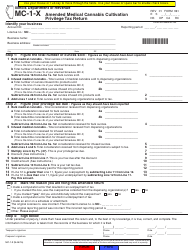

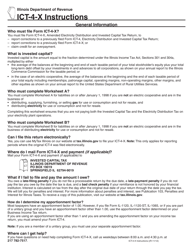

Instructions for Form CC-1-X Amended Adult Use Cannabis Cultivation Privilege Tax Return - Illinois

This document contains official instructions for Form CC-1-X , Amended Adult Use Cannabis Cultivation Privilege Tax Return - a form released and collected by the Illinois Department of Revenue.

FAQ

Q: What is Form CC-1-X?

A: Form CC-1-X is the Amended Adult Use Cannabis Cultivation Privilege Tax Return in Illinois.

Q: Who should file Form CC-1-X?

A: Adult use cannabis cultivators in Illinois who need to amend their previously filed tax returns should file Form CC-1-X.

Q: Why would I need to file an amended tax return?

A: You may need to file an amended tax return if you made errors or need to update information on your original tax return for cannabis cultivation privilege tax in Illinois.

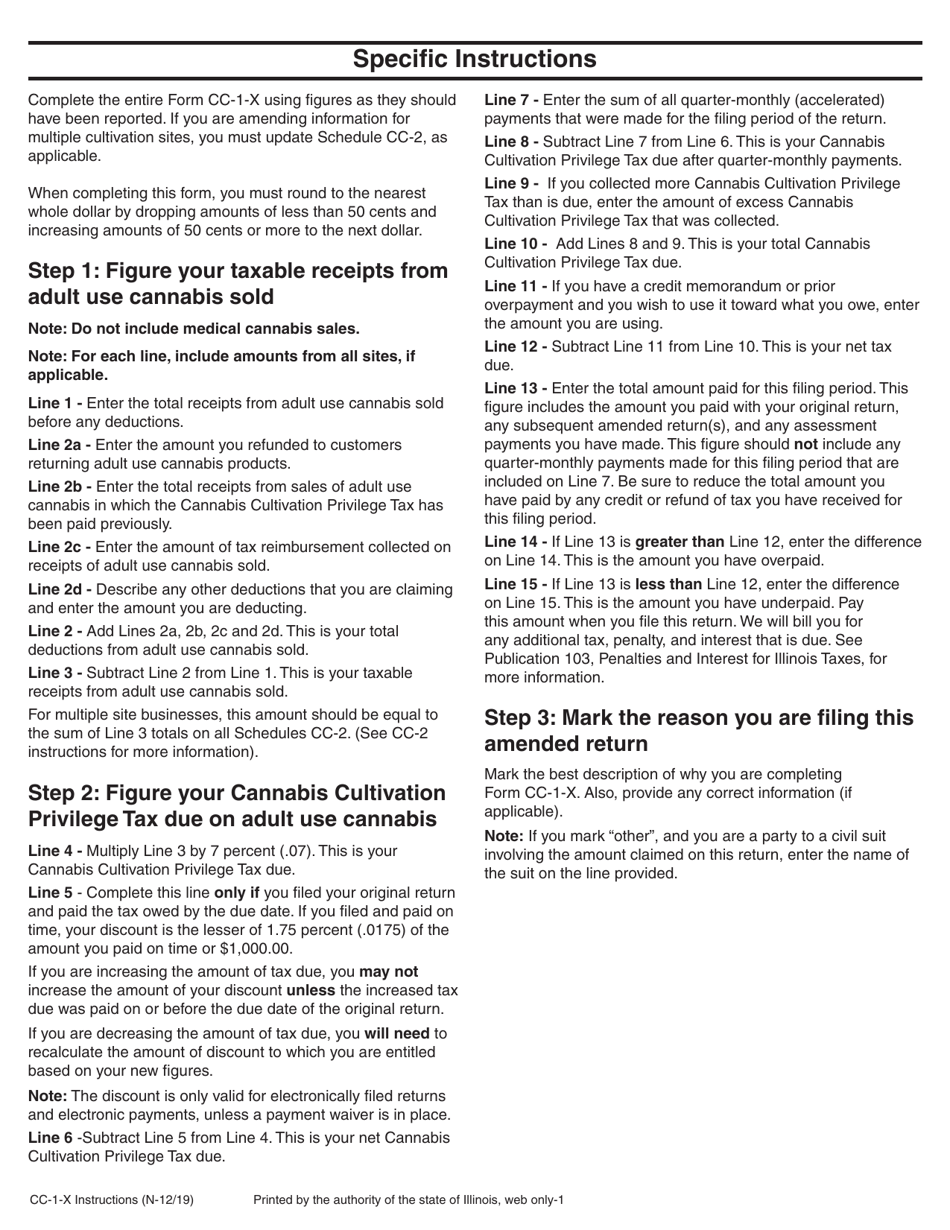

Q: What information do I need to provide on Form CC-1-X?

A: You will need to provide your name, cultivator identification number, the tax period you are amending, and the specific changes you are making to the previously filed return.

Q: Is there a deadline for filing Form CC-1-X?

A: Yes, Form CC-1-X must be filed within three years from the original due date of the tax return being amended.

Q: Are there any penalties for filing an amended tax return?

A: Late filed or incorrectly filed amended tax returns may result in penalties or interest charges, so it's important to file accurately and on time.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.