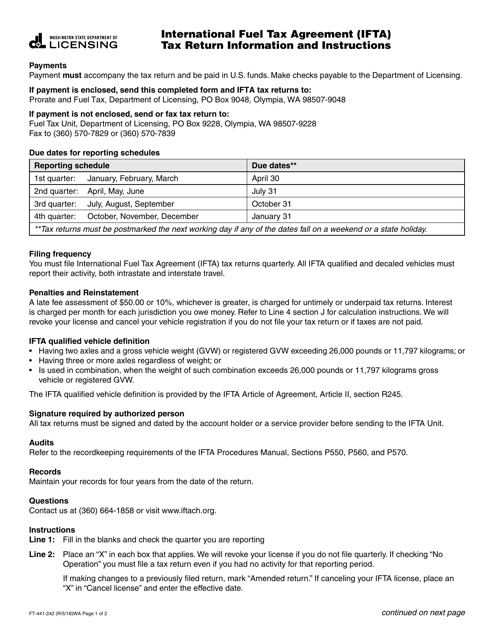

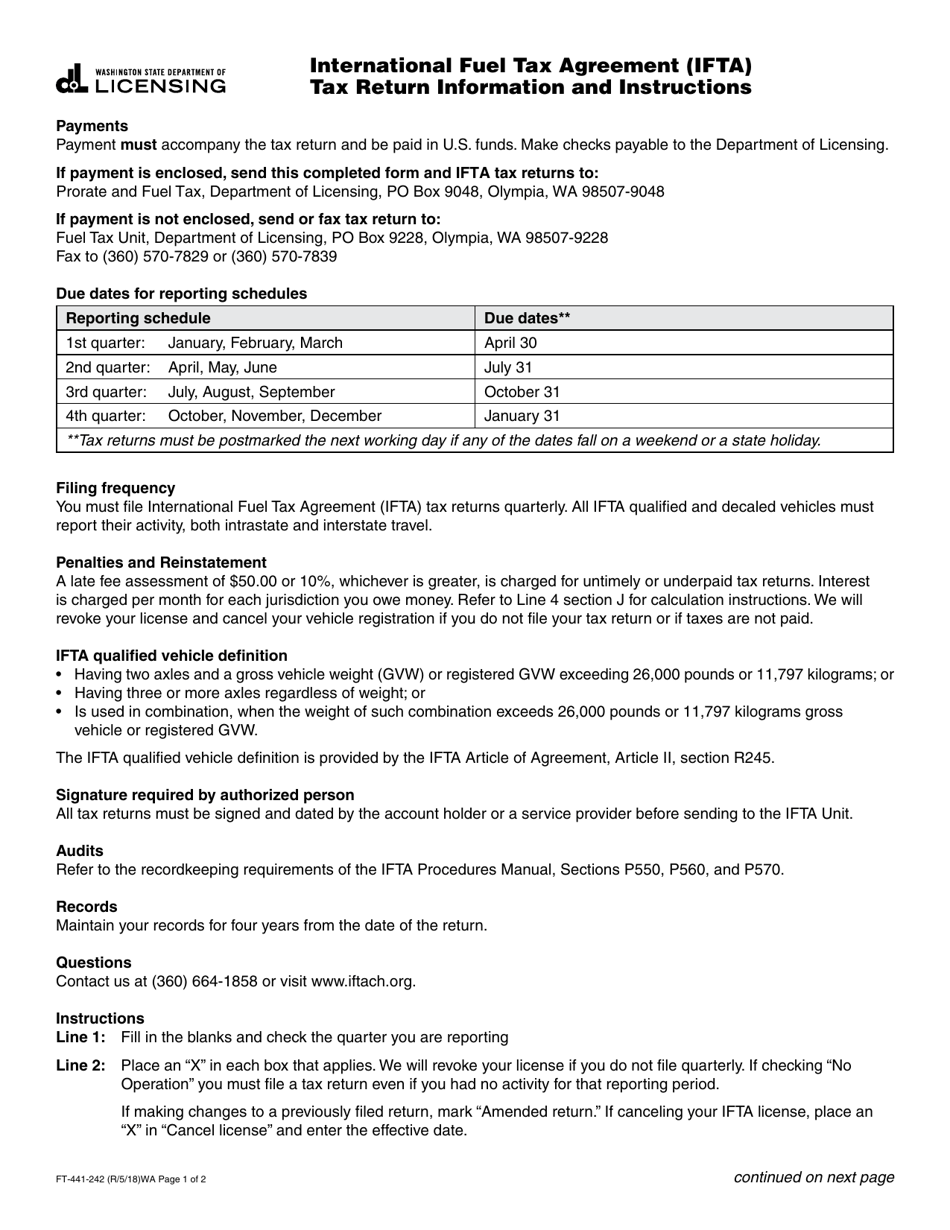

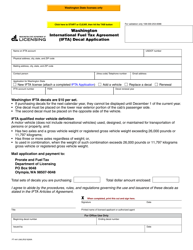

Instructions for Form FT-441-241 International Fuel Tax Agreement Tax Return - Washington

This document contains official instructions for Form FT-441-241 , International Fuel Tax Agreement Tax Return - a form released and collected by the Washington State Department of Licensing.

FAQ

Q: What is Form FT-441-241?

A: Form FT-441-241 is the International Fuel Tax Agreement (IFTA) Tax Return for the state of Washington.

Q: What is the purpose of Form FT-441-241?

A: The purpose of Form FT-441-241 is to report and pay taxes on motor fuel that is used in qualified motor vehicles traveling in multiple jurisdictions.

Q: Who needs to file Form FT-441-241?

A: Motor carriers who operate qualified motor vehicles in Washington and are registered for the International Fuel Tax Agreement (IFTA) need to file Form FT-441-241.

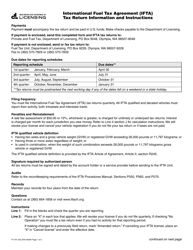

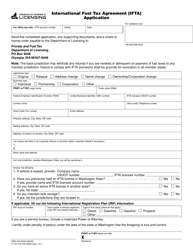

Q: How often do I need to file Form FT-441-241?

A: Form FT-441-241 must be filed quarterly.

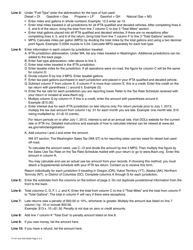

Q: What information do I need to complete Form FT-441-241?

A: To complete Form FT-441-241, you will need vehicle mileage records, total fuel purchases, and total miles traveled in each jurisdiction.

Q: How do I file Form FT-441-241?

A: You can file Form FT-441-241 electronically or by mail. Details on how to file are provided in the instructions on the form.

Q: When is the deadline to file Form FT-441-241?

A: The deadline to file Form FT-441-241 is the last day of the month following the end of the quarter being reported.

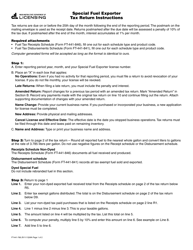

Q: Can I make corrections to Form FT-441-241 after it is filed?

A: Yes, you can make corrections to Form FT-441-241 by filing an amended return.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Washington State Department of Licensing.