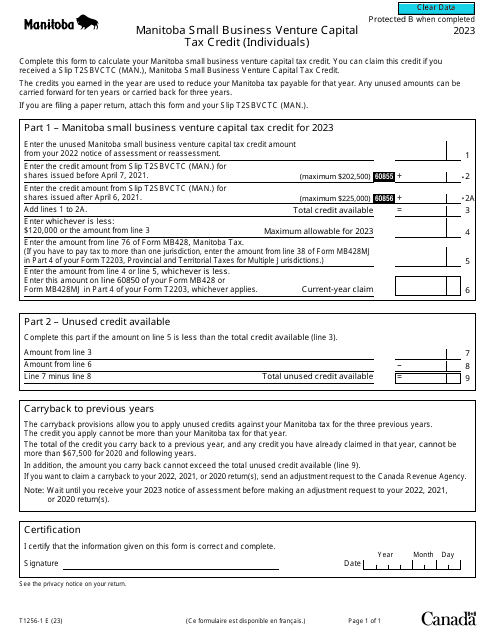

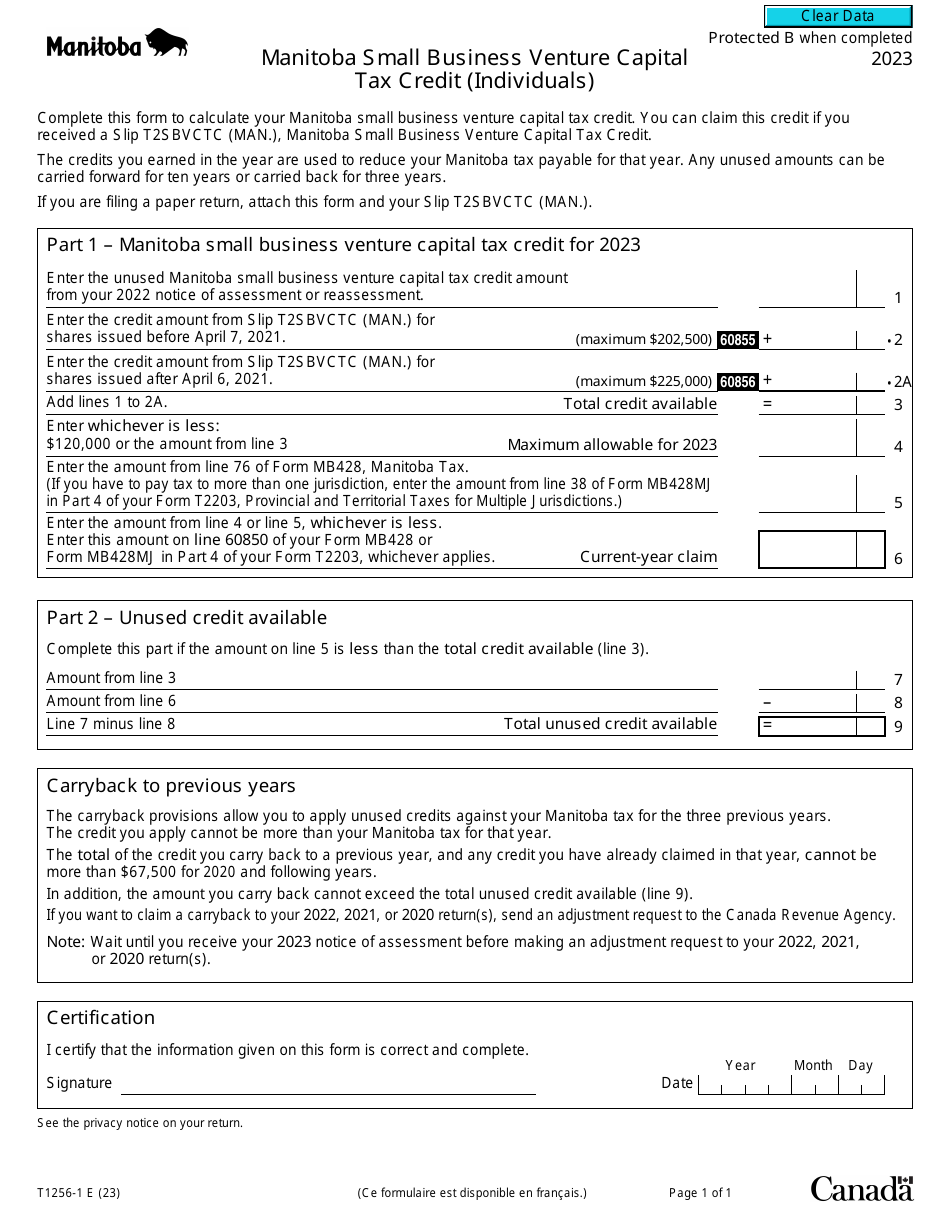

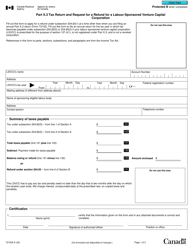

Form T1256-1 Manitoba Small Business Venture Capital Tax Credit (Individuals) - Canada

Form T1256-1 is used in Canada for individuals seeking to claim the Manitoba Small Business Venture Capital Tax Credit. This credit encourages individuals to invest in eligible Manitoba small business corporations by providing them with a tax credit equal to a percentage of their investment. The form is used to calculate and report the eligible amount for the tax credit.

Form T1256-1 Manitoba Small Business Venture Capital Tax Credit (Individuals) - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T1256-1?

A: Form T1256-1 is the Manitoba Small Business Venture Capital Tax Credit form for individuals in Canada.

Q: What is the purpose of Form T1256-1?

A: The purpose of Form T1256-1 is to claim the Manitoba Small Business Venture Capital Tax Credit for individuals.

Q: Who can use Form T1256-1?

A: Form T1256-1 can be used by individuals in Manitoba, Canada who are eligible for the Small Business Venture Capital Tax Credit.

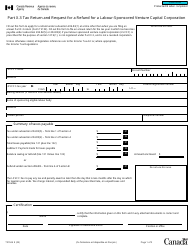

Q: How do I fill out Form T1256-1?

A: To fill out Form T1256-1, you will need to provide your personal information, details of the investment, and any other required information as outlined in the form's instructions.

Q: Is there a deadline for filing Form T1256-1?

A: Yes, there is a deadline for filing Form T1256-1. The specific deadline will be provided by the Manitoba Finance department.

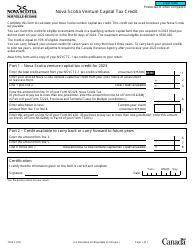

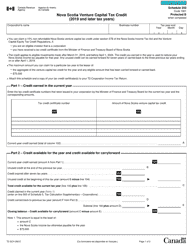

Q: Are there any eligibility requirements for claiming the Small Business Venture Capital Tax Credit?

A: Yes, there are eligibility requirements for claiming the Small Business Venture Capital Tax Credit. These requirements are outlined by the Manitoba Finance department and must be met in order to qualify for the credit.

Q: What is the Small Business Venture Capital Tax Credit?

A: The Small Business Venture Capital Tax Credit is a tax credit available to individuals in Manitoba, Canada who invest in eligible small businesses.

Q: What are the benefits of claiming the Small Business Venture Capital Tax Credit?

A: Claiming the Small Business Venture Capital Tax Credit can provide individuals with a tax credit that helps offset their tax liability and encourages investment in small businesses in Manitoba.