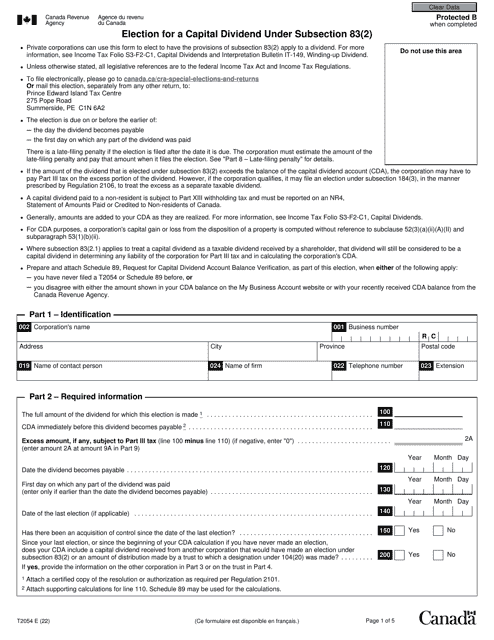

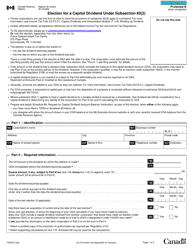

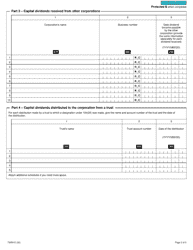

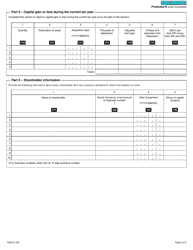

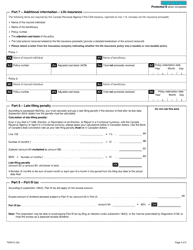

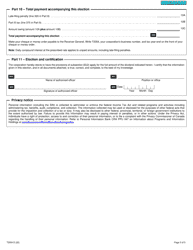

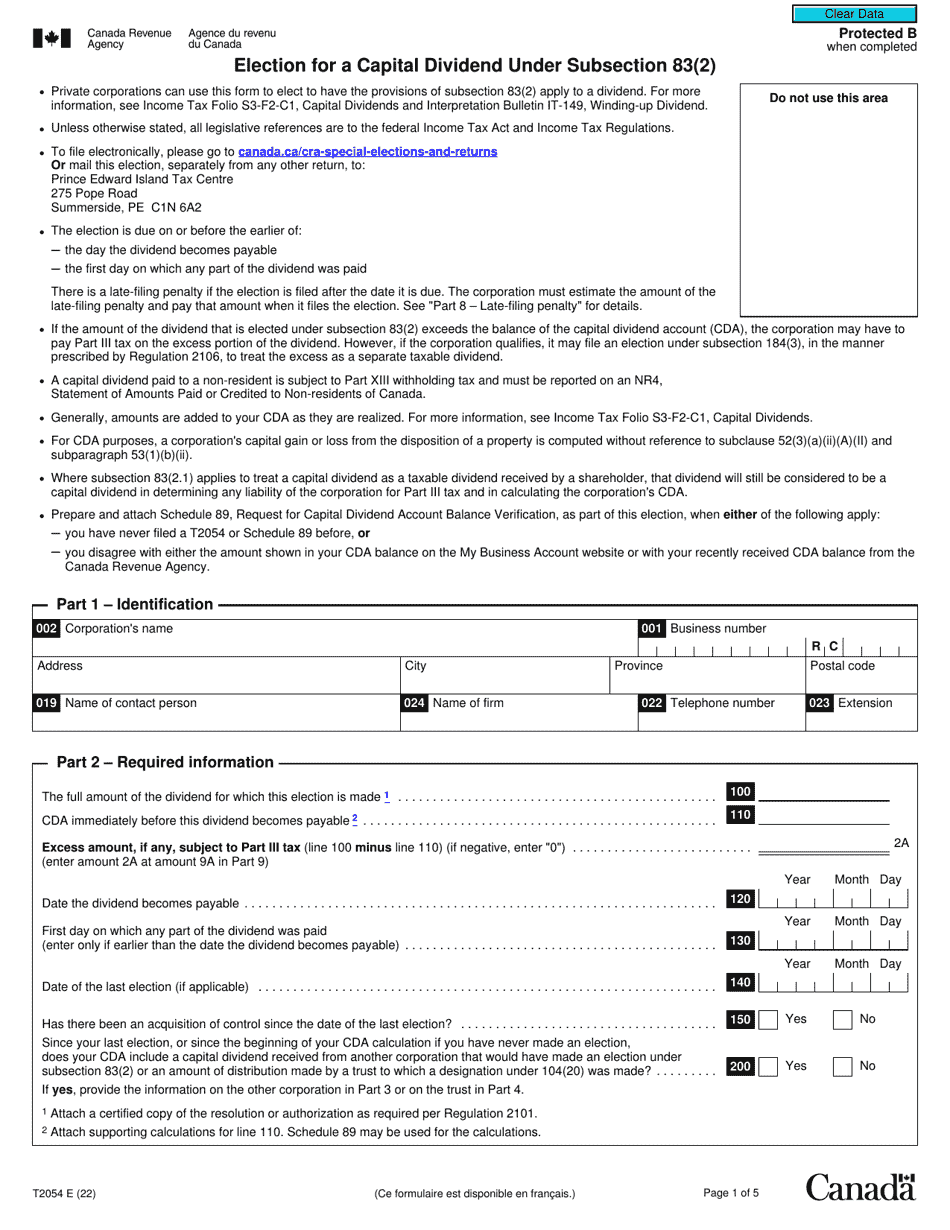

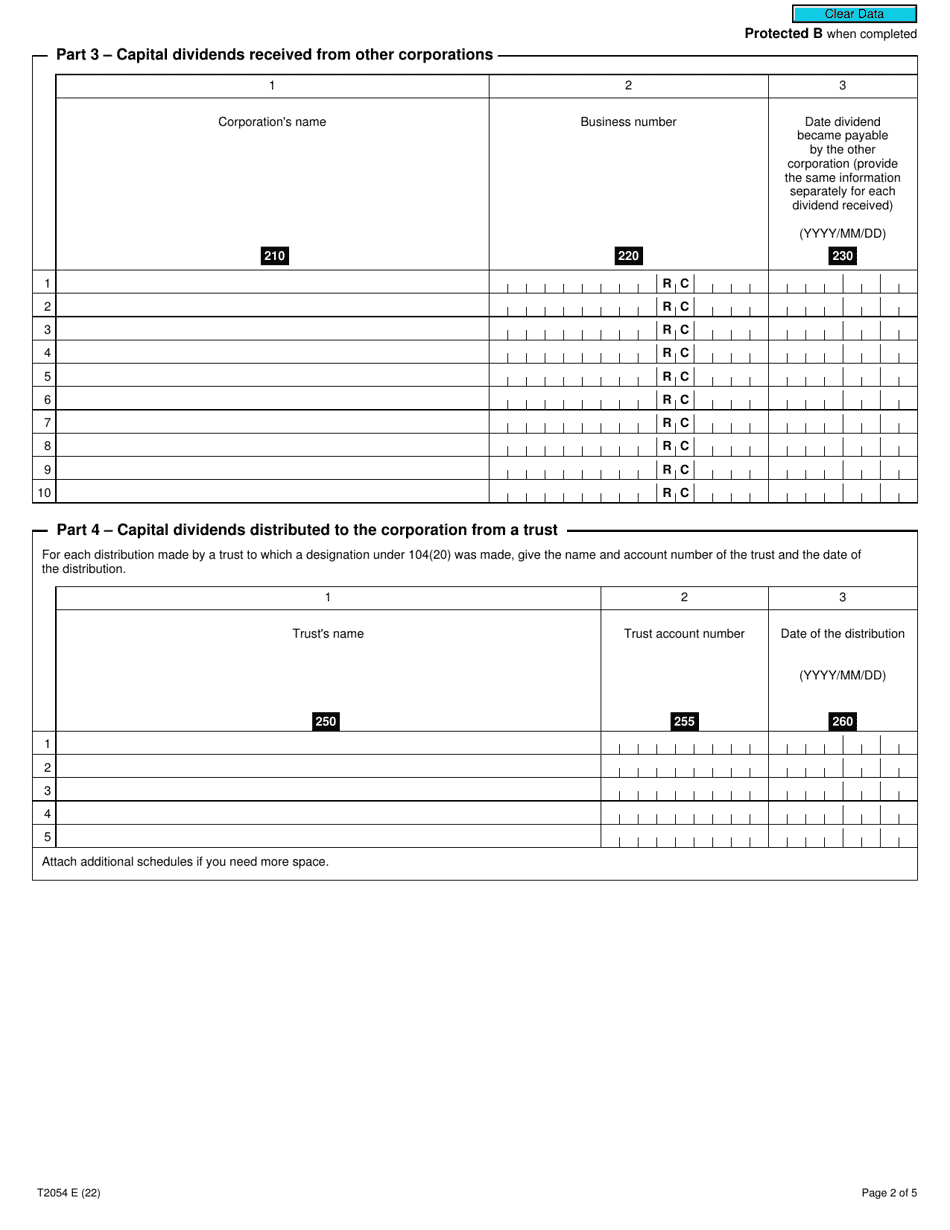

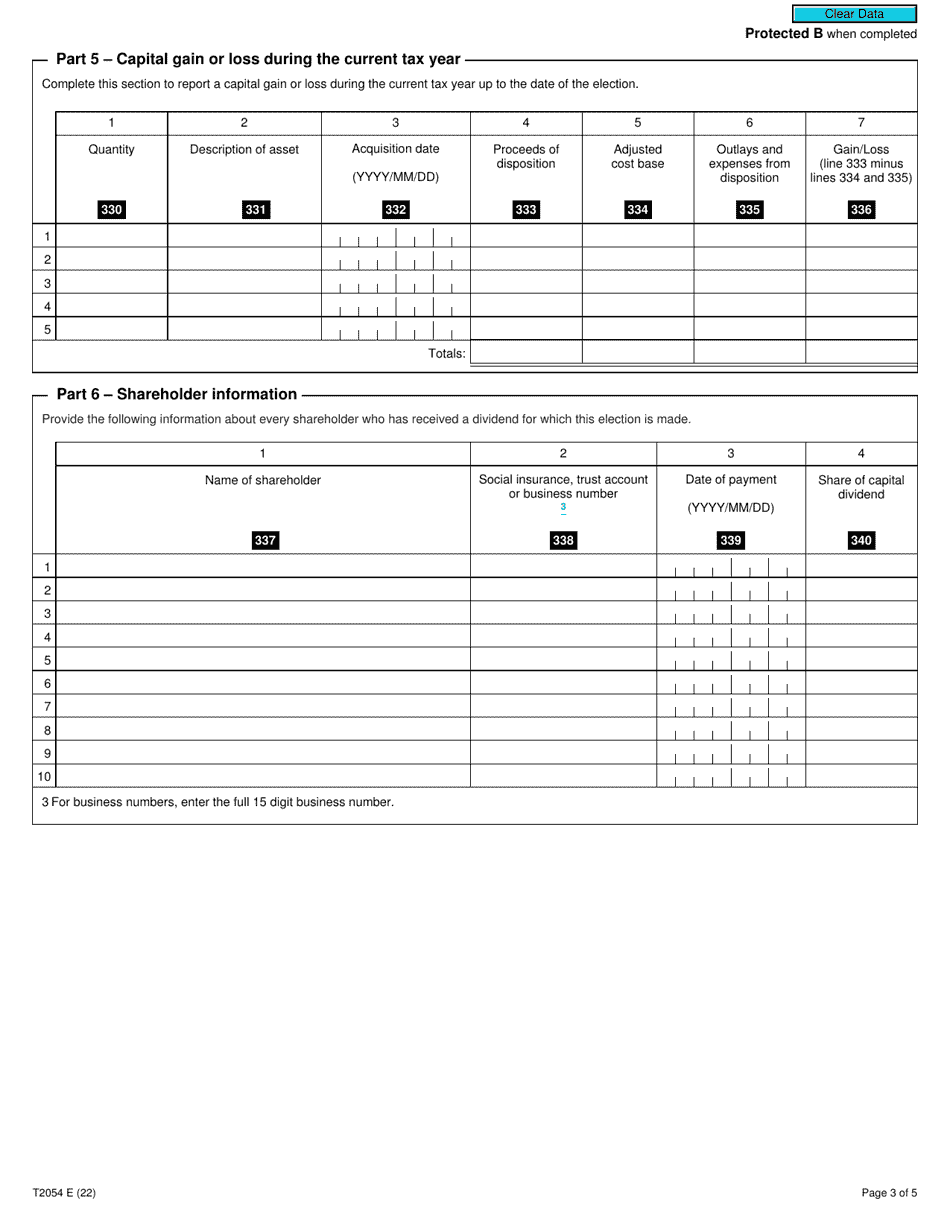

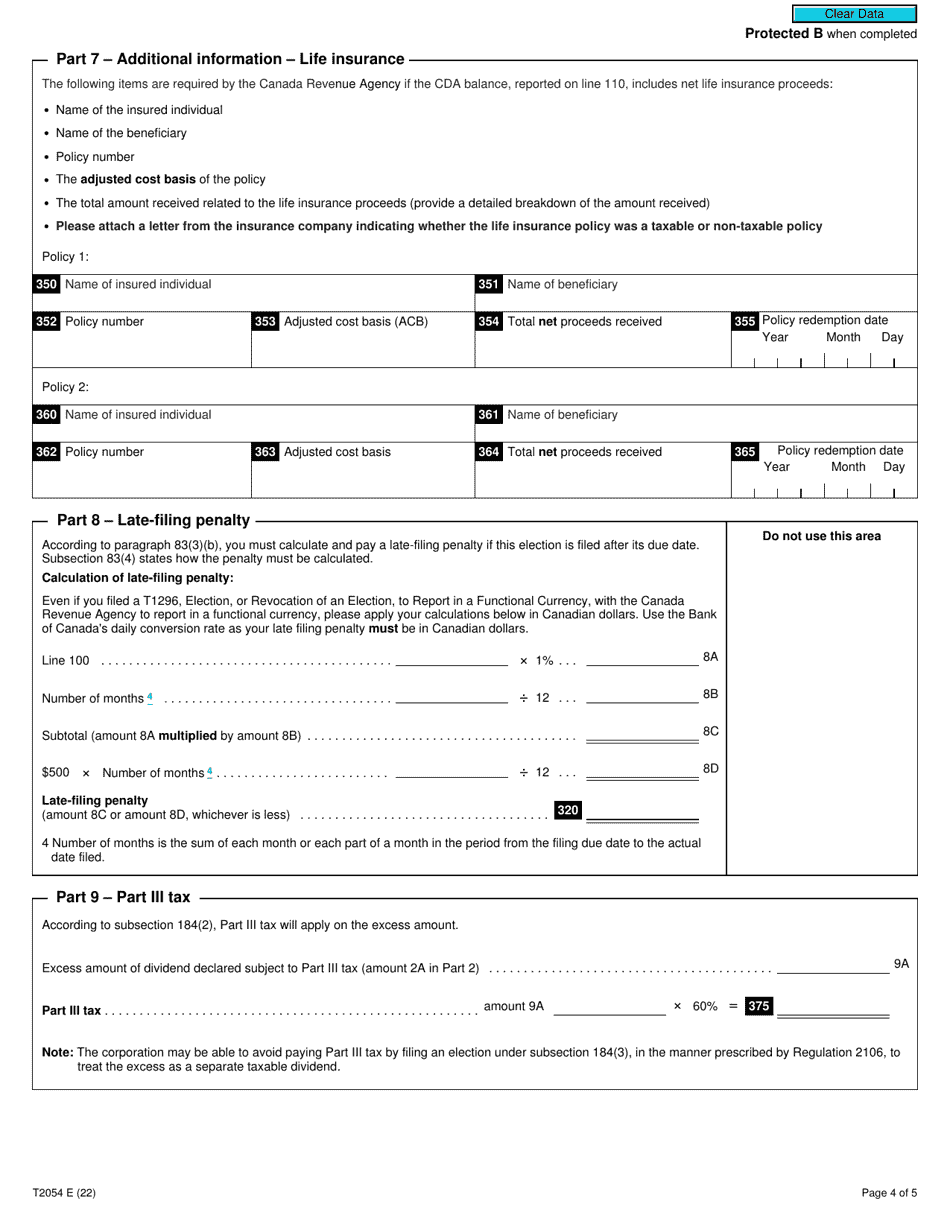

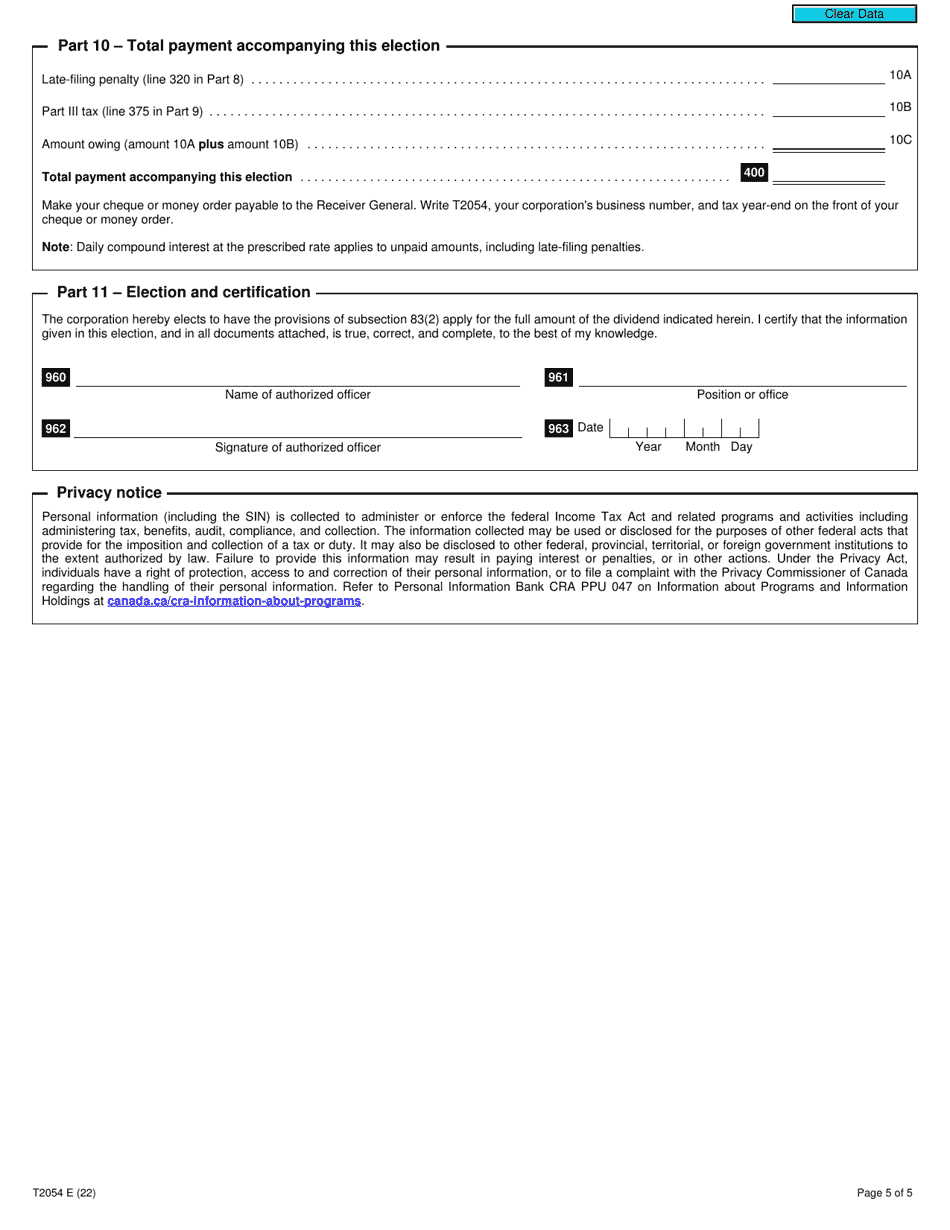

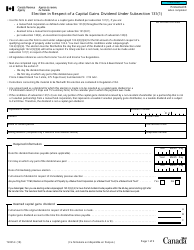

