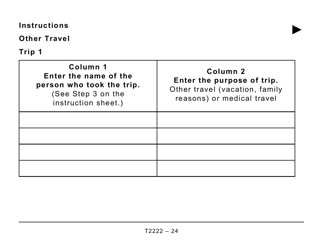

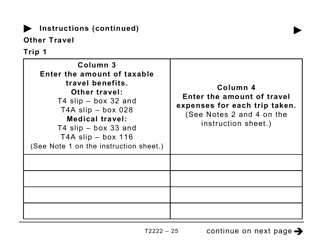

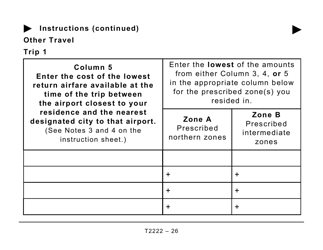

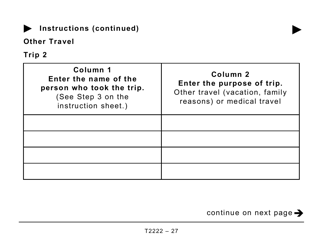

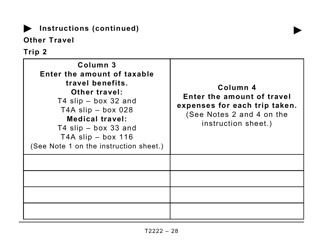

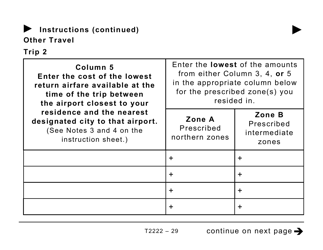

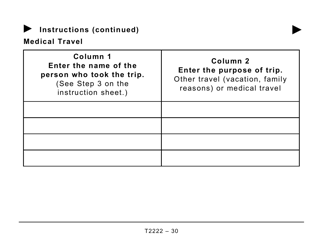

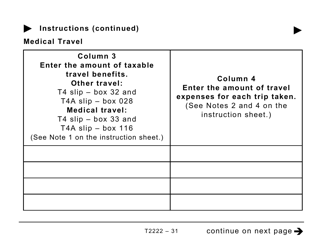

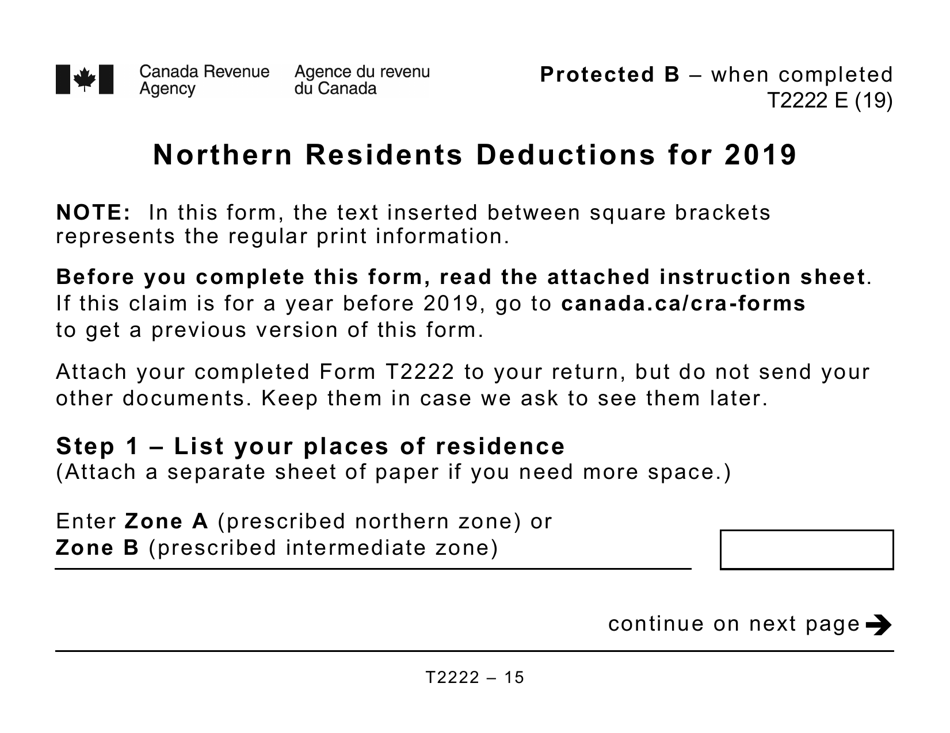

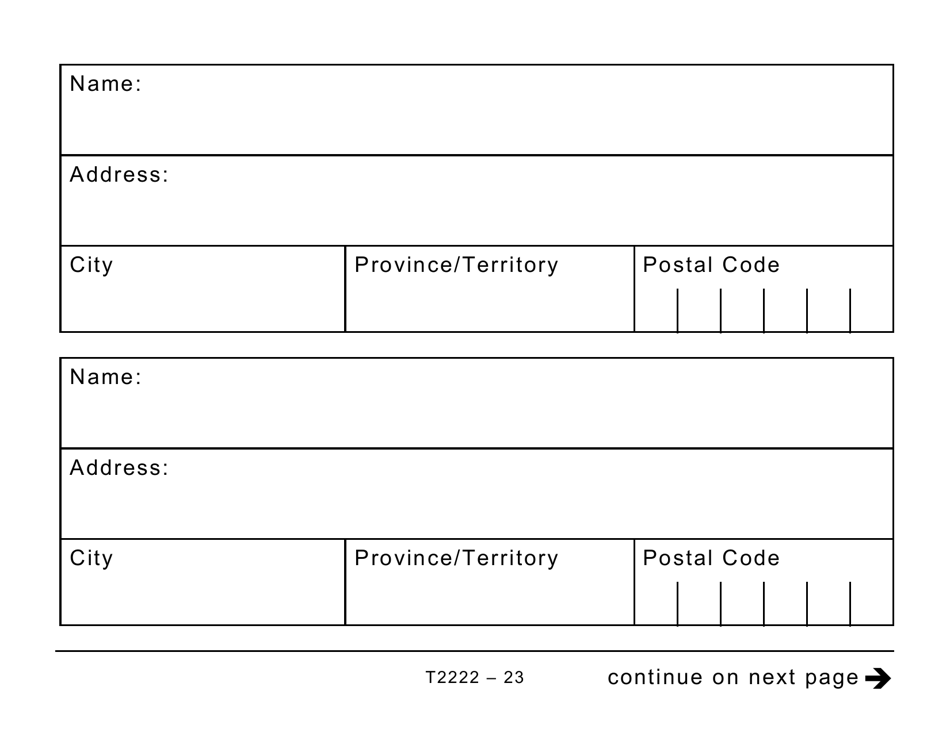

