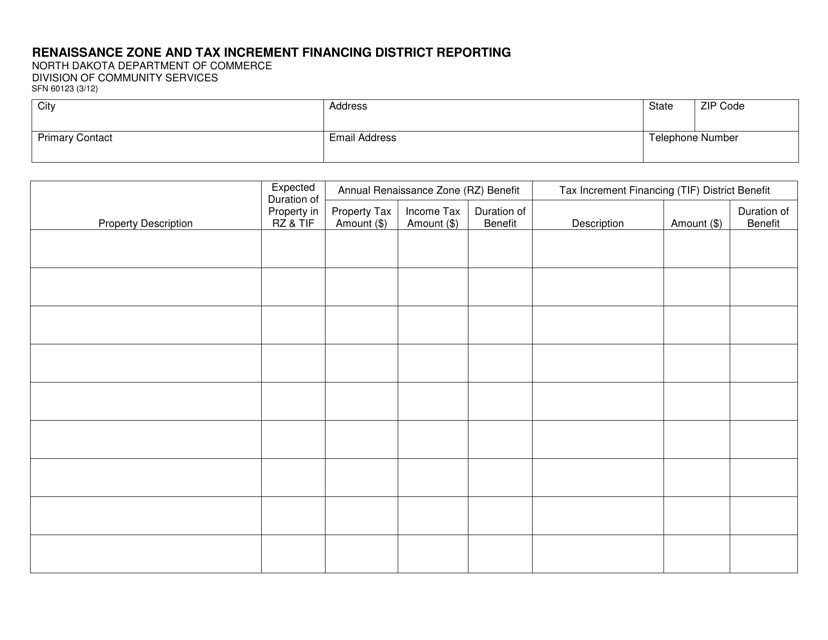

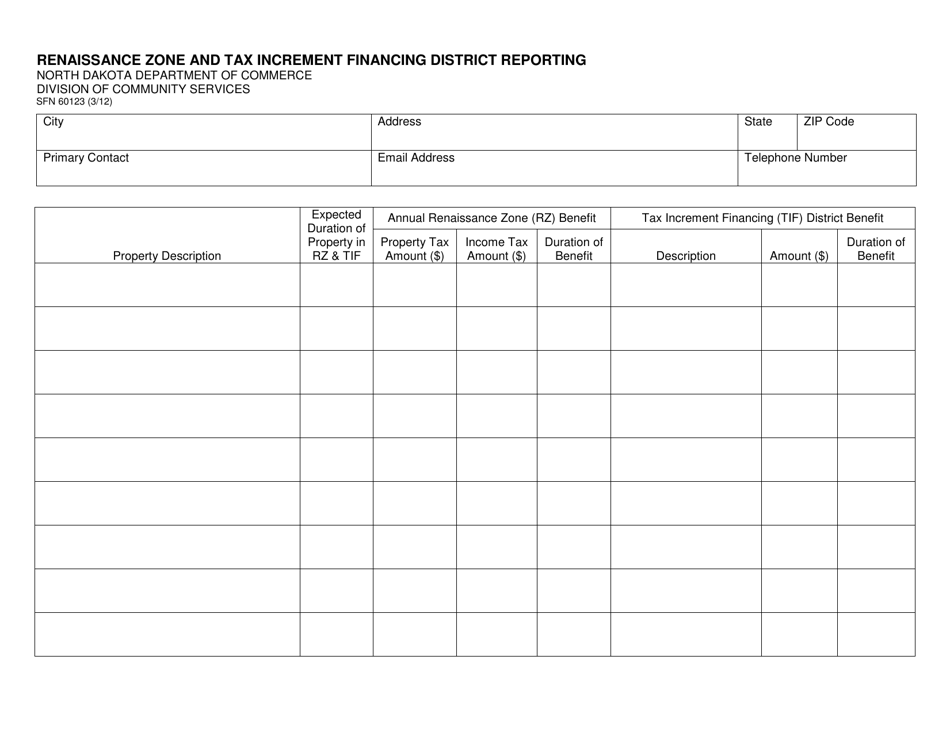

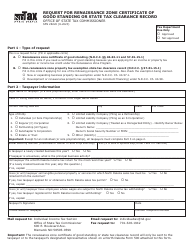

Form SFN60123 Renaissance Zone and Tax Increment Financing District Reporting - North Dakota

What Is Form SFN60123?

This is a legal form that was released by the North Dakota Department of Commerce - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the SFN60123 Renaissance Zone and Tax Increment Financing District Reporting?

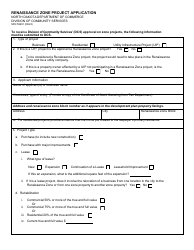

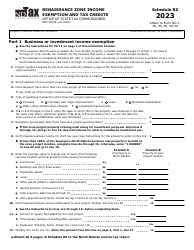

A: The SFN60123 Renaissance Zone and Tax Increment Financing District Reporting is a reporting form in North Dakota for Renaissance Zones and Tax Increment Financing (TIF) Districts.

