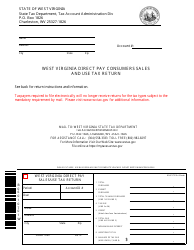

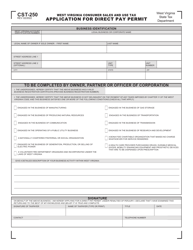

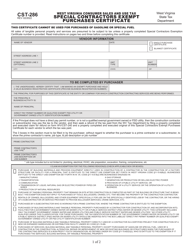

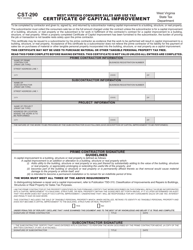

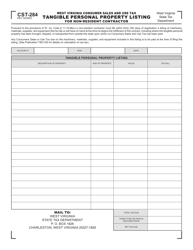

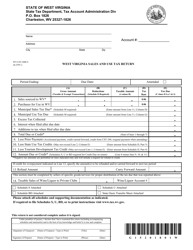

Form WV / CST-210 West Virginia Direct Pay Consumers Sales and Use Tax Return - West Virginia

What Is Form WV/CST-210?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is WV/CST-210?

A: WV/CST-210 is the West Virginia Direct Pay Consumers Sales and Use Tax Return.

Q: What is the purpose of WV/CST-210?

A: The purpose of WV/CST-210 is to report and pay sales and use taxes directly by consumers.

Q: Who needs to file WV/CST-210?

A: Consumers who make purchases subject to West Virginia sales and use tax and choose to pay the tax directly need to file WV/CST-210.

Q: What is the sales and use tax in West Virginia?

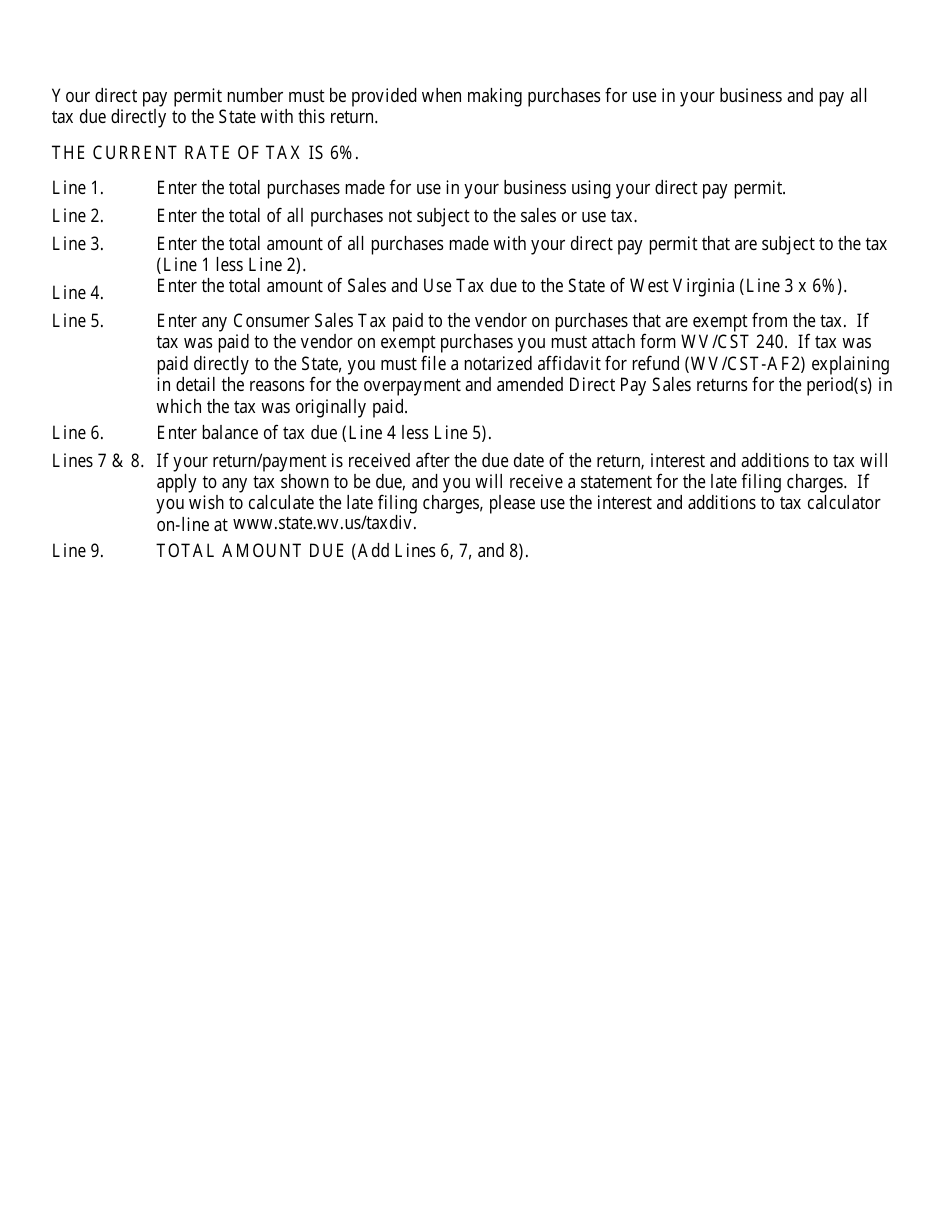

A: The sales and use tax rate in West Virginia is 6%.

Q: When is the deadline to file WV/CST-210?

A: The deadline to file WV/CST-210 is the 20th day of the month following the reporting period.

Q: Are there any penalties for late filing of WV/CST-210?

A: Yes, there are penalties for late filing of WV/CST-210. The penalty is 0.5% per month or fraction of a month, up to a maximum of 25% of the tax due.

Q: Can I claim a refund on WV/CST-210?

A: No, WV/CST-210 is specifically for reporting and paying sales and use taxes, not for claiming refunds.

Q: Is there a minimum threshold for filing WV/CST-210?

A: Yes, if your total tax liability for the reporting period is less than $50, you are not required to file WV/CST-210.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WV/CST-210 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.