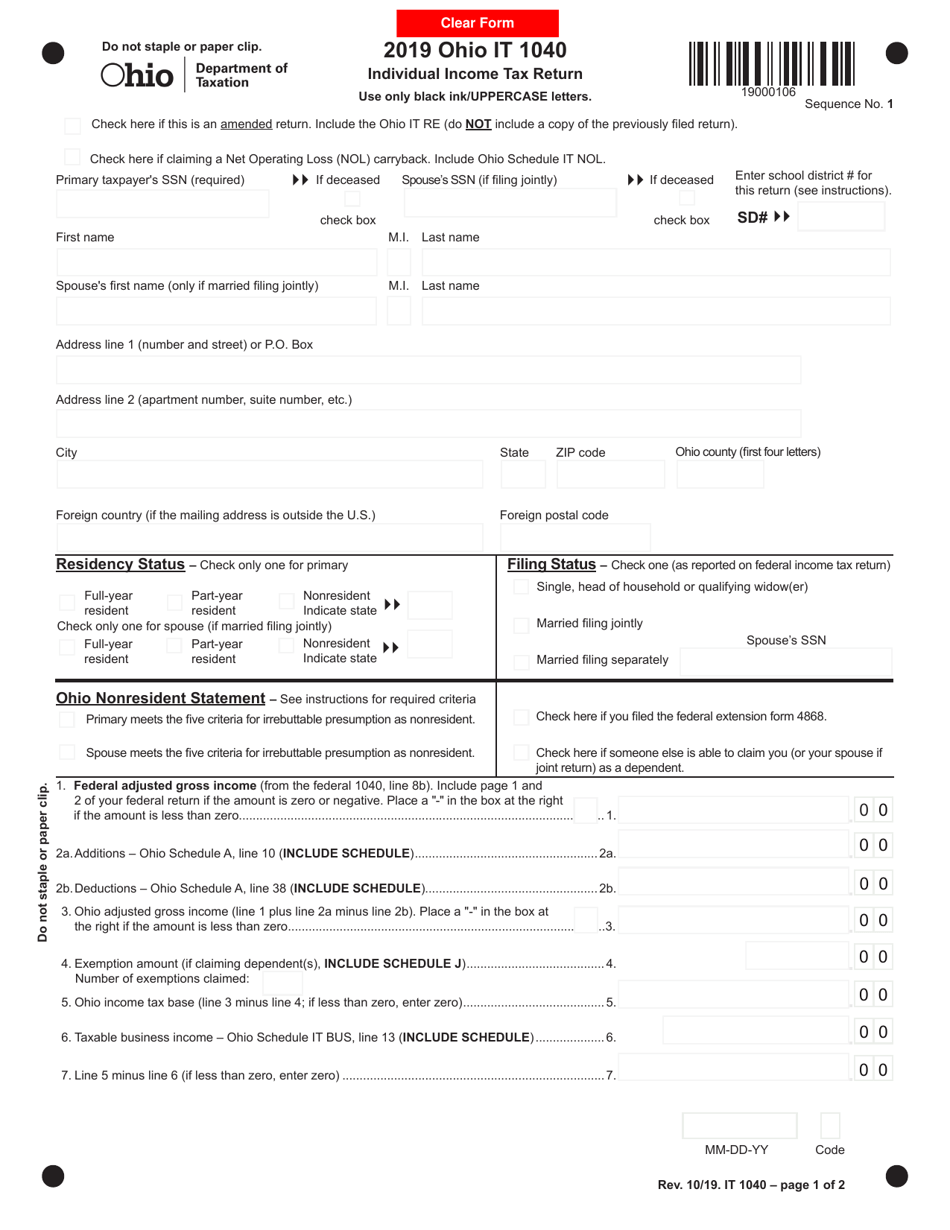

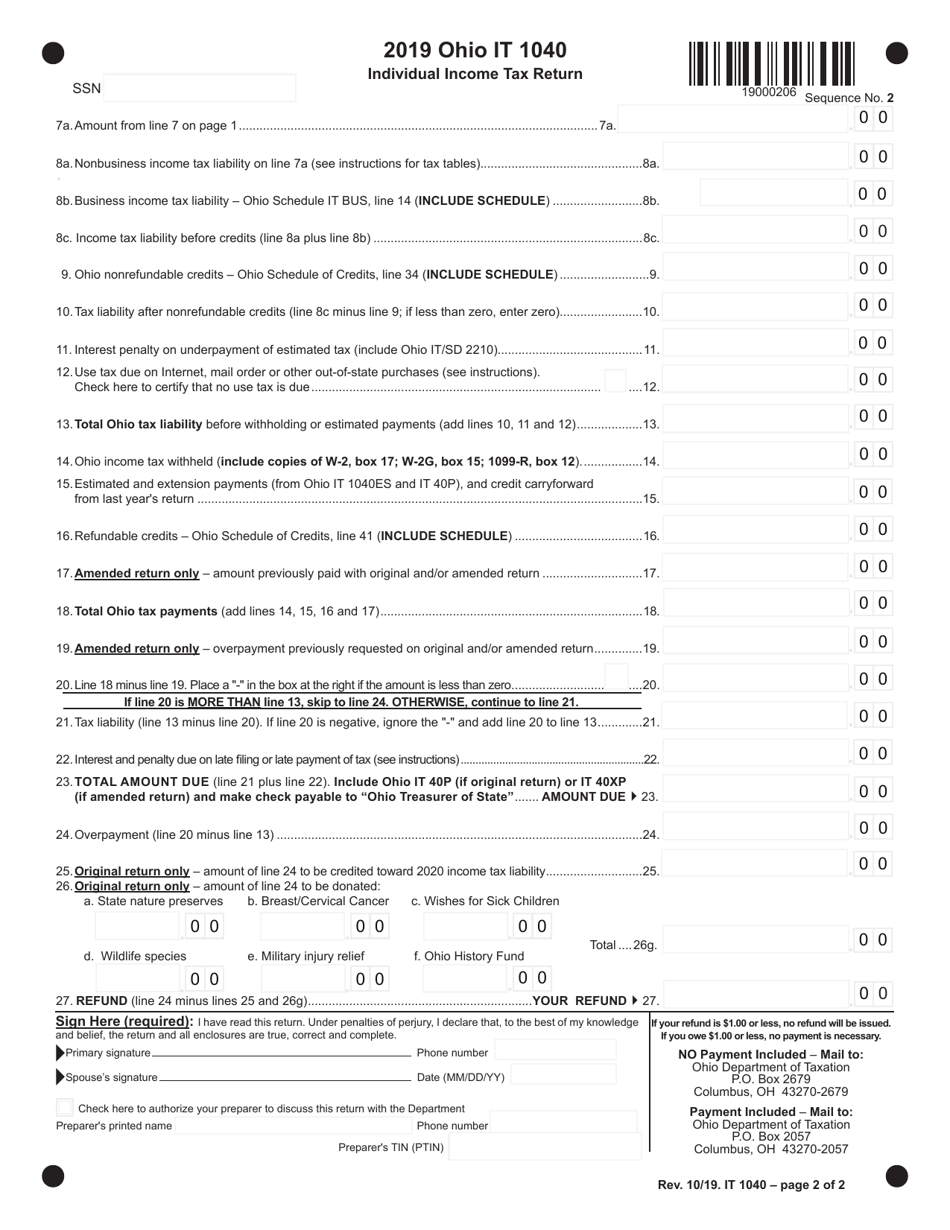

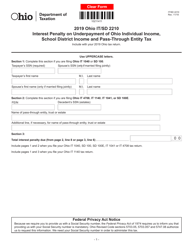

Form IT1040 Individual Income Tax Return - Ohio

What Is Form IT1040?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the IT1040 form?

A: The IT1040 form is the Individual Income Tax Return form for residents of Ohio.

Q: Who needs to file the IT1040 form?

A: Residents of Ohio who earned income during the tax year need to file the IT1040 form.

Q: When is the deadline for filing the IT1040 form?

A: The deadline for filing the IT1040 form is typically April 15th of each year, but may vary.

Q: What are some common credits and deductions on the IT1040 form?

A: Common credits and deductions on the IT1040 form include the dependent exemption, tuition credit, and the Ohio Earned Income Credit.

Q: What happens if I file my IT1040 form late?

A: If you file your IT1040 form late, you may be subject to penalties and interest on any unpaid taxes.

Q: Can I get an extension to file my IT1040 form?

A: Yes, you can request a filing extension for the IT1040 form, but any taxes owed are still due by the original deadline.

Q: What if I need help completing the IT1040 form?

A: If you need assistance completing the IT1040 form, you can contact the Ohio Department of Taxation or seek help from a tax professional.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT1040 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.