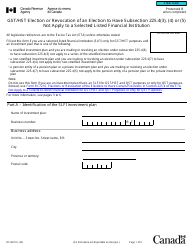

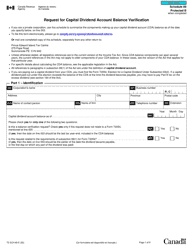

Form T2054 Election for a Capital Dividend Under Subsection 83(2) - Canada

Form T2054 Election for a Capital Dividend Under Subsection 83(2) is used in Canada to elect to receive a capital dividend from a Canadian corporation. This form is filed by shareholders who want to designate a portion or all of the dividend they receive as a capital dividend, which may have certain tax advantages.

The corporation that is declaring the capital dividend would file the Form T2054 Election for a Capital Dividend Under Subsection 83(2) in Canada.

Form T2054 Election for a Capital Dividend Under Subsection 83(2) - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T2054?

A: Form T2054 is a tax form used in Canada for electing a capital dividend under subsection 83(2).

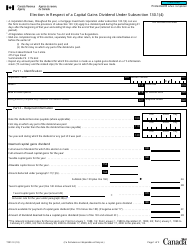

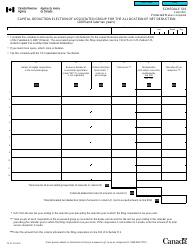

