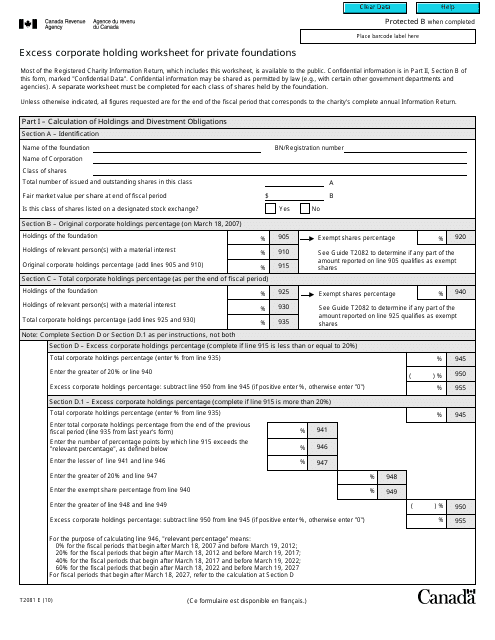

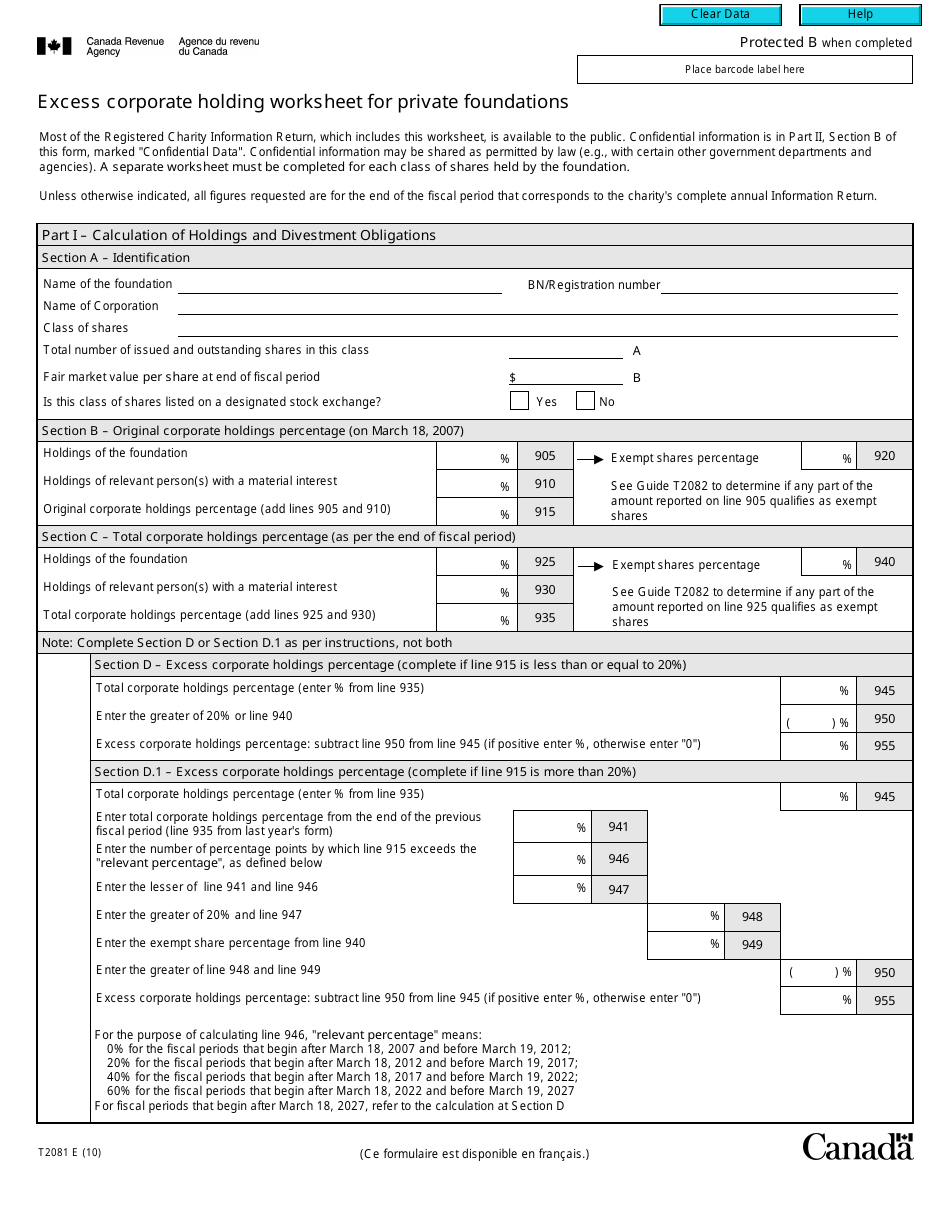

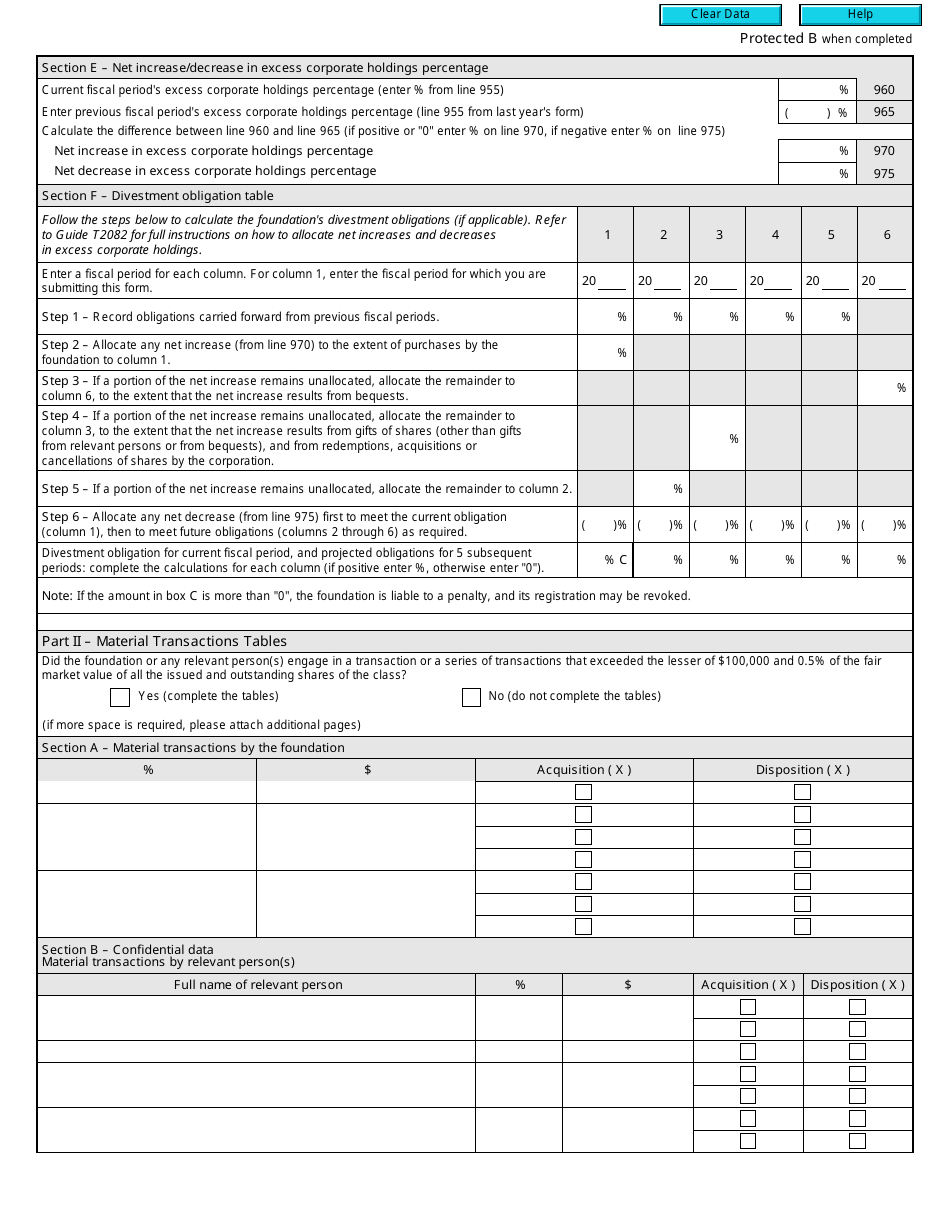

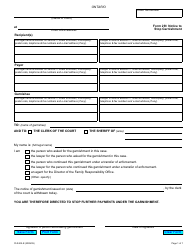

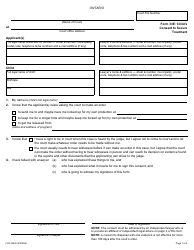

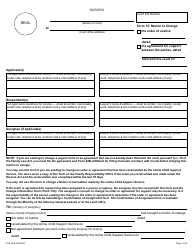

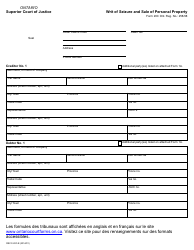

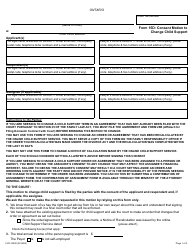

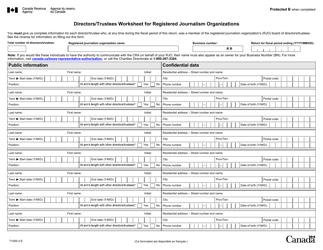

Form T2081 Excess Corporate Holdings Worksheet for Private Foundations - Canada

Form T2081 is a Canadian Revenue Agency form also known as the "Form T2081 "excess Corporate Holdings Worksheet For Private Foundations" - Canada" . The latest edition of the form was released in January 1, 2010 and is available for digital filing.

Download a PDF version of the Form T2081 down below or find it on Canadian Revenue Agency Forms website.

FAQ

