This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for

for the current year.

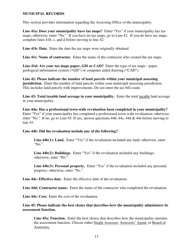

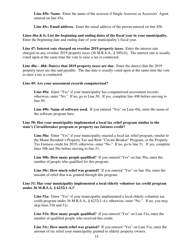

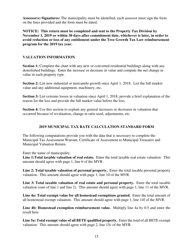

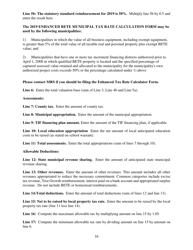

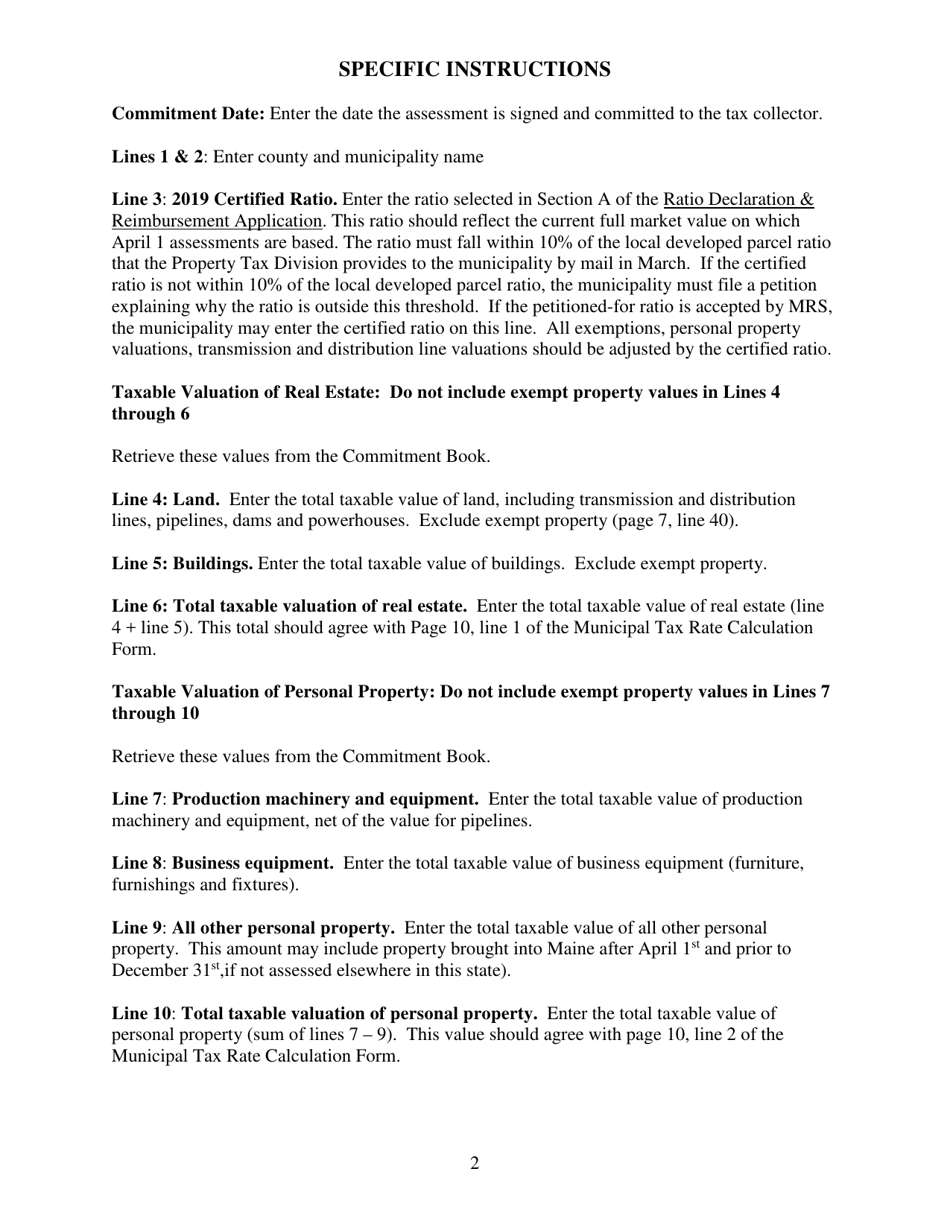

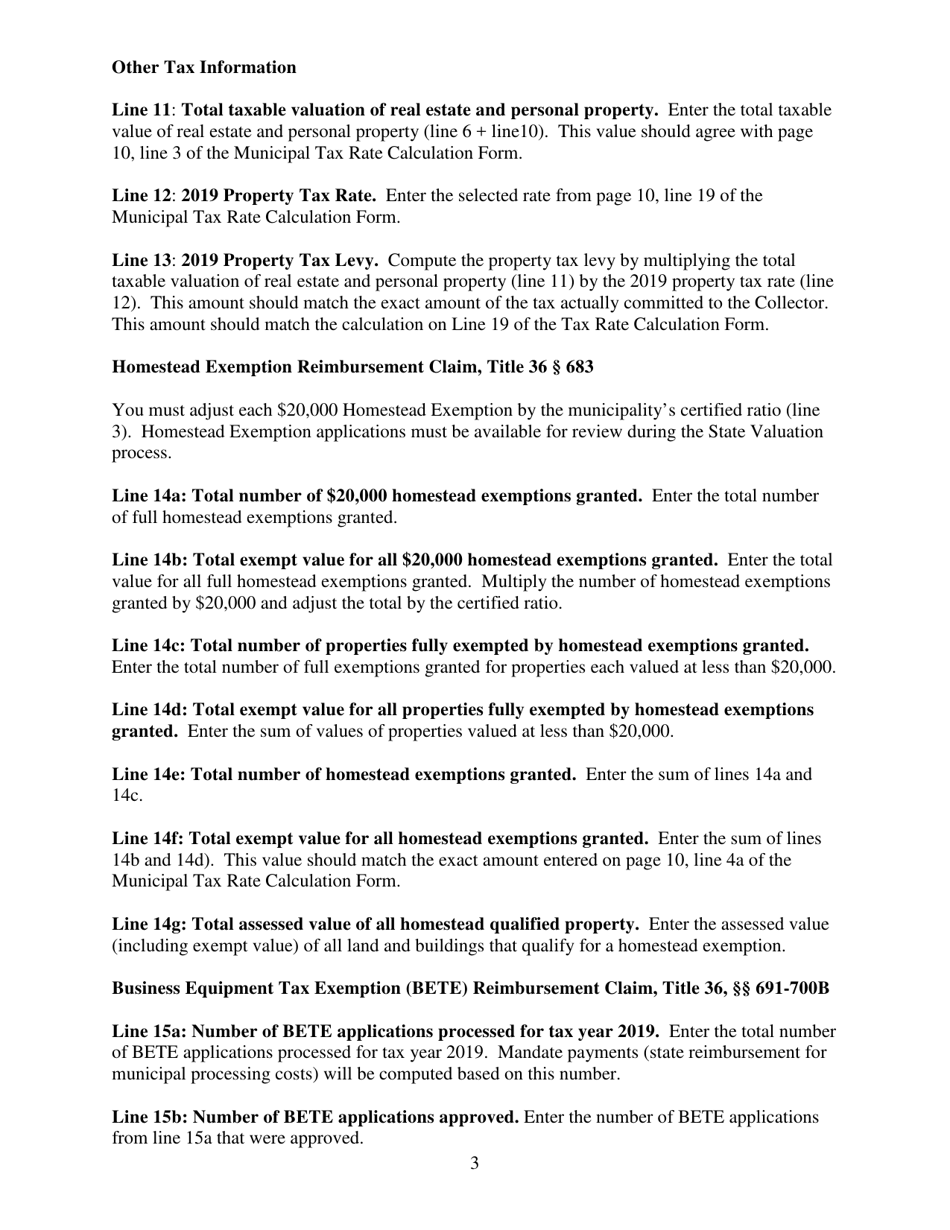

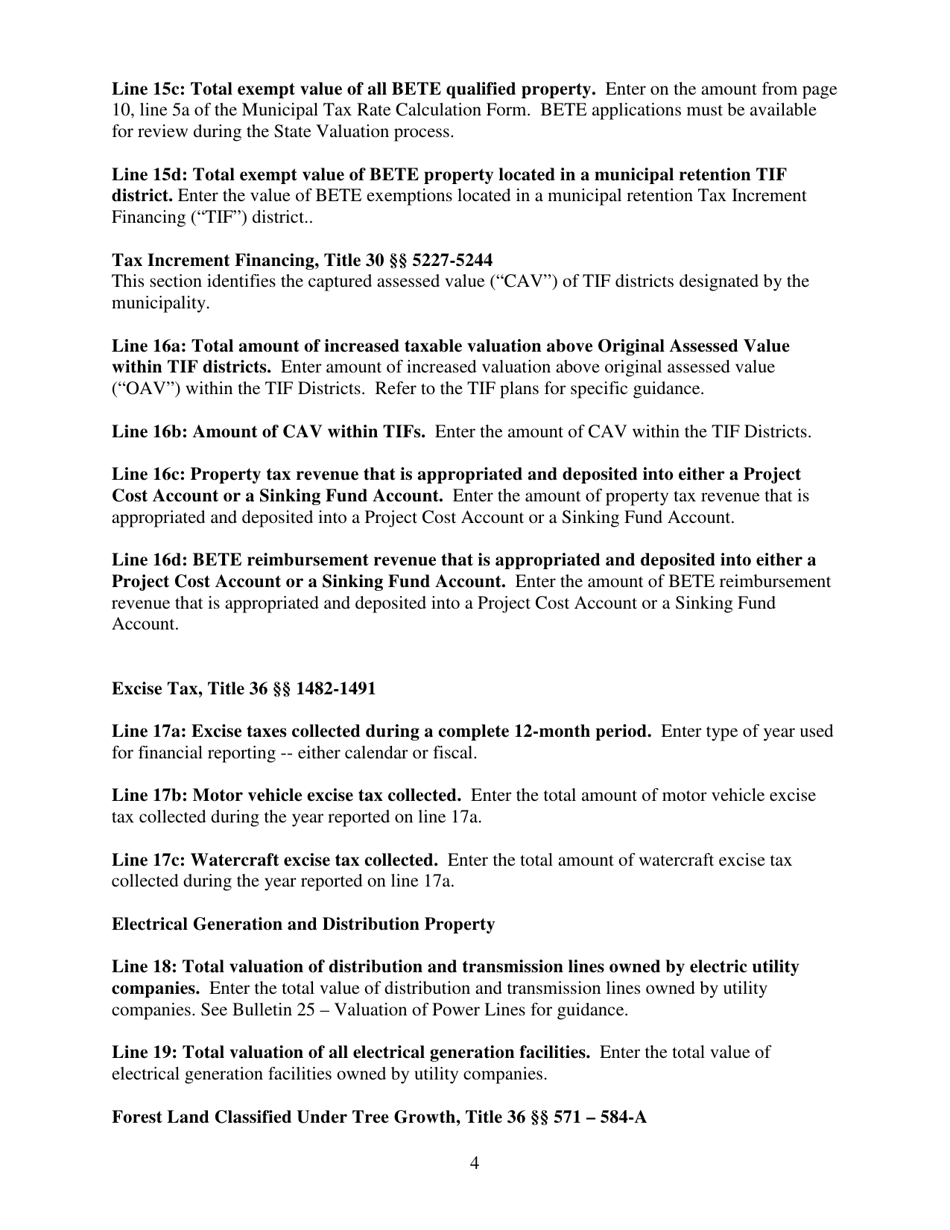

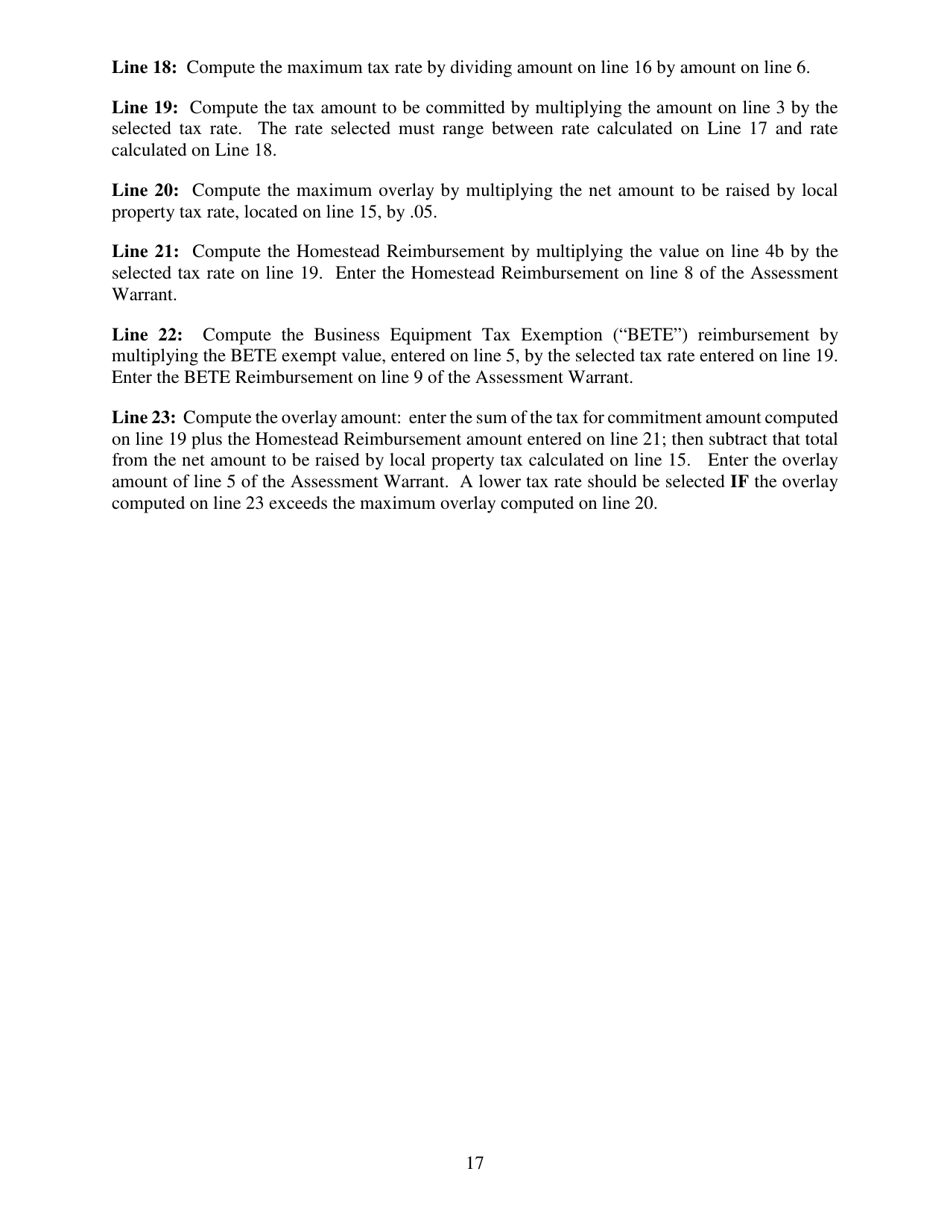

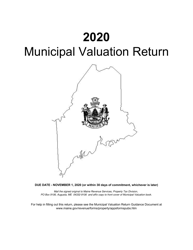

Instructions for Municipal Valuation Return - Maine

This document was released by Maine Department of Administrative and Financial Services and contains the most recent official instructions for Municipal Valuation Return .

FAQ

Q: What is a Municipal Valuation Return?

A: The Municipal Valuation Return is a document used to report property values to the local municipality for tax assessment purposes.

Q: Who is required to submit a Municipal Valuation Return in Maine?

A: In Maine, property owners are required to submit a Municipal Valuation Return to the local municipality.

Q: When is the deadline to submit a Municipal Valuation Return in Maine?

A: The deadline to submit a Municipal Valuation Return in Maine varies by municipality. Property owners should check with their local municipality for the specific deadline.

Q: What information is needed to complete a Municipal Valuation Return?

A: The information needed to complete a Municipal Valuation Return may include details about the property, such as ownership information, description of improvements, and any recent sales.

Q: Is it possible to request an extension for filing a Municipal Valuation Return in Maine?

A: Some municipalities in Maine may offer extensions for filing Municipal Valuation Returns. Property owners should contact their local municipality to inquire about extension options.

Instruction Details:

- This 17-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library legal documents released by the Maine Department of Administrative and Financial Services.