This version of the form is not currently in use and is provided for reference only. Download this version of

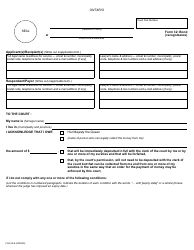

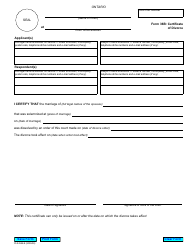

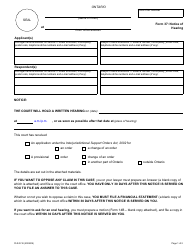

Form T1223

for the current year.

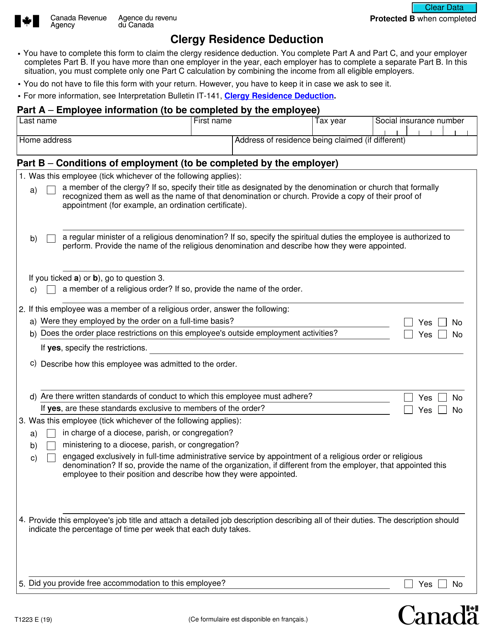

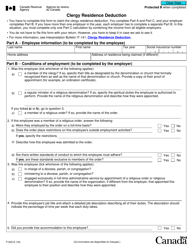

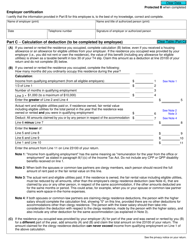

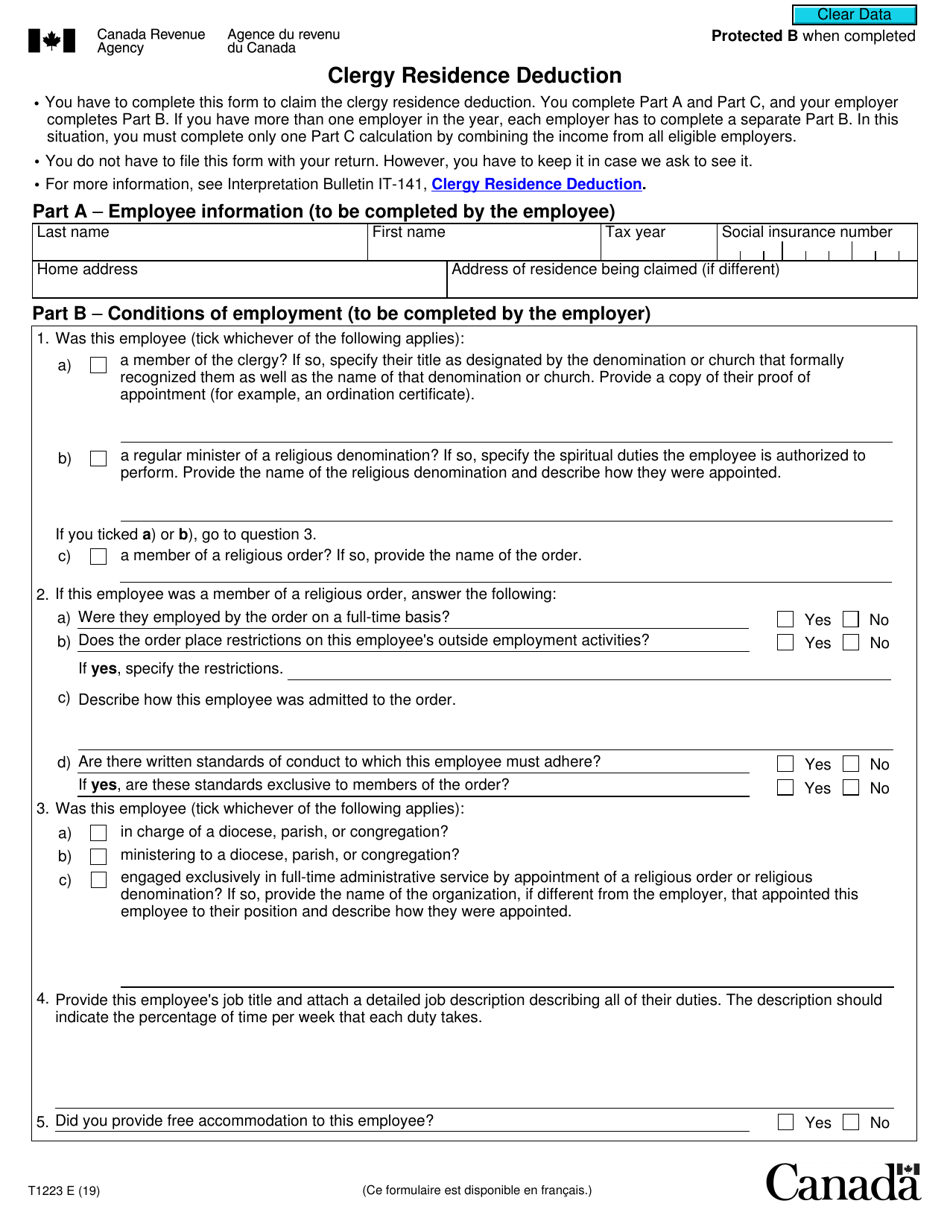

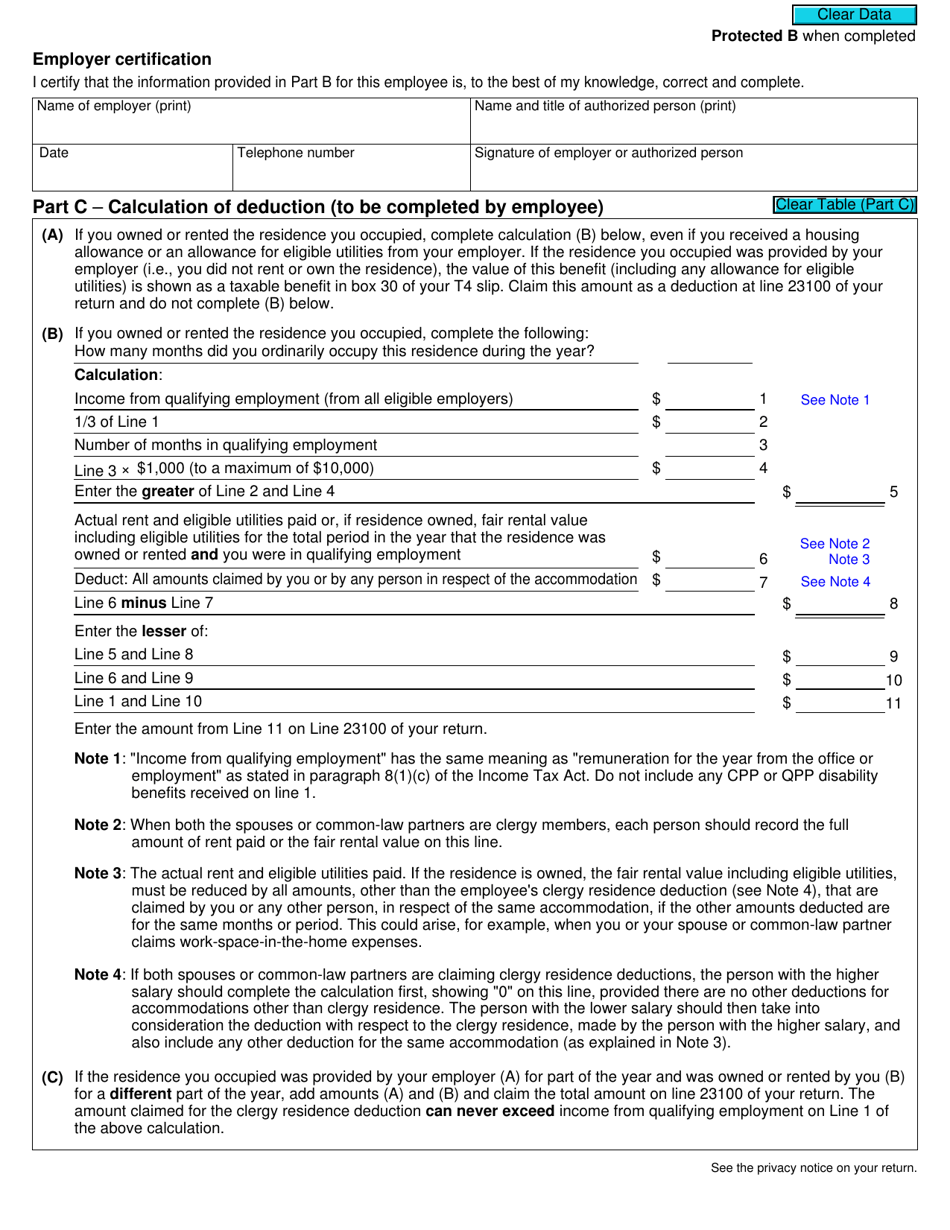

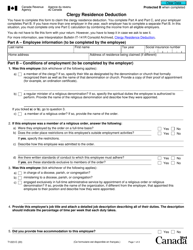

Form T1223 Clergy Residence Deduction - Canada

Form T1223 Clergy Residence Deduction is used in Canada to claim a tax deduction for clergy members who live in a residence provided by their employer. It allows them to deduct certain housing expenses related to their duties as clergy.

