This version of the form is not currently in use and is provided for reference only. Download this version of

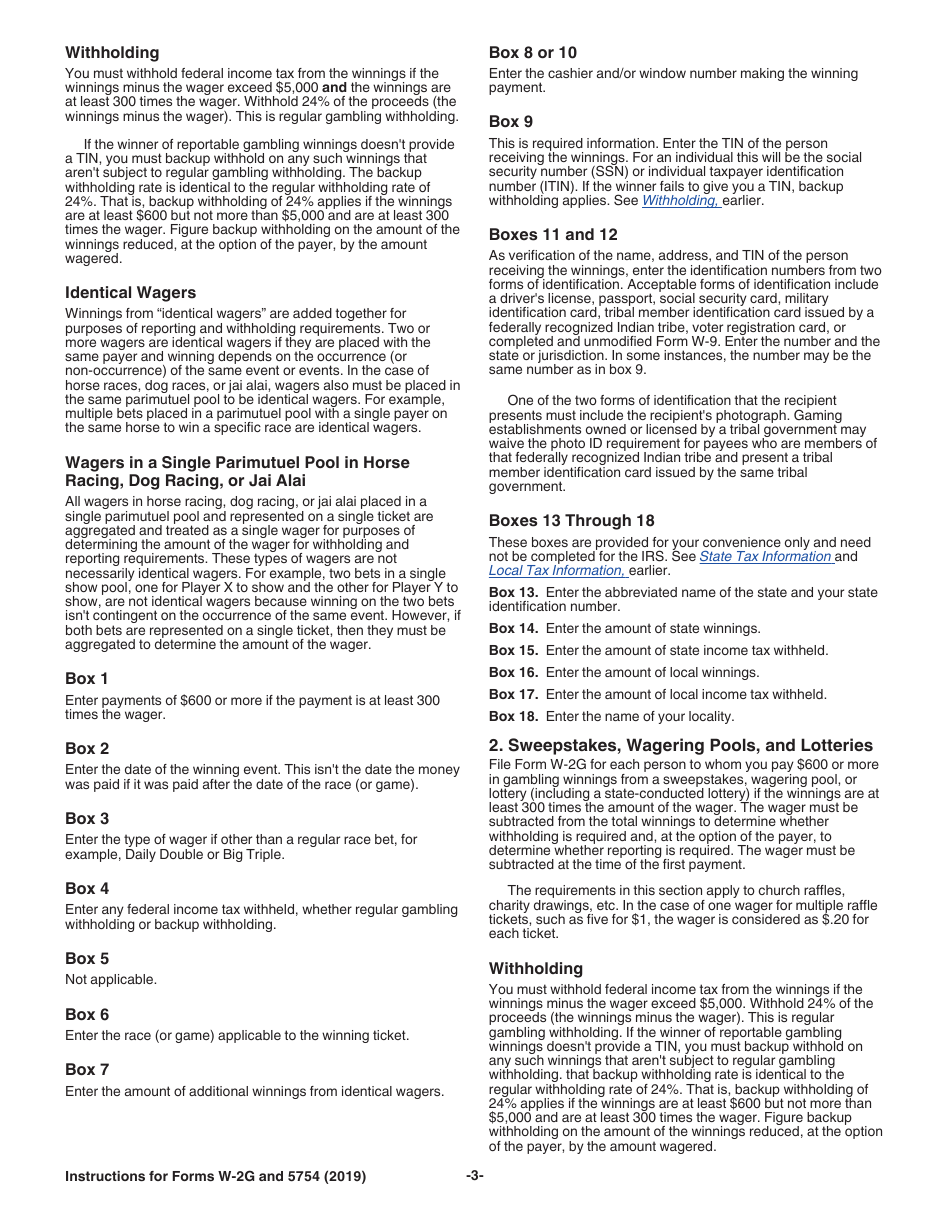

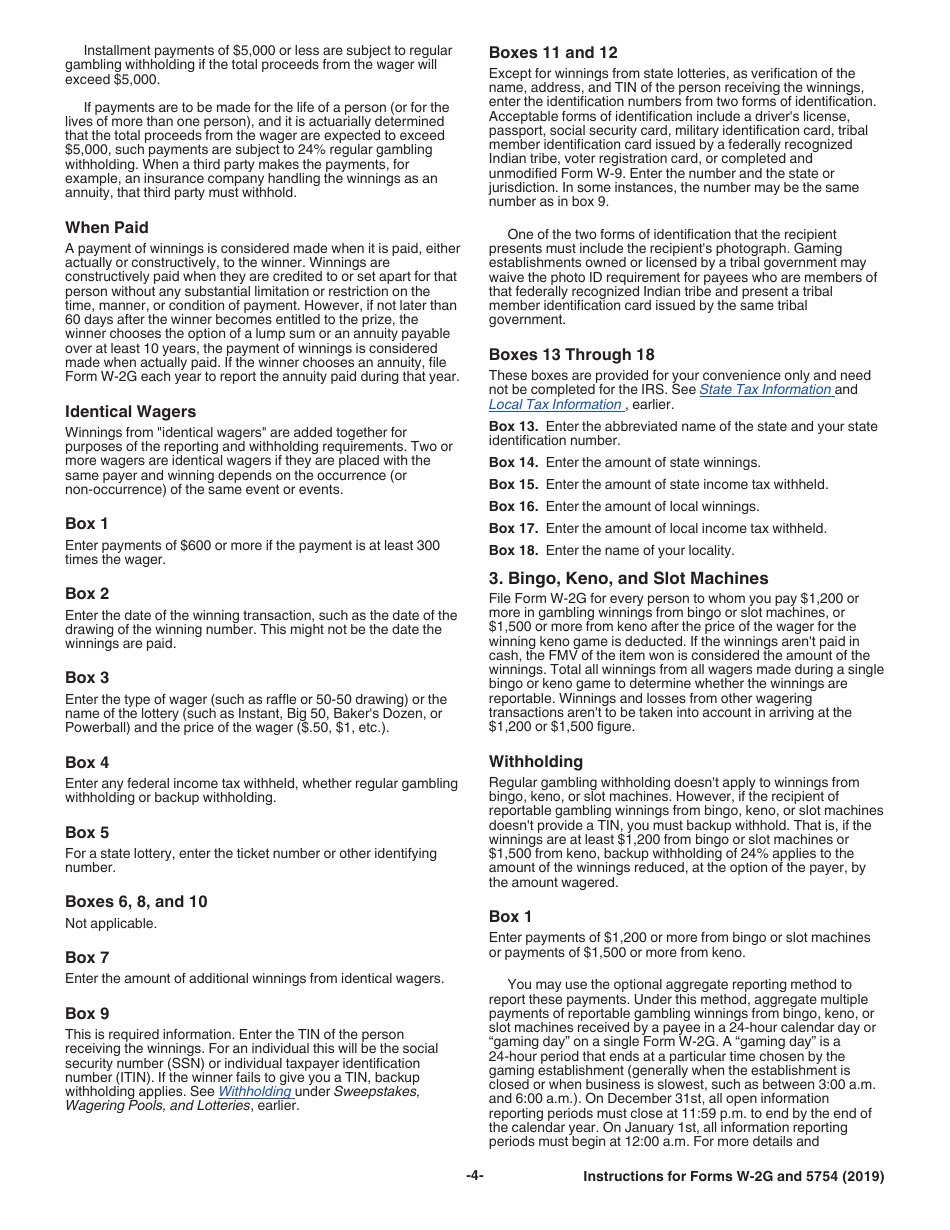

Instructions for IRS Form W-2G, 5754

for the current year.

Instructions for IRS Form W-2G, 5754

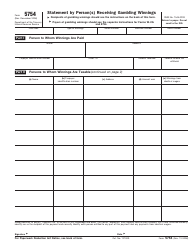

This document contains official instructions for IRS Form W-2G , and IRS Form 5754 . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form W-2G is available for download through this link.

FAQ

Q: What is Form W-2G?

A: Form W-2G is a tax form used to report certain gambling winnings.

Q: Who needs to file Form W-2G?

A: Anyone who receives certain gambling winnings must file Form W-2G.

Q: What information is needed to complete Form W-2G?

A: You will need to provide your name, address, and Social Security number, as well as details about the gambling winnings.

Q: Are all gambling winnings required to be reported on Form W-2G?

A: No, only certain gambling winnings above a certain threshold are required to be reported on Form W-2G.

Q: What should I do if I receive Form W-2G?

A: Keep a copy of the form for your records and use it when preparing your tax return.

Q: Can I file Form W-2G electronically?

A: Yes, you can file Form W-2G electronically if you choose.

Q: When is the deadline to file Form W-2G?

A: Form W-2G must be filed by January 31 of the year following the year in which the gambling winnings were received.

Q: What happens if I don't file Form W-2G?

A: Failure to file Form W-2G or reporting incorrect information may result in penalties or additional taxes.

Q: Are there any exceptions to filing Form W-2G?

A: There are certain exceptions for winnings from bingo, keno, and slot machines, but it is important to consult the IRS guidelines to determine if you qualify for an exception.

Instruction Details:

- This 6-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.