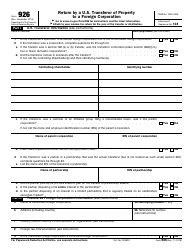

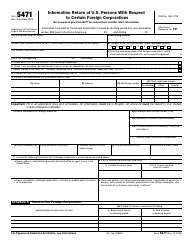

Instructions for IRS Form 926 Return by a U.S. Transferor of Property to a Foreign Corporation

Use these Instructions for IRS Form 926 to fill outIRS Form 926, Return by a U.S. Transferor of Property to a Foreign Corporation, and to report certain transfers of tangible or intangible property to a foreign corporation, as required by section 6038B. The instructions are revised annually by the Internal Revenue Service (IRS) with the latest edition released on November 1, 2018 .

Note that Form 926 needs to be filed with the income tax return of the U.S. transferor (or, if they are exempt, the organization return) for the tax year when the date of the transfer occurred. IRS 926 filings with the IRS must have the additional information listed in the Regulation sections 1.6038B-1 (c) through (e) and Temporary Regulations sections 1.6038B-1T (c) and (d).

Who Must File IRS Form 926?

IRS Form 926 needs to be filed when a U.S. citizen or resident, a domestic corporation, or a domestic estate or trust completes certain transfers of property to a foreign corporation described in section 6038B(a)(1)(A), 367(d), or 367(e).

IRS Form 926 Instructions include the following:

- The first part asks for the "U.S. Transferor Information," including the name of the transferor, controlling shareholder(s), identifying number(s), name of the parent corporation, EIN of the parent corporation, name of the partnership, and EIN of partnership.

- The second part asks for the "Transferee Foreign Corporation Information," including the name of the transferee (foreign corporation), address, country code of the country of incorporation or organization, foreign law characteristics, identifying number (if any), reference ID number, and if the transferee foreign corporation is a controlled foreign corporation.

- The third part asks for "Information Regarding the Transfer of Property." Section A for Cash, Section B for Other Property (listed as other than intangible property subject to section 367 (d)), Section C for Intangible Property Subject to Section 367 (d), and Supplemental Part III information Required to be Reported which asks the filer to provide a general description of the transfer and any wider transaction of which it forms a part, including a chronology of the transfers involved and an identification of the other parties to the transaction to the extent known.

- The fourth part asks for "Additional Information Regarding Transfer of Property" including type, gain recognition, exchange gain recognition, and if the transfer resulted in a change in entity recognition.