Form T2222 Northern Residents Deductions - Large Print - Canada

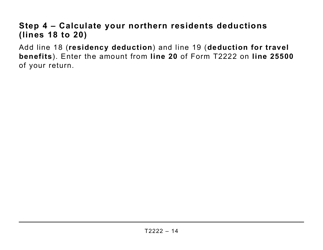

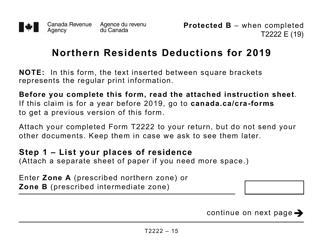

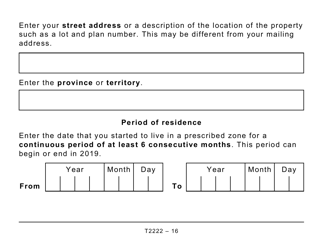

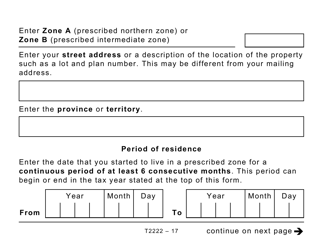

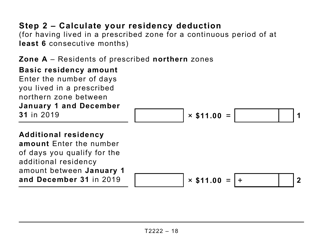

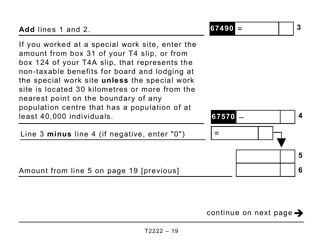

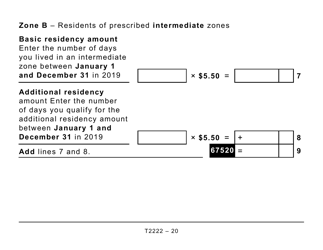

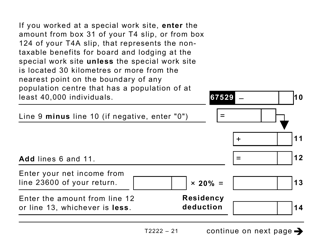

