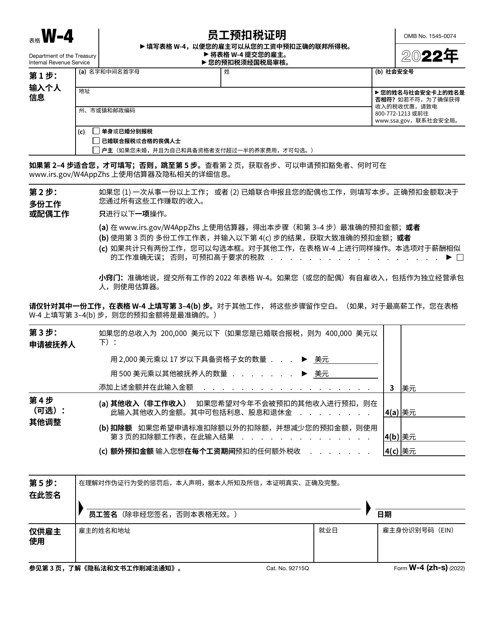

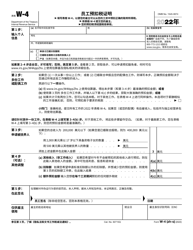

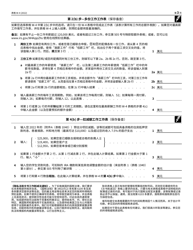

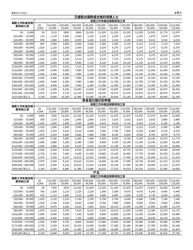

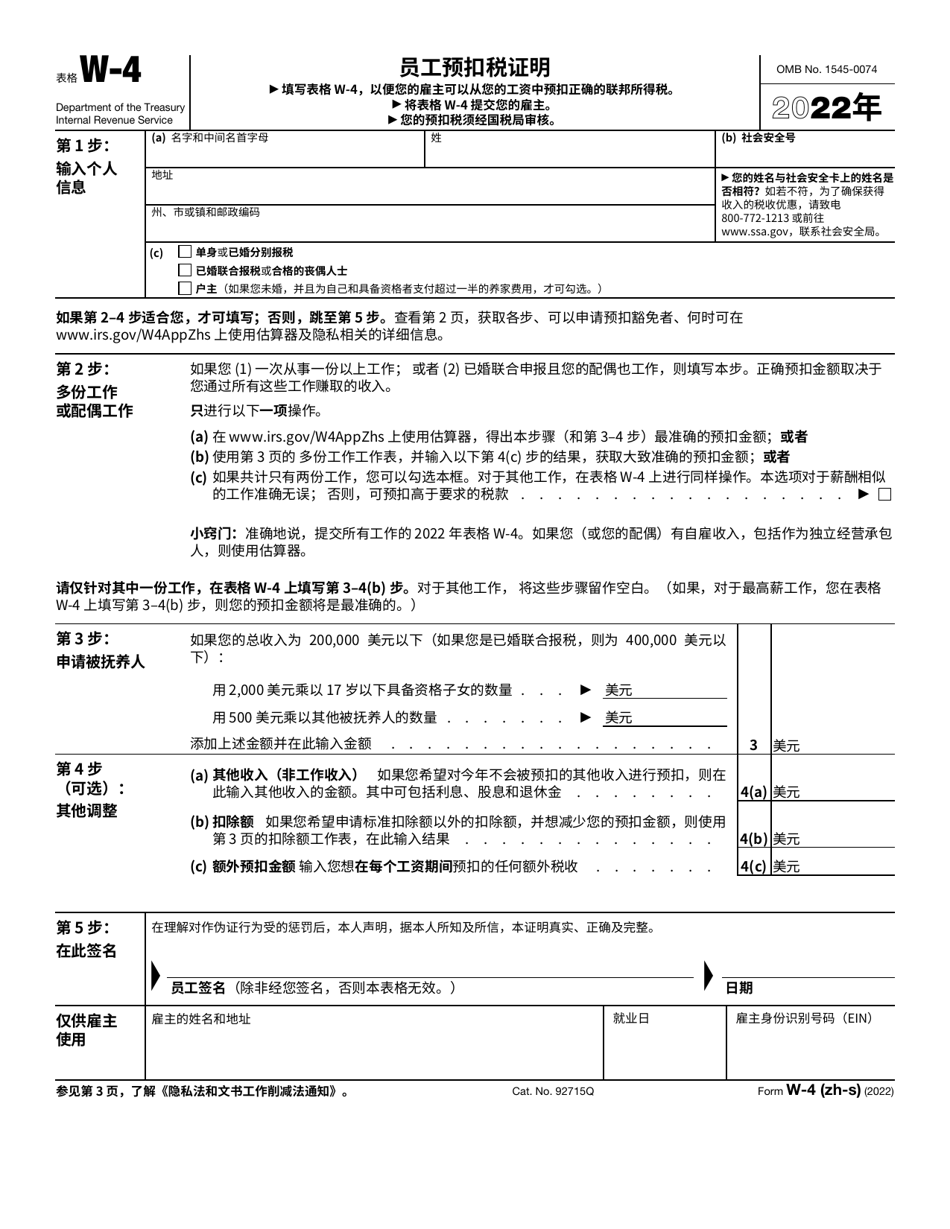

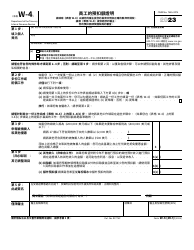

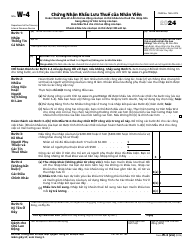

IRS Form W-4 Employee's Withholding Certificate (Chinese Simplified)

