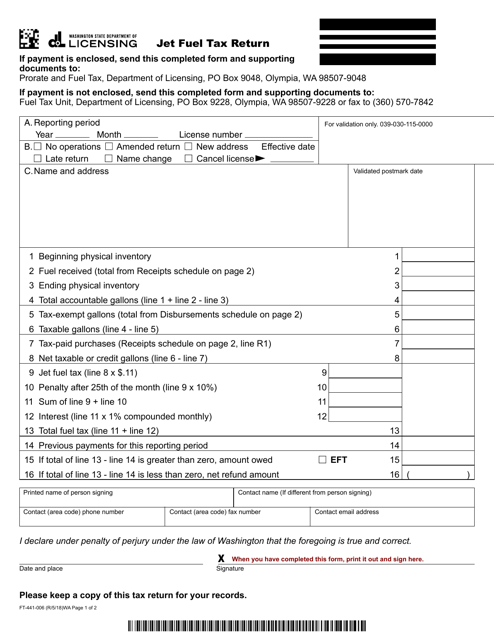

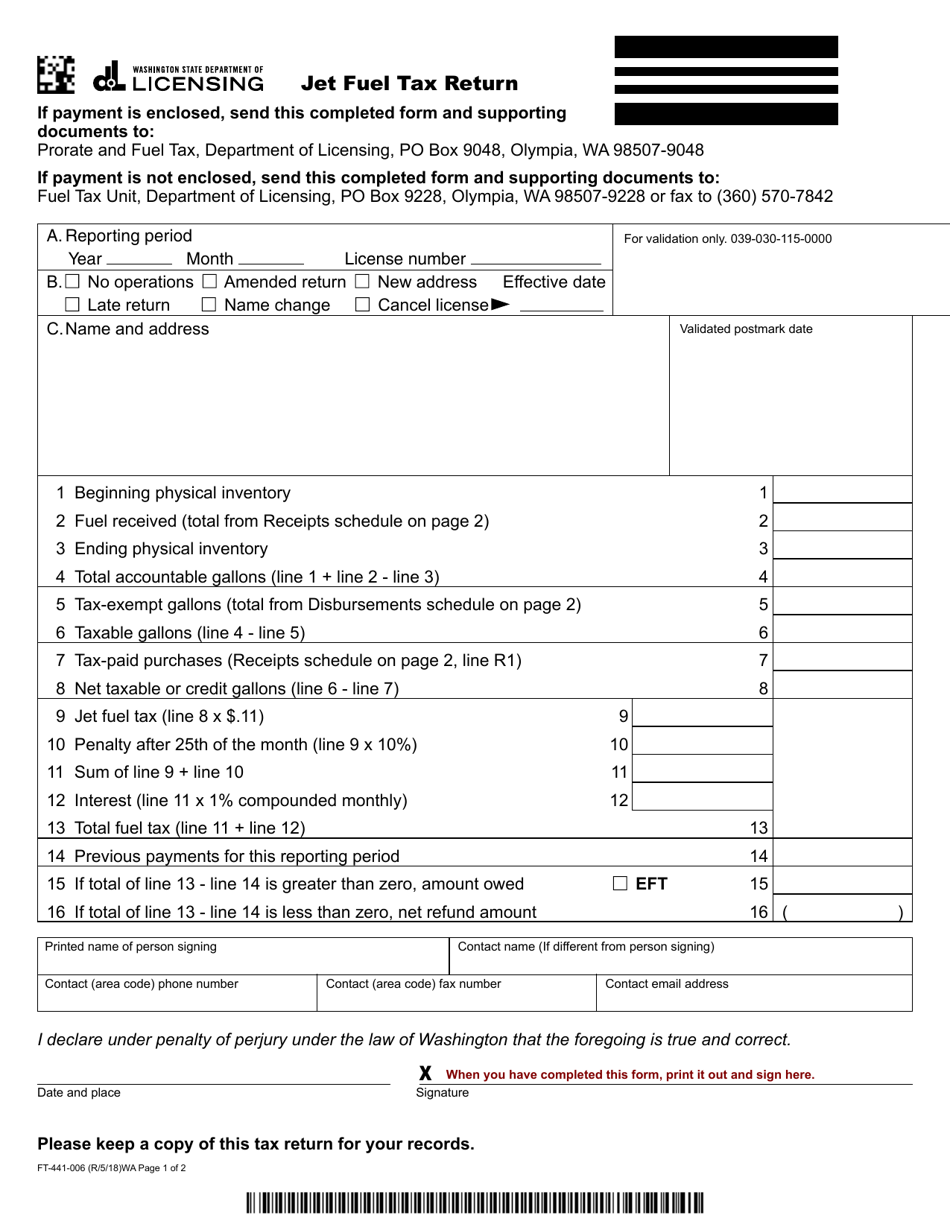

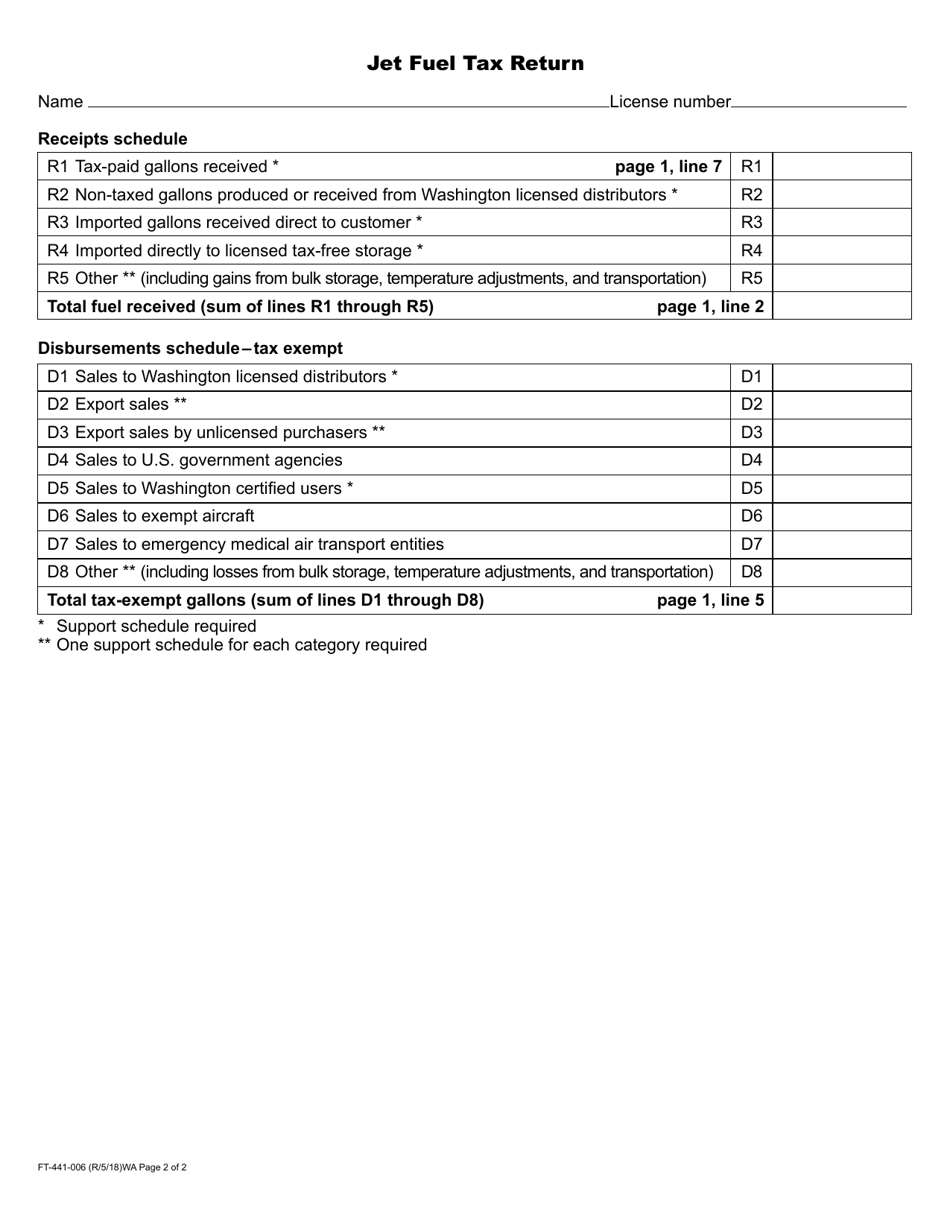

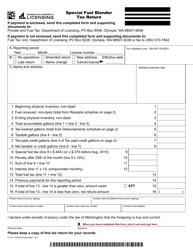

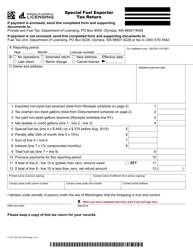

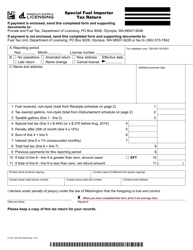

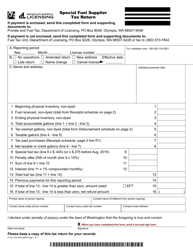

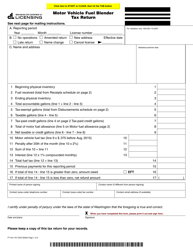

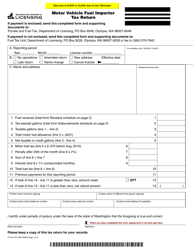

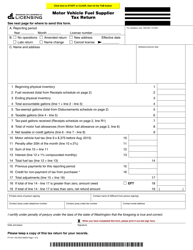

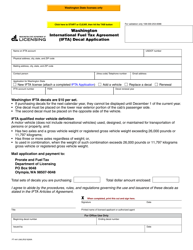

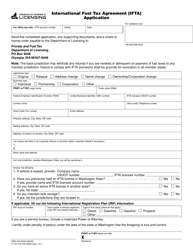

Form FT-441-006 Jet Fuel Tax Return - Washington

What Is Form FT-441-006?

This is a legal form that was released by the Washington State Department of Licensing - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FT-441-006?

A: Form FT-441-006 is a tax return form used to report and pay Jet Fuel Tax in the state of Washington.

Q: Who needs to file Form FT-441-006?

A: Any person or entity that sells or uses jet fuel in Washington is required to file Form FT-441-006.

Q: When is Form FT-441-006 due?

A: Form FT-441-006 is due on the 25th day of the month following the reporting period.

Q: What information do I need to complete Form FT-441-006?

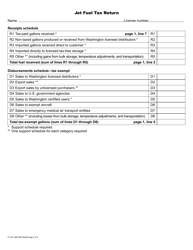

A: You will need to provide details of all jet fuel sales and usage during the reporting period, including gallons sold, gallons used, and any exemptions claimed.

Q: Are there any penalties for late filing or non-compliance?

A: Yes, there are penalties for late filing or non-compliance, including interest charges and additional penalties.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the Washington State Department of Licensing;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FT-441-006 by clicking the link below or browse more documents and templates provided by the Washington State Department of Licensing.