This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form W-2 G, 5754

for the current year.

Instructions for IRS Form W-2 G, 5754

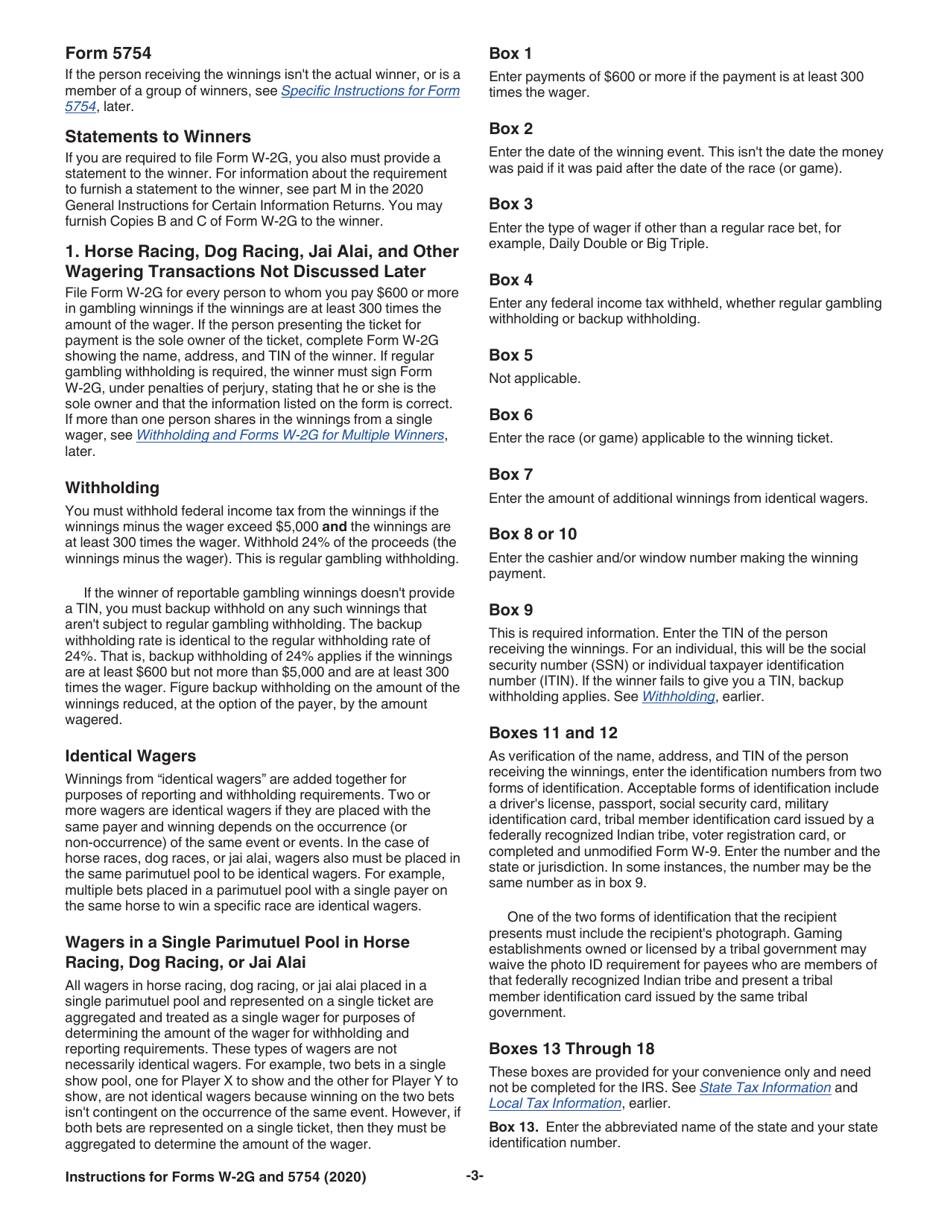

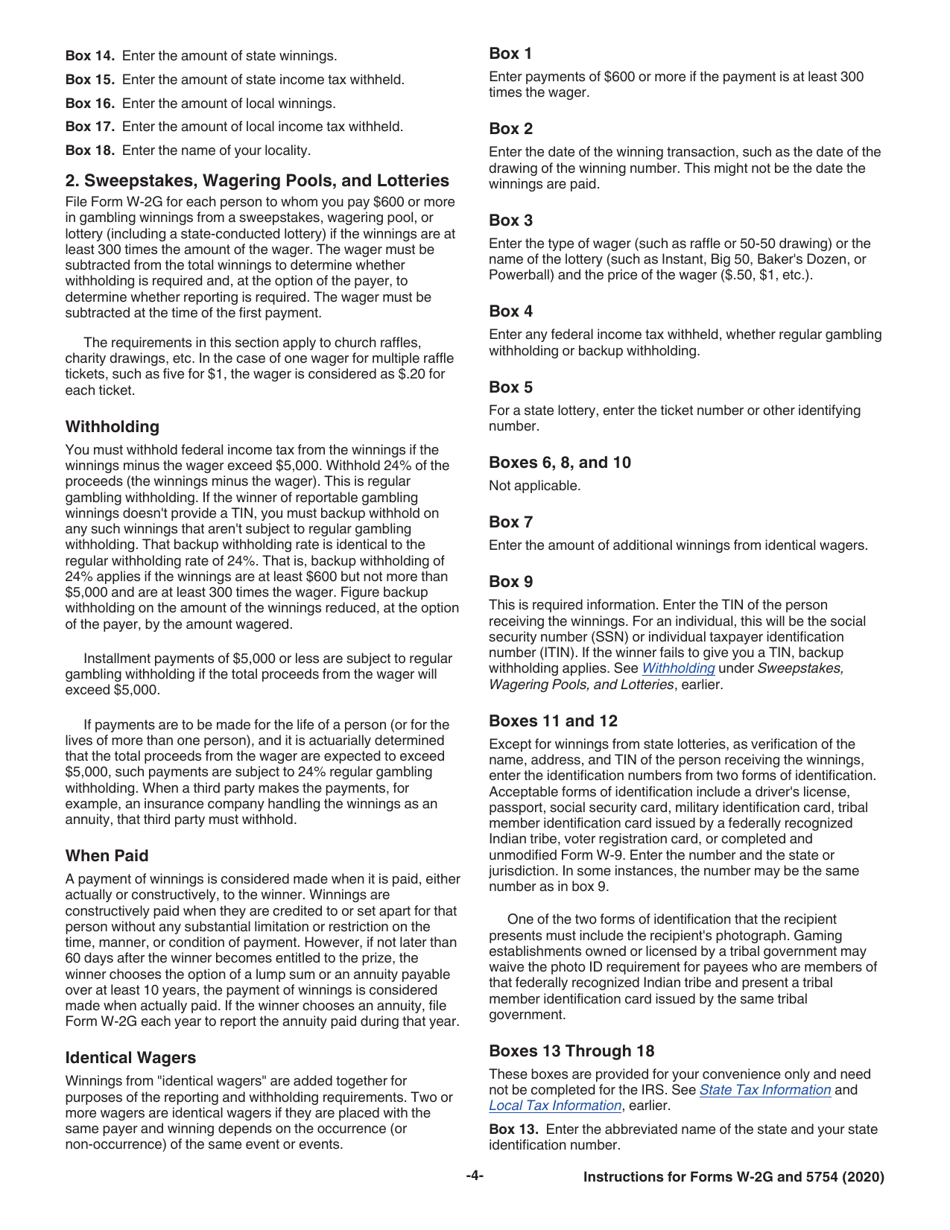

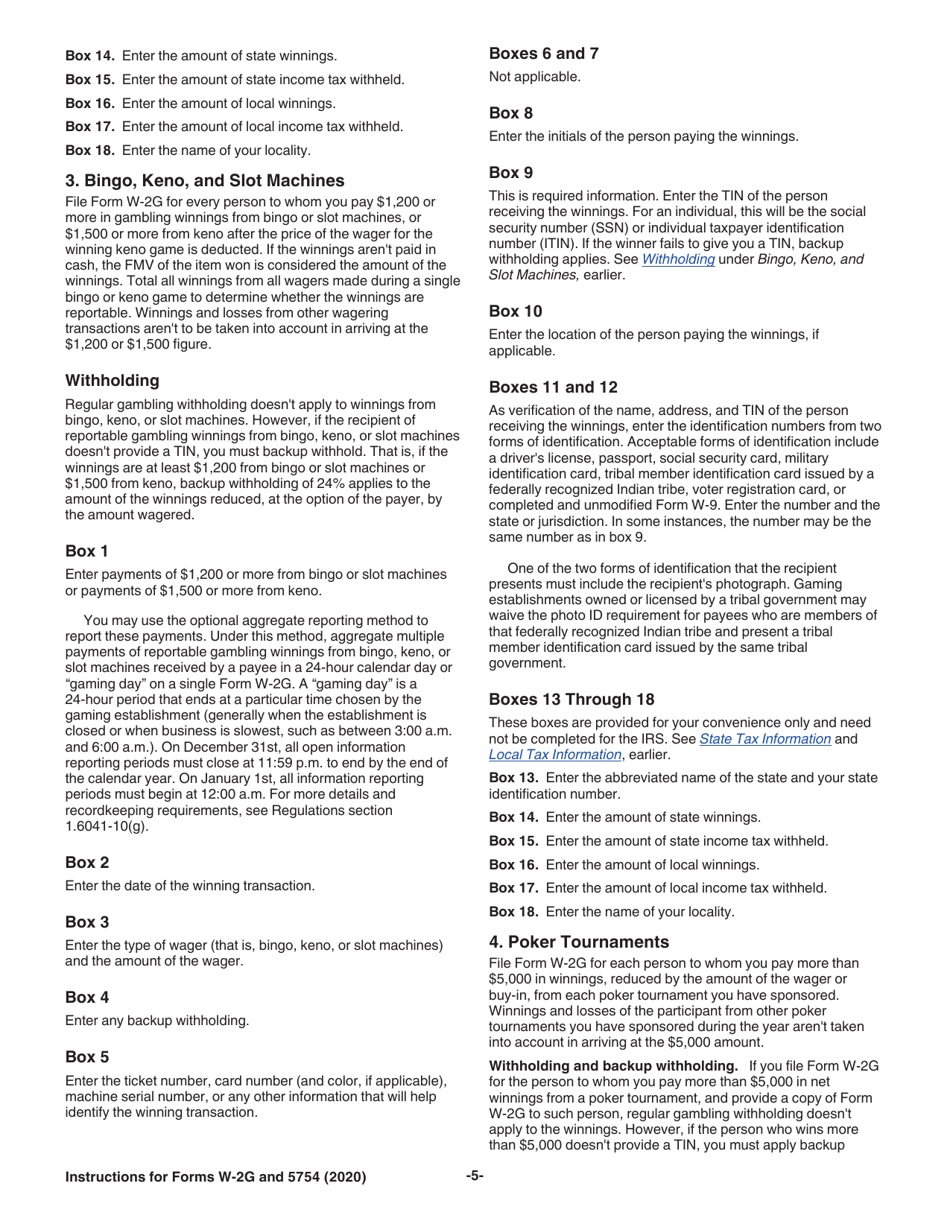

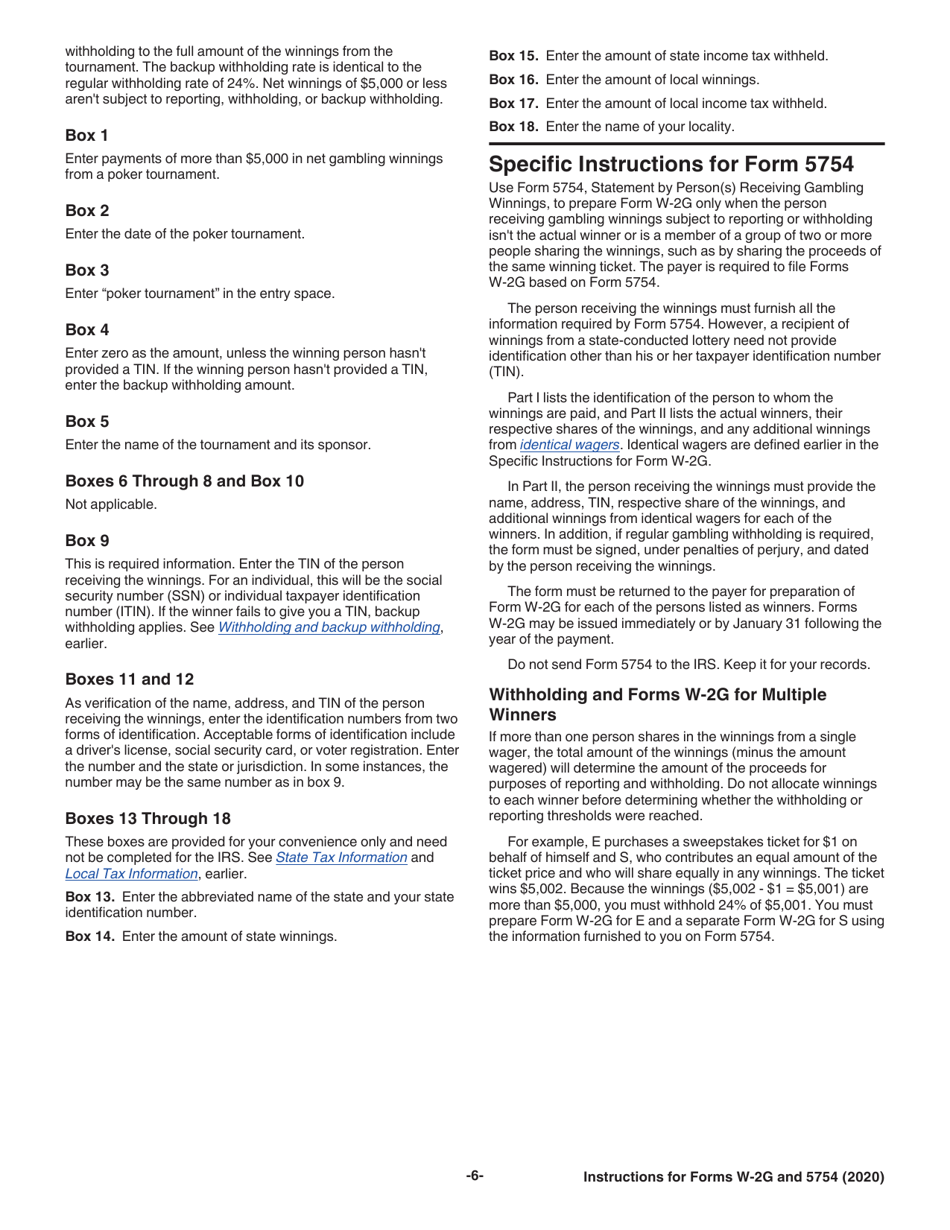

This document contains official instructions for IRS Form W-2 G , and IRS Form 5754 . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is the IRS Form W-2G?

A: The IRS Form W-2G is a tax form used to report gambling winnings.

Q: What should I use Form W-2G for?

A: You should use Form W-2G to report certain gambling winnings, such as winnings from casinos, lotteries, or horse racing.

Q: Do I need to file Form W-2G?

A: You need to file Form W-2G if your gambling winnings meet certain thresholds set by the IRS.

Q: When is the deadline to file Form W-2G?

A: The deadline to file Form W-2G is typically January 31st of the following year.

Q: What information do I need to complete Form W-2G?

A: You will need to provide your name, address, social security number, and the amount of your gambling winnings.

Q: Can I e-file Form W-2G?

A: Yes, you can e-file Form W-2G using the IRS's e-file system or through approved tax software.

Q: Do I need to include a copy of Form W-2G with my tax return?

A: No, you do not need to include a copy of Form W-2G with your tax return. However, you should keep it for your records.

Q: What are the penalties for not filing Form W-2G?

A: Failure to file Form W-2G may result in penalties and interest on the unreported winnings.

Instruction Details:

- This 6-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.