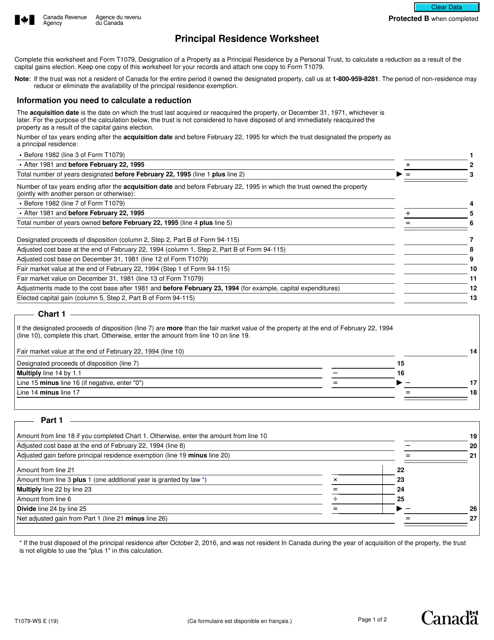

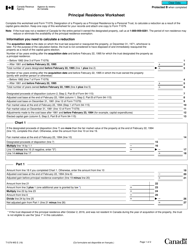

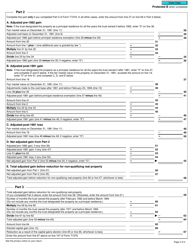

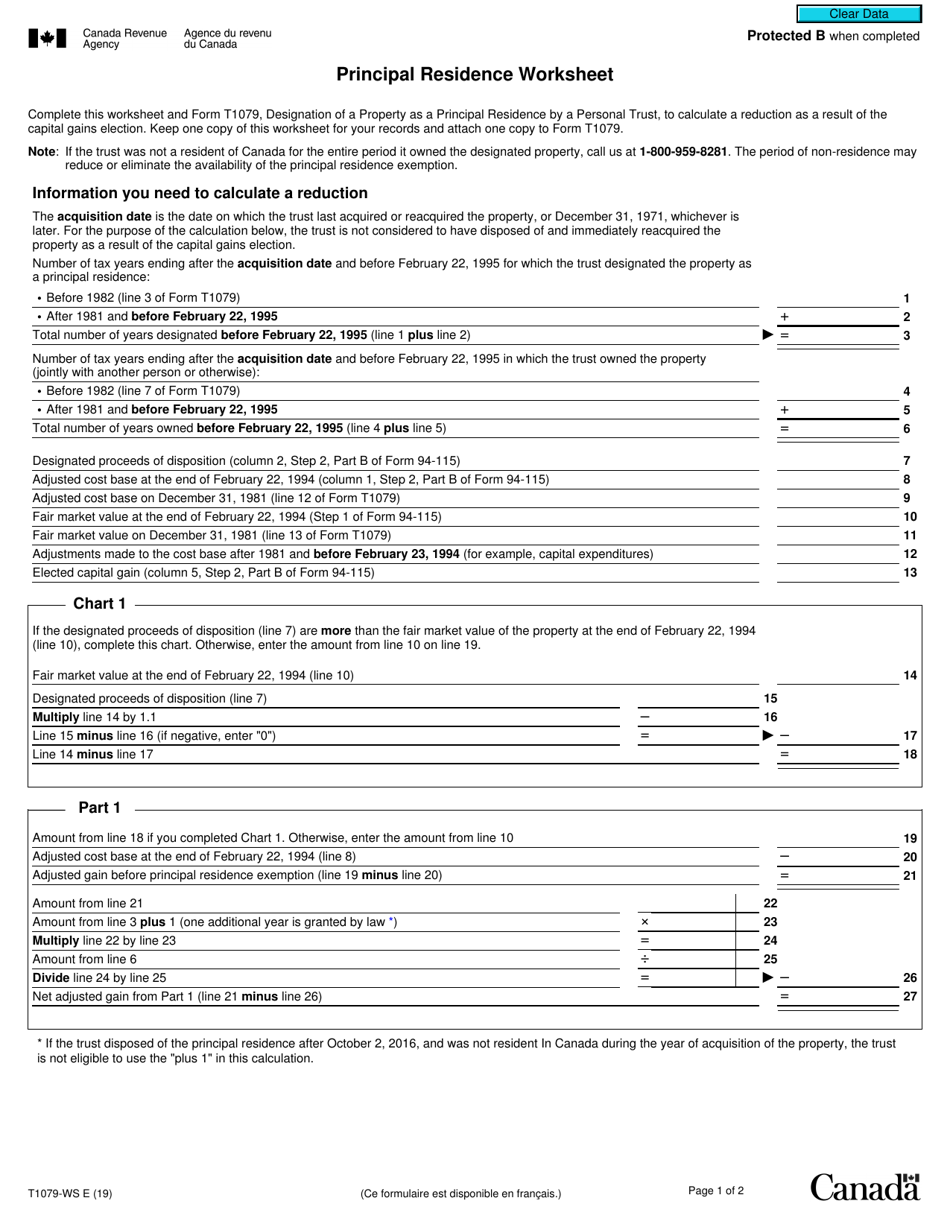

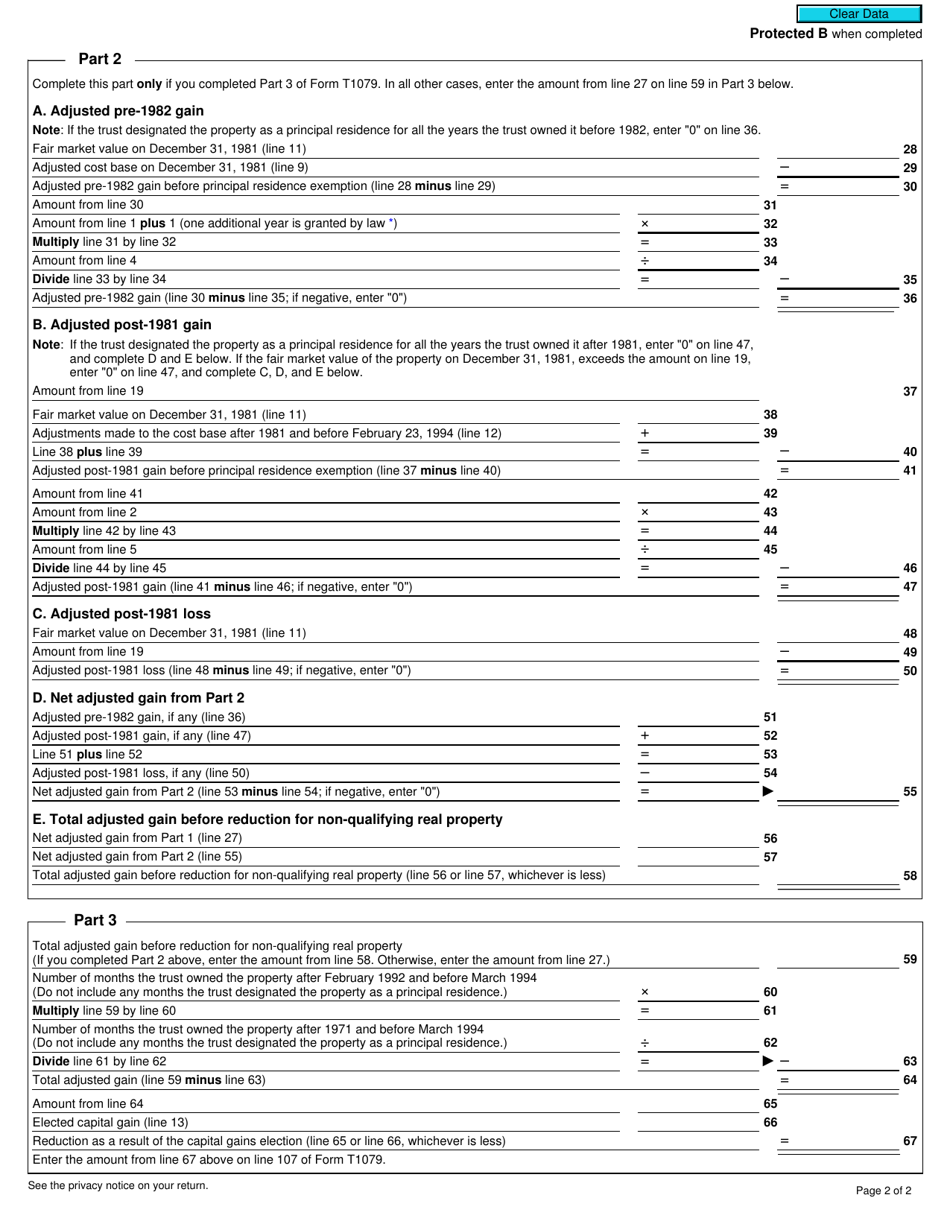

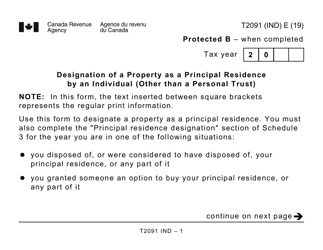

Form T1079WS Principal Residence Worksheet - Canada

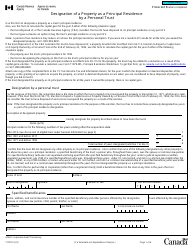

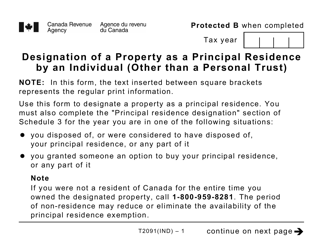

Form T1079WS, Principal Residence Worksheet, is used by residents of Canada to calculate the capital gain exemption for the sale of their principal residence. It helps determine the amount of the gain that can be claimed as tax-free.

The Form T1079WS Principal Residence Worksheet in Canada is filed by individuals who are claiming the principal residence exemption.

FAQ

Q: What is Form T1079WS?

A: Form T1079WS is the Principal Residence Worksheet for Canadian taxpayers.

Q: What is a principal residence?

A: A principal residence is the main home you live in during the year.

Q: Why do I need to fill out Form T1079WS?

A: You need to fill out Form T1079WS if you sold or changed the use of your principal residence during the year.

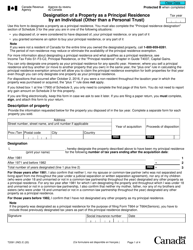

Q: What information is required on Form T1079WS?

A: Form T1079WS requires you to provide details about the sale or change of use of your principal residence, such as the date of acquisition, proceeds of disposition, and adjustments.

Q: When is the deadline to file Form T1079WS?

A: The deadline to file Form T1079WS is generally the same as your personal income tax return, which is April 30th of the following year (or June 15th if you or your spouse is self-employed).