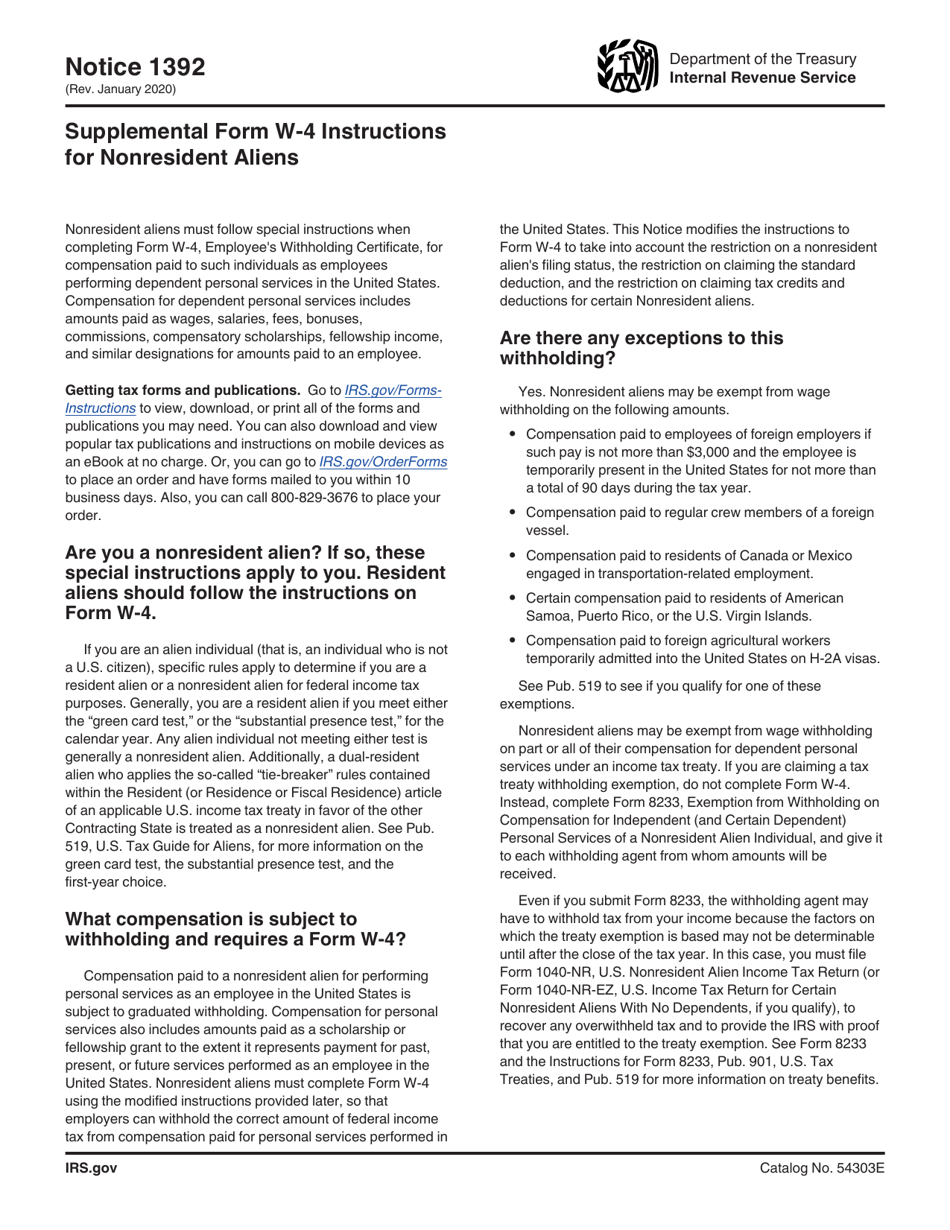

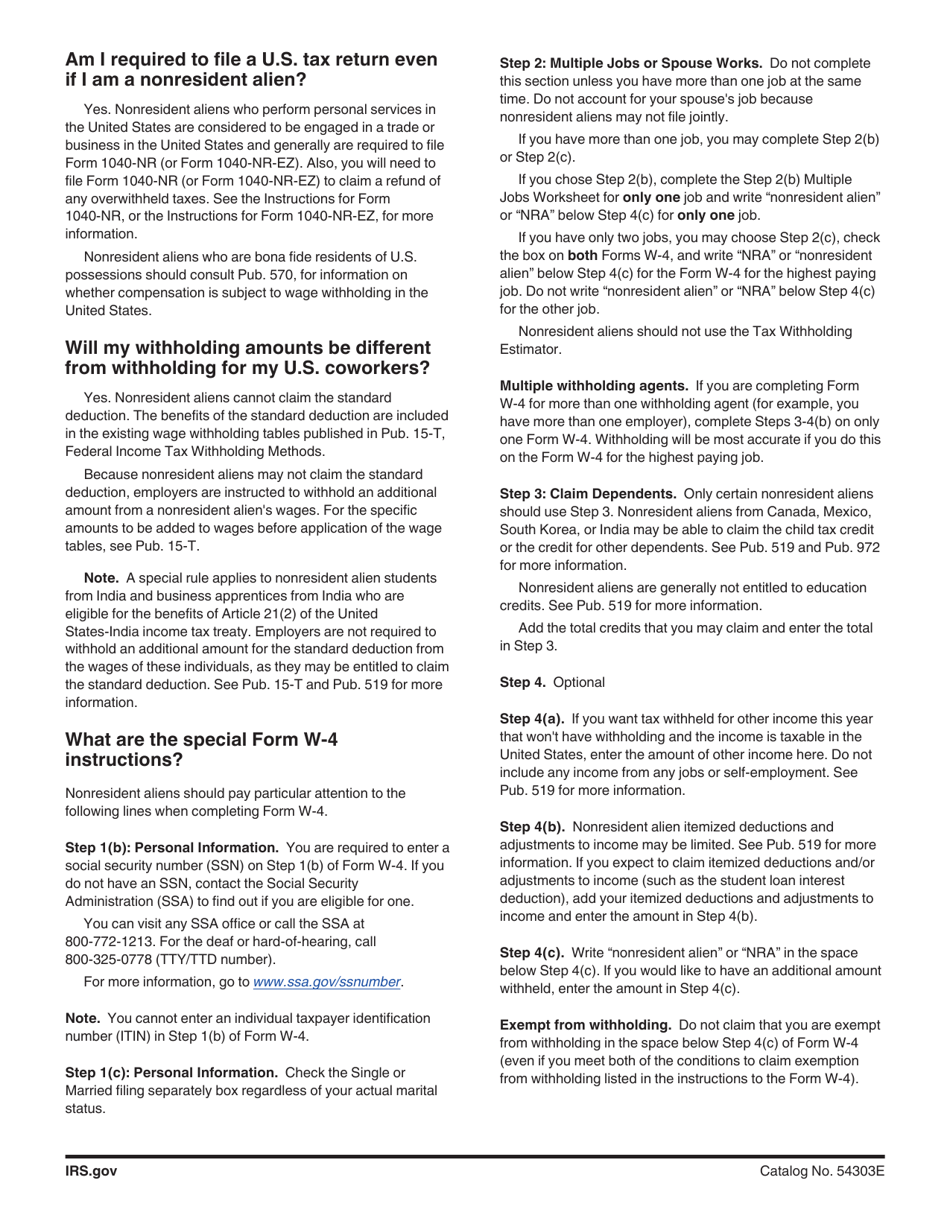

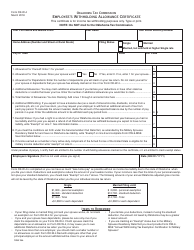

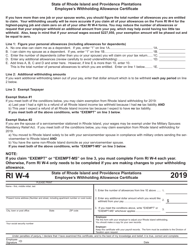

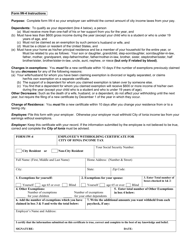

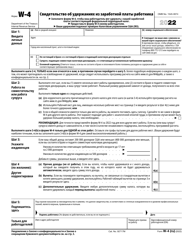

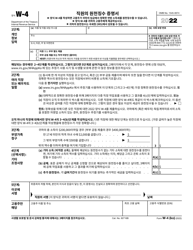

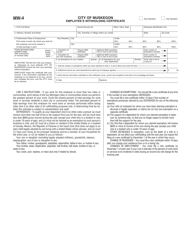

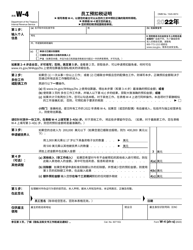

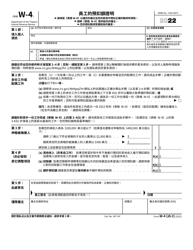

Instructions for IRS Form W-4 Employee's Withholding Certificate

This document contains official instructions for IRS Form W-4 , Employee's Withholding Certificate - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form W-4?

A: IRS Form W-4 is a form used by employees to indicate their tax withholding preferences.

Q: Why do I need to fill out Form W-4?

A: You need to fill out Form W-4 so that your employer can withhold the correct amount of federal income tax from your paycheck.

Q: When do I need to fill out Form W-4?

A: You should fill out Form W-4 when you start a new job or whenever you want to update your withholding information.

Q: What information do I need to fill out Form W-4?

A: You'll need your personal information, including your name, address, Social Security number, filing status, and the number of allowances you want to claim.

Q: What are allowances on Form W-4?

A: Allowances are used to account for various deductions and credits you expect to have on your tax return. The more allowances you claim, the less tax will be withheld from your paycheck.

Q: How many allowances should I claim on Form W-4?

A: The number of allowances you should claim depends on your personal and financial situation. The IRS provides a worksheet to help you determine the appropriate number of allowances.

Q: Can I update my withholding anytime?

A: Yes, you can update your withholding anytime throughout the year by filling out a new Form W-4 and submitting it to your employer.

Q: What happens if I don't fill out Form W-4?

A: If you don't fill out Form W-4, your employer will be required to withhold taxes from your paycheck at the highest withholding rate, resulting in potentially higher tax deductions.

Q: Can I change my withholding after submitting Form W-4?

A: Yes, you can change your withholding by submitting a new Form W-4 at any time throughout the year.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.