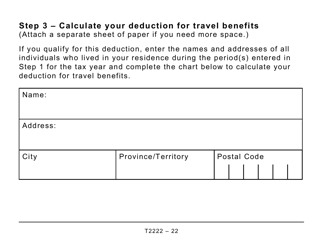

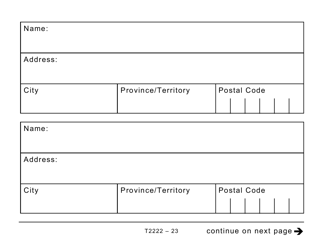

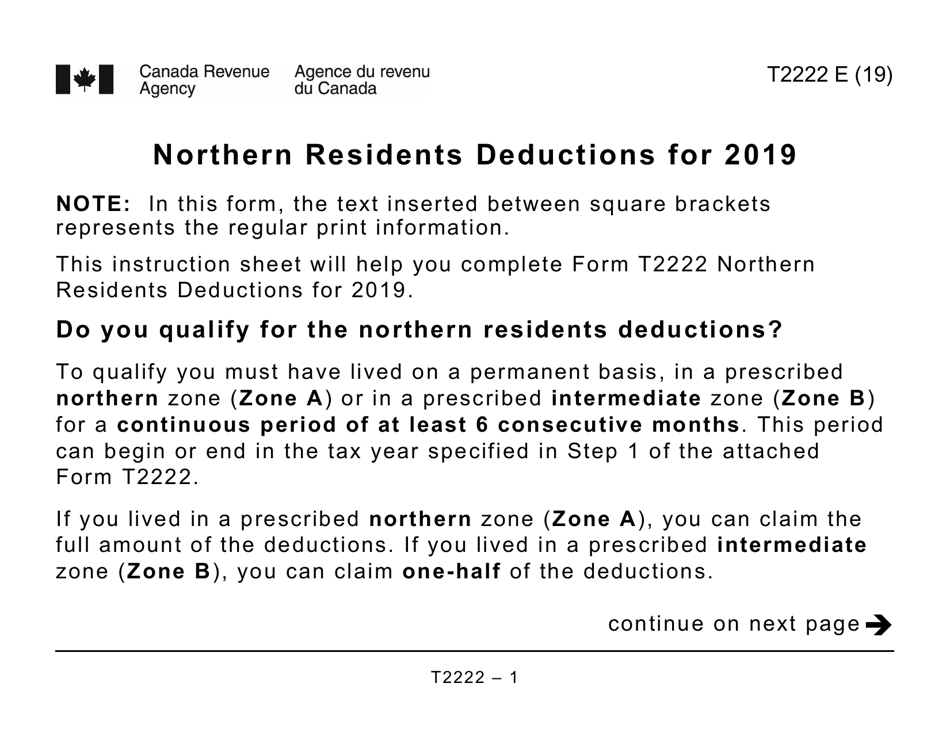

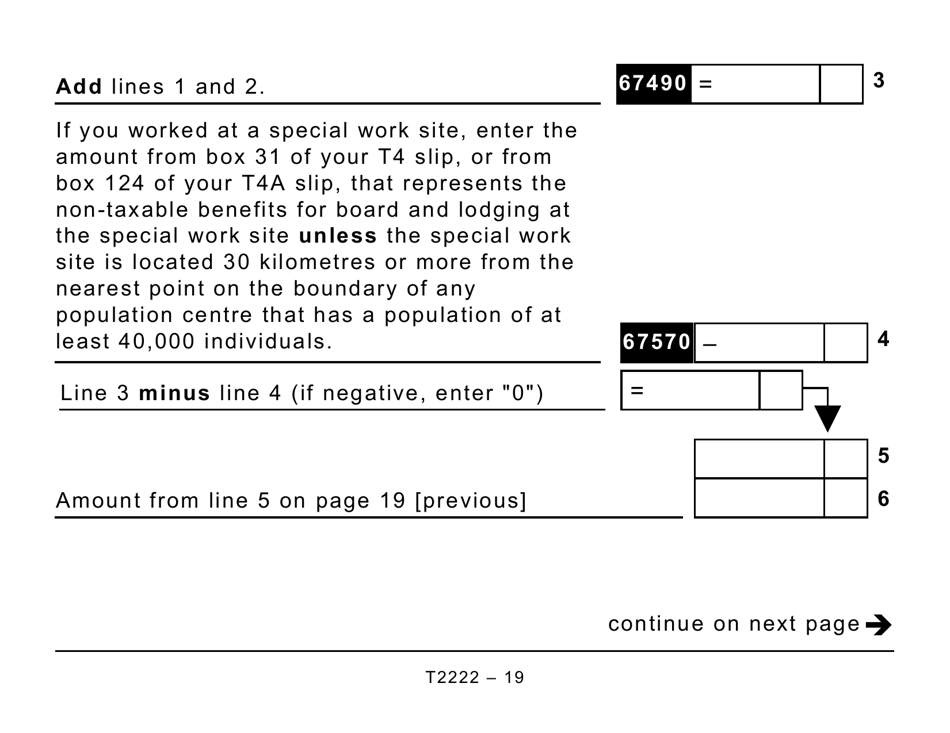

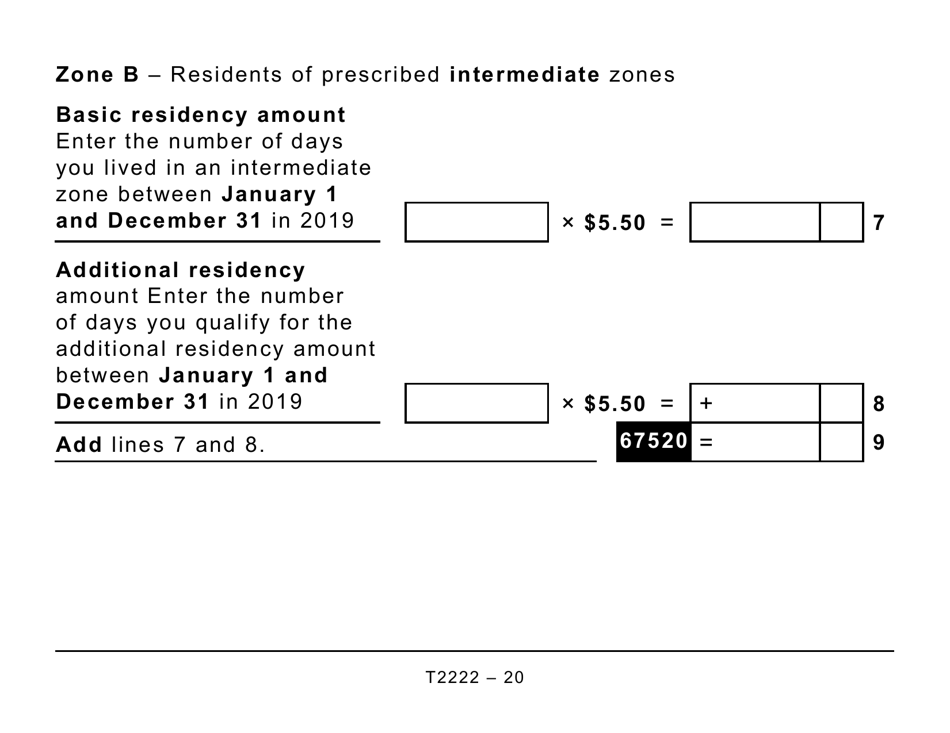

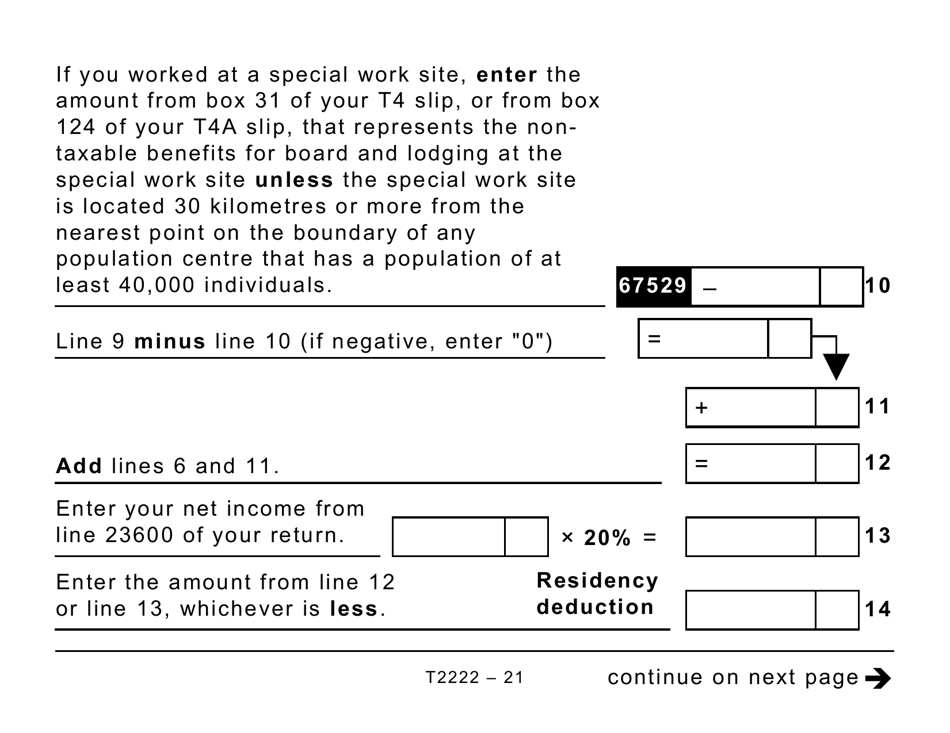

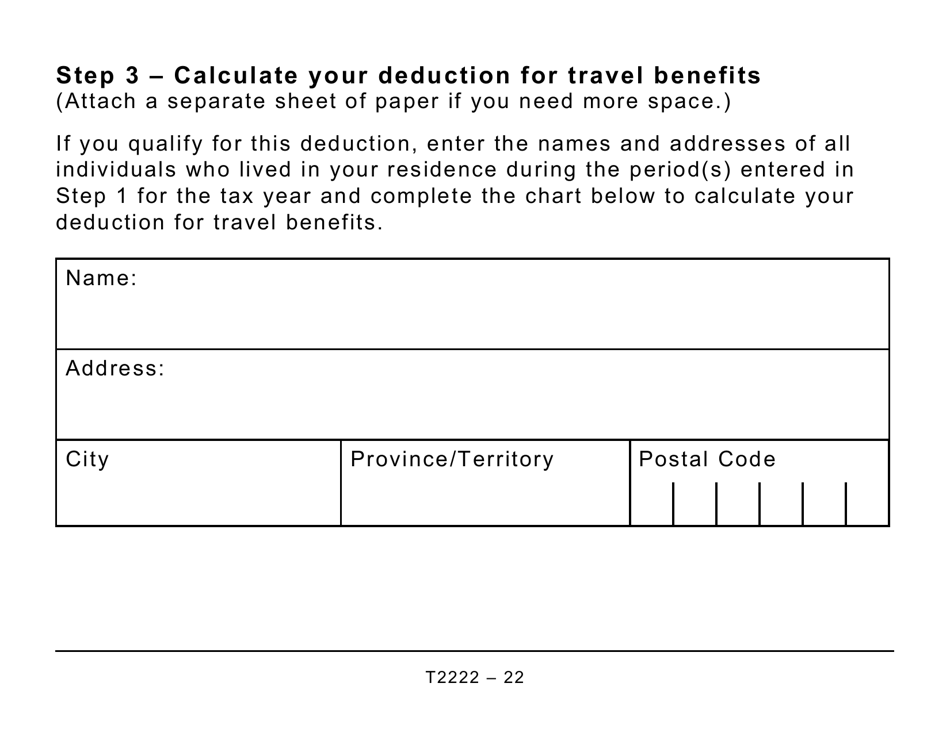

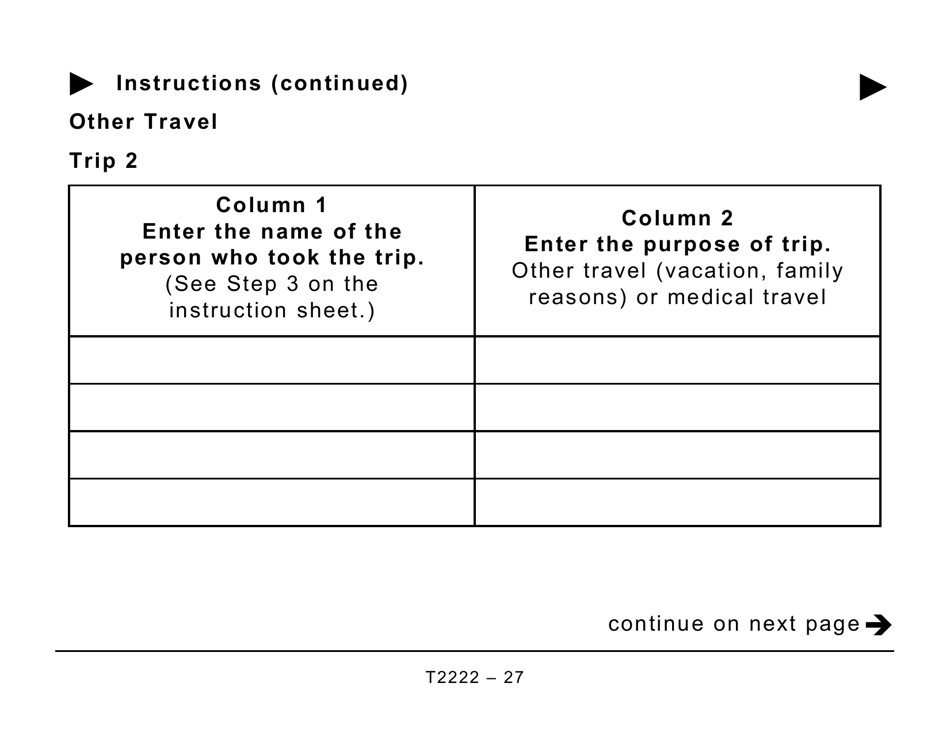

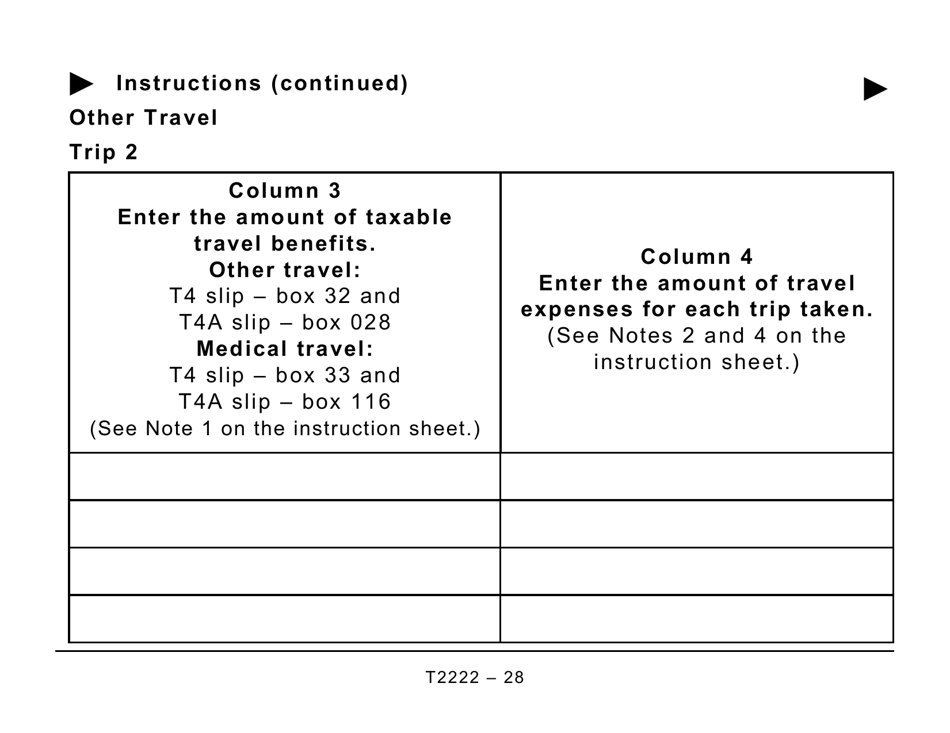

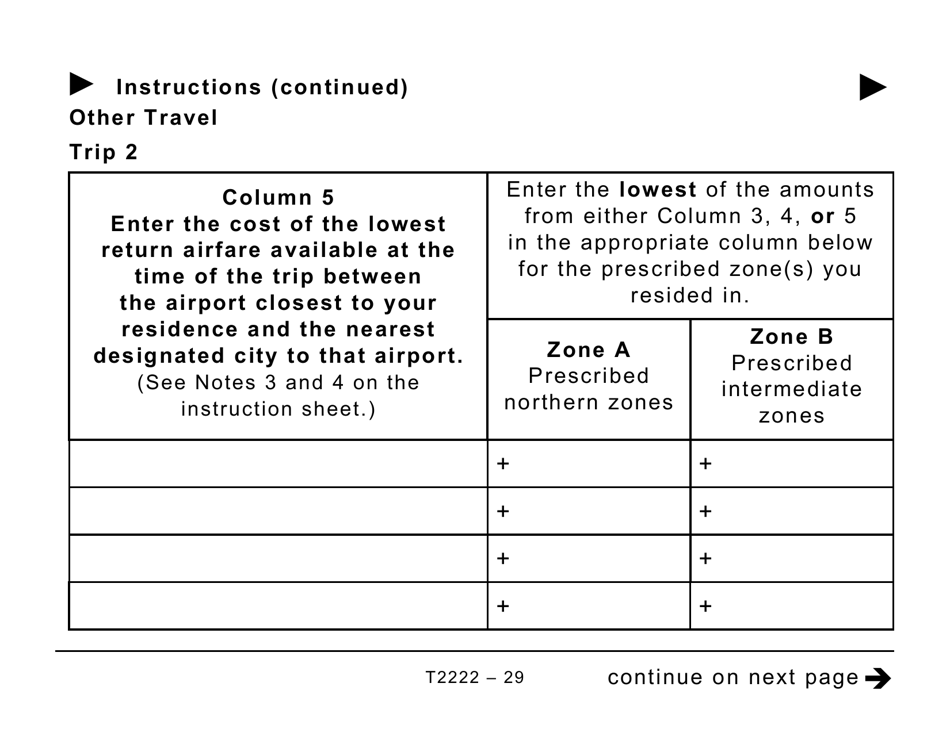

