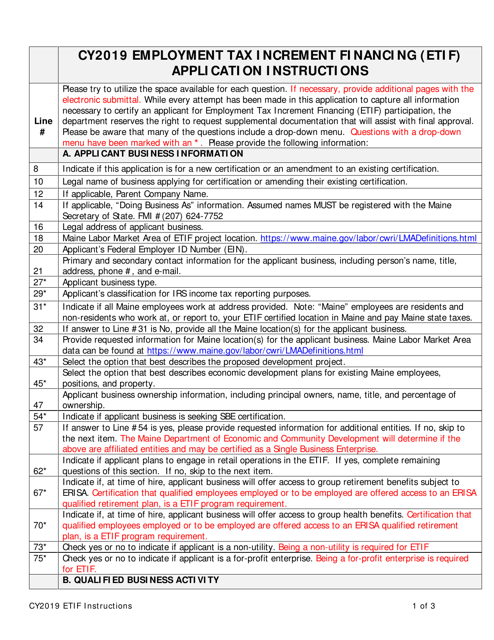

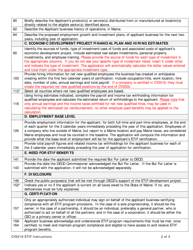

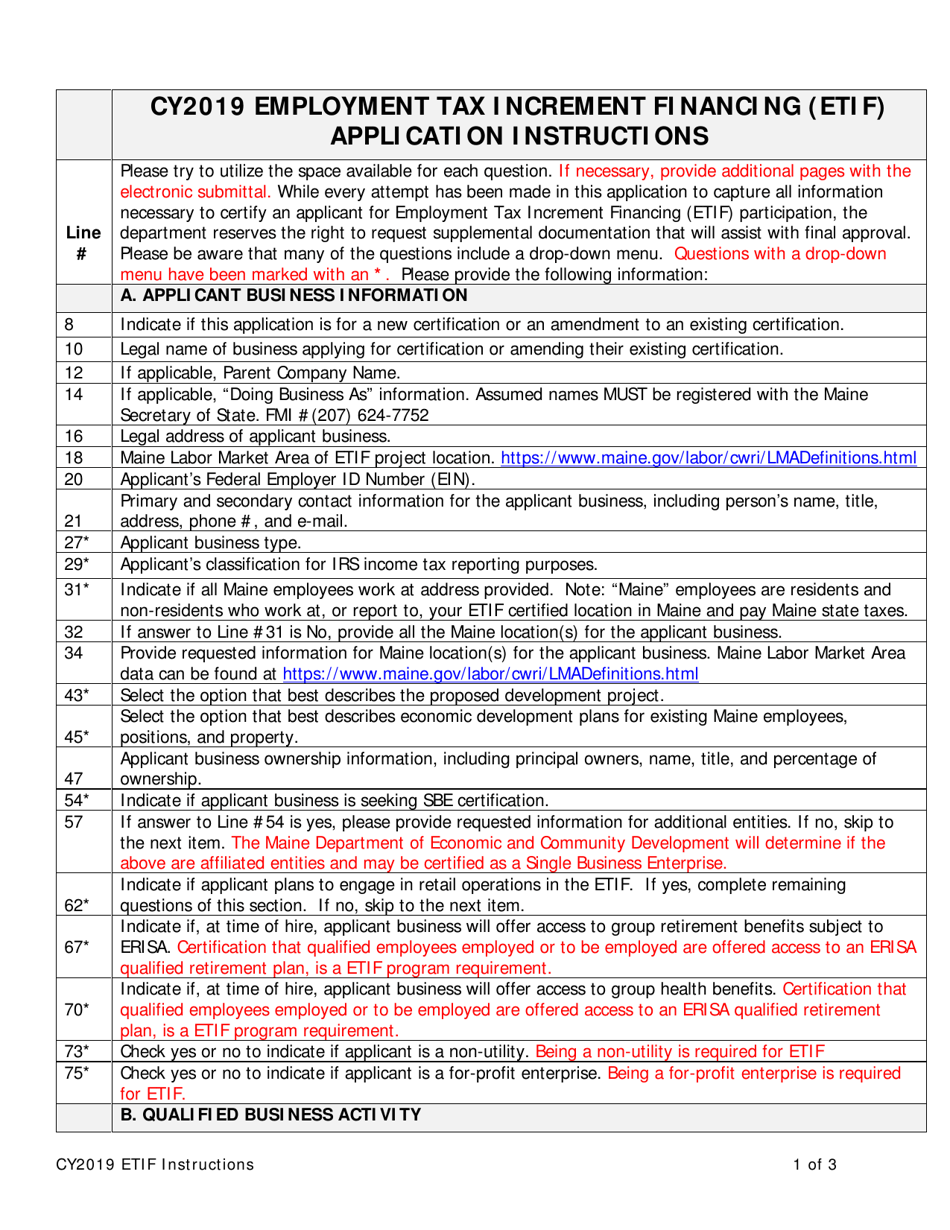

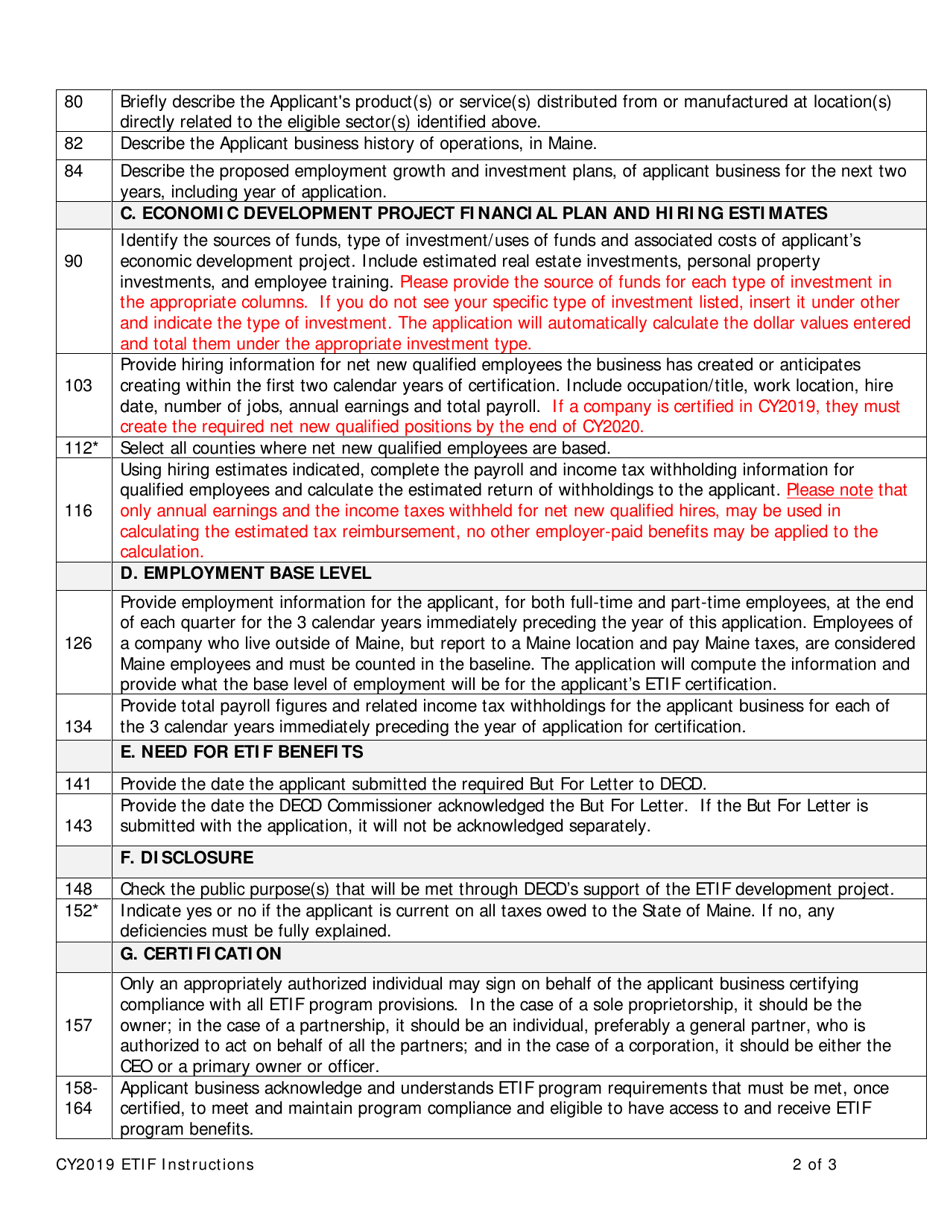

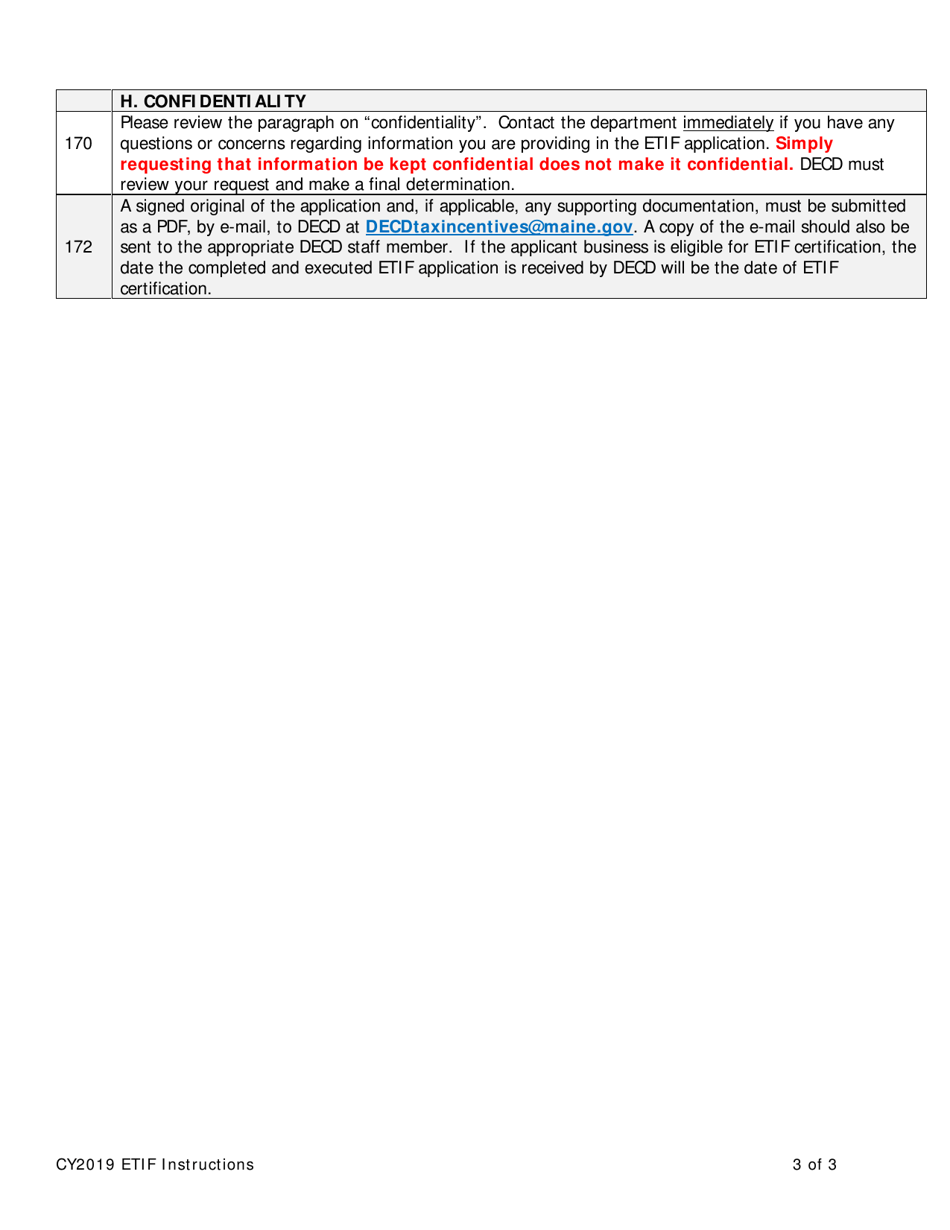

Instructions for Form ETIF Employment Tax Increment Financing Application - Maine

This document contains official instructions for Form ETIF , Employment Tax Increment Financing Application - a form released and collected by the Maine Department of Economic & Community Development.

FAQ

Q: What is the Form ETIF?

A: The Form ETIF is an Employment Tax Increment Financing Application.

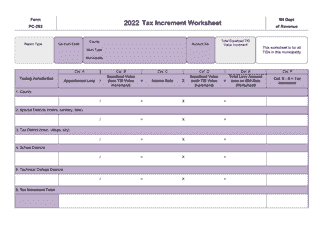

Q: What is Employment Tax Increment Financing (ETIF)?

A: ETIF is a program in Maine that provides tax incentives to businesses that create new jobs.

Q: Who can use Form ETIF?

A: Businesses in Maine that are applying for Employment Tax Increment Financing can use this form.

Q: What is the purpose of Form ETIF?

A: The purpose of Form ETIF is to apply for tax incentives under the Employment Tax Increment Financing program.

Q: Are there any fees associated with filing Form ETIF?

A: No, there are no fees associated with filing Form ETIF.

Q: How do I fill out Form ETIF?

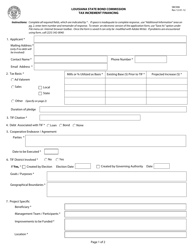

A: The form requires information about the business, the proposed project, and the number of jobs that will be created.

Q: What happens after I submit Form ETIF?

A: After submission, the Maine Revenue Services will review the application and make a decision about whether to approve or deny the tax incentives.

Q: How long does it take to process a Form ETIF application?

A: The processing time for a Form ETIF application varies, but it typically takes several weeks to several months.

Instruction Details:

- This 3-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Maine Department of Economic & Community Development.