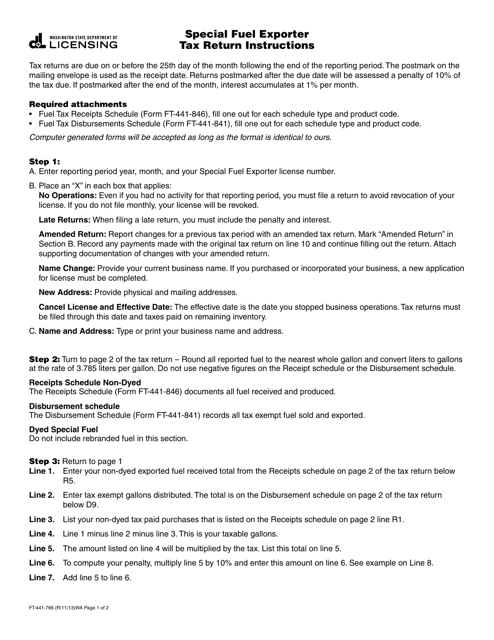

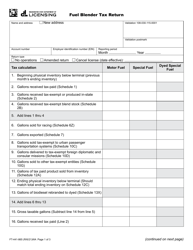

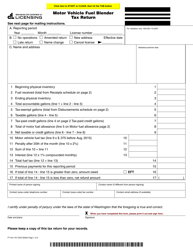

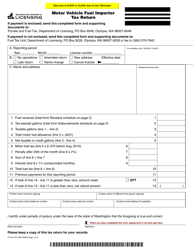

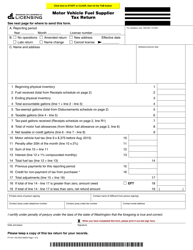

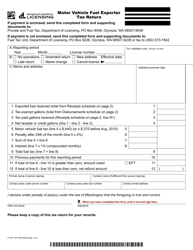

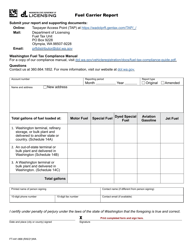

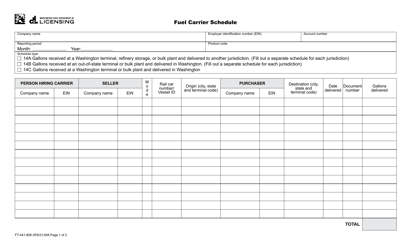

Instructions for Form FT-441-765 Special Fuel Exporter Tax Return - Washington

This document contains official instructions for Form FT-441-765 , Special Fuel Exporter Tax Return - a form released and collected by the Washington State Department of Licensing. An up-to-date fillable Form FT-441-765 is available for download through this link.

FAQ

Q: What is Form FT-441-765?

A: Form FT-441-765 is the Special Fuel Exporter Tax Return for Washington.

Q: Who needs to file Form FT-441-765?

A: Special Fuel Exporters in Washington need to file Form FT-441-765.

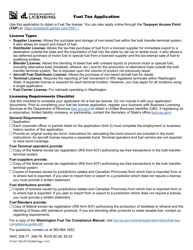

Q: What is special fuel?

A: Special fuel is a type of fuel used in motor vehicles and equipment, such as diesel fuel or gasoline.

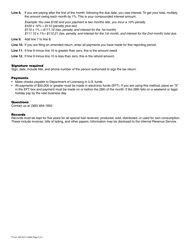

Q: When is Form FT-441-765 due?

A: Form FT-441-765 is due on a quarterly basis. The due dates are April 25, July 25, October 25, and January 25.

Q: Are there any penalties for late filing?

A: Yes, there are penalties for late filing. The penalty is 5% of the tax due for the first month, with an additional 5% for each additional month that the return is late, up to a maximum of 25%.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

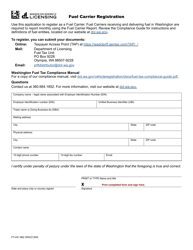

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Washington State Department of Licensing.