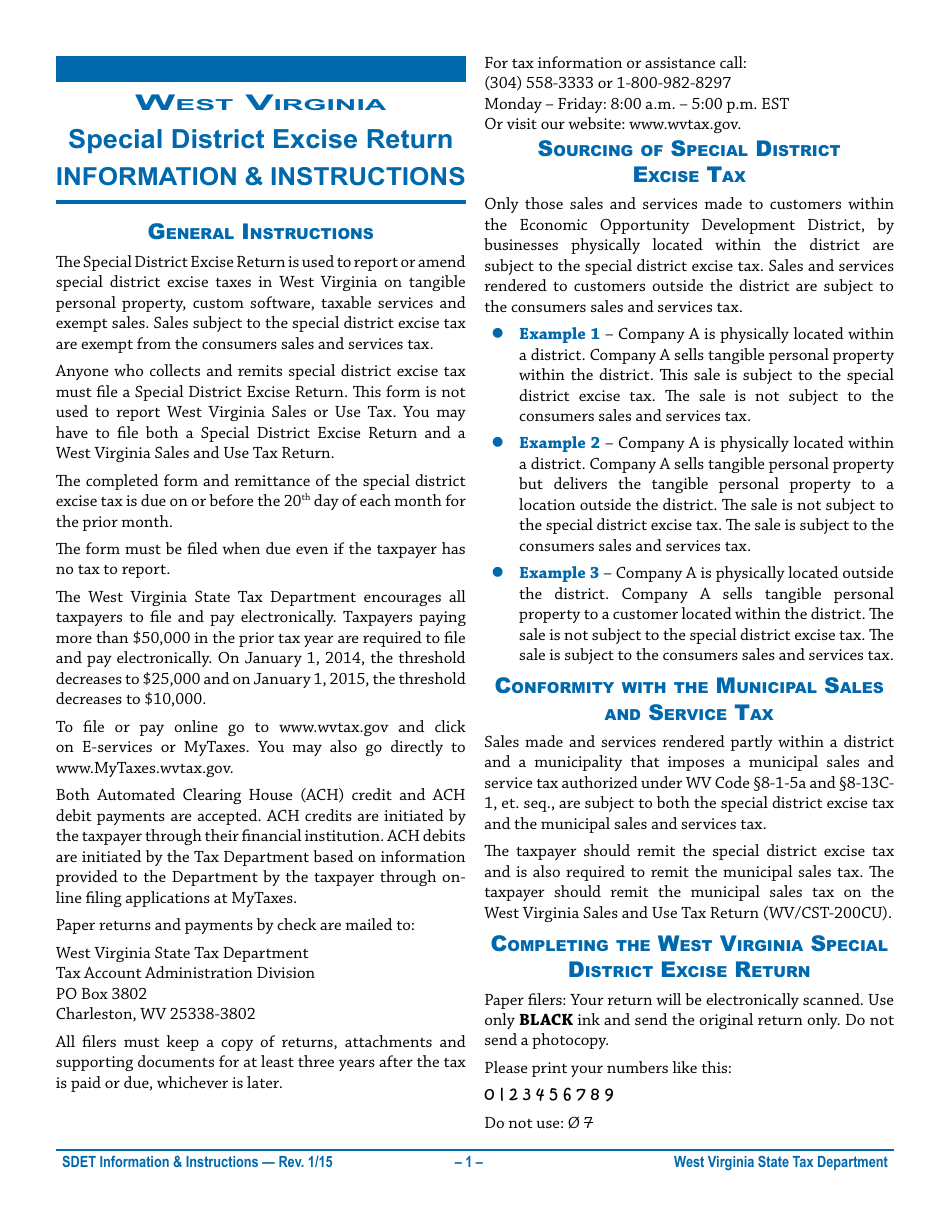

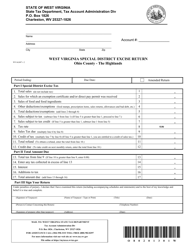

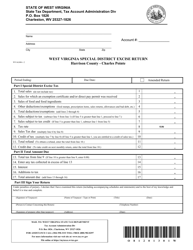

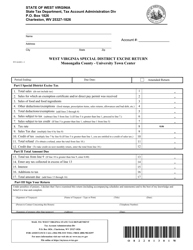

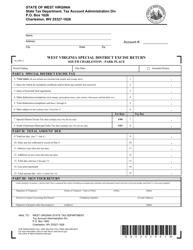

Instructions for Special District Excise Return Form - West Virginia

This document was released by West Virginia State Tax Department and contains the most recent official instructions for Special District Excise Return Form .

FAQ

Q: What is the Special District Excise Return Form?

