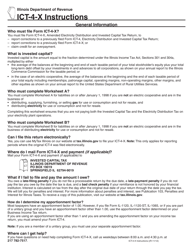

Instructions for Form ST-4-X, 038 Amended Metropolitan Pier and Exposition Authority Food and Beverage Tax Return - Illinois

This document contains official instructions for Form ST-4-X , and Form 038 . Both forms are released and collected by the Illinois Department of Revenue.

FAQ

Q: What is Form ST-4-X?

A: Form ST-4-X is the Amended Metropolitan Pier and Exposition Authority Food and Beverage Tax Return in Illinois.

Q: What is the purpose of Form ST-4-X?

A: The purpose of Form ST-4-X is to amend the Metropolitan Pier and Exposition Authority Food and Beverage Tax Return.

Q: Who needs to file Form ST-4-X?

A: Anyone who needs to amend their Metropolitan Pier and Exposition Authority Food and Beverage Tax Return in Illinois needs to file Form ST-4-X.

Q: When is Form ST-4-X due?

A: Form ST-4-X is due on the same due date as the original Food and Beverage Tax Return for the Metropolitan Pier and Exposition Authority.

Q: How do I fill out Form ST-4-X?

A: You need to provide the necessary information on the form, including the original return information, the corrected information, and the reason for the amendment.

Q: What if I make a mistake on Form ST-4-X?

A: If you make a mistake on Form ST-4-X, you can file another amended return with the correct information.

Q: Are there any penalties for filing Form ST-4-X late?

A: Yes, there are penalties for filing Form ST-4-X late. It is important to file the amended return by the due date to avoid penalties.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.