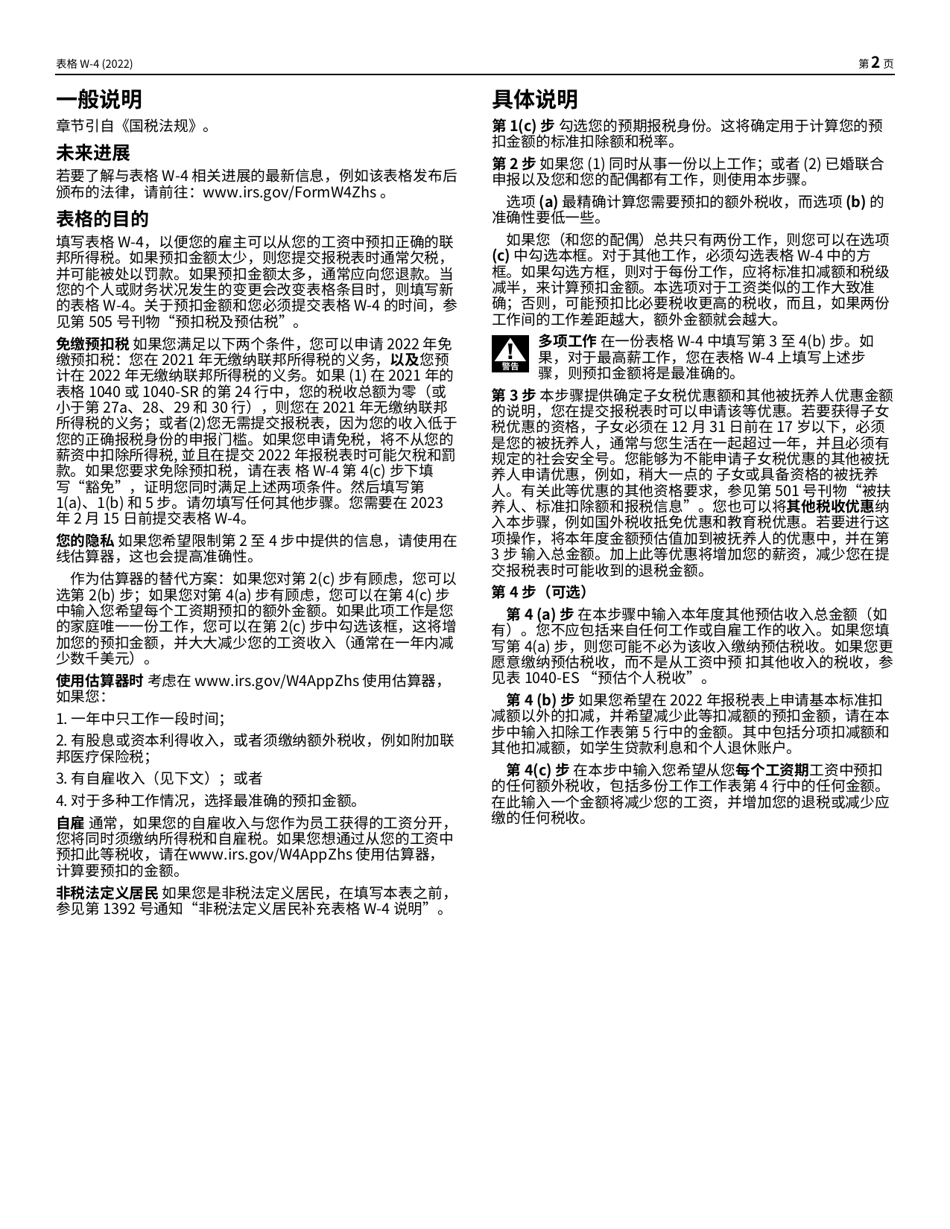

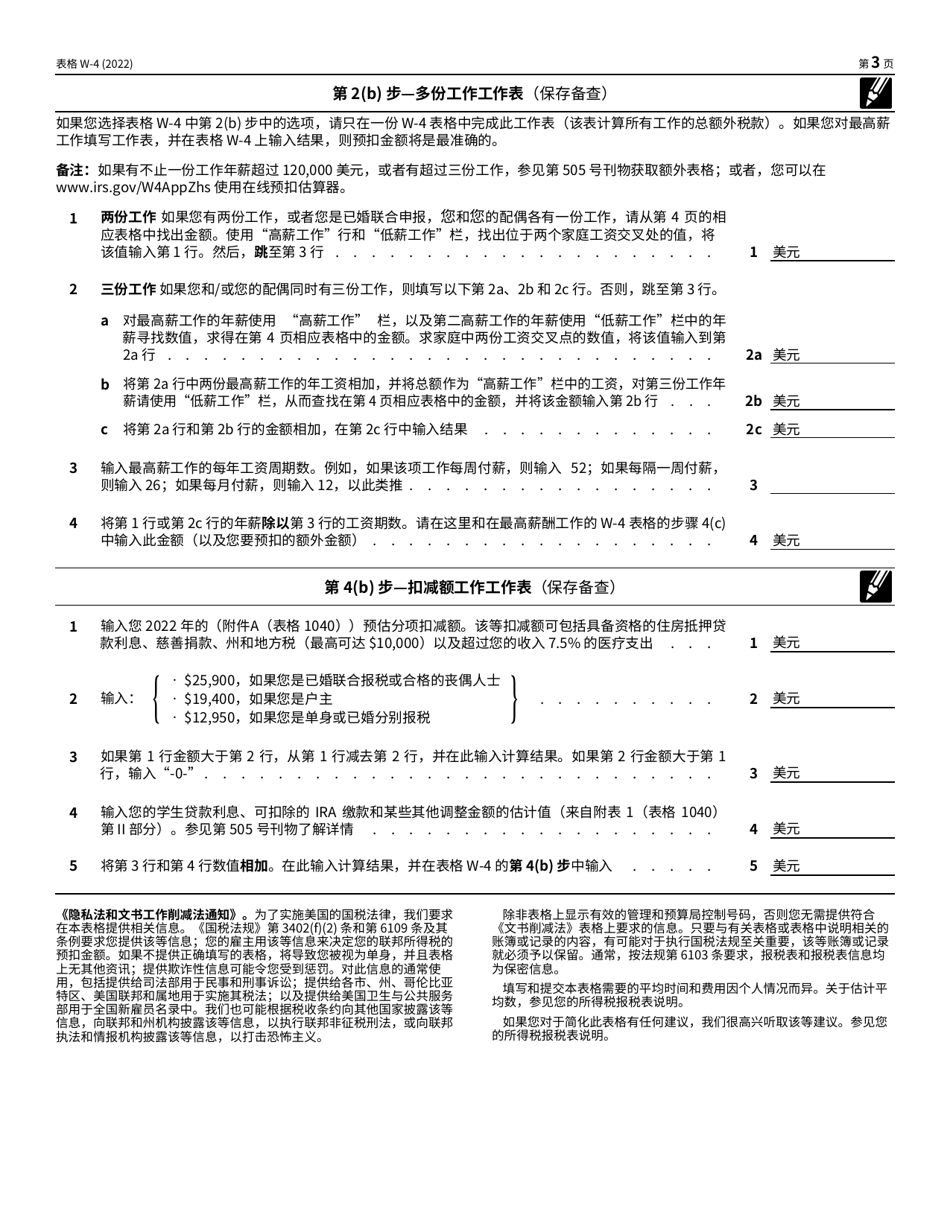

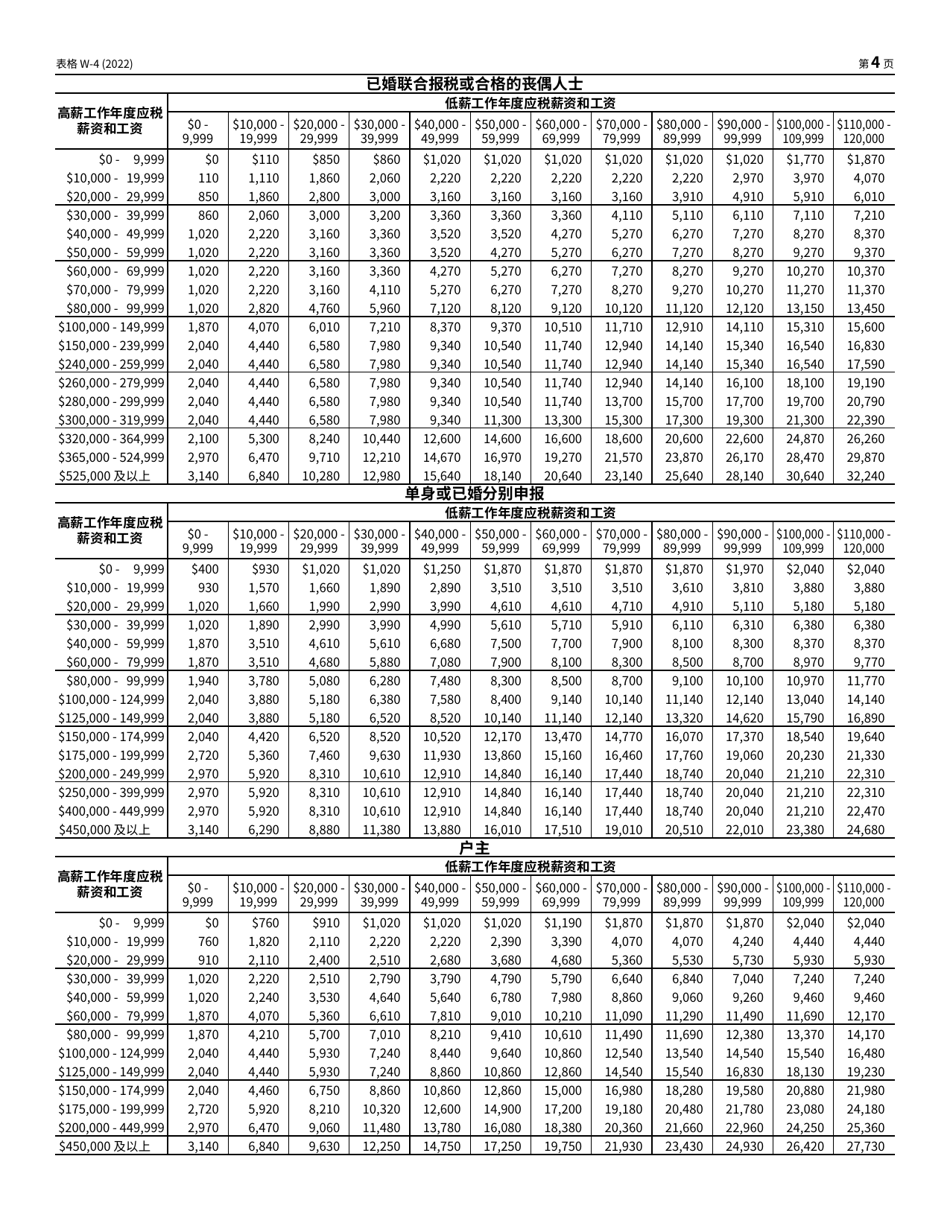

The IRS Form W-4 (Chinese Simplified) is used by employees to provide their employer with information on how much federal income tax to withhold from their paycheck.

The IRS Form W-4 Employee's Withholding Certificate is filed by employees who need to update their withholding allowances for federal incometax purposes.

FAQ

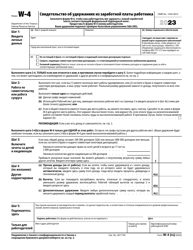

Q: What is IRS Form W-4?

A: IRS Form W-4 is the Employee's Withholding Certificate used to determine the amount of federal income tax to be withheld from an employee's paycheck.

