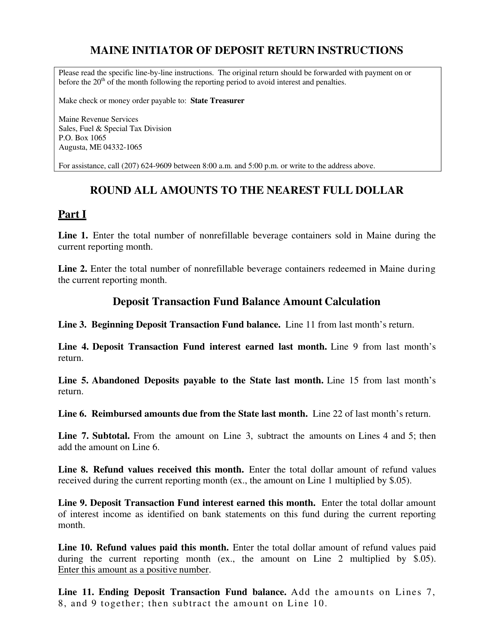

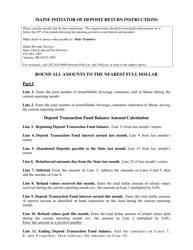

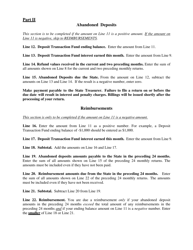

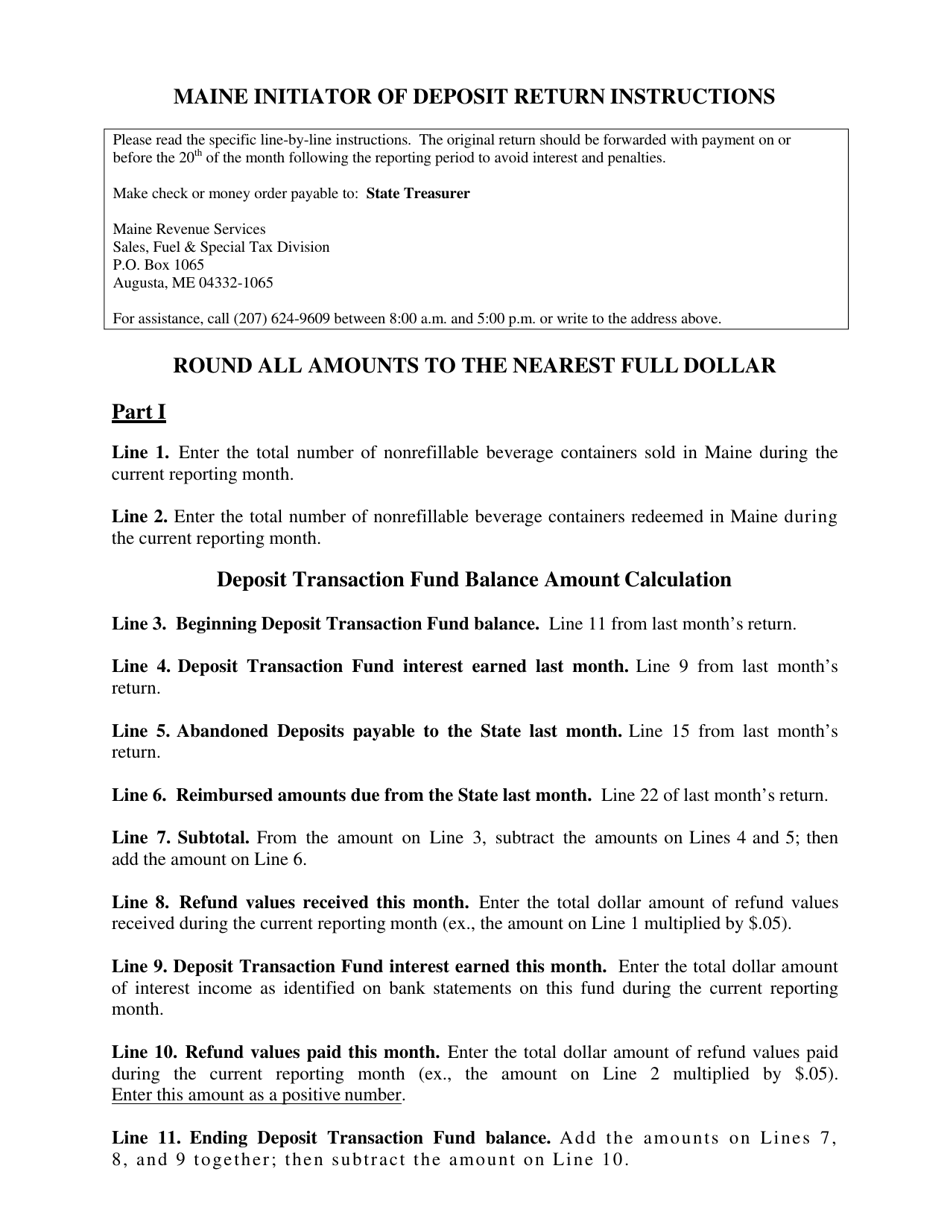

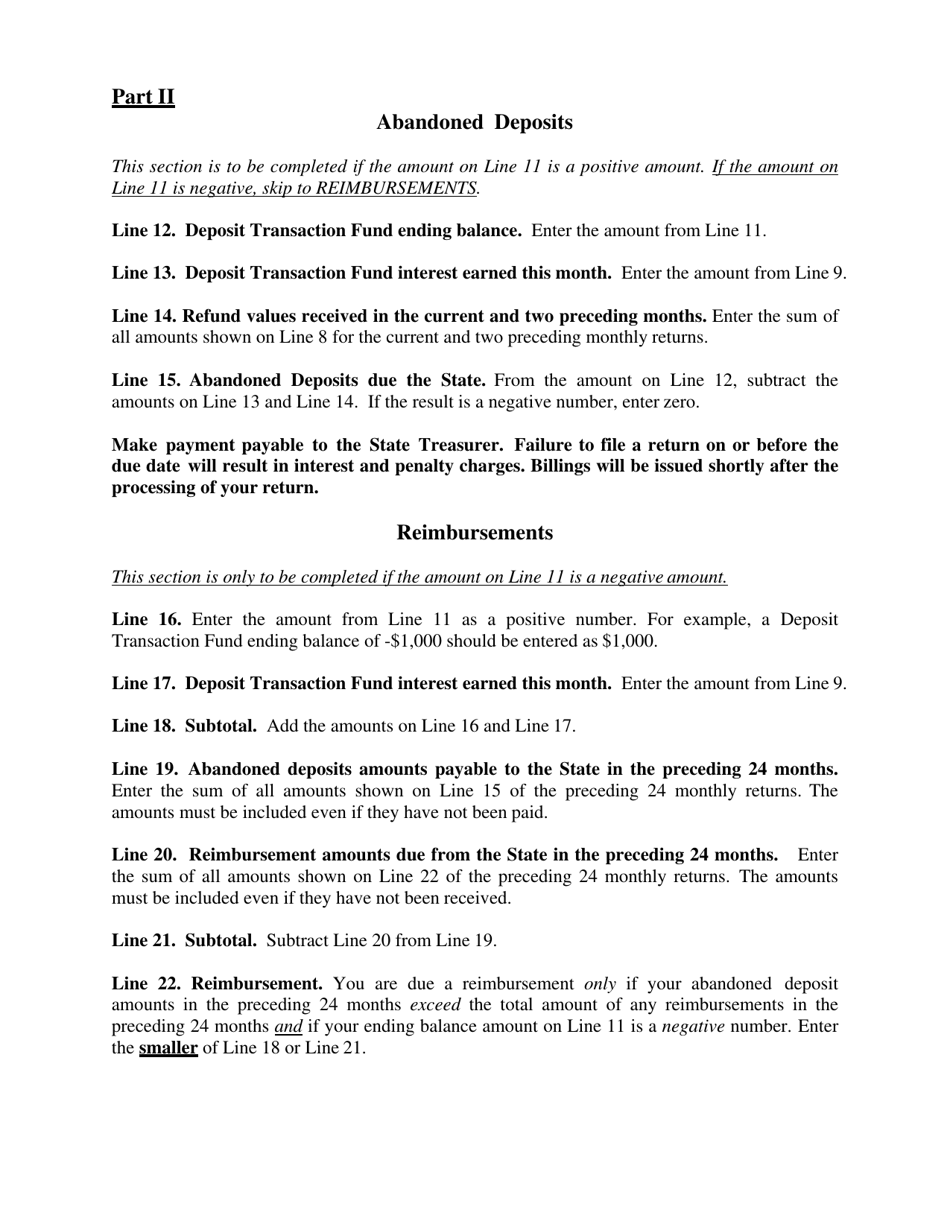

Instructions for Initiator of Deposit Tax Return - Maine

This document was released by Maine Department of Administrative and Financial Services and contains the most recent official instructions for Initiator of Deposit Tax Return .

FAQ

Q: Who needs to file a Deposit Tax Return in Maine?

A: Any individual or business who holds deposits subject to tax in Maine needs to file a Deposit Tax Return.

Q: What is a Deposit Tax Return?

A: A Deposit Tax Return is a form used to report and remit the tax on certain deposits held in Maine.

Q: How often does the Deposit Tax Return need to be filed?

A: The Deposit Tax Return needs to be filed on a quarterly basis, meaning four times a year.

Q: What deposits are subject to tax in Maine?

A: Deposits subject to tax in Maine include certain bank deposits, trust deposits, and unallocated insurance company deposits.

Q: Is there a minimum threshold for filing a Deposit Tax Return?

A: Yes, if your deposits subject to tax are less than $250,000 in a calendar year, you are not required to file a Deposit Tax Return.

Q: What are the consequences of not filing a Deposit Tax Return?

A: Failure to file a Deposit Tax Return can result in penalties and interest being assessed by the Maine Revenue Services.

Q: Are there any exemptions to the deposit tax in Maine?

A: Certain deposits are exempt from the deposit tax, including deposits held by governmental entities and certain nonprofit organizations.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library legal documents released by the Maine Department of Administrative and Financial Services.