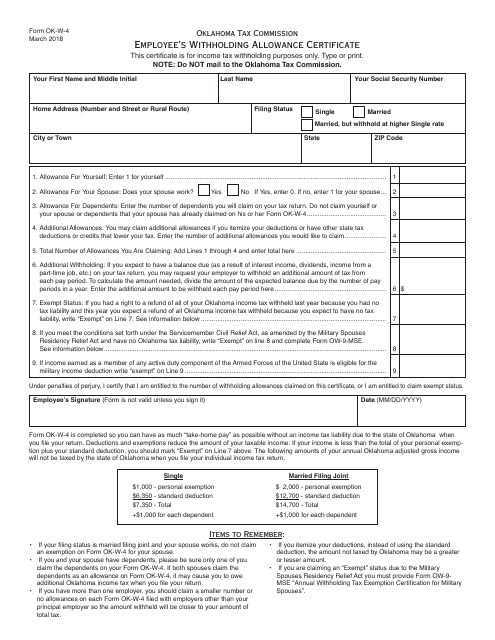

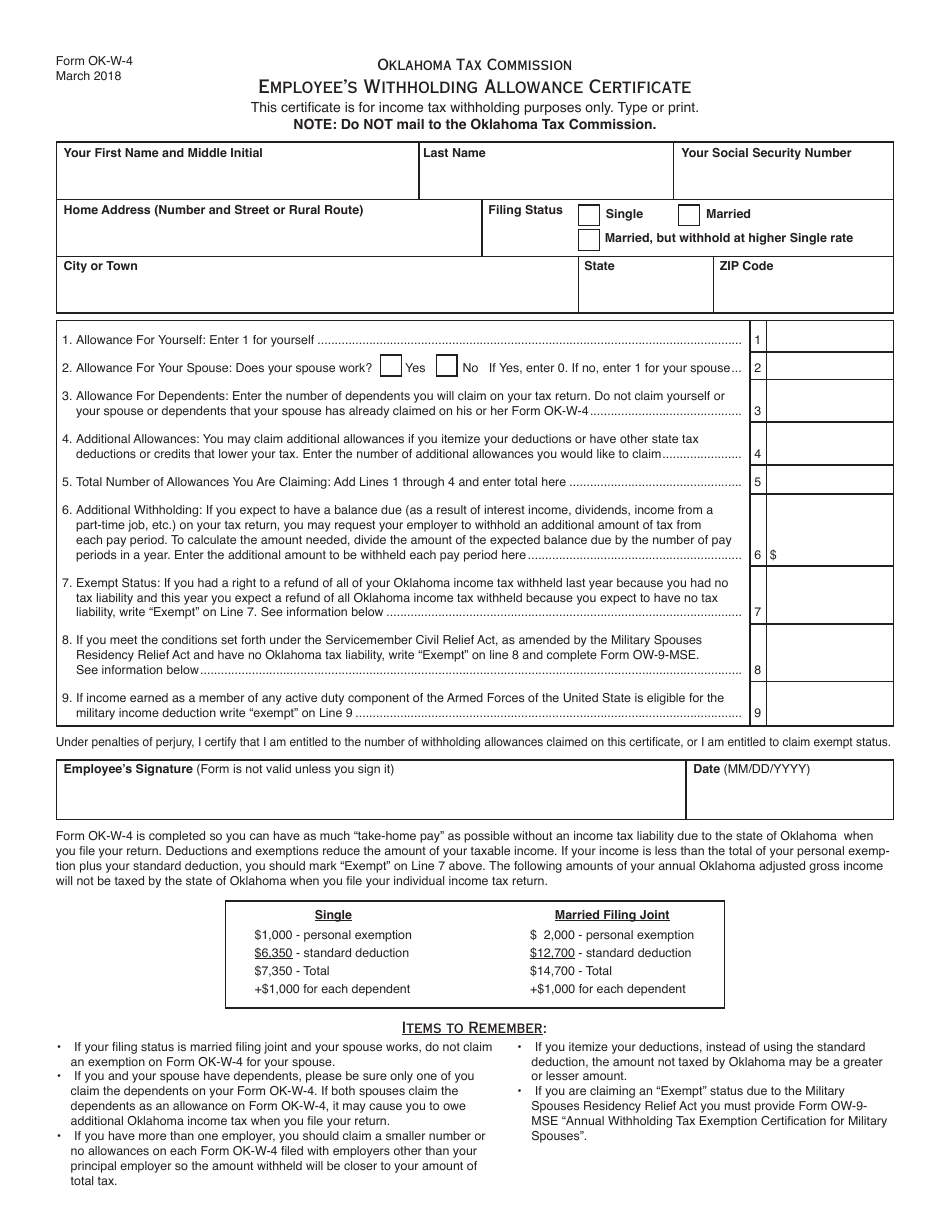

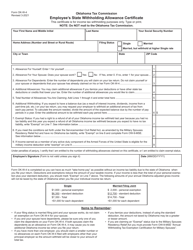

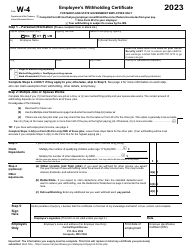

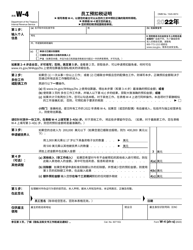

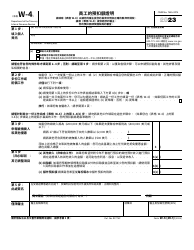

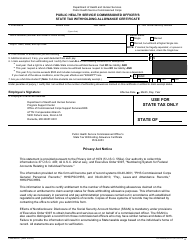

OTC Form W-4 Employee's Withholding Allowance Certificate - Oklahoma

What Is OTC Form W-4?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the purpose of Form W-4?

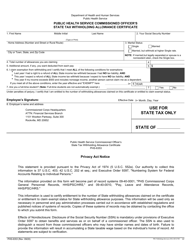

A: The purpose of Form W-4 is to inform employers about how much federal tax to withhold from an employee's paycheck.

Q: Who should fill out Form W-4?

A: All employees in the United States are required to fill out Form W-4.

Q: Is Form W-4 specific to Oklahoma?

A: No, Form W-4 is used nationwide and is not specific to any state.

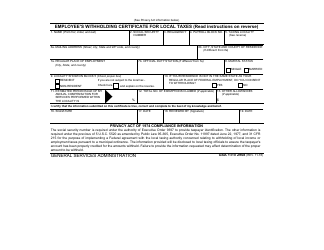

Q: What information is required on Form W-4?

A: Form W-4 requires information such as marital status, number of dependents, and other factors that impact tax withholding.

Q: Can I change my withholding allowances on Form W-4?

A: Yes, employees can change their withholding allowances on Form W-4 at any time if they experience a change in their personal or financial situation.

Form Details:

- Released on March 1, 2018;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form W-4 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.