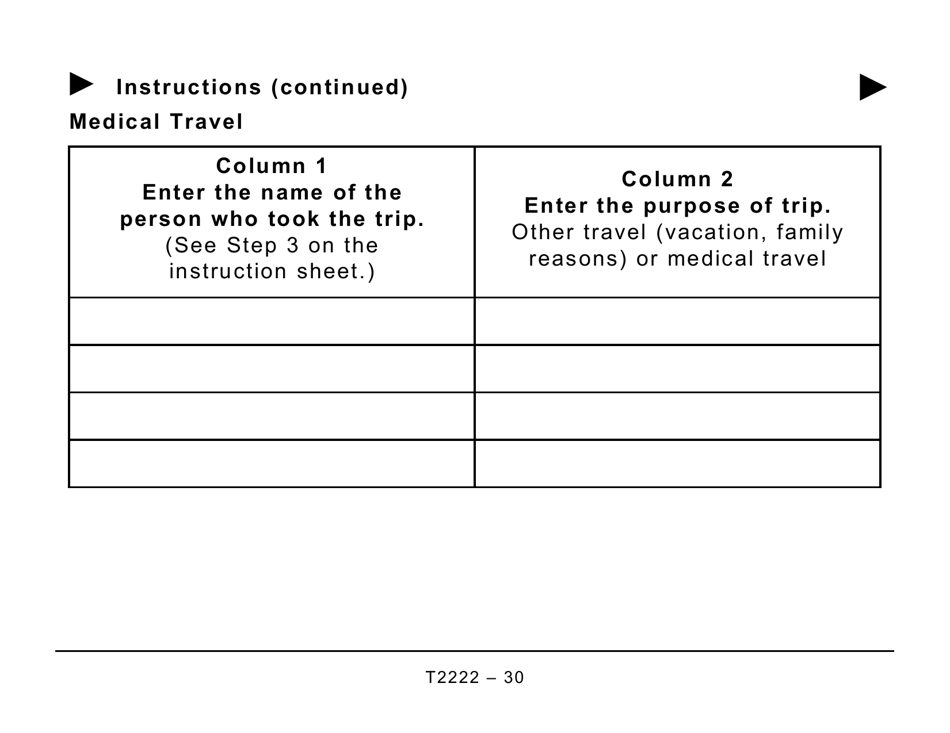

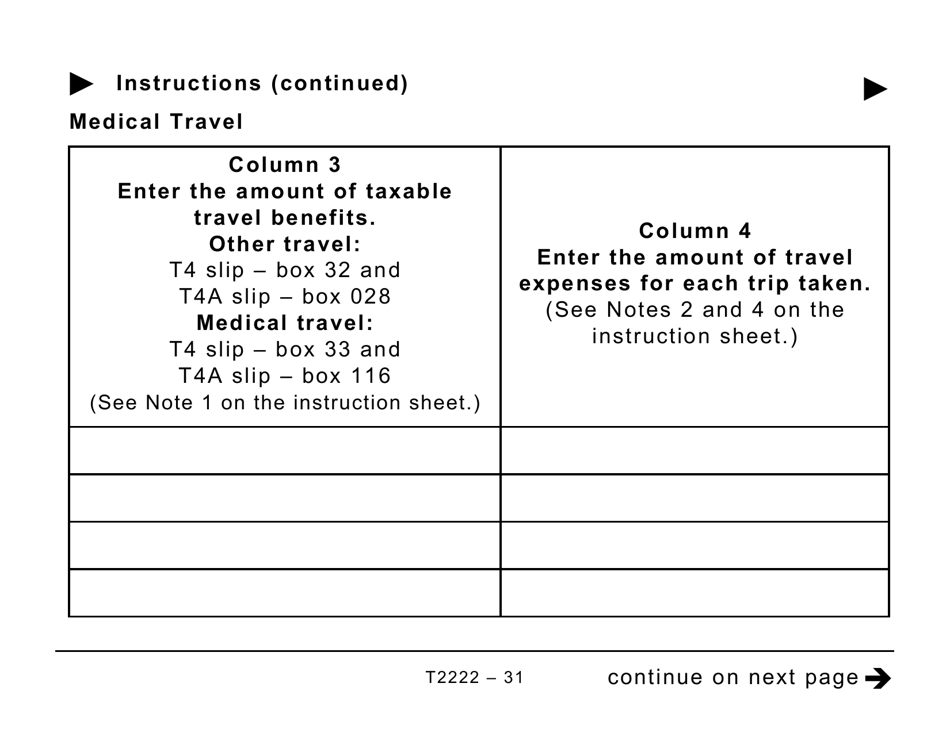

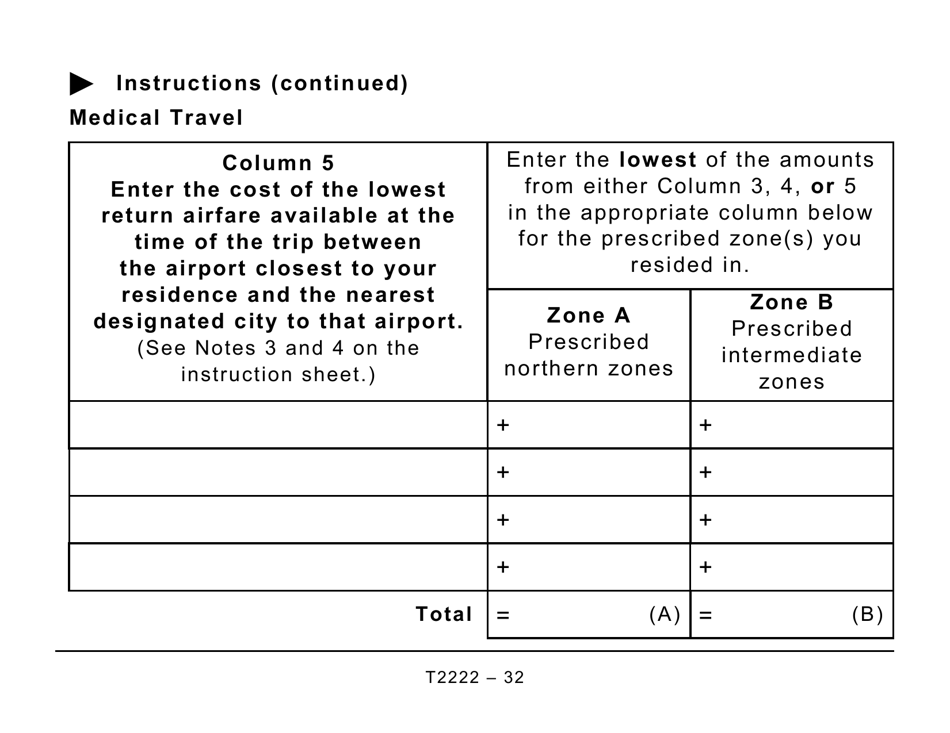

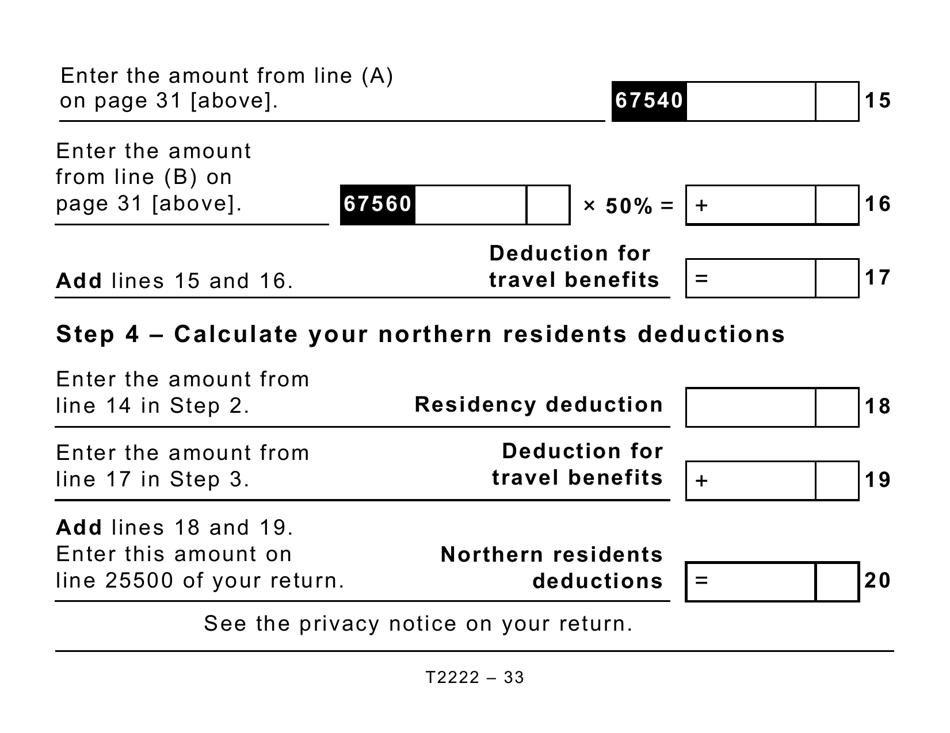

Form T2222 is used by residents of Canada who live in a prescribed northern or intermediate zone. This form is used to claim deductions and credits related to living and transportation expenses incurred in these designated areas. It helps individuals reduce their federal tax payable.

The Form T2222 Northern Residents Deductions - Large Print in Canada is filed by the individuals who are eligible for the Northern Residents Deductions.

FAQ

Q: What is Form T2222?

A: Form T2222 is a tax form used by Canadian residents who live in qualifying Northern regions to claim the Northern Residents Deductions.

Q: What are the Northern Residents Deductions?

