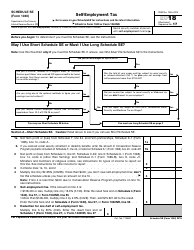

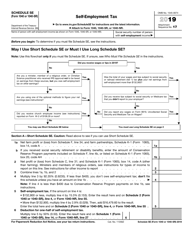

Instructions for Schedule SE Self-employment Tax

This document contains official instructions for Schedule SE , Self-employment Tax - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is Schedule SE?

A: Schedule SE is a tax form used to calculate and report self-employment tax.

Q: Who needs to file Schedule SE?

A: You need to file Schedule SE if you have self-employment income of $400 or more in a year.

Q: What is self-employment tax?

A: Self-employment tax is the equivalent of Social Security and Medicare taxes for self-employed individuals.

Q: How is self-employment tax calculated?

A: Self-employment tax is calculated based on your net earnings from self-employment.

Q: What is the current self-employment tax rate?

A: The self-employment tax rate is 15.3% (12.4% for Social Security and 2.9% for Medicare) as of 2021.

Q: What deductions can be taken on Schedule SE?

A: You can deduct 50% of your self-employment tax as an adjustment to income.

Q: How do I fill out Schedule SE?

A: You will need to report your self-employment income, calculate your self-employment tax, and determine your net earnings from self-employment.

Q: When is Schedule SE due?

A: Schedule SE is typically due on April 15th, along with your federal income tax return.

Q: Can I file Schedule SE electronically?

A: Yes, you can file Schedule SE electronically using tax preparation software or through the IRS's e-file system.

Instruction Details:

- This 6-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.