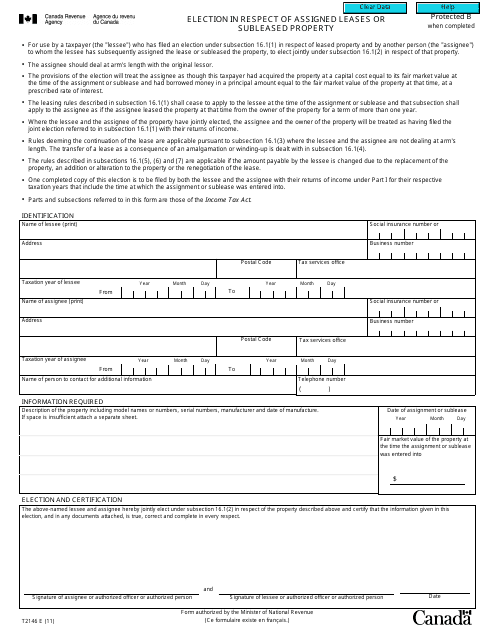

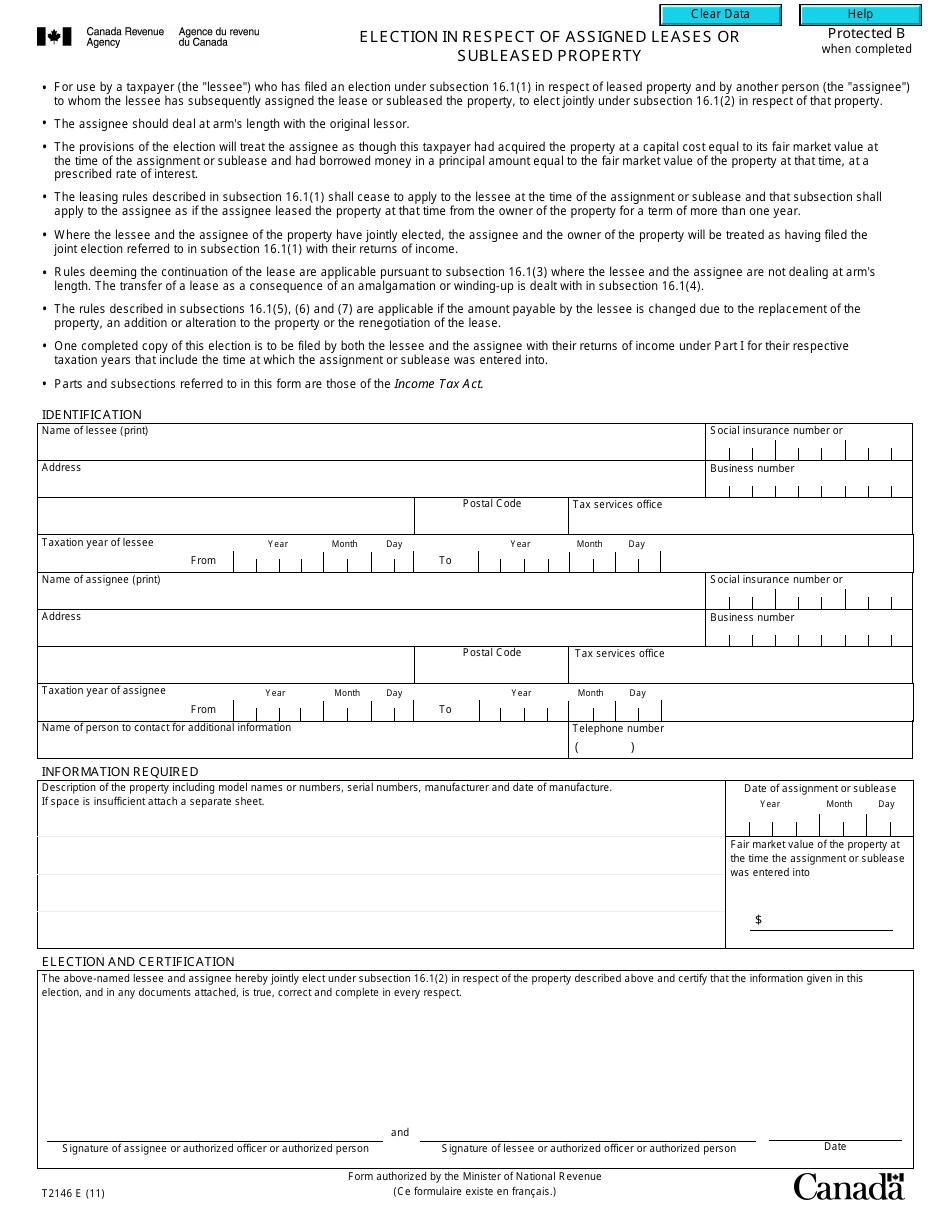

Form T2146 Election in Respect of Assigned Leases or Subleased Property - Canada

Form T2146 Election in Respect of Assigned Leases or Subleased Property in Canada is used by a taxpayer to elect to include the fair market value of assigned leases or subleased property in the taxpayer’s income. This form is typically used when there has been a transfer of such leases or property between related parties.

In Canada, the Form T2146 Election in Respect of Assigned Leases or Subleased Property is filed by the landlord or lessor.

FAQ

Q: What is Form T2146?

A: Form T2146 is an election form in respect of assigned leases or subleased property in Canada.

Q: Who should use Form T2146?

A: Form T2146 should be used by Canadian taxpayers who have assigned leases or subleased property.

Q: What is the purpose of Form T2146?

A: The purpose of Form T2146 is to make an election regarding the treatment of assigned leases or subleased property for tax purposes.

Q: What information is required on Form T2146?

A: Form T2146 requires information about the taxpayer, the assigned leases or subleased property, and the details of the election being made.

Q: Are there any deadlines for filing Form T2146?

A: Yes, Form T2146 must be filed by the due date of the taxpayer's personal tax return for the year in which the election is being made.

Q: Are there any penalties for failing to file Form T2146?

A: Yes, failing to file Form T2146 by the deadline may result in penalties and interest charges.

Q: Can I make changes to my election after filing Form T2146?

A: No, once Form T2146 is filed, the election is generally irrevocable.