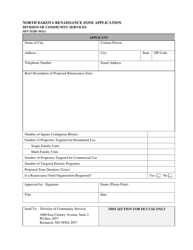

Q: What is a Renaissance Zone?

A: A Renaissance Zone is a designated area in North Dakota where certain tax incentives and exemptions are provided to encourage economic development and revitalization.

Q: What is Tax Increment Financing (TIF) District?

A: A Tax Increment Financing (TIF) District is a designated area where property taxes generated from new development within the district are used to fund public infrastructure improvements.

Q: Who is required to submit the SFN60123 report?

A: Entities that have established Renaissance Zones or Tax Increment Financing Districts in North Dakota are required to submit the SFN60123 report.

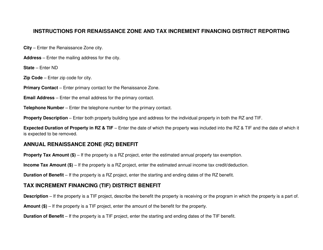

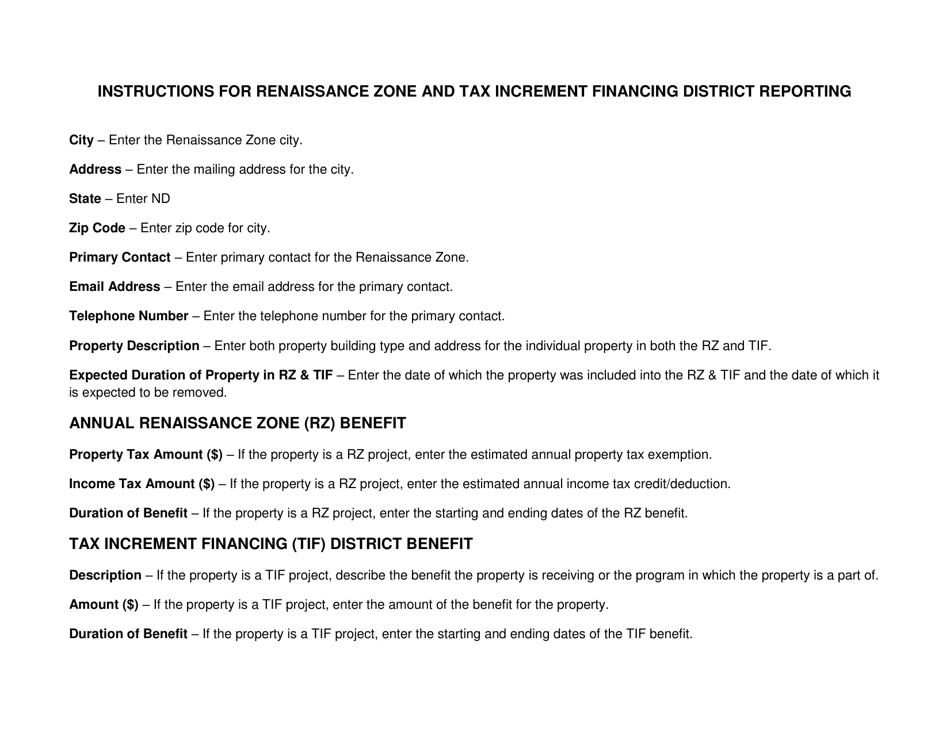

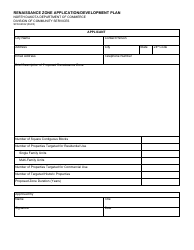

Q: What information is required in the SFN60123 report?

A: The SFN60123 report requires information on the activities and financial status of the Renaissance Zone or Tax Increment Financing District, including details on projects, employment, investment, and revenue.

Q: What is the deadline for submitting the SFN60123 report?

A: The deadline for submitting the SFN60123 report is typically specified by the North Dakota State Government or the relevant government agency. It is important to check the specific deadline for each reporting period.

Q: Are there any penalties for non-compliance with the reporting requirements?

A: Failure to submit the SFN60123 report, or non-compliance with the reporting requirements, may result in penalties or loss of benefits associated with the Renaissance Zone or Tax Increment Financing District.

Q: Who should I contact for more information or assistance with the SFN60123 reporting?

A: For more information or assistance with the SFN60123 reporting, you can contact the North Dakota State Government or the relevant government agency responsible for Renaissance Zones and Tax Increment Financing Districts.

Form Details:

- Released on March 1, 2012;

- The latest edition provided by the North Dakota Department of Commerce;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN60123 by clicking the link below or browse more documents and templates provided by the North Dakota Department of Commerce.