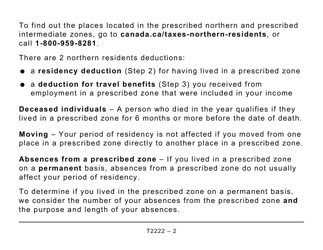

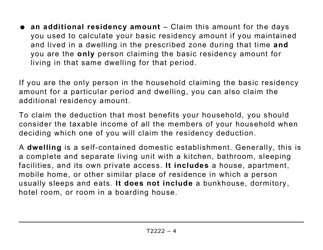

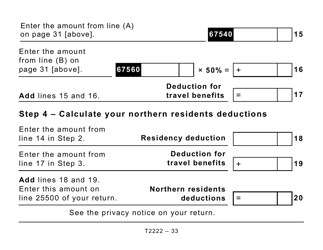

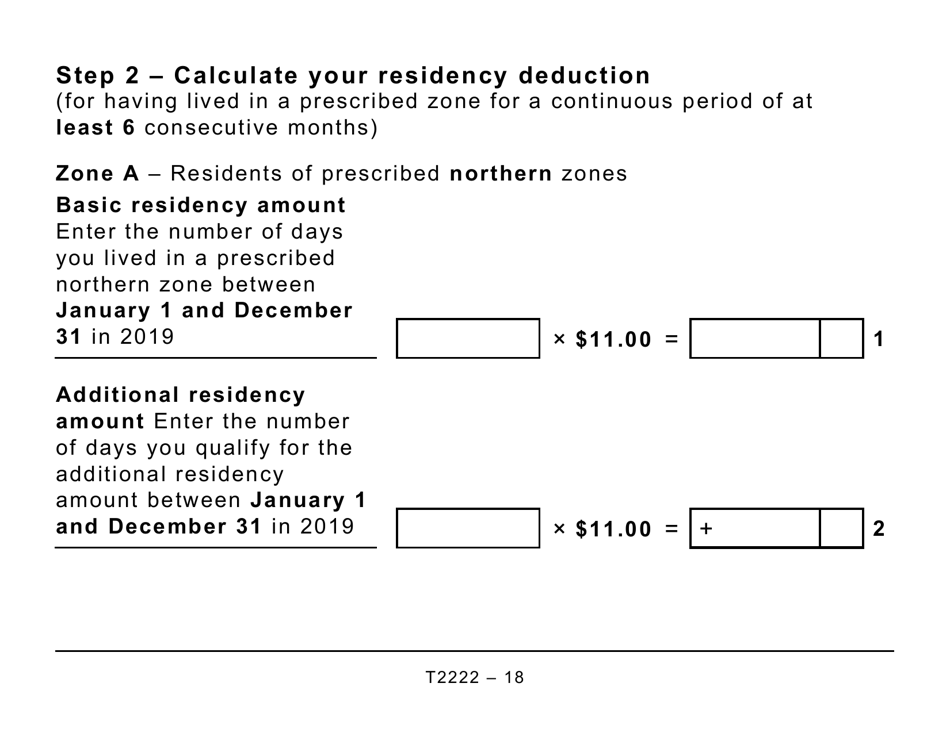

A: Northern Residents Deductions are tax deductions available to Canadian residents who live in a qualifying Northern region. These deductions help offset the higher cost of living in those areas.

Q: Who is eligible to claim the Northern Residents Deductions?