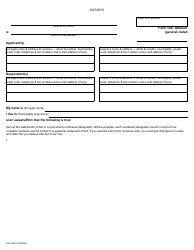

The Form T1223 for Clergy Residence Deduction in Canada is filed by individuals who are ordained, licensed, or commissioned members of clergy and meet specific eligibility criteria.

FAQ

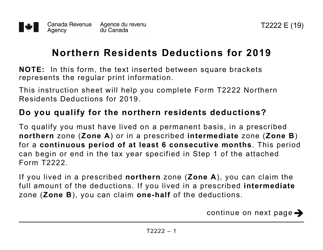

Q: What is Form T1223?

A: Form T1223 is a tax form used in Canada to claim the Clergy Residence Deduction.

Q: Who is eligible for the Clergy Residence Deduction?

A: Clergy members who receive a salary or honorarium for providing religious services are eligible for the Clergy Residence Deduction.

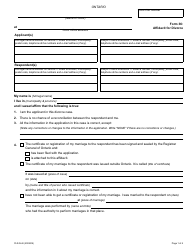

Q: What is the purpose of the Clergy Residence Deduction?

A: The purpose of the Clergy Residence Deduction is to allow clergy members to deduct expenses related to their housing.

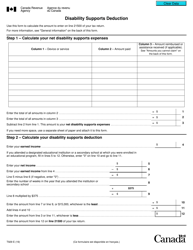

Q: What expenses can be deducted through the Clergy Residence Deduction?

A: Clergy members can deduct expenses such as rent, mortgage interest, utilities, and repairs and maintenance related to their housing.

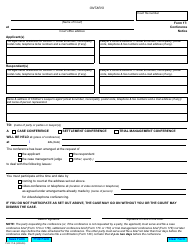

Q: How do I claim the Clergy Residence Deduction?

A: To claim the Clergy Residence Deduction, you need to complete Form T1223 and include it with your tax return.

Q: Are there any limitations to the Clergy Residence Deduction?

A: Yes, there are limitations to the Clergy Residence Deduction, including a limit of 1/3 of your salary or honorarium and a limit based on the fair market value of your housing.