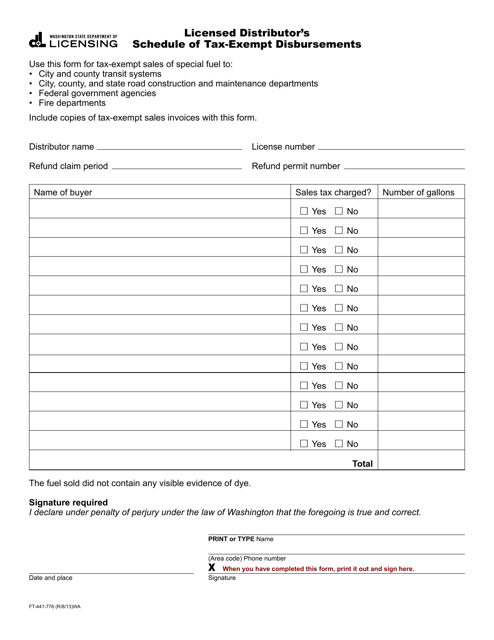

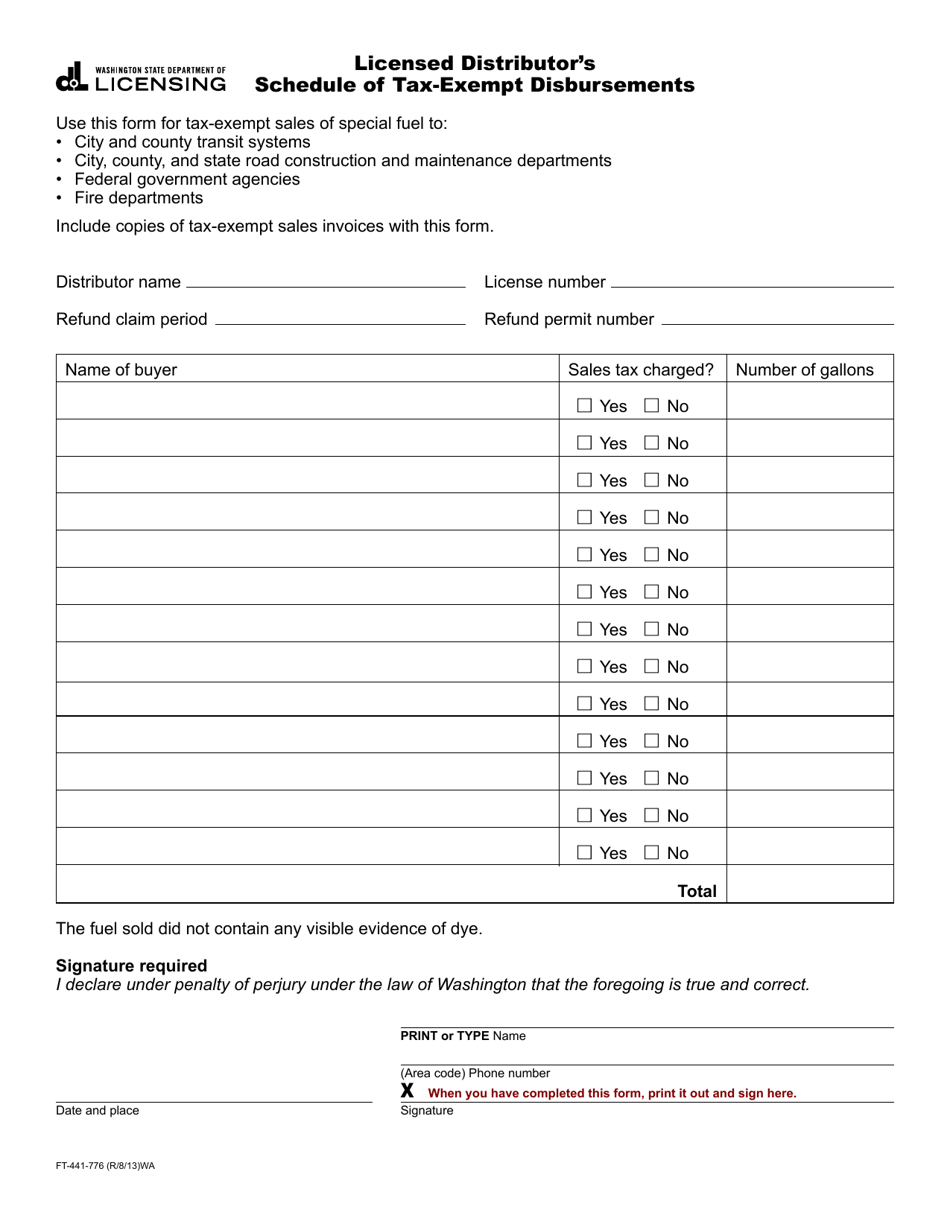

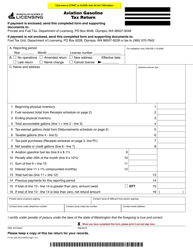

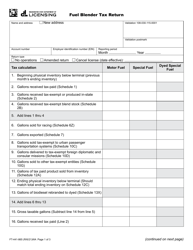

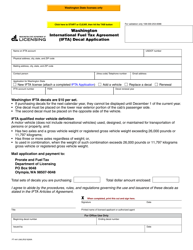

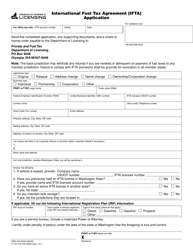

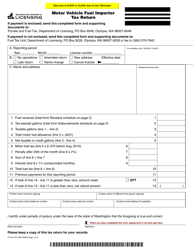

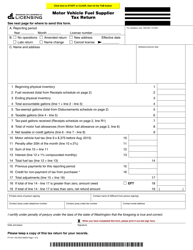

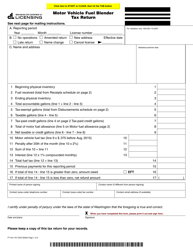

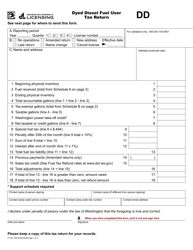

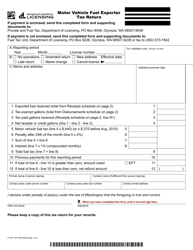

Form FT-441-776 Licensed Distributor's Schedule of Tax-Exempt Disbursements - Washington

What Is Form FT-441-776?

This is a legal form that was released by the Washington State Department of Licensing - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FT-441-776?

A: Form FT-441-776 is the Licensed Distributor's Schedule of Tax-Exempt Disbursements in Washington.

Q: Who needs to fill out this form?

A: Licensed distributors in Washington who make tax-exempt disbursements must fill out this form.

Q: What is a tax-exempt disbursement?

A: A tax-exempt disbursement is a transaction where no sales tax is charged or collected.

Q: Why do I need to report tax-exempt disbursements?

A: Reporting tax-exempt disbursements helps the state track and monitor sales tax exemptions.

Q: Is there a deadline to submit this form?

A: Yes, the deadline to submit Form FT-441-776 is determined by the Washington State Department of Revenue.

Form Details:

- Released on August 1, 2013;

- The latest edition provided by the Washington State Department of Licensing;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FT-441-776 by clicking the link below or browse more documents and templates provided by the Washington State Department of Licensing.