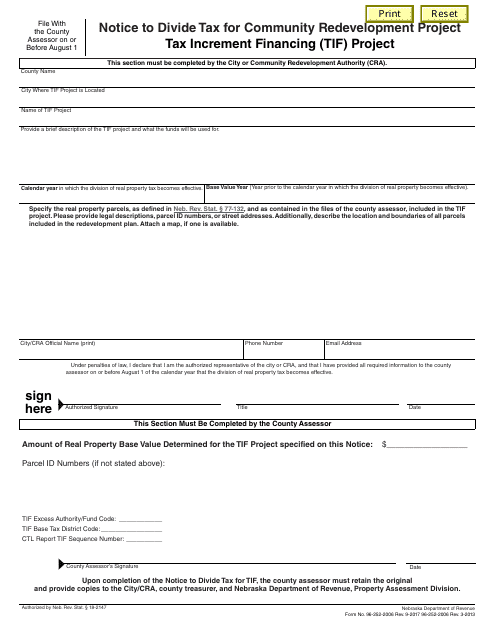

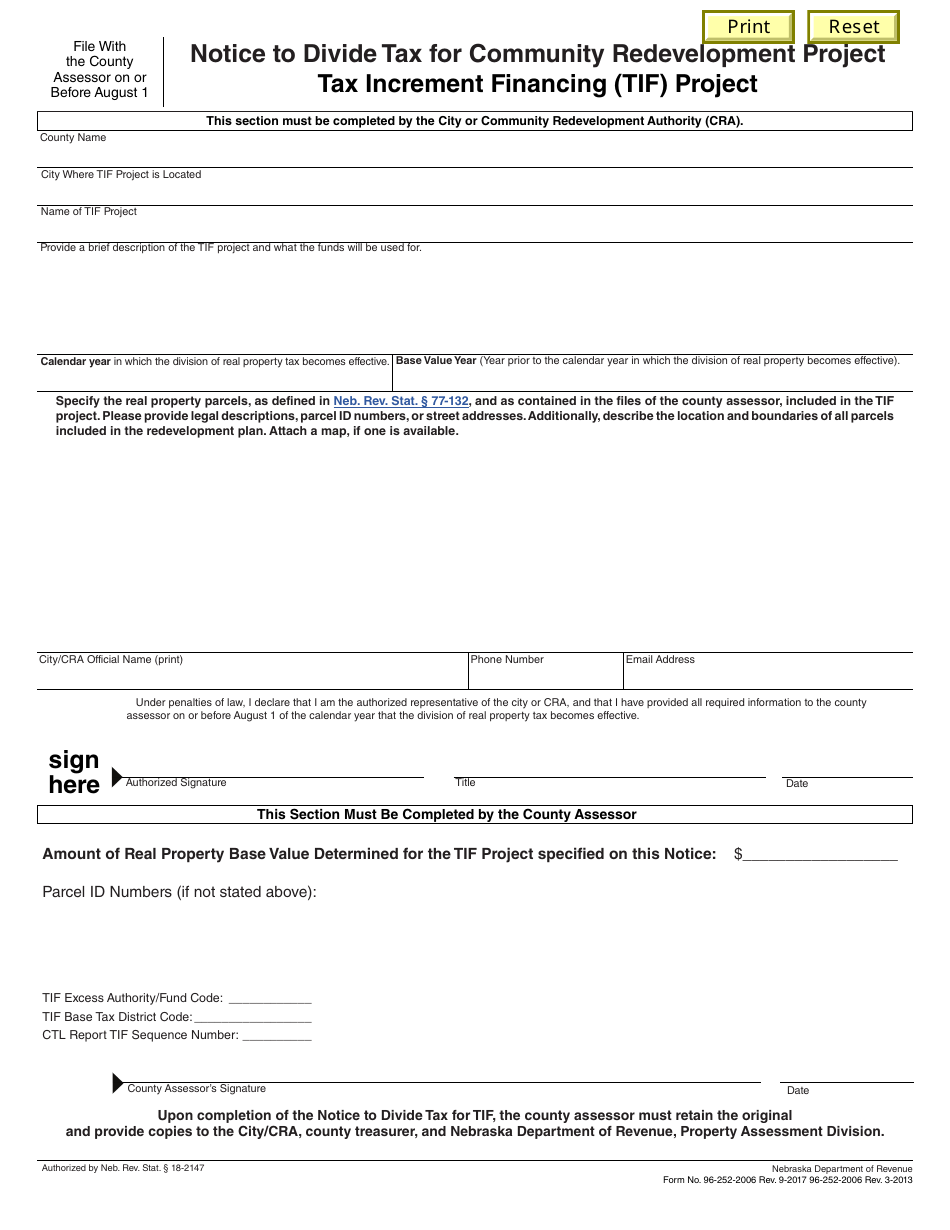

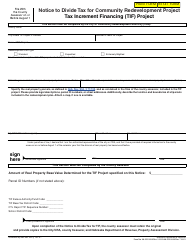

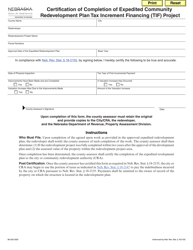

Form 96-252-2006 Notice to Divide Tax for Community Redevelopment Project Tax Increment Financing (Tif) Project - Nebraska

What Is Form 96-252-2006?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 96-252-2006?