Q: What is Form T2081?

A: Form T2081 is the Excess Corporate Holdings Worksheet for Private Foundations in Canada.

Q: Who needs to file Form T2081?

A: Private foundations in Canada need to file Form T2081.

Q: What is the purpose of Form T2081?

A: The purpose of Form T2081 is to calculate excess corporate holdings of a private foundation.

Q: What are excess corporate holdings?

A: Excess corporate holdings refer to the amount of shares held by a private foundation in a corporation that exceed the allowable limit.

Q: How to complete Form T2081?

A: Form T2081 should be completed by providing information about the private foundation, the corporation, and the shares held.

Q: When is the deadline to file Form T2081?

A: The deadline to file Form T2081 is within 90 days after the end of the private foundation's fiscal period.

Q: Are there any penalties for not filing Form T2081?

A: Yes, there are penalties for not filing Form T2081, including financial penalties and potential loss of registered status.

Q: Can Form T2081 be filed electronically?

A: Yes, Form T2081 can be filed electronically using the CRA's My Business Account or Represent a Client services.

Q: Is there a fee to file Form T2081?

A: No, there is no fee to file Form T2081.

Q: Can a private foundation have excess corporate holdings?

A: Yes, a private foundation can have excess corporate holdings, but there are limits on the allowable amount.

Q: What happens if a private foundation exceeds the allowable limit of corporate holdings?

A: If a private foundation exceeds the allowable limit of corporate holdings, it must report and take corrective measures to avoid penalties.