Q: Why do I need to fill out IRS Form W-4?

A: You need to fill out IRS Form W-4 so that your employer can withhold the correct amount of federal income tax from your paycheck.

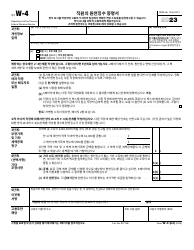

Q: Can I change my withholding during the year?

A: Yes, you can change your withholding during the year by submitting a new IRS Form W-4 to your employer.

Q: What information do I need to provide on IRS Form W-4?

A: You need to provide personal information, such as your name, address, and Social Security number, as well as information about your filing status and dependents.

Q: What is the purpose of the Chinese Simplified version of IRS Form W-4?

A: The Chinese Simplified version of IRS Form W-4 is provided to accommodate taxpayers who prefer to complete the form in Chinese Simplified.

Q: Do I need to submit a new IRS Form W-4 every year?

A: No, you do not need to submit a new IRS Form W-4 every year. However, it is recommended to review your withholding annually and submit a new form if necessary.

Q: Can I claim exempt from federal income tax withholding on IRS Form W-4?

A: Yes, you can claim exempt from federal income tax withholding on IRS Form W-4 if you meet certain criteria. However, you must meet the qualifications and complete the form accurately.

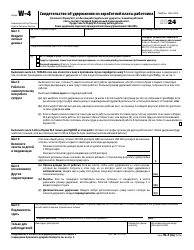

Q: What if I make a mistake on IRS Form W-4?

A: If you make a mistake on IRS Form W-4, you can submit a corrected form to your employer. It is important to ensure that the form reflects your current information.

Q: Is IRS Form W-4 specific to the United States and Canada?

A: No, IRS Form W-4 is specific to the United States. Canada has its own withholding tax forms and regulations.