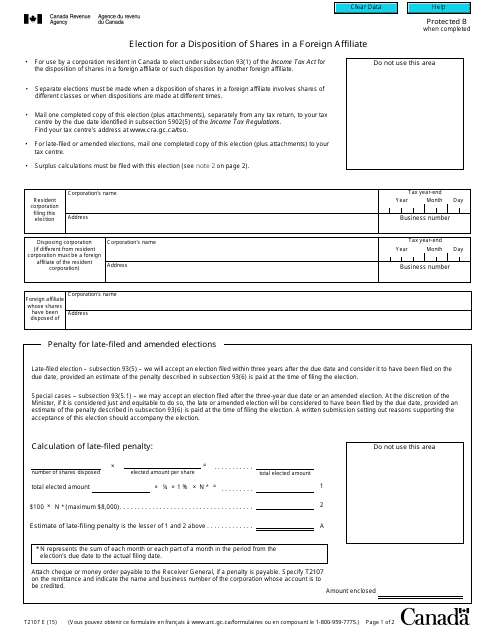

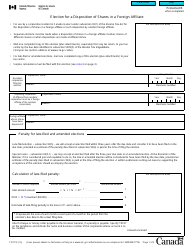

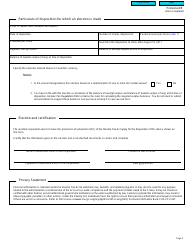

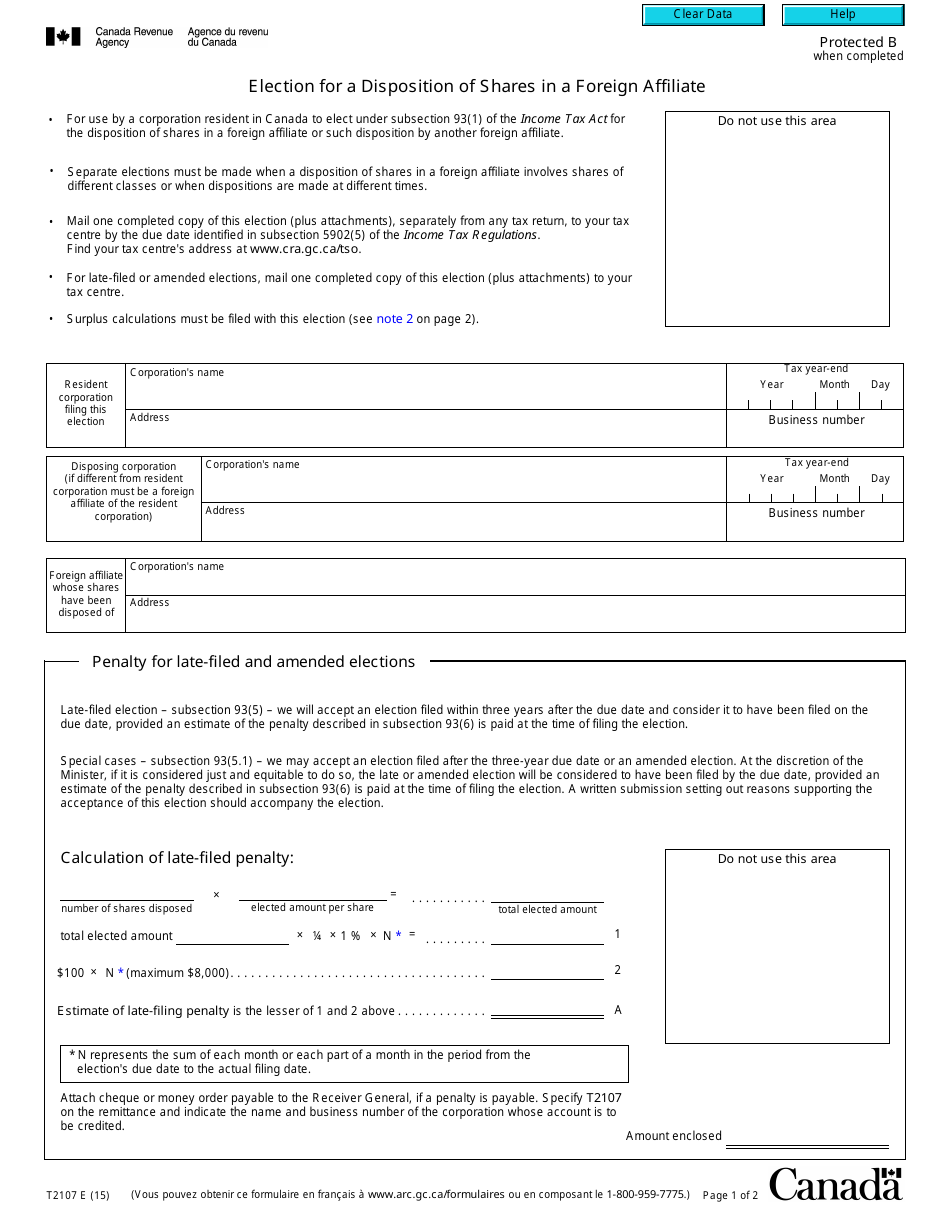

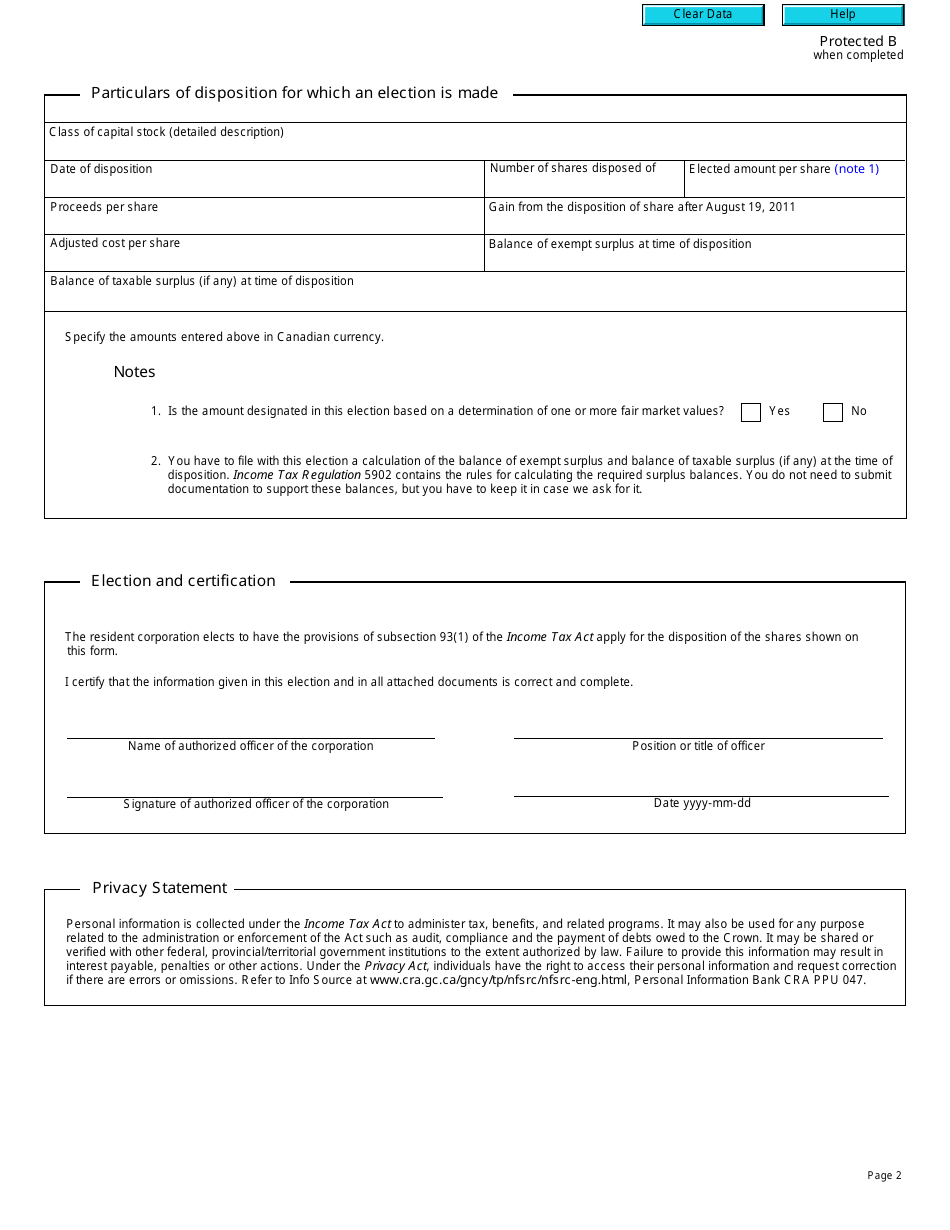

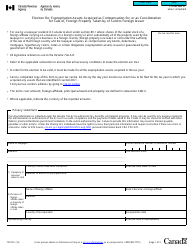

Form T2107 Election for a Disposition of Shares in a Foreign Affiliate - Canada

Form T2107 Election for a Disposition of Shares in a Foreign Affiliate is used in Canada for reporting the disposition of shares in a foreign affiliate. It is used to calculate any potential capital gains or losses from the disposition for tax purposes.

FAQ

Q: What is Form T2107?

A: Form T2107 is the Election for a Disposition of Shares in a Foreign Affiliate in Canada.

Q: Who needs to file Form T2107?

A: Individuals or corporations in Canada who have disposed of shares in a foreign affiliate.

Q: When should Form T2107 be filed?

A: Form T2107 should be filed within the prescribed timeframe as per the Canadian tax laws.

Q: What is the purpose of Form T2107?

A: Form T2107 is used to elect to treat a disposition of shares in a foreign affiliate as a capital gain for tax purposes in Canada.

Q: Are there any special requirements for filing Form T2107?

A: Yes, there are certain specific conditions, limitations, and eligibility criteria that need to be met for filing Form T2107.

Q: Is Form T2107 applicable only to individuals?

A: No, Form T2107 can be filed by both individuals and corporations in Canada.