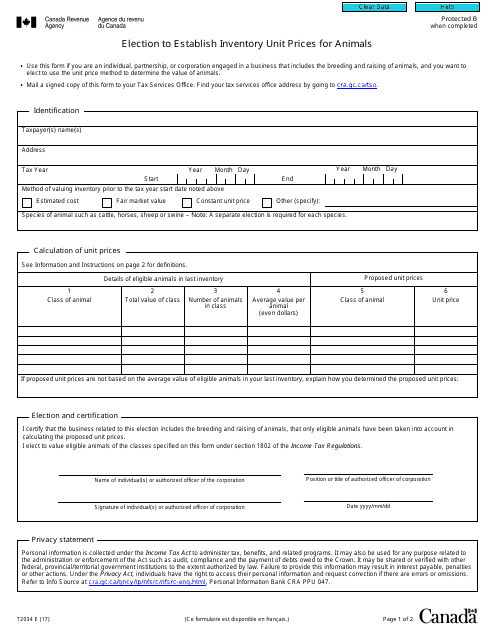

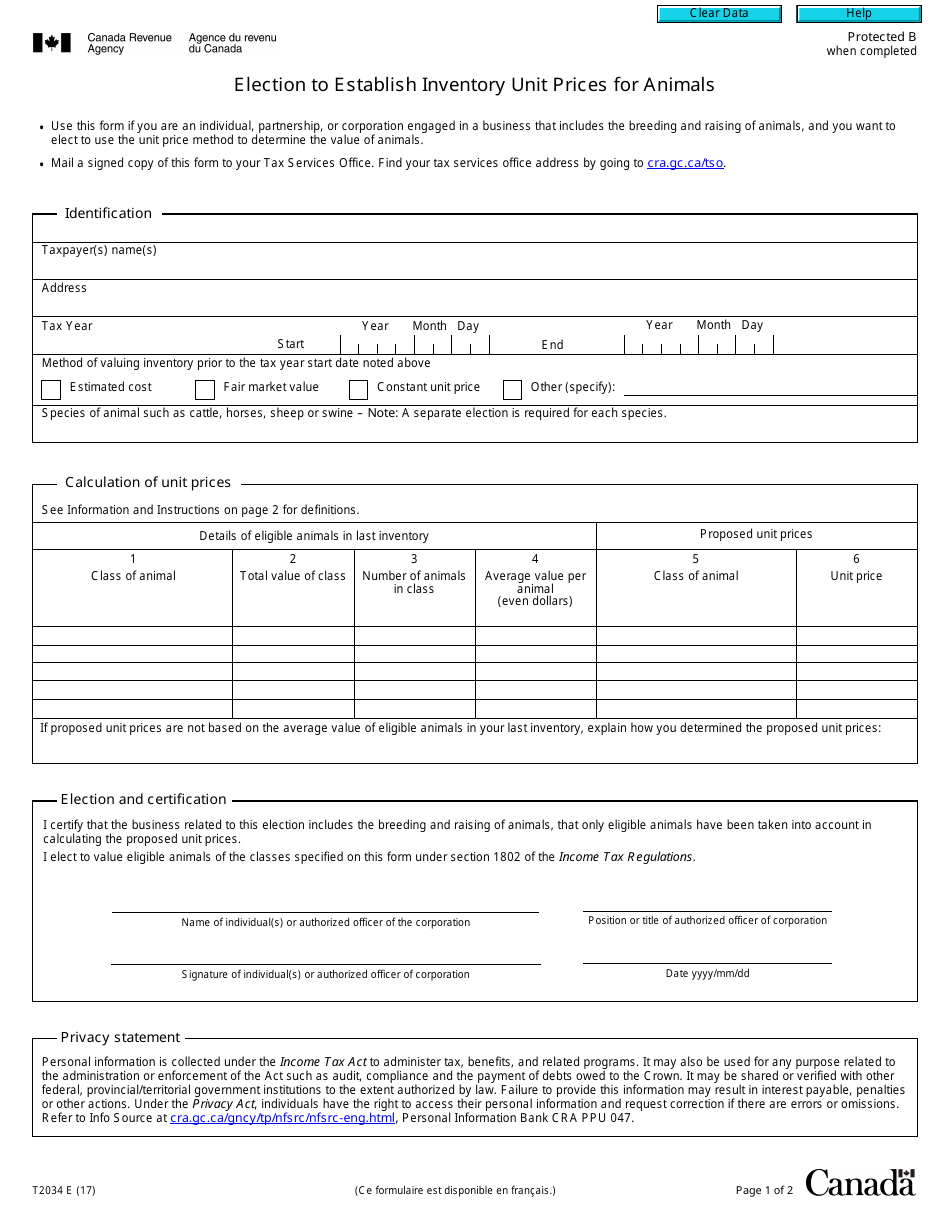

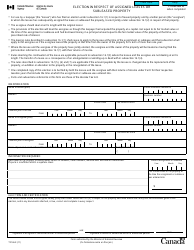

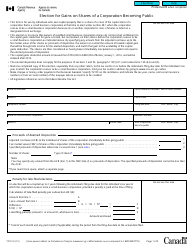

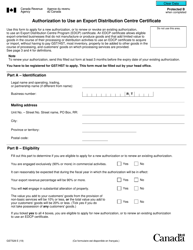

Form T2034 Election to Establish Inventory Unit Prices for Animals - Canada

Form T2034 or the "Form T2034 "election To Establish Inventory Unit Prices For Animals" - Canada" is a form issued by the Canadian Revenue Agency .