A: Form 96-252-2006 is a Notice to Divide Tax for Community Redevelopment Project Tax Increment Financing (TIF) Project in Nebraska.

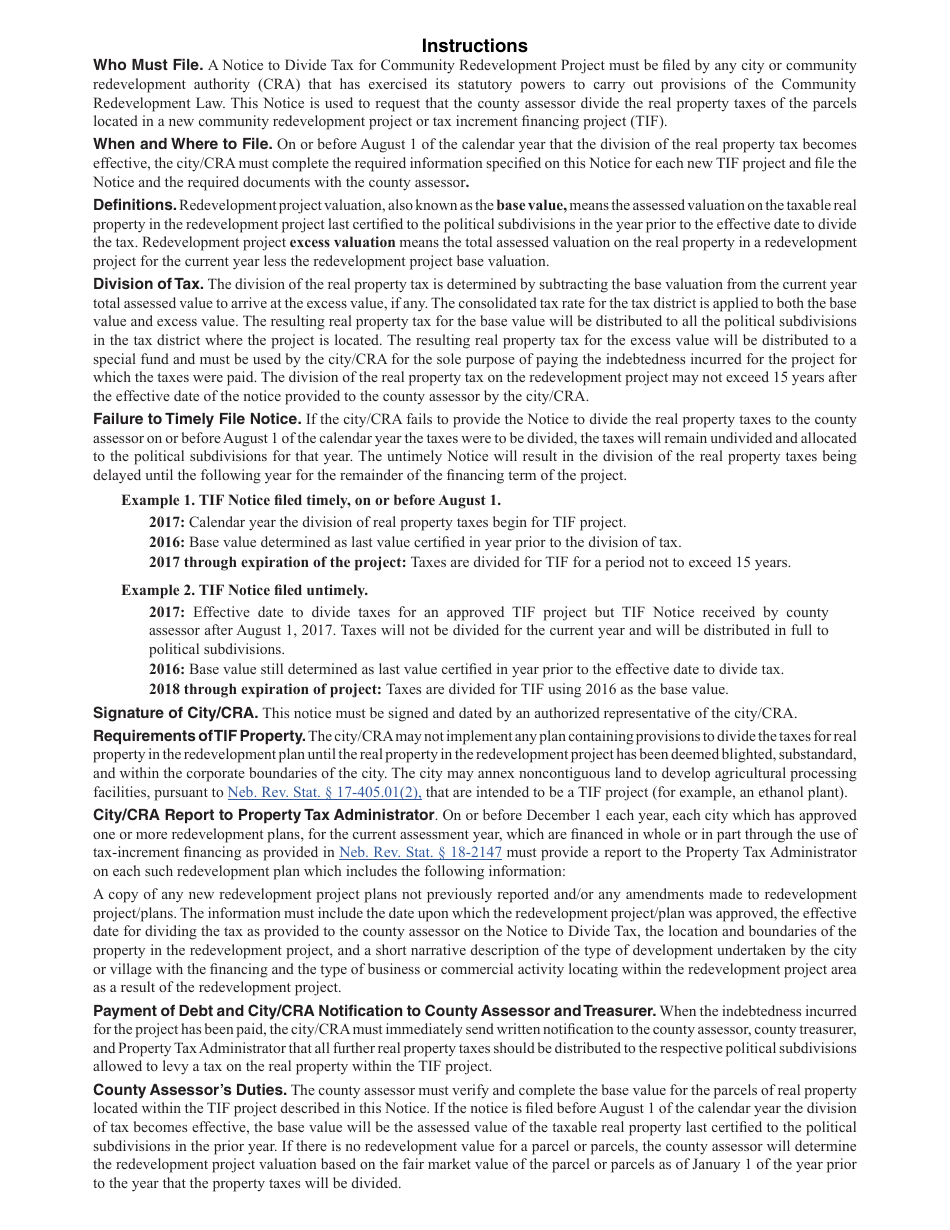

Q: What is a Community Redevelopment Project Tax Increment Financing (TIF) Project?

A: A Community Redevelopment Project Tax Increment Financing (TIF) Project is a project designed to promote economic development and revitalization in a designated area through the use of tax increment financing.

Q: What is tax increment financing?

A: Tax increment financing is a public financing tool used to subsidize redevelopment, infrastructure, and other community-improvement projects. It involves capturing a portion of the incremental increase in property taxes generated by a development project and using those funds to support the project.

Q: Who is required to file Form 96-252-2006?

A: The entities responsible for the Community Redevelopment Project Tax Increment Financing (TIF) Project are required to file Form 96-252-2006.

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 96-252-2006 by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.