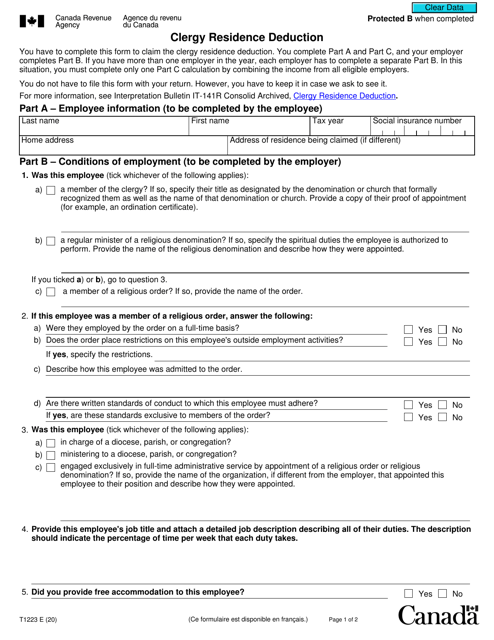

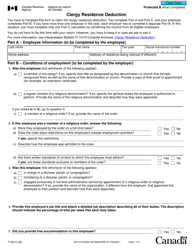

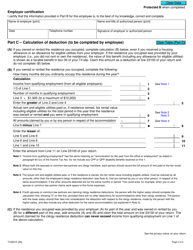

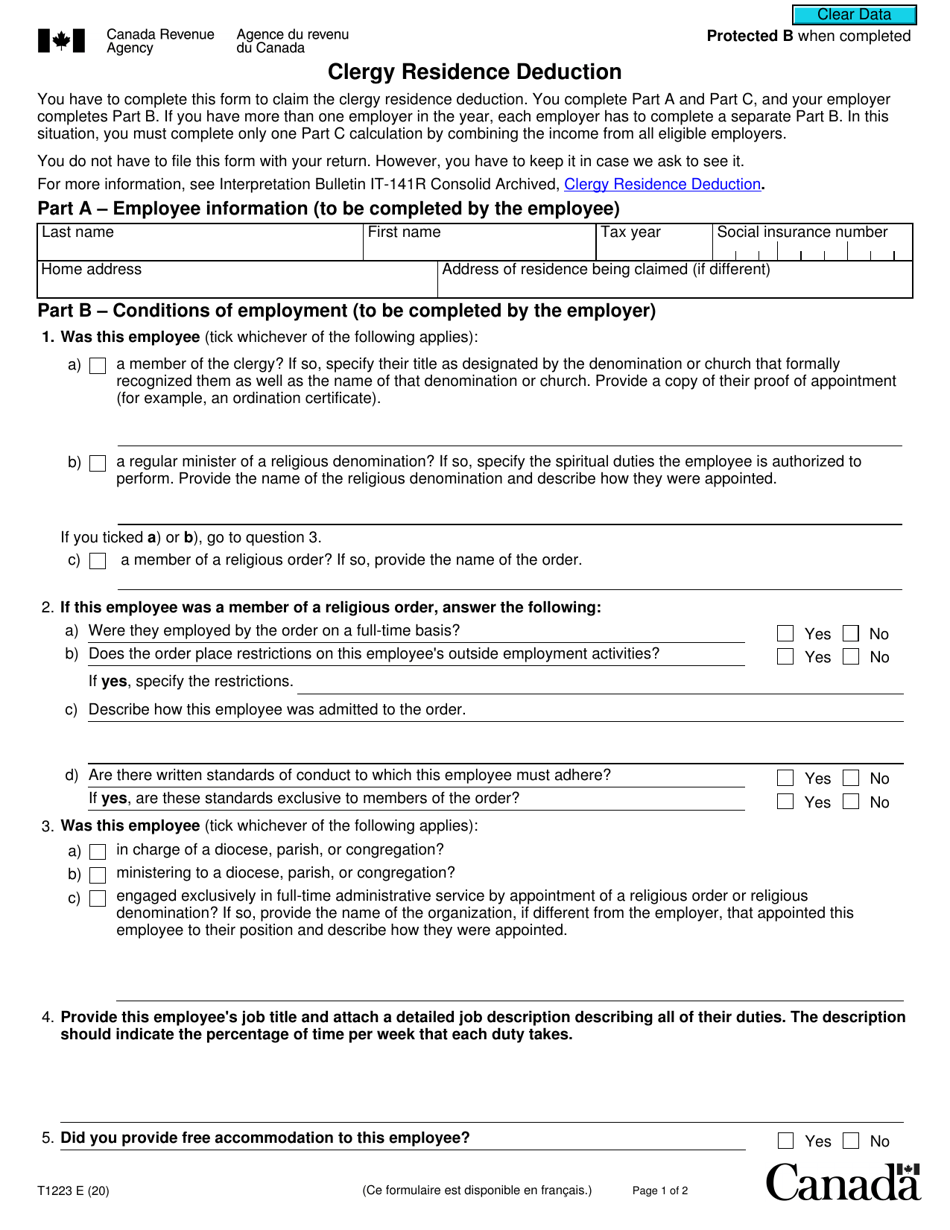

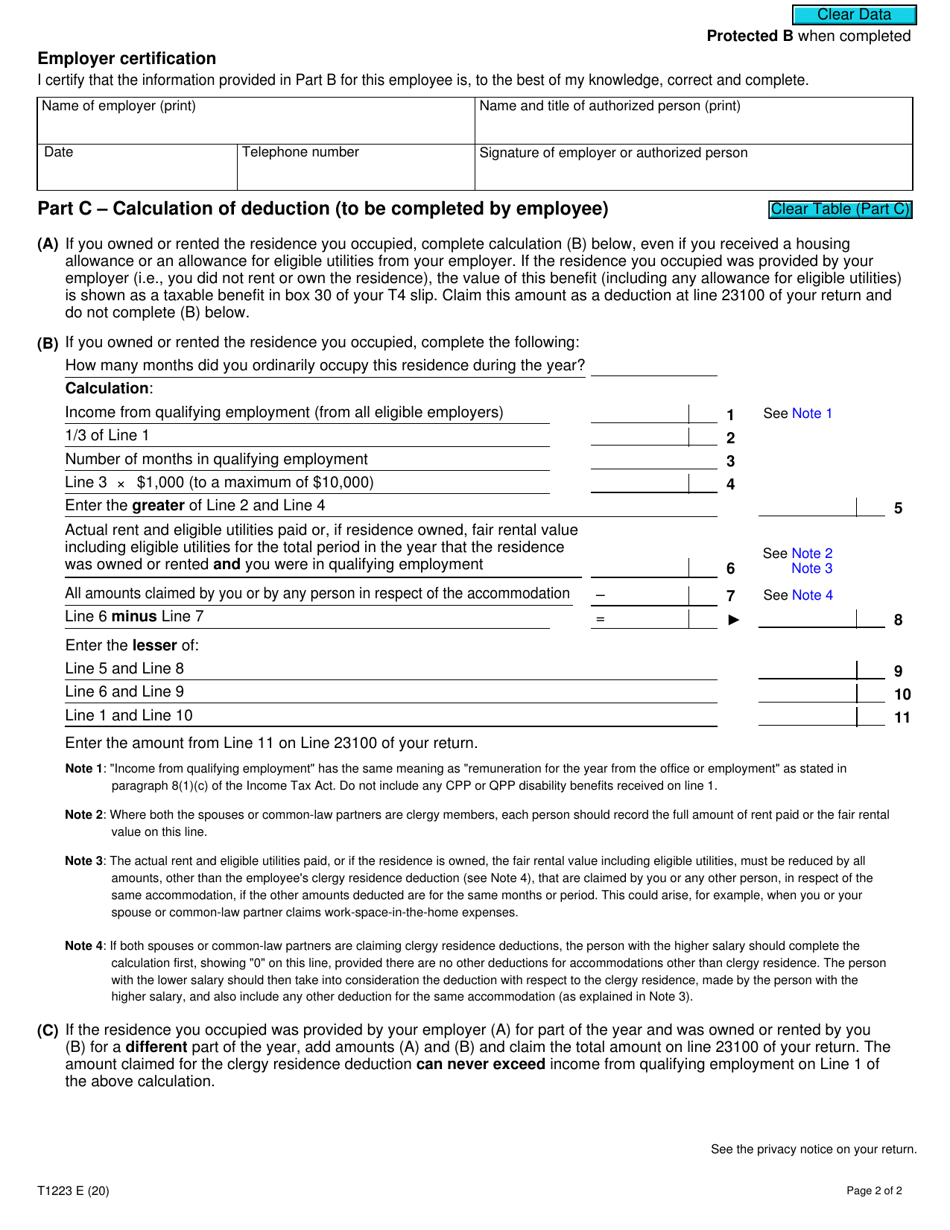

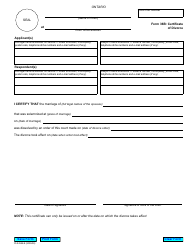

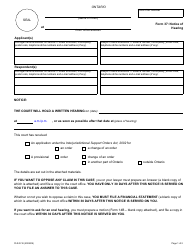

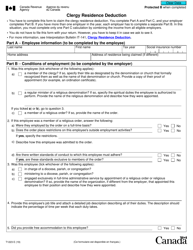

Form T1223 Clergy Residence Deduction - Canada

Form T1223 Clergy Residence Deduction in Canada is used by members of the clergy to claim a deduction for housing expenses related to their duties. It allows eligible clergy members to reduce their taxable income by the amount spent on maintaining a home that is used as a residence for performing their religious duties.

The Form T1223 for Clergy Residence Deduction in Canada is filed by clergy members who qualify for this tax deduction.

Form T1223 Clergy Residence Deduction - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T1223?

A: Form T1223 is a form used in Canada to claim the Clergy Residence Deduction.

Q: What is the Clergy Residence Deduction?

A: The Clergy Residence Deduction is a tax deduction in Canada that allows members of the clergy to deduct the cost of housing from their taxable income.

Q: Who is eligible for the Clergy Residence Deduction?

A: Members of the clergy, such as ministers, priests, or rabbis, who live in a designated clergy residence are eligible for this deduction.

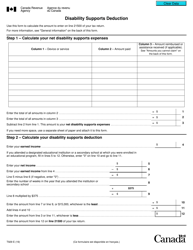

Q: What expenses can be claimed under the Clergy Residence Deduction?

A: Expenses such as rent, mortgage interest, property taxes, utilities, and certain repairs and maintenance costs can be claimed.

Q: How do I claim the Clergy Residence Deduction?

A: To claim the Clergy Residence Deduction, you need to fill out Form T1223 and submit it with your income tax return.

Q: Are there any conditions or limitations for claiming the Clergy Residence Deduction?

A: Yes, there are certain conditions and limitations. It is best to consult the CRA or a tax professional for specific details based on your situation.

Q: Is the Clergy Residence Deduction available in the United States?

A: No, the Clergy Residence Deduction is a tax deduction specific to Canada and is not available in the United States.