The form was last revised in January 1, 2017 and is available for digital filing. Download an up-to-date Form T2034 in PDF-format down below or look it up on the Canadian Revenue Agency Forms website.

FAQ

Q: What is Form T2034?

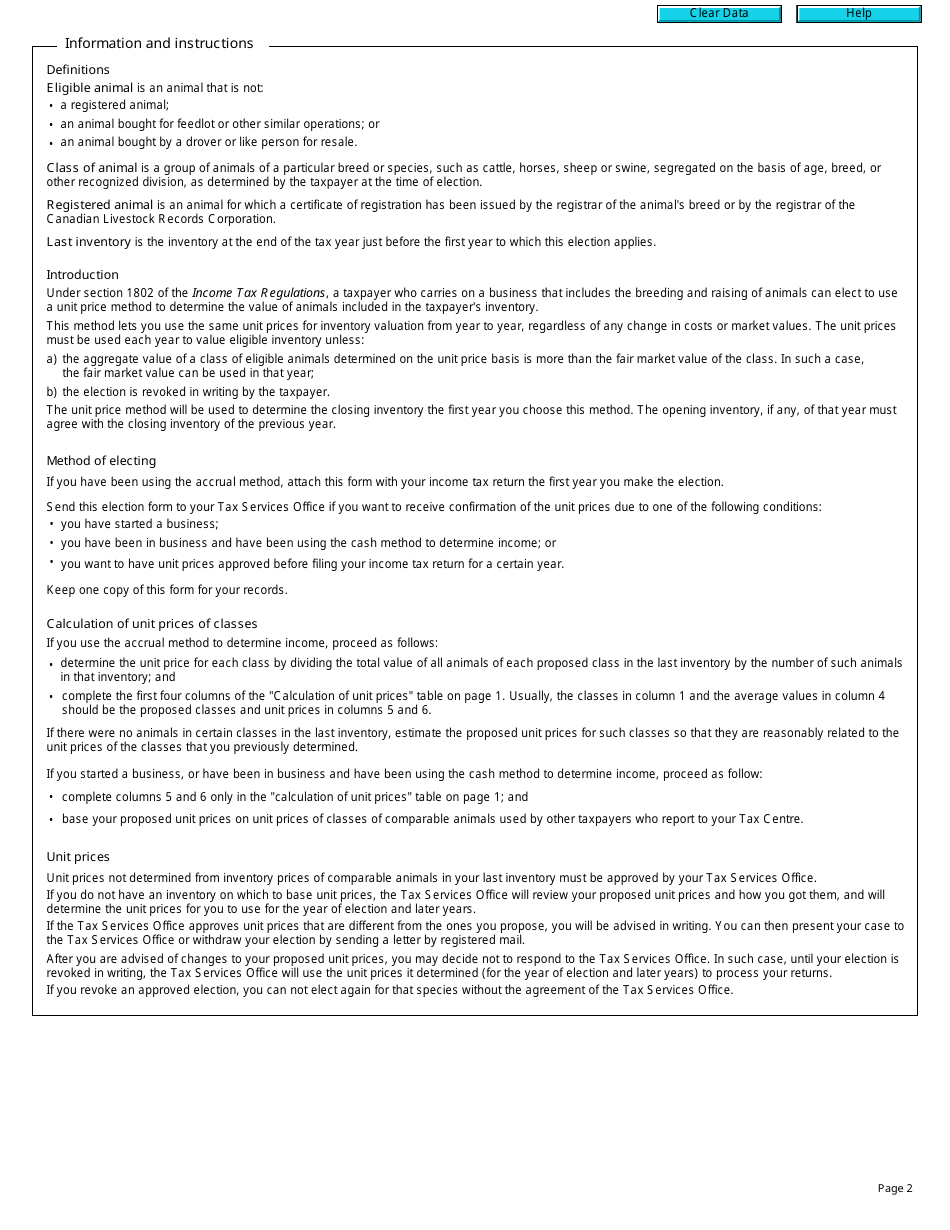

A: Form T2034 is an Election to Establish Inventory Unit Prices for Animals in Canada.

Q: What is the purpose of Form T2034?

A: The purpose of Form T2034 is to allow farmers and breeders to establish unit prices for their animals in order to calculate their inventory value.

Q: Who can use Form T2034?

A: Farmers and breeders in Canada can use Form T2034.

Q: When should Form T2034 be filed?

A: Form T2034 should be filed with the taxpayer's income tax return for the tax year in which the election is made.

Q: Are there any conditions for using Form T2034?

A: Yes, there are certain conditions that must be met in order to use Form T2034, such as being engaged in the business of breeding or raising animals for resale.

Q: Is there a deadline for filing Form T2034?

A: Yes, Form T2034 must be filed by the taxpayer's filing due date, which is usually April 30th of the following year.

Q: What happens if I don't file Form T2034?

A: If you don't file Form T2034, you won't be able to establish unit prices for your animals and your inventory value may be calculated differently.

Q: Can I amend Form T2034?

A: Yes, you can amend Form T2034 within the normal reassessment period, which is usually three years from the date you filed your original tax return.

Q: What supporting documents are required with Form T2034?

A: You may be required to provide supporting documents such as breeding records, purchase and sale documents, and other relevant information.