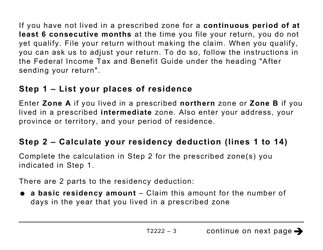

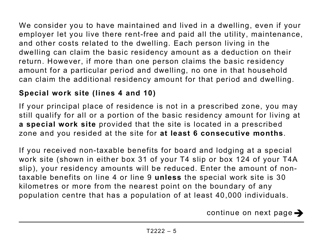

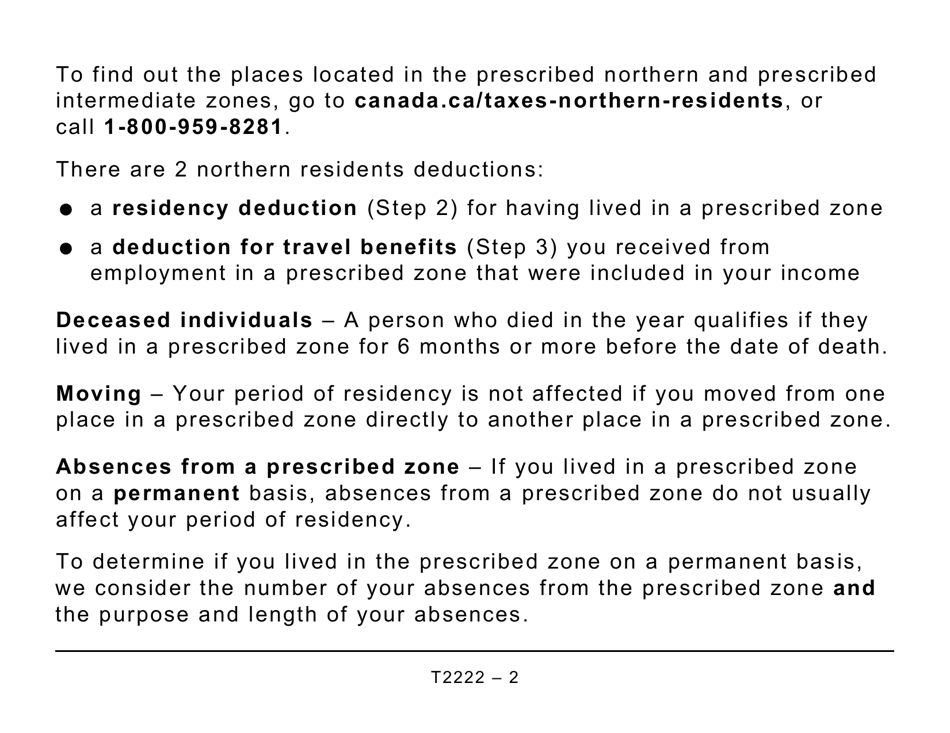

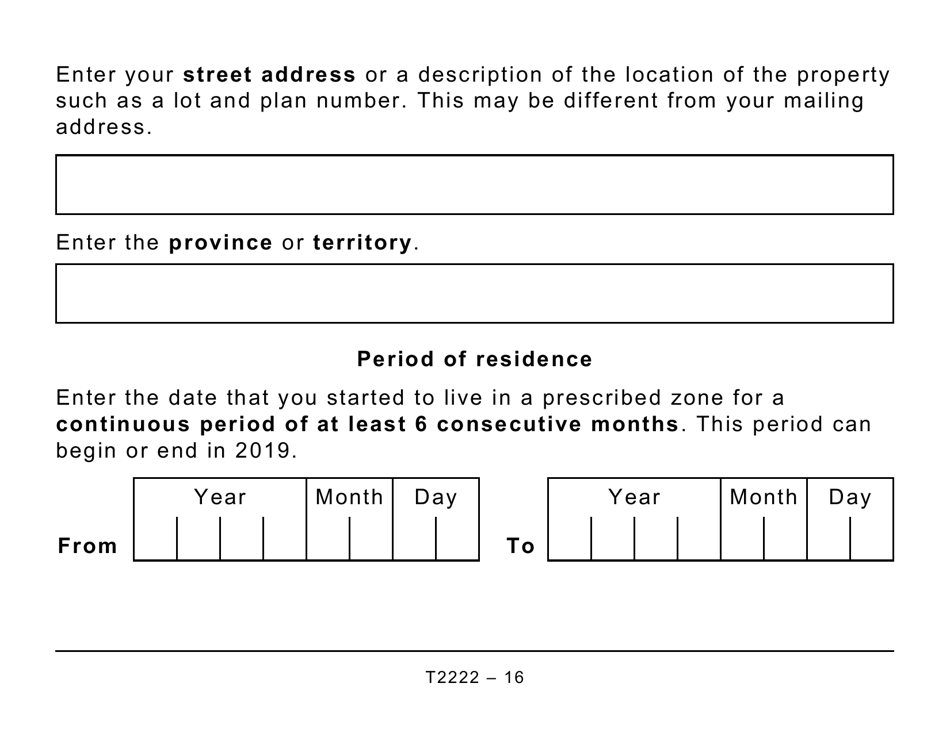

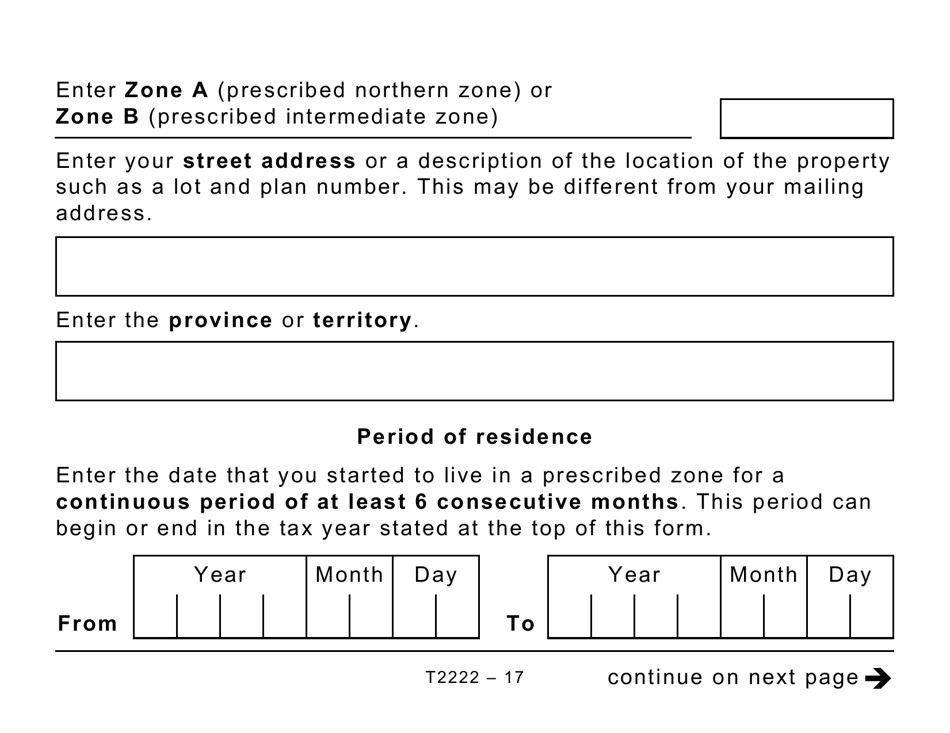

A: Canadian residents who live in prescribed Northern zones for at least six consecutive months in a year may be eligible to claim the Northern Residents Deductions.

