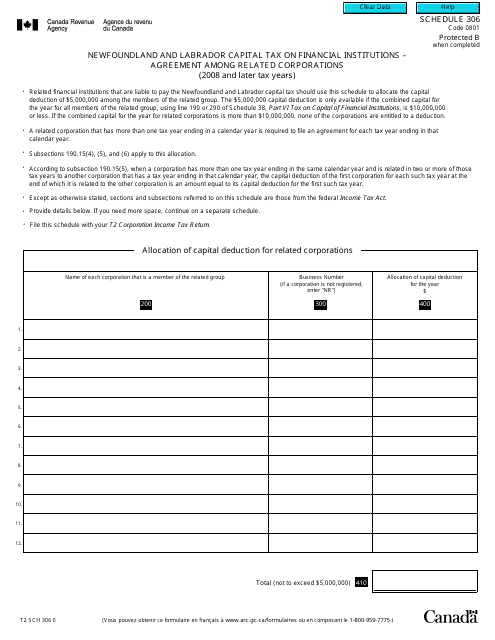

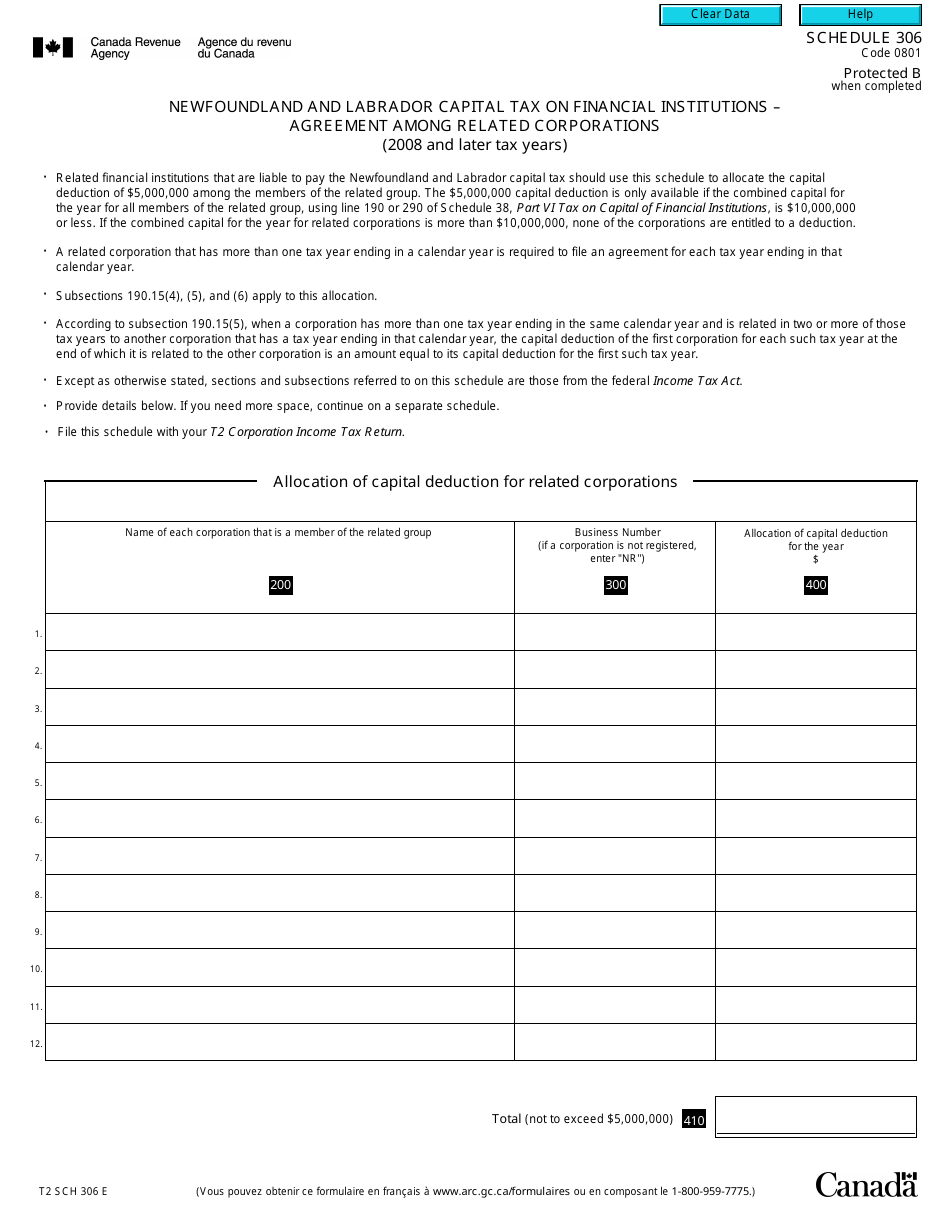

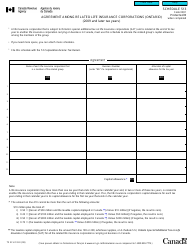

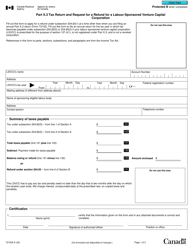

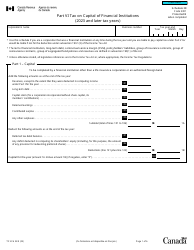

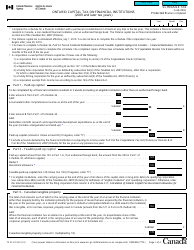

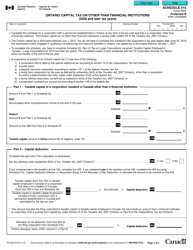

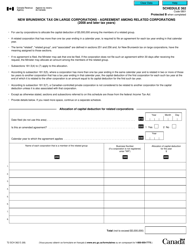

Form T2 Schedule 306 Newfoundland and Labrador Capital Tax on Financial Institutions - Agreement Among Related Corporations (2008 and Later Tax Years) - Canada

Form T2 Schedule 306 Newfoundland and Labrador Capital Tax on Financial Institutions - Agreement Among Related Corporations (2008 and Later Tax Years) is used by financial institutions in Newfoundland and Labrador, Canada, to determine the capital tax payable by related corporations. It helps calculate the tax liability based on the agreements among these corporations.

FAQ

Q: What is Form T2 Schedule 306?

A: Form T2 Schedule 306 is a tax form used in Canada.

Q: What is Newfoundland and Labrador Capital Tax on Financial Institutions?

A: Newfoundland and Labrador Capital Tax on Financial Institutions is a tax levied on financial institutions operating in Newfoundland and Labrador province in Canada.

Q: What is the Agreement Among Related Corporations?

A: The Agreement Among Related Corporations is a provision that allows related corporations to allocate and transfer their tax liabilities in Newfoundland and Labrador Capital Tax on Financial Institutions.

Q: When can Form T2 Schedule 306 be used?

A: Form T2 Schedule 306 can be used for tax years 2008 and later.

Q: Who is required to fill out Form T2 Schedule 306?

A: Financial institutions operating in Newfoundland and Labrador province in Canada are required to fill out Form T2 Schedule 306 if they have an agreement among related corporations.