A: The Special District Excise Return Form is a form used in West Virginia to report and pay excise tax for certain special districts.

Q: Who needs to file the Special District Excise Return Form?

A: Any person or business that is liable for special district excise tax in West Virginia needs to file this form.

Q: What is special district excise tax?

A: Special district excise tax is a tax imposed on certain goods or services within designated special districts in West Virginia.

Q: How often do I need to file the Special District Excise Return Form?

A: The frequency of filing the form depends on the special district and the type of tax. Check the instructions for specific filing requirements.

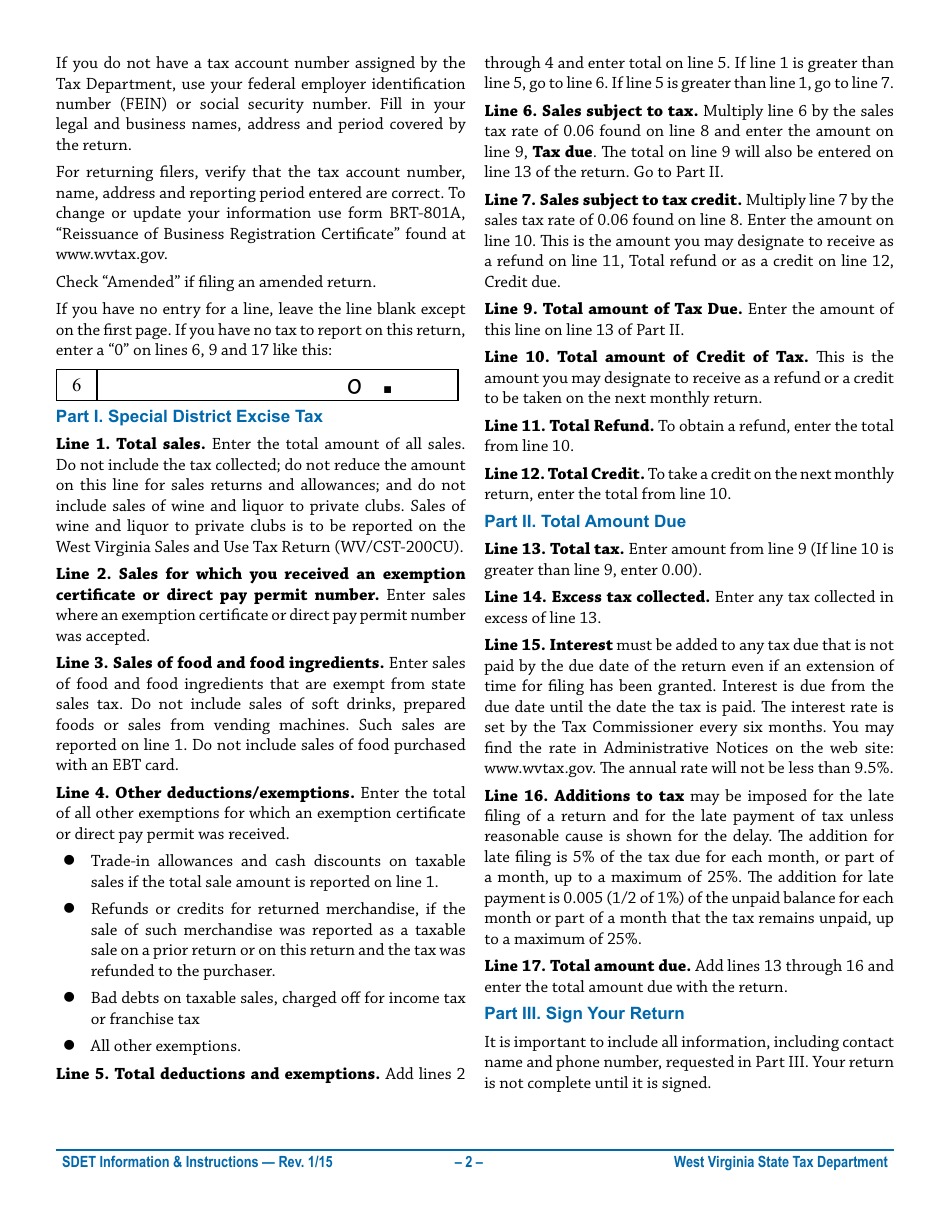

Q: How do I complete the form?

A: Carefully follow the instructions provided with the form. Fill in all required information accurately and report the correct amount of tax due.

Q: Are there any penalties for late or incorrect filing?

A: Yes, penalties may apply for late or incorrect filing. It is important to file the form on time and accurately to avoid penalties.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library legal documents released by the West Virginia State Tax Department.