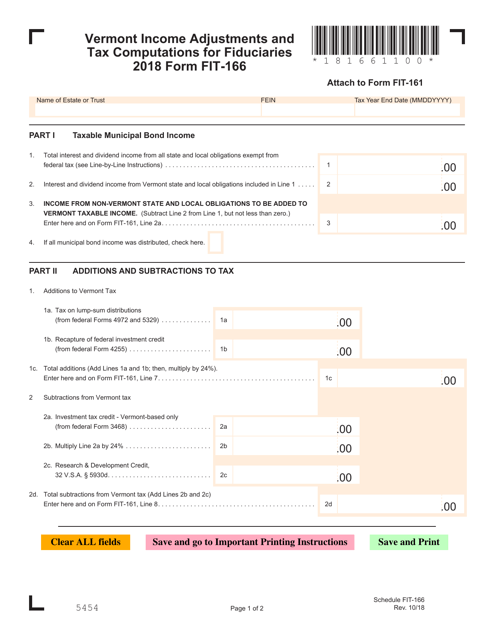

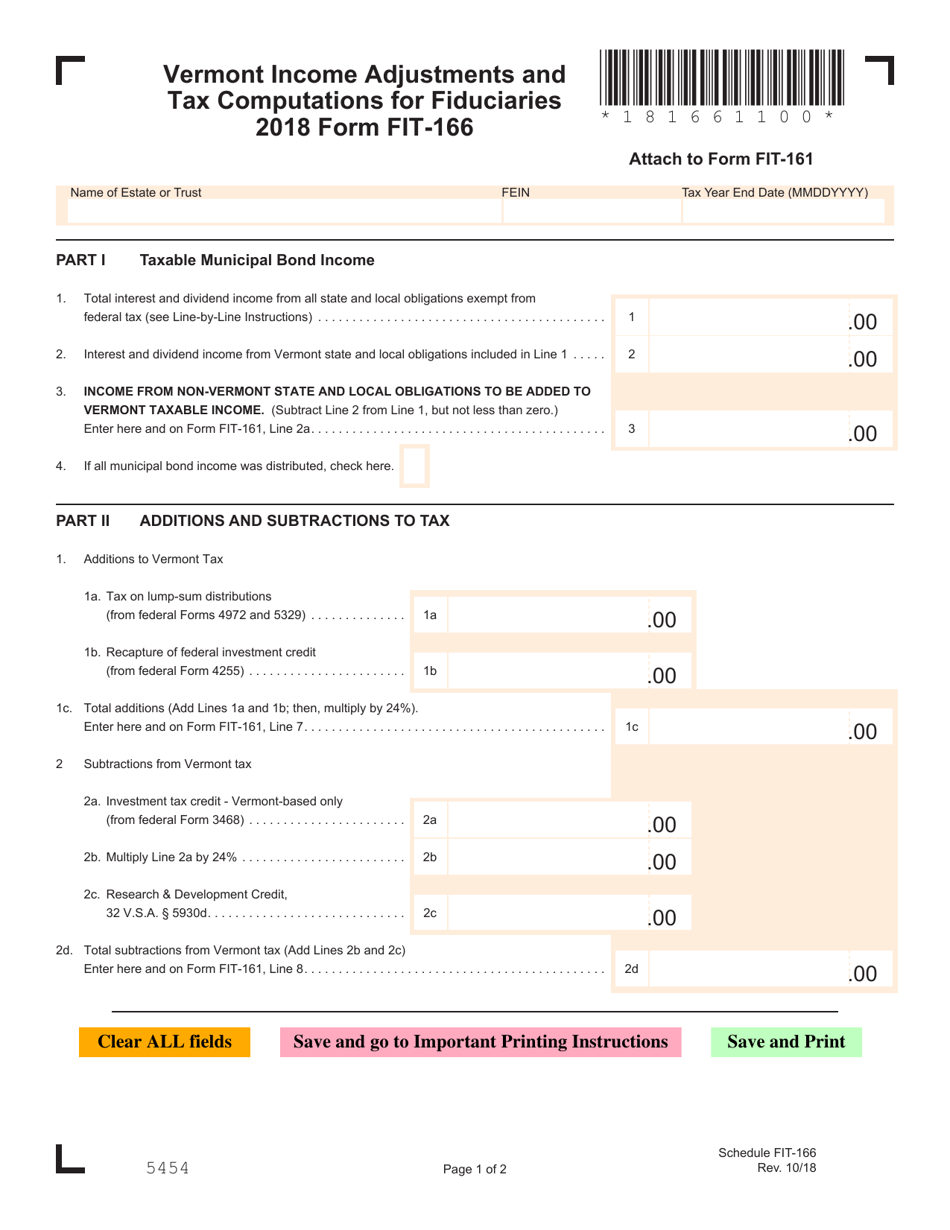

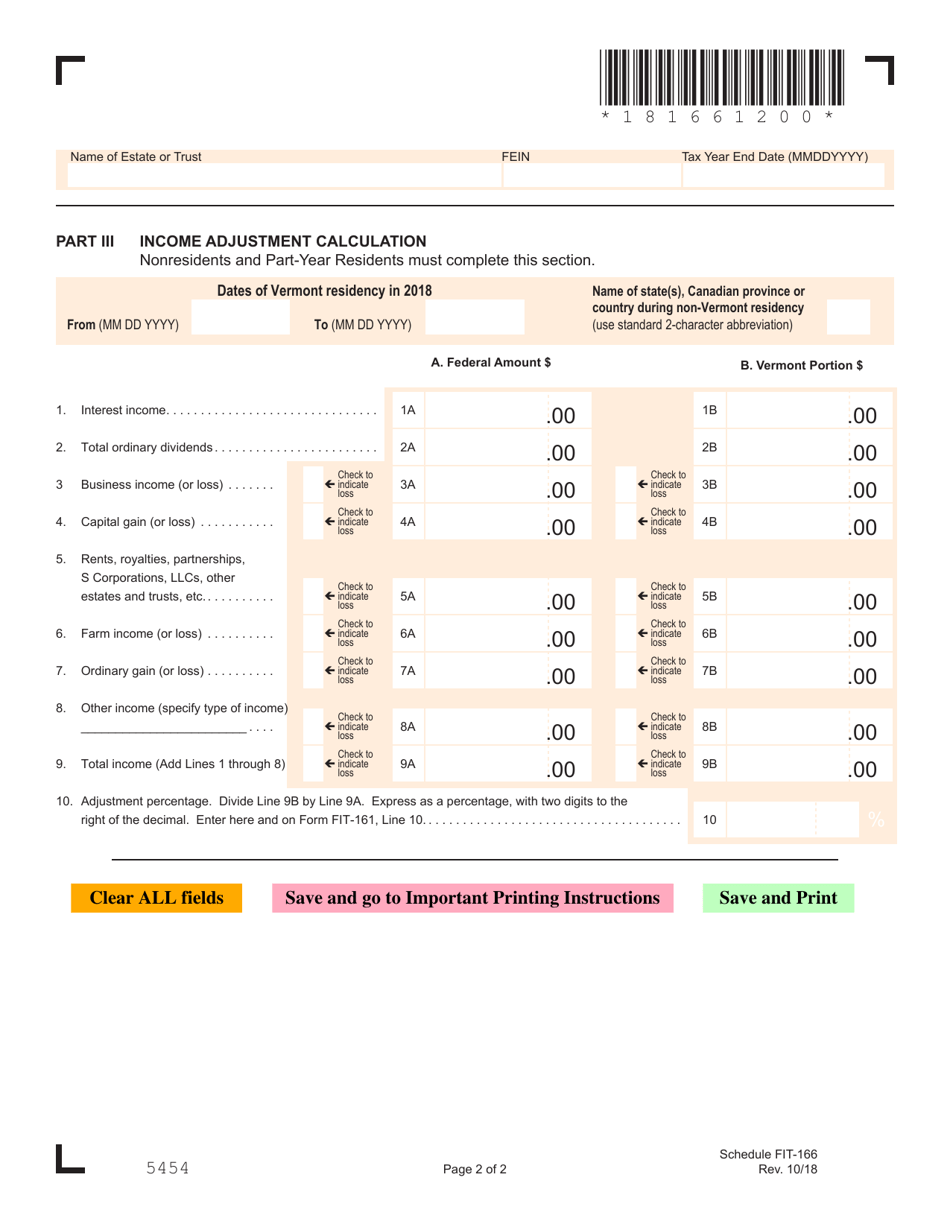

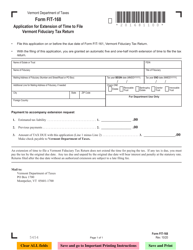

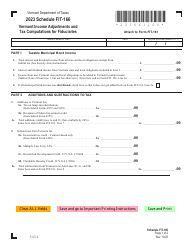

VT Form FIT-166 Income Adjustments and Tax Computations for Fiduciaries - Vermont

What Is VT Form FIT-166?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FIT-166?

A: Form FIT-166 is a tax form for fiduciaries in Vermont.

Q: Who needs to file Form FIT-166?

A: Fiduciaries in Vermont need to file Form FIT-166.

Q: What are income adjustments?

A: Income adjustments are changes made to income before calculating tax liabilities.

Q: What are tax computations for fiduciaries?

A: Tax computations for fiduciaries are calculations of tax liabilities for fiduciary entities.

Q: Is Form FIT-166 for individuals or businesses?

A: Form FIT-166 is for fiduciary entities, not individuals or businesses.

Q: Do I need to include income adjustments on Form FIT-166?

A: Yes, you need to include income adjustments on Form FIT-166 if applicable.

Q: How do I calculate tax liabilities for fiduciaries?

A: Tax liabilities for fiduciaries can be calculated using the information provided on Form FIT-166.

Q: When is the deadline to file Form FIT-166?

A: The deadline to file Form FIT-166 in Vermont is usually April 15th, unless it falls on a weekend or holiday.

Q: Are there any penalties for late filing of Form FIT-166?

A: Yes, there may be penalties for late filing of Form FIT-166. It is important to file on time to avoid penalties.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VT Form FIT-166 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.