Q: What is a capital dividend?

A: A capital dividend is a type of dividend that can be paid out by a Canadian corporation to its shareholders tax-free.

Q: What is subsection 83(2)?

A: Subsection 83(2) refers to a specific section of the Canadian Income Tax Act that allows corporations to designate a portion of their capital gains as eligible for the capital dividend election.

Q: Why would a corporation elect for a capital dividend?

A: A corporation may elect for a capital dividend to distribute capital gains to its shareholders without incurring tax.

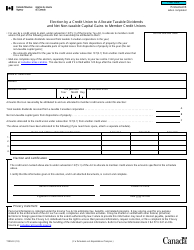

Q: Who can file Form T2054?

A: The corporation that wishes to make the capital dividend election must file Form T2054 with the Canada Revenue Agency (CRA).

Q: Are there any specific requirements for making a capital dividend election?

A: Yes, there are certain conditions that must be met in order to make a valid capital dividend election, including adequate capital gains and compliance with the tax rules.

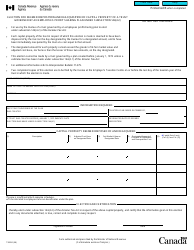

Q: Is a capital dividend taxable for the shareholders?

A: No, a capital dividend is generally tax-free for the shareholders.

Q: Can a capital dividend be paid in cash?

A: Yes, a capital dividend can be paid in cash or through the transfer of assets.

Q: What is the deadline for filing Form T2054?

A: The deadline for filing Form T2054 is generally the same as the corporation's tax return filing deadline.