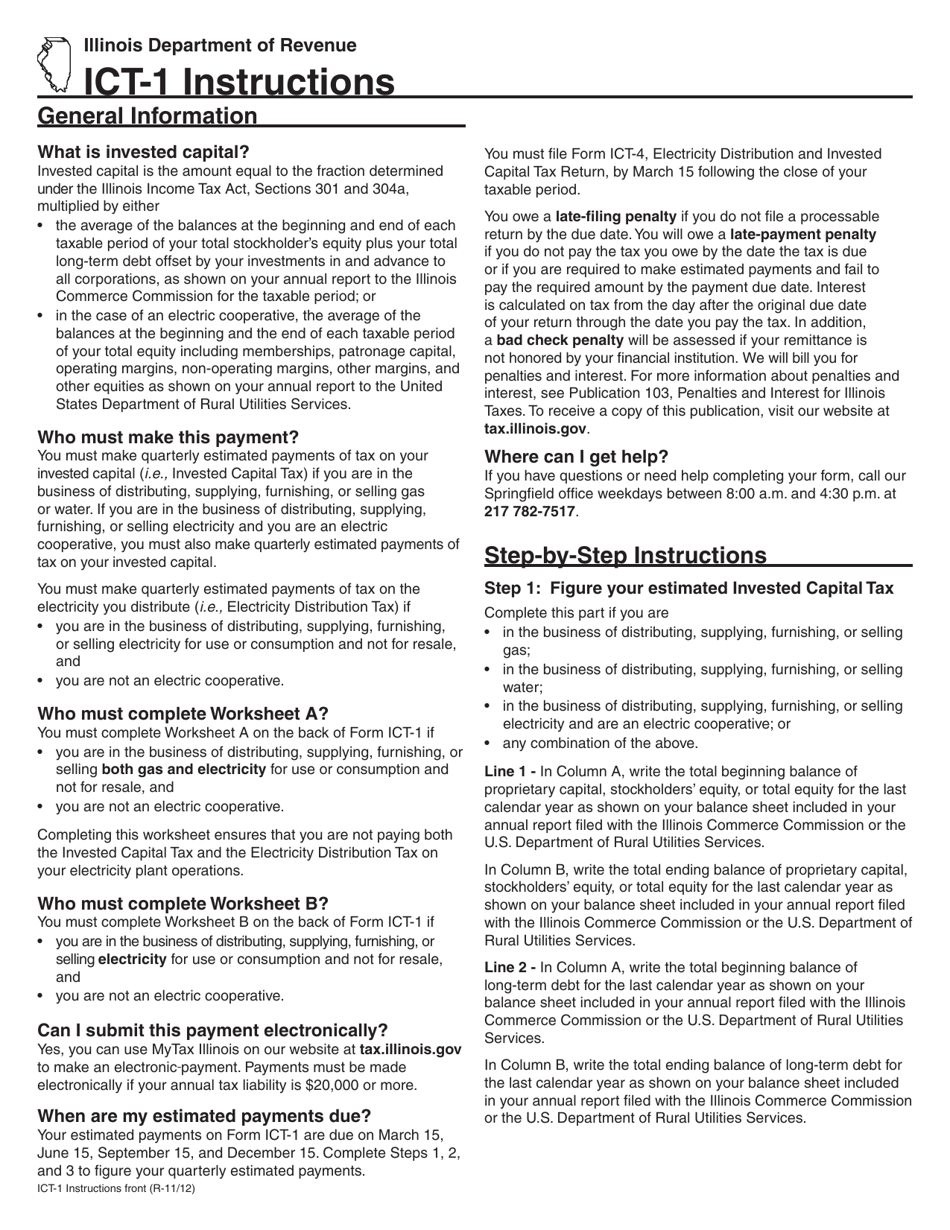

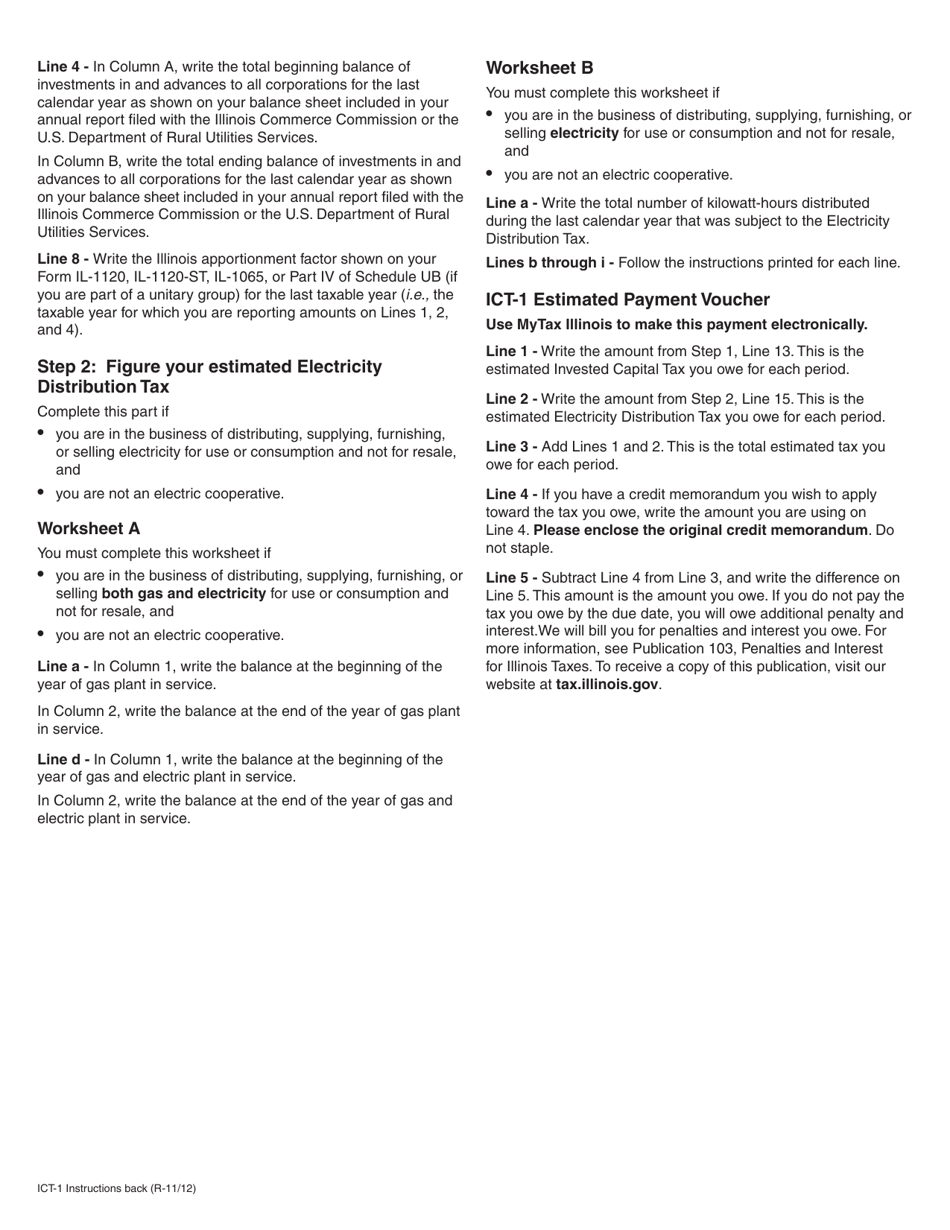

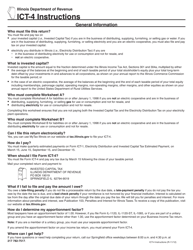

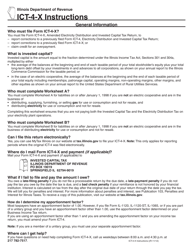

Instructions for Form ICT-1 Electricity Distribution and Invested Capital Tax Estimated Payment - Illinois

This document contains official instructions for Form ICT-1 , Electricity Distribution and Invested Capital Tax Estimated Payment - a form released and collected by the Illinois Department of Revenue.

FAQ

Q: What is Form ICT-1?

A: Form ICT-1 is a tax form used for making estimated electricity distribution and invested capital tax payments in the state of Illinois.

Q: What is the purpose of the Electricity Distribution and Invested Capital Tax?

A: The Electricity Distribution and Invested Capital Tax is imposed on public utilities that distribute electricity in Illinois.

Q: Who needs to file Form ICT-1?

A: Public utilities that distribute electricity in Illinois are required to file Form ICT-1 and make estimated tax payments.

Q: When should Form ICT-1 be filed?

A: Form ICT-1 should be filed on a quarterly basis, with payments due on April 15th, July 15th, October 15th, and January 15th.

Q: How is the tax calculated?

A: The tax is calculated based on the utility's invested capital and the electricity distribution revenues.

Q: Is there a penalty for late filing or underpayment?

A: Yes, there is a penalty for late filing or underpayment. It is important to file and pay on time to avoid penalties.

Q: What supporting documentation is required with Form ICT-1?

A: Form ICT-1 should be accompanied by Form RUT-25 or Form RUT-50, as well as any required payment vouchers.

Q: Are there any exemptions or deductions available for the Electricity Distribution and Invested Capital Tax?

A: There are no specific exemptions or deductions mentioned in the document. However, it's advisable to consult with a tax professional for more information.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.