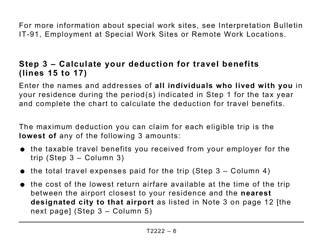

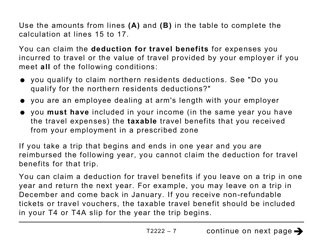

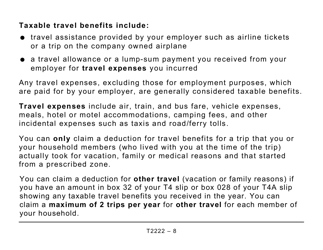

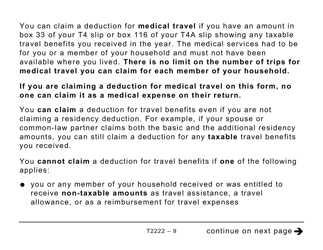

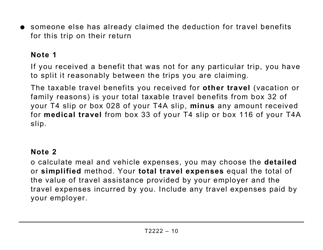

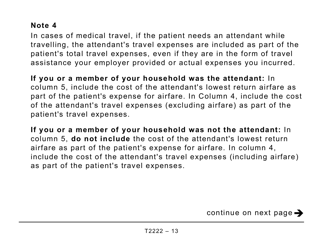

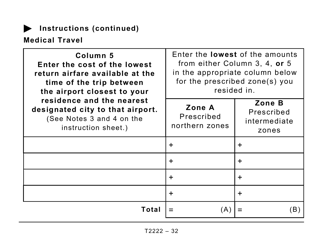

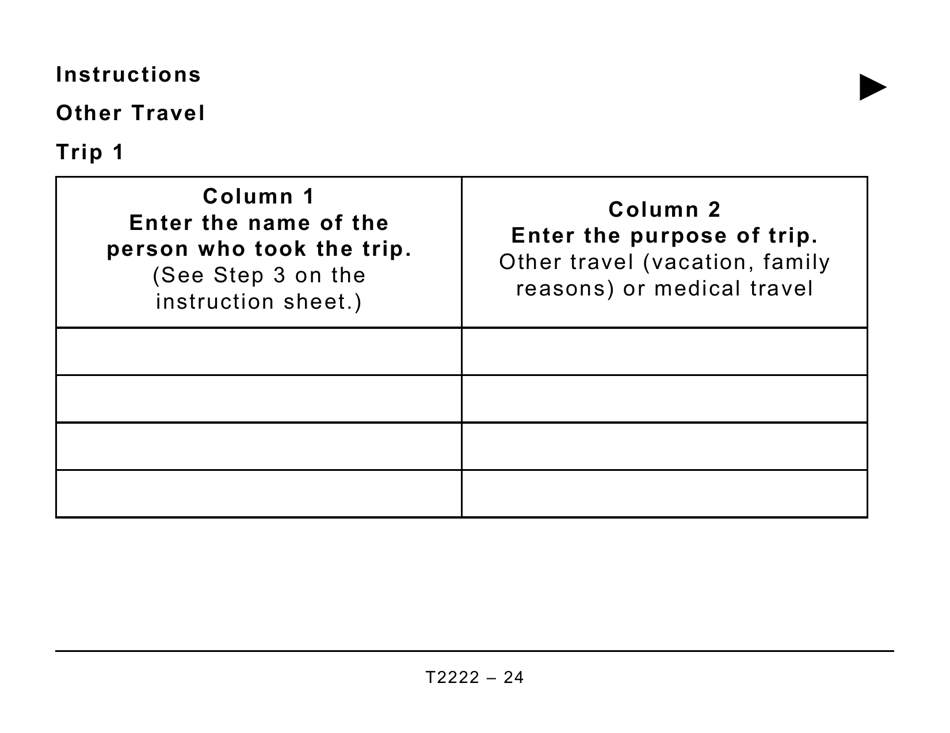

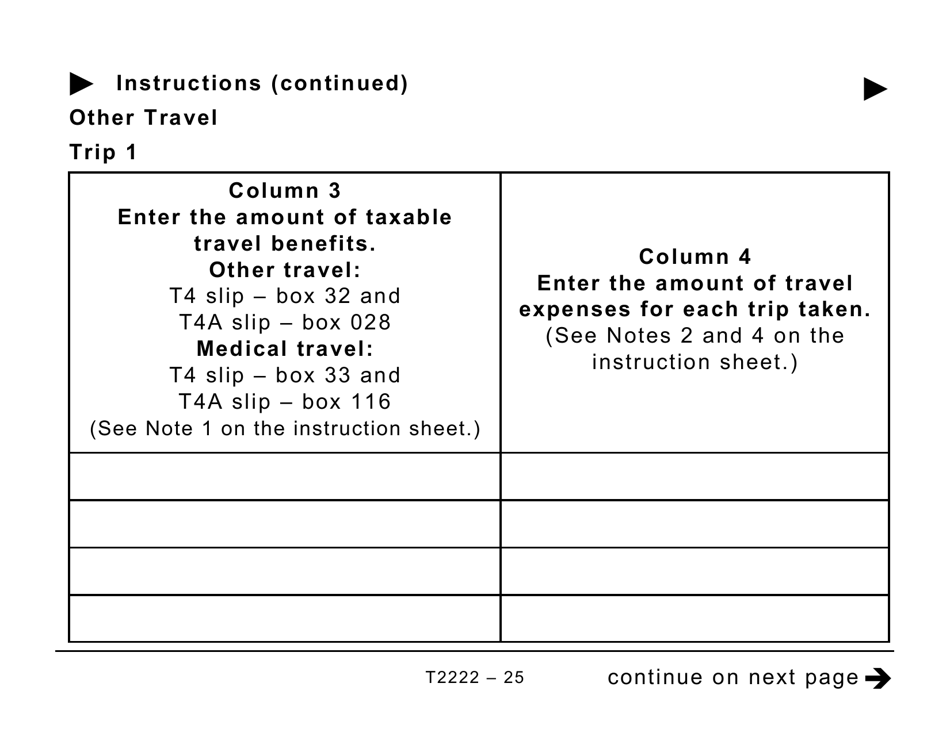

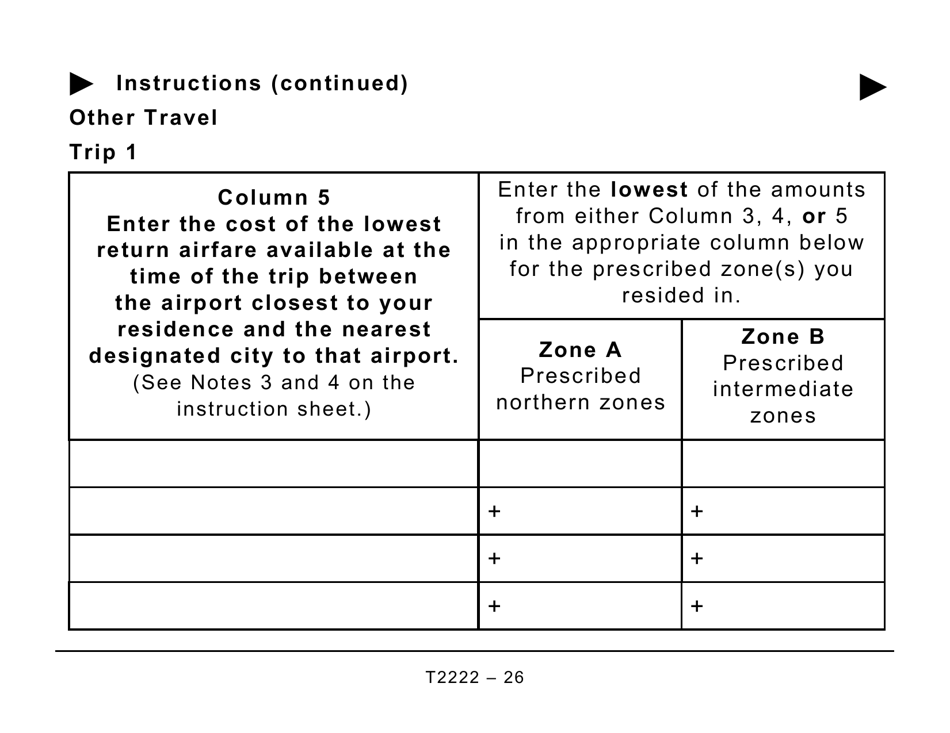

Q: What expenses can be claimed under the Northern Residents Deductions?

A: Expenses such as rent, travel, food, heating, and electricity costs can be claimed under the Northern Residents Deductions.

Q: Is there a deadline to file Form T2222?

A: Yes, Form T2222 must be filed along with your annual tax return by the normal tax filing deadline - generally April 30th for most individuals.

Q: Are there specific requirements to qualify for the Northern Residents Deductions?

A: Yes, there are specific requirements such as residency in a prescribed Northern zone, living there for at least six consecutive months, and having a primary place of residence in the Northern zone.

Q: Can I claim the Northern Residents Deductions for multiple years?

A: Yes, you can claim the Northern Residents Deductions for multiple years if you continue to meet the eligibility criteria and file the necessary forms with your tax return.

Q: Are there any limits on the amount I can claim for Northern Residents Deductions?

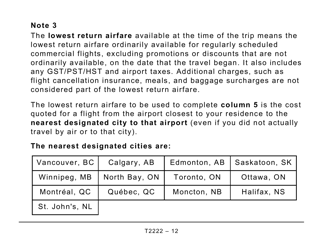

A: Yes, there are limits on the amounts you can claim for different expenses under the Northern Residents Deductions. These limits are outlined in the tax form instructions.

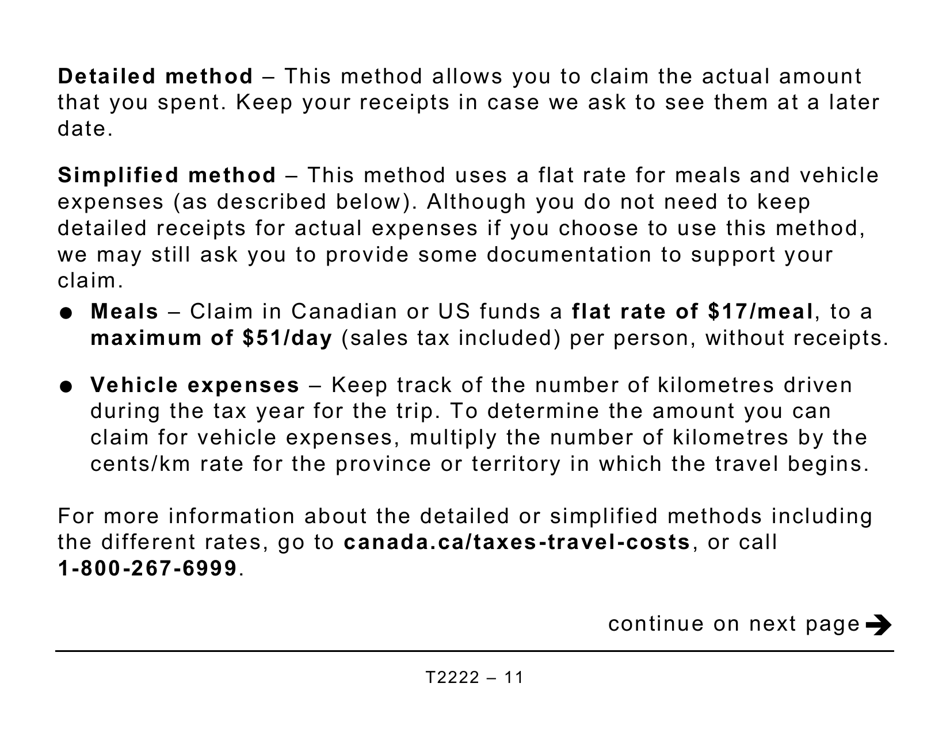

Q: Do I need to keep receipts for my claimed expenses?

A: Yes, it is important to keep receipts and supporting documents for your claimed expenses in case the Canada Revenue Agency (CRA) requests them for verification.